成本會計(第一次) 89/11/

advertisement

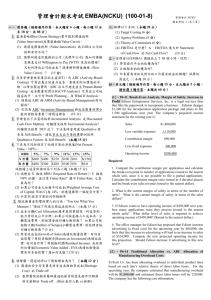

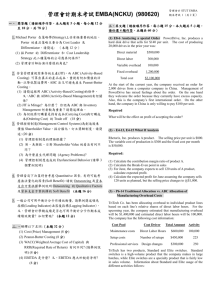

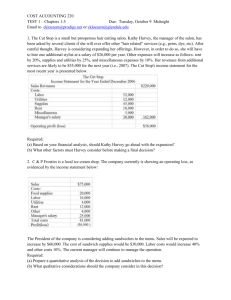

管理會計 NCKU EMBA 管理會計期末考試 EMBA(NCKU) (970112) 期末考試 1 (共 2 頁) 一、 簡答題(請按順序作答,本大題有 6 小題,每小題 12 分 至 18 分,共 90 分) 1. 藍海策略(Blue Ocean Strategy)書中提到價值創新 (Value Innovation)及價值曲線(Value Curve): (1). 請舉例簡述價值創新 (Value Innovation) 與價值曲線 (Value Curves) 。 (2). 請舉例簡述 Blue Ocean Strategy 的 6 Paths。 (3) Value Innovation 與 ZARA 公司的 Process Innovation 有何不同? (18 分) 2. 存貨管理重視零庫存的生產(JIT),而 ABC (Activity-Based Costing) 可算出真正的產品成本,重視有附加價值的活 動,以降低製造費用,ABC 法又可避免產生 Peanut-Butter Costing。 (1) 請簡述棌用 ABC (Activity-Based Costing)的條件。 又,ABC 與 ABM (Activity-Based Management)有何 關係? (2) JIT is Mirage? 為什麼? 你認為 ABC 與 Inventory Management 何者較為重要?請簡述理由。 (15 分) 3. 管理當局下決策時會考慮 Quantitative 因素及 Qualitative 因素。請就 Dropping a Product Line, Special Order 及 Opportunity Cost 舉例說明 Quantitative Factors 及 Qualitative Factors. (15 分) 4. 管理控制制度(Management Control Systems)為達公司預 定目標,績效衡量(Performance Measurement)與奬酬 (Compensation) 是管理控制制度的支柱。 (1) 績效衡量造成 Dysfunction Behavior。請舉四種實例簡 單說明之。 (2)為何 Incentive 與 Risk 應作適當的 Trade Off?請舉例簡 單說明之。 (3) 在資訊不對稱(Asymmetry)的情況下,Manager 與 Owner 常發生利益衝突(Conflict of Interest),而產生代 理問題 (Agency Problems),請舉例簡單說明之。 (18 分) 6. 標準成本的差異分析(Variance Analysis): (1) 設定標準成本時,不應棌 Ideal Standard,也不應棌 Past Performance Standard,應棌 Attainable Standard?為什麼? (2) 假設 Unfavorable 的材料數量差異 (Material Quantity Variance)、Unfavorable 的人工效率差異 (Labor Efficiency Variance)、Unfavorable 的製造費用可控制 差異 (Controllable Overhead Variance),and Favorable 的材料價格差異 (Material Price Variance) 責任歸屬屬何部門?有否例外情況? (12 分) 二、 請解釋以下名詞:(本題 30 分) (1) Balanced Scorecard 四大構面的因果關係 (6 分) (2) Fisher Rate & WACC (8 分) (3) EVPI & VMI (Vendor Management Inventory) (8 分) (4) EBITDA & NOPAT (8 分) 三、英文題(請按順序作答,每小題 15 分。本大題共 5 小題, 請任選 4 題作答,本題共 60 分) (1)、Break-Even Analysis, Margin of Safety, Increase in Profit Edison Entrepreneur Services, Inc. is a legal services firm that files the paperwork to incorporate a business. Edision charges $1,000 for the incorporation application package and plans to file 1,600 applications next year. The company’s projected income statement for the coming year is: Sales Less variable expenses $1,440,000 1,008,000 Contribution margin 432,000 Less fixed expenses 250,000 Operating income $182,000 Required: 5. 下列四個 CVP(Cost-Volume-Profit) Chart,請解釋從實線 變成虛線代表什麼意思。(12 分) (a) (b) 1. Compute the contribution margin per application and calculate the break-even point in number of applications (round to the nearest whole unit, since it is not possible to file a partial application). Calculate the contribution margin ratio and the break-even sales revenue. 2. What is the current margin of safety in terms of the number of units? What is the current margin of safety in terms of the sales dollars? (c) (d) 3. If Edison wants to have operating income of $350,000 next year, how many applications must they process (round to the nearest whole unit)? What dollar level of sales is required to achieve operating income of $350,000? 4. The office manager for Edison has proposed that Edison increase advertising (a fixed cost) for the upcoming year by $750,000; she feels that this increase in advertising will lead to an increase in sales of $300,000. Compute the new projected operating income for this projection. Should Edison increase it advertising to this new level? 管理會計期末考試 EMBA(NCKU) (970112) (2)、Traditional Allocation vs. ABC Allocation of Manufacturing Overhead Costs TriTech Co., has been allocating overhead to individual product lines based on each line’s relative shares of direct labor hours. For the upcoming year, the company estimated that manufacturing overhead will be $1,400,000 and estimated direct labor hours will be 100,000. The company has the following cost information: Cost Pool Cost Driver Total Amount Activity Maintenance costs Direct Labor Hours $600,000 Setup costs Number of setups $450,000 225 $300,000 250 Professional services Design changes 100,000 TriTech has two products, Standard and Elite switches. Standard switches is a high-volume product that the company makes in large batches, while Elite switches are