enter title here

advertisement

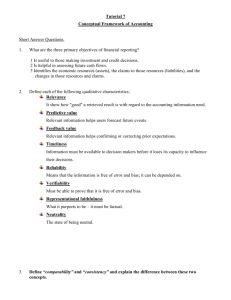

Answering Key Financial Questions for Board and Management through Effective Internal Financial Reporting Ron Salluzzo Phil Tahey Outline and Outcome Session Outline • Role of Internal Financial Reporting • Concepts to Consider in Developing an Internal Reporting Program – Financial health measurements – Internal reporting concepts • Management Discussion and Analysis • Questions Session Outcome • Learn a different approach to internal reporting by focusing on key information, risks and metrics 2 Audience Questions • Are you from a... – Public Institution? – Private Institution? • Do you think your Board members understand higher education industry finances? – Your Institution’s financial issues? – Your Institution's key financial risks? • When was the last time you revised your internal reporting or reports? • Does your internal reporting consist primarily of budget – actual statement of activities and explanation of variances? 3 Role of Internal Financial Reporting… • Internal financial reporting provides methods and tools to evaluate financial risks, condition and operations, and communicate information effectively to institutional stewards at various levels • Several financial questions* that institutions should address are: – – – – – – – How has the Institution responded to its strategic financial risks? What is the institution's liquidity and how does it affect operations? Is debt used strategically? What are the financial operating risks and how are they managed? What are the financial capital risks and how are they managed? Are financial resources allocated to support strategies? What is the institution's overall financial health? *From Strategic Financial Analysis for Higher Education, Seventh Edition DRAFT 4 …As Opposed to External Financial Reporting Objectives • FASB Concepts Statement No. 4, “Objectives of Financial Reporting by Non-business Organizations” issued in 1980 stated that information should be provided to present and potential resource providers and other users about: – – – – – Allocation of resources Assessing the services provided and the ability to continue to provide those services How managers discharged their stewardship responsibilities and their performance Economic resources, obligations and net resources, and the changes therein Performance of the organization for the period • GASB Concepts Statements No.1 “Objectives of Financial Reporting” issued in 1987 stated that financial reporting should assist users in: – Assessing the unit’s public accountability – Evaluating operating results – Assessing the level of services provided and the unit’s ability to meet obligations as they become due 5 Internal Reporting as part of Strategic Plan Monitoring – Mission to Processes 6 Linkage of Strategic Financial Risks to Internal Reporting Identify and Assess Strategic Financial Risks Implement Monitoring and Mitigating Activities Establish Internal Financial Reporting Objectives to Communicate those Activities Develop & Communicate Financial & Non-financial information to meet the Objectives DRAFT 7 Primary Objectives of Internal Financial Reporting • Internal reporting is focused on reporting information related to strategic financial risks and key information in order to answer the high level questions • Primary objectives of internal reporting are: – Report Stewardship over Sources and Uses of Funds – Financial Performance – Liquidity – Balances, sources, uses, needs – Capital Asset Acquisition and Financing – Financial Capital Structure, Leverage and Capital Availability • Objectives are broad and cover diverse aspects of an institution DRAFT 8 Reporting Information to Meet Objectives • Existence of restrictions on use of a significant portion of funds and revenues adds a layer of complexity not in for-profit companies – Government grants and funds for research, tuition or clinical care – Endowments and related pay-out – Current or plant contributions • Due to diverse objectives and presence of restrictions, one basis of reporting cannot meet all objectives effectively • As a result, three bases or perspectives are needed – Funds - GAAP - Cash DRAFT 9 Reporting Information, cont. • Each basis of reporting is more effective at meeting certain objectives – Funds Basis • Stewardship over Funds received • Capital Asset Acquisition and Financing – GAAP Basis • Financial Performance • Capital Structure • Capital Availability – Cash Basis • Liquidity sources, uses, needs DRAFT 10 Levels of Financial Information • Different levels of users of financial Reports – – – – – – Trustees Senior central management Divisional senior management Departmental management Faculty members Middle central management • Although one set of reports cannot meet needs at all levels, basic information will be the same – Difference is in level of detail and grouping of information DRAFT 11 Levels of Financial Information Pyramid TRUSTEES SR. CENTRAL MGMT DIVISIONAL MGMT. DEPARTMENTAL MGMT. FACULTY & STAFF DRAFT 12 Putting It All Together • In order to meet the Reporting Objectives, significant changes are needed • At the Trustee Level: – More use of metrics and discussion of risks and results of