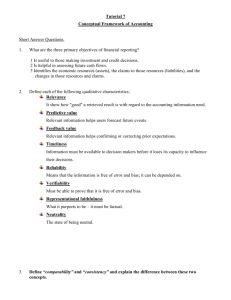

Conceptual Framework Issues

advertisement

Financial Reporting Issues James Leisenring, FASB Senior Advisor The views expressed in this presentation are my own and do not necessarily represent official positions of the Financial Accounting Standards Board. Official positions of the FASB Board are arrived at only after extensive due process and deliberations. The Vision 2 ...one single set of high quality global standards... ...used on the global capital markets. Financial Reporting Issues Benefits of Global Standards 3 • Fundamental to getting to a high-quality global reporting system • Attracting investment through transparency • Reducing the cost of capital • Increasing world-wide investment • Reducing costs Financial Reporting Issues Benefits of Global Standards Critical Factors Must in fact adopt and not adapt IFRS • Some (most?) adapt not adopt • Some such as Europe have not adopted but decide whether to adopt standard by standard Financial Reporting Issues 4 Benefits of Global Standards Questions What does “used” mean: • If application of the standards is not consistent, are the benefits illusory? • If application is not consistent, is the cost of conversion in the USA worth it? Financial Reporting Issues 5 Benefits of Global Standards Questions Do we agree on what is meant by a high-quality accounting standard? • FASB/IASB Research Conference • My view Financial Reporting Issues 6 Attributes of a High-Quality Standard(1) 1. Be consistent with the guidance provided by an underlying conceptual framework. 2. Avoid or minimize alternative accounting procedures, explicit or implicit, because comparability and consistency enhance the usefulness of information. 3. Be unambiguous and comprehensible so that the standard is understandable by preparers and auditors who must apply the standard, by authorities who must enforce the standard, and by users who must deal with the information produced by the standard. 4. Be capable of rigorous interpretation and application so that similar events and transactions are accounted for similarly across time periods and among companies. (1) A Vision of the Future (FASB 1999) Financial Reporting Issues 7 Attributes of High-Quality Standards 8 Each attribute serves to promote comparability • Application of standards leads to consistent conclusions across varieties of transactions • Explicit alternatives not comparable • Implicit alternatives are the result of ambiguity and inability to apply and interpret consistently Financial Reporting Issues Does the IASB Agree with These Attributes of High-Quality? 1. “IFRSs are based on the Framework, which addresses the concepts underlying the information presented in general purpose financial statements. The objective of the Framework is to facilitate the consistent and logical formulation of IFRSs.” (Preface to IFRSs, paragraph 8) 2. The IASB’s objective is to require like transactions and events to be accounted for and reported in a like way and unlike transactions and events to be accounted for and reported differently, both within an entity over time and among entities. Consequently, the IASB intends not to permit choices in accounting treatment.” (Preface to IFRSs, paragraph 13) 3. Although a single economic phenomenon can be faithfully represented in multiple ways, permitting alternative accounting methods for the same economic phenomenon diminishes comparability. (IFRS, QC 25) 4. One of the most important reasons that financial reporting standards are needed is to increase the comparability of reported financial information. (IFRS, BC3.33) Financial Reporting Issues 9 Does the IASB Agree with These Attributes of High-Quality? (cont.) Question ARE “principles-based” standards unambiguous? • What do we mean by principles-based? • What do IASB constituents mean? • Does principles-based allow implicit alternatives? In my view what is often meant by principlesbased contradicts any notion of comparability. Financial Reporting Issues 10 Convergence 11 • Memorandum of Understanding (Roadmap) • Focus on major projects on agenda • Don’t try to address every reconciling item • Don’t try to converge inadequate standards Financial Reporting Issues MOU Projects • • • • • • • • • • • Business Combinations (completed) Consolidations Derecognition Fair Value Measurements Liability and Equity Distinctions Financial Statement Presentation Postretirement Benefits Revenue Recognition Leases Financial Instruments Intangible Assets (not on agenda) Financial Reporting Issues 12 Framework Consequences • Boards to date have not expended the resources to resolve the conceptual issues inherent in the MoU projects Risk of very inconsistent answers Has been a major impediment to project resolutions Financial Reporting Issues 13 Objective of Financial Reporting 14 • “The objective of general purpose financial reporting is to provide financial information about the reporting entity that is useful to existing and potential investors, lenders, and other creditors in making decisions about providing resources to the entity. Those decisions involve buying, selling, or holding equity and debt instruments, and providing or settling loans and other forms of credit.” (OB-2) • Seems to be fundamental agreement if one accepts: General purpose financial reporting Not management accounting Not regulatory accounting Financial Reporting Issues Qualitative Characteristics Fundamental qualitative characteristics • Relevance (Information capable of making a difference) If not material, it does not make a difference. • Faithful representation (Faithfully represents what it purports to represent.) Neutrality Completeness Financial Reporting Issues 15 Qualitative Characteristics Enhancing qualitative characteristics • Comparability • Verifiability • Timeliness • Understandability Cost as a pervasive constraint. Financial Reporting Issues 16 Qualitative Characteristics 17 • Seem to have basic agreement now on the fundamental and enhancing characteristics of decision-useful information. • Boards also have said comparability is an essential objective of standard setting. “One of the most important reasons that reporting standards are needed is to increase comparability of reported information” (QC-BC 3.33) Financial Reporting Issues Qualitative Characteristics 18 But do we agree on what we mean by comparability? • Is historical cost