成本會計(第一次) 89/11/

advertisement

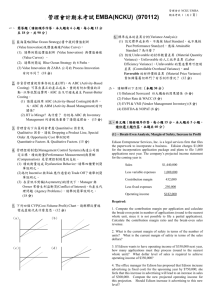

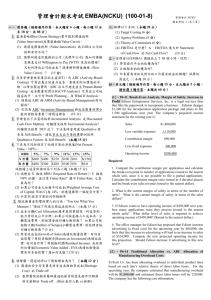

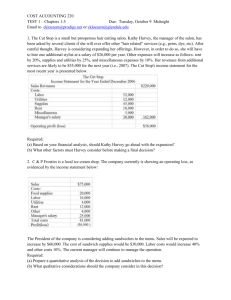

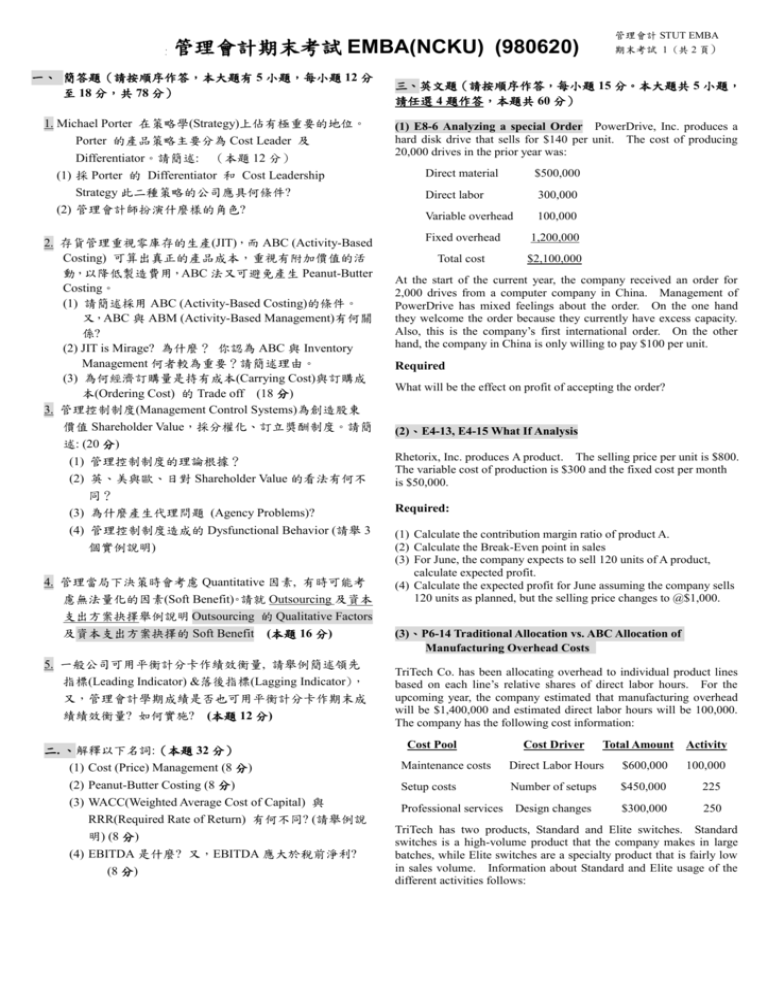

管理會計 STUT EMBA 管理會計期末考試 EMBA(NCKU) (980620) 一、 簡答題(請按順序作答,本大題有 5 小題,每小題 12 分 至 18 分,共 78 分) 1. Michael Porter 在策略學(Strategy)上佔有極重要的地位。 Porter 的產品策略主要分為 Cost Leader 及 Differentiator。請簡述: (本題 12 分) (1) 採 Porter 的 Differentiator 和 Cost Leadership Strategy 此二種策略的公司應具何條件? (2) 管理會計師扮演什麼樣的角色? 2. 存貨管理重視零庫存的生產(JIT),而 ABC (Activity-Based Costing) 可算出真正的產品成本,重視有附加價值的活 動,以降低製造費用,ABC 法又可避免產生 Peanut-Butter Costing。 (1) 請簡述棌用 ABC (Activity-Based Costing)的條件。 又,ABC 與 ABM (Activity-Based Management)有何關 係? (2) JIT is Mirage? 為什麼? 你認為 ABC 與 Inventory Management 何者較為重要?請簡述理由。 (3) 為何經濟訂購量是持有成本(Carrying Cost)與訂購成 本(Ordering Cost) 的 Trade off (18 分) 3. 管理控制制度(Management Control Systems)為創造股東 價值 Shareholder Value,採分權化、訂立獎酬制度。請簡 述: (20 分) (1) 管理控制制度的理論根據? (2) 英、美與歐、日對 Shareholder Value 的看法有何不 同? (3) 為什麼產生代理問題 (Agency Problems)? (4) 管理控制制度造成的 Dysfunctional Behavior (請舉 3 個實例說明) 4. 管理當局下決策時會考慮 Quantitative 因素, 有時可能考 慮無法量化的因素(Soft Benefit)。請就 Outsourcing 及資本 支出方案抉擇舉例說明 Outsourcing 的 Qualitative Factors 及資本支出方案抉擇的 Soft Benefit (本題 16 分) 5. 一般公司可用平衡計分卡作績效衡量, 請舉例簡述領先 指標(Leading Indicator) &落後指標(Lagging Indicator), 又,管理會計學期成績是否也可用平衡計分卡作期末成 績績效衡量? 如何實施? (本題 12 分) 二. 、解釋以下名詞:(本題 32 分) (1) Cost (Price) Management (8 分) (2) Peanut-Butter Costing (8 分) (3) WACC(Weighted Average Cost of Capital) 與 RRR(Required Rate of Return) 有何不同? (請舉例說 明) (8 分) (4) EBITDA 是什麼? 又,EBITDA 應大於稅前淨利? (8 分) 期末考試 1 (共 2 頁) 三、英文題(請按順序作答,每小題 15 分。本大題共 5 小題, 請任選 4 題作答,本題共 60 分) (1) E8-6 Analyzing a special Order PowerDrive, Inc. produces a hard disk drive that sells for $140 per unit. The cost of producing 20,000 drives in the prior year was: Direct material $500,000 Direct labor 300,000 Variable overhead 100,000 Fixed overhead 1,200,000 Total cost $2,100,000 At the start of the current year, the company received an order for 2,000 drives from a computer company in China. Management of PowerDrive has mixed feelings about the order. On the one hand they welcome the order because they currently have excess capacity. Also, this is the company’s first international order. On the other hand, the company in China is only willing to pay $100 per unit. Required What will be the effect on profit of accepting the order? (2)、E4-13, E4-15 What If Analysis Rhetorix, Inc. produces A product. The selling price per unit is $800. The variable cost of production is $300 and the fixed cost per month is $50,000. Required: (1) Calculate the contribution margin ratio of product A. (2) Calculate the Break-Even point in sales (3) For June, the company expects to sell 120 units of A product, calculate expected profit. (4) Calculate the expected profit for June assuming the company sells 120 units as planned, but the selling price changes to @$1,000. (3)、P6-14 Traditional Allocation vs. ABC Allocation of Manufacturing Overhead Costs TriTech Co. has been allocating overhead to individual product lines based on each line’s relative shares of direct labor hours. For the upcoming year, the company estimated that manufacturing overhead will be $1,400,000 and estimated direct labor hours will be 100,000. The company has the following cost information: Cost Pool Cost Driver