a specialty product that is fairly low in sales volume. Information about Standard and Elite usage of the different activities follows: Direct labor hours Standard Elite 1,500 120 管理會計 NCKU EMBA 期末考試 2 (共 2 頁) (4)、Comprehensive Capital Budgeting Problem Van Doren Corporation is considering producing a new product, Autodial. Marketing data indicate that the company will be able to sell 35,000 units per year at $35. The product will be produced in a section of an existing factory that is currently not in use. To produce Autodial, Van Doren must buy a machine that costs $410,000. The machine has an expected life of five years and will have an ending residual value of $12,000. Van Doren will depreciate the machine over five years using the straight-line method for both tax and financial reporting purposes. In addition to the cost of the machine, the company will incur incremental manufacturing costs of $350,000 for component parts, $400,000 for direct labor, and $185,000 of miscellaneous costs. Also, the company plans to spend $135,000 annually for advertising Autodial. Van Doren has a tax rate of 40%, and the company’s required rate of return is 12%. Required a. Compute the net present value. b. Compute the payback period. c. Should Van Doren make the investment required to produce Autodial? 7 13 (5)、ROI and EVA Number of design changes 5 20 ELN Waste Management has a subsidiary that disposes of hazardous waste and a subsidiary that collects and disposes of residential garbage. Information related to the two subsidiaries follows: Number of setups Required: (a) Calculate the predetermined overhead rate based on direct labor hours (traditional allocation). Use this predetermined overhead rate to calculate the amount of overhead to apply to Standard and Elite Switches, based on their usage of direct labor hours. (b) Calculate the individual ABC pool rates by taking the total amount of overhead for each cost pool and dividing that total by the total amount of activity for that pool. Allocate ove5rhead to each of the two products using these three activity rates. (c) Compare the overhead calculated in part a to that calculated in part b. Why are they different? Which allocation method (traditional or ABC) most likely results in a better estimate of product cost? (3)、Make or Buy Decision Hazardous Residential Waste Waste $12,000,000 $65,000,000 Noninterest-bearing Liabilities 2,500,000 10,300,000 Net income 1,600,000 5,700,000 Interest expense 1,200,000 7,000,000 Total assets Required rate of return 12% 14% Tax rate 40% 40% Required: a. Calculate ROI for both subsidiaries. Imperial Corp. produces whirlpool tubs. Currently, the company uses internally manufactured pumps to power water jets. Imperial Corp. has found that 40% of the pumps have failed within their 12-month warranty period, causing huge warranty costs. Because of the company’s inability to manufacture high-quality pumps, management is considering buying pumps from a reputable manufacturer who will also bear any related warranty costs. Imperial’s unit cost of manufacturing pumps is $72.85 per unit, which includes $16.75 of allocated fixed overhead (primarily depreciation of plant and equipment). Also, the company has spent an average of $19.75 (labor and parts) repairing each pump returned. Imperial Corp. can purchase pumps for $85.25 per pump. Required: During 2008, Imperial Corp. plans to sell 14,200 whirlpools (requiring 14,200 pumps). Determine whether the company should make or buy the pumps and the amount of cost savings related to the best alternative. What qualitative factors should be considered in the outsourcing decision? b. Calculate EVA for both subsidiaries. Note that since no adjustments for “accounting distortions” are being made, EVA is equivalent to residual income. c. Which subsidiary has added the most to shareholder value; in the last year? d. Based on the limited information, which subsidiary is the best candidate for expansion? Explain. e. The focus on ROI and shareholder value is not the same in France, Germany, and Japan as it is in the United States and Great Britain. What is the difference between France and United States?