activities – Presentation of key financial drivers instead of detailed financial information – Use of summarized financial reports – Discussion of liquidity, capital asset acquisitions and financing, and capital needs • Changes at the senior central management level: – – – – – More use of metrics of risks’ monitoring and mitigating activities Divisional results highlighted instead of detailed Use of Divisional scorecard and metrics More discussion of liquidity, capital structure More discussion of capital asset costs and financing DRAFT 13 Putting It All Together, cont. • Changes at the divisional management level: – Use of GAAP to reflect Financial Performance, Capital Structure and Liquidity on a divisional basis – Revised Funds Basis Statement of Activities to show controllable costs vs. allocations, and to show support separate from revenues • Other Changes – Using Natural Class of Expenditures for Funds Reports (or a matrix of natural class and function) – Presenting Fund Balances / Net Assets as well as significant restrictions – Presenting Capital Asset Acquisitions and Sources of Financing – Reporting Central Bank (if one) Liquidity and Needs DRAFT 14 Specific Topical Discussions • Budgets • All Funds Reporting / Net Asset Categories • Financial Operations Reporting • Management Discussion and Analysis 15 A Word About Budgets • Budgets are a control process and tool to manage financial affairs • Trustees are interested in: – – – – Ensuring that proper financial controls are in place Overseeing monitoring and mitigating processes What happened vs. planned Whether reserves are sufficient and flexible to cover contingencies • Significant variances occur for a number of reasons – Poor planning – either good or bad – Unanticipated linkages (or not) between events – Inadequate controls • Reporting to Trustees needs to focus on why a significant variance occurred and if internal action is needed to correct process, and less on the variance itself DRAFT 16 All Funds Reporting • Issue is that the board is responsible for all of the funds, throughout the year, not just at the annual audit • Most internal reports are driven by the operating budget, may include a capital budget, and likely has something about cash flow (post 2008) • Financial Statement presentation of net asset categories is not detailed enough to ensure the board and senior non-financial leadership understand their stewardship responsibilities 17 Public Institution Net Asset Categories • Composition of the reporting entity is critical – Institution – Component Units • Net Assets in a GASB set of financial statements: – Invested in capital assets, net of related debt – Restricted: • Non-expendable • Expendable – Unrestricted 18 Public Institution Net Asset Categories • Sub-categories of Net Assets in a GASB set of financial statements: – Net investment in plant – Restricted –non-expendable by purpose of restriction. Includes • Endowment • Loan permanent funds – Restricted –Expendable by purpose • • • • • Current Loans Unexpended Plant Debt Service Unspent payout – Unrestricted • Current • Designated for plant 19 Private Institution Net Asset Categories • Unrestricted Net Assets • Temporarily Restricted Net Assets • Permanently Restricted Net Assets Translates into these categories…… 20 Private Institution Net Asset Categories Unrestricted Net Assets • • • • • • • Current Unrestricted Funds Loan Funds Quasi – endowment, unrestricted Unrestricted unexpended plant funds Renewals and replacements for plant funds Retirement of indebtedness funds Net invested in plant funds Temporarily Restricted Net Assets • Current Restricted Funds (including sponsor funds, donor funds and unspent gains from total return program) • Loan Funds • Quasi – endowment, restricted • Term endowment • Restricted unexpended plant funds • Contractual renewals and replacement funds Permanently Restricted Net Assets • Endowment Funds • Loan Funds - Revolving 21 Financial Operations • College has a “balanced budget” – – – – Uses its external financial statement format to also report internally Uses an operating indicator that is fairly industry consistent High endowment payout rate Also uses operating gifts to fund current operations • Does the College have a structural deficit? – Structural deficit is when recurring revenues are less than recurring operating expenses – Financial Statement format may be key communication tool – Need to highlight differences between revenues and support • Board members often do not understand differences and nature of support since they do not exist in for-profit organizations – Need to communicate dependency on operating contributions and endowment payout 22 Operating Performance Normal Format NORMAL FORMAT 2006 2010 TUITION & FEES, NET 25,200 31,400 AUXILIARY ENTERPRISES 10,900 13,000 CONTRIBUTIONS 4,000 2,200 ENDOWMENT PAYOUT 8,500 7,500 OTHER 4,200 4,600 52,800 58,700 24,200 28,000 5,500 5,800 12,000 13,500 LIBRARY 2,000 2,600 ADMINISTRATION 9,000 11,400 TOTAL EXPENSES 52,700 61,300 100 (2,600) REVENUES AND SUPPORT: TOTAL REVENUES & SUPPORT EXPENSES INSTRUCTION STUDENT SERVICES AUXILIARY ENTERPRISES NET OPERATING SURPLUS (DEFICIT) 23 Revised Format to Segregate Support from Revenues 2006 2010 OPERATING