ABC Costing Part 1 Powerpoint

advertisement

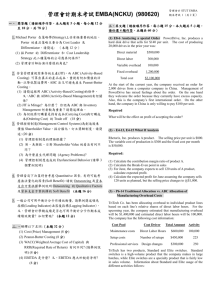

ABC Software Development Part 1 Summit Business Consultants Cost Structure of Manufacture Direct labor cost Direct materials cost Manufacturing overhead Manufacturing cost Traditional Costing System • Utilize a single, volume-based cost driver Direct Costs Overhead (Allocated based on direct labor hour/dollar etc.) Product Cost ABC Costing System • Assign costs based on consumption of the resources caused by activities Direct Costs Overhead (Allocated based on activities that drive the overhead) Product Cost ABC Costing System • Resource driver is a measure of the quantity of resources consumed by an activity. • Activity driver is a measure of frequency and intensity of demands placed on activities by cost objects. ABC Costing System Overhead Costs Setting Up Machine Cost Pool Machining Cost Pool ………. Supervising Cost Pool Resource Drivers Number of Setups Machine Hours ………. Direct Labor Hours Activity Drivers Products Example Company makes Product A and Product B Product A 400 100 50 Direct labor hours Machine hours Purchase orders Product B 600 150 50 Overheads = $11,250 in total Payroll taxes $1,000 Machine maintenance $500 Purchasing Dept. labor $4,000 Fringe benefits $2,000 Purchasing Dept. Supplies $250 Equipment depreciation $750 Electricity $1,250 Unemployment insurance $1,500 Total 1,000 250 100 Example – Traditional Costing • The rate would be: – OH Rate = Overhead/Direct Labor Hours – $11,250/1,000 = $11.25 per hour. • Applying overhead using this rate: – Product A: 400 hours x $11.25 = $4,500 – Product B: 600 hours x $11.25 = $6,750 Example – ABC Costing Direct Labor Overhead Allocation Payroll taxes $1,000 Machine maintenance $500 Purchasing Dept. labor $4,000 Fringe benefits $2,000 Purchasing Dept. Supplies $250 Equipment depreciation $750 Electricity $1,250 Unemployment insurance $1,500 Calculated Rates Direct Labor $4.5 per hour Machine Hours $10 per hour # of Purchase Orders $42.5 per order $1,000 2,000 1,500 $4,500 Machine Hours $ 500 750 1,250 $2,500 # of Purchase Orders $4,000 250 $4,250 Example – ABC Costing Product A Direct labor hours Machine hours Purchase orders Total Base 400 100 50 Rate $ 4.50 $ 10.00 $ 42.50 Allocated $ 1,800.00 $ 1,000.00 $ 2,125.00 $ 4,925.00 Product B Direct labor hours Machine hours Purchase orders Total Base 600 150 50 Rate $ 4.50 $ 10.00 $ 42.50 Allocated $ 2,700.00 $ 1,500.00 $ 2,125.00 $ 6,325.00 Benefits of ABC Costing System Accuracy of Product Cost Accuracy of Cost Management Improved Decisionmaking Limitations of ABC Costing System Expensive and Timeconsuming Omission of Costs Allocation Impractical Problems with Traditional ABC System Non-linear links between resources and activities are ignored Do not cater for unknowns such as Carbon Tax Non-financial aspect is completely ignored Need for tailor made solution Stage 1 Sample Stage 1 Sample