Total Amount Activity Maintenance costs Direct Labor Hours $600,000 Setup costs Number of setups $450,000 225 $300,000 250 Professional services Design changes 100,000 TriTech has two products, Standard and Elite switches. Standard switches is a high-volume product that the company makes in large batches, while Elite switches are a specialty product that is fairly low in sales volume. Information about Standard and Elite usage of the different activities follows: 管理會計期末考試 EMBA(NCKU) (980620) 管理會計 NCKU EMBA 期末考試 2 (共 2 頁) Standard Elite 1,500 120 Direct labor hours Number of setups 7 13 Number of design changes 5 20 Required: (a) Calculate the predetermined overhead rate based on direct labor hours (traditional allocation). Use this predetermined overhead rate to calculate the amount of overhead to apply to Standard and Elite Switches, based on their usage of direct labor hours. (b) Calculate the individual ABC pool rates by taking the total amount of overhead for each cost pool and dividing that total by the total amount of activity for that pool. Allocate ove5rhead to each of the two products using these three activity rates. (c) Compare the overhead calculated in part a to that calculated in part b. Why are they different? Which allocation method (traditional or ABC) most likely results in a better estimate of product cost (4)、P9-7 NPV, IRR, Payback, and Taxes (5) ROI、RI、ROA、EVA【13-12】 Watkins Company with three divisions: Trucking, Seafood, and Construction. Assume that the company uses return on investment, residual income, and economic value-added residual income as three of the evaluation tools for division managers. The company has a weighted average cost of capital of 10 percent with a 30 percent of income tax rate. Selected operating data for three divisions of the company follow. Trucking Sales $600,000 Stockholder’s Equity 300,000 Net operating income 51,000 Bonds Payable(Rate 6%)100,000 Seafood Construction $750,000 250,000 56,000 100,000 $900,000 350,000 59,000 100,000 Required: (請用一般管理會計中文課本方法計算 ROI, ROA, RI, and EVA) (a) Compute the return on investment for each division. (Round answers to three decimal places.) (b) Compute the Return on Assets for Each Division (Round answers to three decimal places.) (c) Compute the residual income for each division. Adrian Sonnetson, the owner of Adrian Motors, is considering the addition of a paint and body shop to his automobile dealership. Construction of a building and the purchase of necessary equipment is estimated to cost $700,000 and both the building and equipment will be depreciated over 10 years using the straight-line method. The building and equipment have zero estimated residual value at the end of 10 years. Sonnetson’s required rate of return for this project is 12%. Net income related to each year of the investment is as follows: Revenue $420,000 Less: Material cost 65,000 Labor 140,000 Depreciation 70,000 Other 5,000 Income before taxes 140,000 Income Taxes (40%) 56,000 Net income $84,000 Required a. Determine the net present value of the investment in the paint and body shop. Should Sonnetson invest in the paint and body shop? b. Calculate the internal rate of return of the investment. c. Calculate the payback period of the investment. (d) Compute the economic value-added residual income for each division.