Tax Depreciation (MACRS) Methods

advertisement

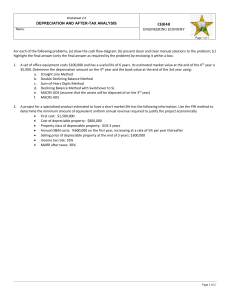

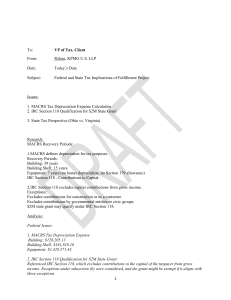

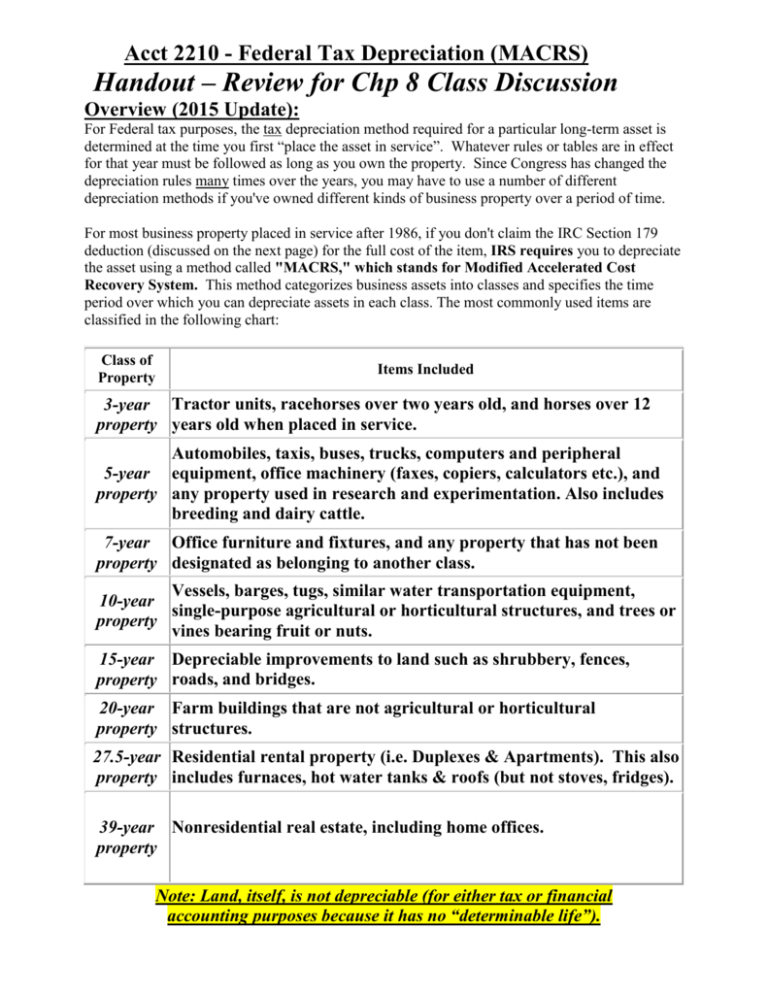

Acct 2210 - Federal Tax Depreciation (MACRS) Handout – Review for Chp 8 Class Discussion Overview (2015 Update): For Federal tax purposes, the tax depreciation method required for a particular long-term asset is determined at the time you first “place the asset in service”. Whatever rules or tables are in effect for that year must be followed as long as you own the property. Since Congress has changed the depreciation rules many times over the years, you may have to use a number of different depreciation methods if you've owned different kinds of business property over a period of time. For most business property placed in service after 1986, if you don't claim the IRC Section 179 deduction (discussed on the next page) for the full cost of the item, IRS requires you to depreciate the asset using a method called "MACRS," which stands for Modified Accelerated Cost Recovery System. This method categorizes business assets into classes and specifies the time period over which you can depreciate assets in each class. The most commonly used items are classified in the following chart: Class of Property Items Included 3-year Tractor units, racehorses over two years old, and horses over 12 property years old when placed in service. Automobiles, taxis, buses, trucks, computers and peripheral 5-year equipment, office machinery (faxes, copiers, calculators etc.), and property any property used in research and experimentation. Also includes breeding and dairy cattle. 7-year Office furniture and fixtures, and any property that has not been property designated as belonging to another class. Vessels, barges, tugs, similar water transportation equipment, 10-year single-purpose agricultural or horticultural structures, and trees or property vines bearing fruit or nuts. 15-year Depreciable improvements to land such as shrubbery, fences, property roads, and bridges. 20-year Farm buildings that are not agricultural or horticultural property structures. 27.5-year Residential rental property (i.e. Duplexes & Apartments). This also property includes furnaces, hot water tanks & roofs (but not stoves, fridges). 39-year Nonresidential real estate, including home offices. property Note: Land, itself, is not depreciable (for either tax or financial accounting purposes because it has no “determinable life”). Class Handout: MACRS Depr Schedules Tax Year MACRS Depreciation rate for recovery period Based upon 200% DDB Method and half-year convention 3-year 5-year 7-year 10-year 15-year 20-year 1 33.33% 20.00% 14.29% 10.00% 5.00% 3.750% 2 44.45 32.00 24.49 18.00 9.50 7.219 3 14.81 19.20 17.49 14.40 8.55 6.677 4 7.41 11.52 12.49 11.52 7.70 6.177 5 11.52 8.93 9.22 6.93 5.713 6 5.76 8.92 7.37 6.23 5.285 7 8.93 6.55 5.90 4.888 8 4.46 6.55 5.90 4.522 9 6.56 5.91 4.462 10 6.55 5.90 4.461 11 3.28 5.91 4.462 12 5.90 4.461 13 5.91 4.462 14 5.90 4.461 15 5.91 4.462 16 2.95 4.461 17 4.462 18 4.461 19 4.462 20 4.461 21 2.231 IRC Sec 179 Note: Writing off (expensing) the Asset in the year acquired. Normally, you can't take a current Federal tax deduction for the entire cost of an asset in the year of purchase because the asset's usefulness will extend beyond the year in which it was purchased. For tax purposes, an asset must generally be depreciated per the grid above. An exception exists called the IRC “Section 179 Expensing” Election. While many rules and exceptions apply, this Federal tax law provision generally allows business the option of claiming a tax deduction in the first year for the entire cost of qualifying assets purchased. For 2012 - 2014, this amount was up to $500,000. For 2015, this amount is currently only $25,000! (legislative action pending). This incentive, legislated by Congress, is meant to encourage businesses to buy equipment, invest in their own businesses, and thereby create economic activity. The law has changed many times over the years. For comparison, the 2002 limit was only $24,000. This is one example of Congress using tax policy to achieve certain goals. A powerful tool to manipulate social and/or economic conditions!