REVENUES : TUITION & FEES, NET AUXILIARY ENTERPRISES OTHER TOTAL REVENUES 25,200 10,900 4,200 40,300 31,400 13,000 4,600 49,000 24,200 5,500 12,000 2,000 9,000 52,700 28,000 5,800 13,500 2,600 11,400 61,300 (12,400) (12,300) 4,000 8,500 12,500 2,200 7,500 9,700 100 (2,600) EXPENSES INSTRUCTION STUDENT SERVICES AUXILIARY ENTERPRISES LIBRARY ADMINISTRATION TOTAL EXPENSES DEFICIT BEFORE SUPPORT SUPPORT: CONTRIBUTIONS ENDOWMENT PAYOUT SUPPORT NET OPERATING SURPLUS (DEFICIT) 24 MD&A: A Treatise on Risk • Public Company Topics (as examples) – Qualitative and quantitative risks to the Business and changes to those risks – Revenue recognition and estimates required – Discussion and highlight of major balance sheet and operating metrics – usually a 5 year schedule with discussion of year over year changes in the past 3. – Significant factors effecting performance – Liquidity and Capital Resources – Working Capital – Debt • GASB Reporting Organization Topics – To provides an objective and easily readable analysis of the unit’s financial activities – Should include: • • • • • Comparison of current year to prior year Analysis of overall financial position and results of operations Analysis if significant changes in funds and budget variances Describe capital asset and long-term debt activity Description of currently known facts, decisions or conditions that are expected to have a significant effect on financial position or operating results 25 MD&A - Liquidity • Liquidity Ratio – Sources of Liquidity/Uses of Liquidity – Two time frames – • Short-term – generally 30 days • Intermediate measure – generally 90-120 days • Longer time frames are not that relevant – Sources • Same day or next day assets • Need to address endowment investments and whether to count these • Others as described in policy (SFAHE chapter 4) – Uses • Operation, debt service, capital • Others as described in policy (SFAHE chapter 4) • Importance of establishing policy/criteria to calculate Ratio and rationale of what is in or out 26 MD&A - Financial Health • Composite Financial Index – Measures Overall Financial Health using 4 component ratios and a scoring /weighting system • Four Component Ratios – Primary Reserve - Expendable Net Assets /Total Expenses – Viability Ratio - Expendable Net Assets /Total Debt – Net Operating Revenues – Net Revenues from Operations /Total Unrestricted Operating Revenues – Return on Net Assets – Change in Total Net Assets/Total Assets 27 Institutional Composite Financial Index 4 High Level Questions Sufficiency and Flexibility Live Within our Means Sufficient Return on Net Assets Debt Managed Strategically 4 Ratios Primary Reserve Net Operating Revenues Return on Net Assets Viability 0.73 4.96% 16.24% 0.94 Composite Financial Index (CFI) Compute CFI 5.05 28 Institutional Graphic Financial Profile Primary Reserve 10.00 8.00 5.51 6.00 4.00 2.00 0.00 -2.00 Return on Net Assets 8.12 7.09Net Operating Revenues -4.00 2.25 Viability 2011 29 Financial Health Reserves • What are the levels of our financial reserves? How restrictive? – Levels and Sources – Degree of Flexibility • Institution – President’s discretion • School – Dean’s discretion • Department – Chair’s discretion • Faculty • Financial Aid – how restrictive? 30 Financial Health Reserves in $M BY PURPOSE Institution Wide Department Capital Projects Financial Aid General By Department/Major By Region subtotal - Financial Aid Total By TYPE Endowment Operating/Current Unexpended Plant 2008 2009 2010 2011 32.8 17.1 2.3 25.1 14.9 2.4 26.0 14.2 1.7 29.1 18.4 8.2 35.0 12.2 4.1 51.3 27.2 8.7 2.5 38.4 28.3 9.0 2.9 40.2 30.0 9.3 3.0 42.3 103.5 80.8 82.1 98.0 97.1 4.3 2.1 103.5 75.2 3.2 2.4 80.8 77.4 3.0 1.7 82.1 86.3 3.5 8.2 98.0 31 MD& A – Example Financial Drivers • Some Key Financial Drivers – – – – – – – – Student Headcount Acceptance & Matriculation rates Faculty & Staff headcount Tuition discount rate Capital expenditures Endowment Investment balances and overall return Auxiliary services net margin % Levels of State support • Present drivers over an extended time frame – 5 year historical – Project into future using budget projections and financial statement modeling 32 MD&A – Facilities • Age of Facilities Ratio –accumulated depreciation/depreciation expense • Deferred Maintenance Ratio – Outstanding maintenance requirements /expendable net assets • Risk in funding capital projects & variability in $ and timing of gifts IN $M COST DORM BLDG A BLDG B 2013 10.0 5.0 15.0 PLANNED FUNDING DEBT 10.0 EQUITY 2.0 GIFTS 3.0 15.0 2014 5.0 20.0 15.0 40.0 2015 5.0 30.0 35.0 TOTAL 15.0 30.0 45.0 90.0 25.0 2.0 13.0 40.0 25.0 4.0 6.0 35.0 60.0 8.0 22.0 90.0 33 MD&A – Tuition Dependency and Discount Rate • Some ratios that portray risk and drivers – Tuition Dependency Ratio • Net tuition & fees divided by operating income – Net Tuition & Fees Contribution Ratio • Net tuition & fees divided by total expenses – Total student revenues can be used too • Net Tuition & Auxiliary Enterprises revenues – Tuition Discount Rate • Need to define discount and what are sources of funding the discount – Just reduction in gross rate or does it also include financial aid awards? Which type of awards? 34 Wrap–Up and Questions Follow up to any topics presented today 35