Tutorial7 Ans_C

advertisement

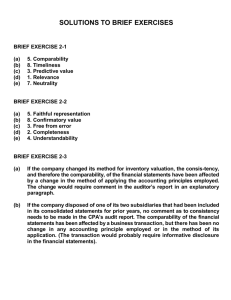

Tutorial 7 Conceptual Framework of Accounting Short Answer Questions. 1. What are the three primary objectives of financial reporting? 1 Is useful to those making investment and credit decisions. 2 Is helpful in assessing future cash flows. 3 Identifies the economic resources (assets), the claims to those resources (liabilities), and the changes in those resources and claims. 2. Define each of the following qualitative characteristics: Relevance It show how "good" a retrieved result is with regard to the accounting information need. Predictive value Relevant information helps users forecast future events. Feedback value Relevant information helps confirming or correcting prior expectations. Timeliness Information must be available to decision makers before it loses its capacity to influence their decisions. Reliability Means that the information is free of error and bias; it can be depended on. Verifiability Must be able to prove that it is free of error and bias. Representational faithfulness What it purports to be – it must be factual. Neutrality The state of being neutral. 3. Define “comparability” and “consistency” and explain the difference between these two concepts. Comparability means that the information should be comparable with accounting information about other enterprises. Consistency means that the same accounting principles and methods should be used from year to year within a company. 4. Define “Revenues” & “Gains” and Why do accountants distinguish between “revenues” and “gains”? The revenue recognition principle dictates that revenue should be recognized in the accounting period in which it is earned. When a sale is involved, revenue is recognized at the point of sale. Gain is a profit or an increase in value of an investment or a business. 5. Define “Expenses” & “Losses” and Why do accounts distinguish between “expenses” and “losses”? Expense recognition is traditionally tied to revenue recognition. This practice – referred to as the matching principle – dictates that expenses be matched with revenues in the period in which efforts are expended to generate revenues. Losses is a suffer or an decrease in value of an investment or a business Multiple Choice Questions. 1. Determining periodic earnings and financial position depends on measuring economic resources and obligations and changes in them as these changes occur. This explanation pertains to A. Disclosure. B. Accrual accounting. C. Materiality. D. The matching concept. 2. Revenue is generally recognized when the earning process is virtually complete and an exchange has taken place. What principle is described herein? A. Consistency. B. Matching. C. Realization. D. Conservatism. 3. According to the FASB conceptual framework, which of the following is an essential characteristic of an asset? A. The claims to an asset’s benefits are legally enforceable. B. An asset is tangible. C. An asset is obtained at a cost. D. An asset provides future benefits. 4. In analyzing a company's financial statements, which financial statement would a potential investor primarily use to assess the company's liquidity and financial flexibility? A. Balance sheet. B. Income statement. C. Statement of retained earnings. D. Statement of cash flows. 5. What is the purpose of information presented in notes to the financial statements? A. To provide disclosures required by generally accepted accounting principles. B. To correct improper presentation in the financial statements. C. To provide recognition of amounts not included in the totals of the financial statements. D. To present management's responses to auditor comments. 6. According to the FASB conceptual framework, the objectives of financial reporting for business enterprises are based on A. Generally accepted accounting principles. B. Reporting on management's stewardship. C. The need for conservatism. D. The needs of the users of the information. 7. According to the FASB conceptual framework, the usefulness of providing information in financial statements is subject to the constraint of A. Consistency. B. Cost-benefit. C. Reliability. D. Representational faithfulness.