The Conceptual Framework

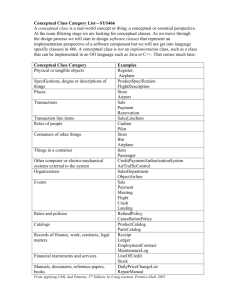

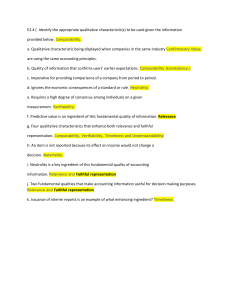

advertisement

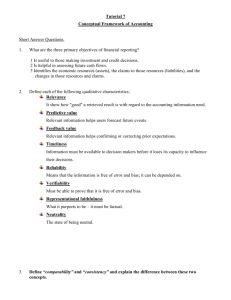

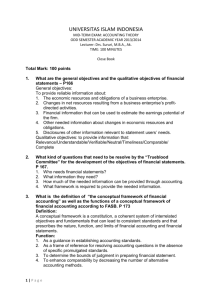

By: Tyler Suter, Brian Garrett, Chris Koucheki, John DeClemente Since the 1930’s there have been serious attempts to develop a theoretical foundation for accounting. The American Accounting Association (AAA) began issuing publications in 1936, the last of which was published in 1965. During this period (1936-1973), there were several other publications issued by the AICPA, which also attempted to develop a conceptual foundation for accounting. In 1973, FASB was established and it responded to the need for a general theoretical framework by undertaking the project called “The Conceptual Framework”. The process was slow, but by 2000, the FASB issued the last of 7 Statements of Financial Accounting Concepts; which provide the basis for the conceptual framework. 1. 2. 3. 4. Build on and relate to an established body of concepts and objectives Provide framework for solving new and emerging practical problems Increase financial statement users’ understanding of financial reporting Enhance comparability among companies financial statements The seven Concept Statements address three major levels of accounting 1. First Level: goals and purposes of accounting 2. Second Level: qualitative characteristics and the basic elements 3. Third Level: the “how” implementation The basic objectives are to provide information that: 1) Is useful to those making investment and credit decisions. 2 Is useful in assessing future cash flows. 3) Is about enterprise resources, claims to resources, and changes in them. Primary Qualities of Accounting: Relevance Reliability Secondary Qualities of Accounting Comparability Consistency 1. Assets 2. Liabilities 3. Equity 4. Investment by Owners 5. Distribution to Owners 6. Comprehensive Income 7. Revenues 8. Expenses 9. Gains and Losses Three Main Areas: 1. Assumptions 2. Principles 3. Constraints 1. 2. 3. 4. Economic Entity: the activity of a company is separate from owners Going Concern: the company will have a long life Monetary Unit: money is the common denominator by which activities are conducted Full Disclosure: Companies provide supplemental information for their financial statements 1. 2. 3. 4. Historical Cost: GAAP requires that companies account for and report purchases on basis on acquisition price Revenue Recognition: recognize revenue when realized or earned Matching Principle: recognizes expenses when it actually makes its contribution Full Disclosure: Companies provide supplemental information for their financial statements 1. 2. 3. 4. Cost-Benefit: the cost of providing information must be weighed against the benefits Materiality: Information is material if its omission or misstatement could influence the economic decision of users taken on the basis of the financial statements. Industry Practices: follow general practices in the company’s industry Conservatism: when in doubt, choose the solution that will be least likely to overstate financial statements 1. What is the conceptual framework? 2. What are the primary qualities of qualitative characteristics? 3. What does the term full disclosure mean? 4. What are the three objectives?