comparable? • Identical assets (which produces comparability?) Account for these the same Account for these as used (or intended to be used) • Does a “business model approach” enhance or impair comparability? Financial Reporting Issues Impediments to Achieving Progress on Standards Selected Conceptual Framework Issues • Definition of control • Asset/Liability definitions • Unit of account issues Illustrate these issues in terms of selected MOU projects Financial Reporting Issues 19 Conceptual Framework Issues Definition of Control • • • As used in asset definition As used in consolidation As used in revenue recognition Questions about Control • Does a forward contract to acquire an asset convey control of that asset? • Does an option to acquire an asset convey control of that asset? • Do we consistently ask “control what“? Financial Reporting Issues 20 Conceptual Framework Issues 21 Asset/Liability Definitions • Where is the focus with respect to an asset: Present right A right either exists or does not exist Probable benefit (cash inflow) The outcome of having a right (which could be zero) • Contingent asset Where is the focus with respect to a liability: Present obligation An obligation either exists or does not exist Probable sacrifice (cash outflow) The outcome of having an obligation (which could be zero) Contingent liability? Discussions of contingent assets/contingent liabilities are really discussions about arrangements with uncertain outcomes Financial Reporting Issues Conceptual Framework Issues Asset Liability Definitions Observations • Some virtually certain in or out bound cash flows are not assets or liabilities • “Risks and rewards” are not liabilities and assets; They are the results of having assets and liabilities • Risks and rewards do affect the measurement of both assets and liabilities • We don’t know what to do with forward (executory) contracts that appear to meet definitions of assets and liabilities Are forwards just “contingent” assets and liabilities? Financial Reporting Issues 22 Conceptual Framework Issues Questions about Assets and Liabilities • Can writing an option (by definition, a liability) result in an asset? • Can one have a liability without any present obligation if non-payment is sufficiently consequential? • Can one have a liability if they contract to refrain from a given activity or did one just sell an unrecognized right? Fundamental: Can one have a liability if presently obligated to deliver an equity instrument rather than an asset? Financial Reporting Issues 23 Conceptual Framework Issues 24 Questions about “Unit of Account” • What does it mean? 1 x or 1,000 x A group of x + y • • • Does the “unit of account” notion only affect measurement or also recognition? If x and y are combined, must both meet the definitions of assets or liabilities to be recognized? What is meant by account for the “whole contract”? Financial Reporting Issues Conceptual Framework Issues Questions about “Unit of Account” • Is linkage (an undefined term) another unit of account issue? Combine contracts only with the same counterparties or with different counterparties? Combine contracts only if entered into contemporarily? • Is a linkage notion operational? Financial Reporting Issues 25 Conceptual Framework 26 Observations about Framework • One phase of the Conceptual Framework project is intended to address measurement attributes and measurement issues Measurement of assets is of course controversial Measurement of liabilities seems to be impossible • We seldom really measure anything, we make calculations Financial Reporting Issues Best estimate Present value of expected cash flows Conceptual Framework 27 Implications on Present Agenda of Framework Uncertainty • • • • • • • • Insurance accounting Consolidations Postretirement benefits (Pensions) Revenue recognition Liabilities and equity Leases Financial Instruments Derecognition Financial Reporting Issues Conceptual Framework Implications of Framework Uncertainty • Insurance accounting Written options are assets Expected distributions are liabilities • Consolidation based on control Ability to be in control Actually controlling Perpetuation of control • Pensions—Is there a unique definition of liabilities to employees? Liability as a result of future service and final pay Liability for unvested obligation Financial Reporting Issues 28 Conceptual Framework 29 Implications of Framework Uncertainty (continued) • Revenue recognition Unit of account: Identification of performance obligation Liability definition: Satisfaction of performance obligations—when the customer obtains control of that good or service • Why does the criterion for revenue recognition focus on the customer (the transferee) to determine the seller’s (the transferor) accounting? Liabilities and equity Liability definition: Is the obligation to deliver an equity instrument a liability? Financial Reporting Issues Conceptual Framework 30 Implications of Framework Uncertainty (continued) • Leases: Basic right of use model (unconditional right and obligation) Do lessors have a performance obligation under a right of use model beyond delivery of the underlying asset? Is the distinction between the lessor derecognition model and the performance obligation model appropriate? Are performance obligations of lessors defined consistent with the revenue recognition project? Financial Reporting Issues Conceptual Framework 31 Implications of Framework Uncertainty (continued) • Financial Instruments Business model—recognition Business model—measurement Business model—presentation • Measurement consequences of multiple attributes Impairment Complexity • Hedging Fair value hedges Cash flow hedges Financial Reporting Issues Conceptual Framework 32 Implications of Framework Uncertainty (continued) • Derecognition Issues Why don’t we derecognize when definitions of assets and liabilities are no longer met? Do we insist on “stickiness” because we think “risks and rewards” are assets and liabilities? How important are “linkage” issues? Why do we conclude forwards and options are more important for derecognition than for recognition? Why would written puts prohibit sale except in revenue recognition? Financial Reporting Issues Conceptual Framework 33 Lack of concentration on the Framework has been my biggest disappointment and frustration during my nine years at the IASB. • Led to serious inefficiency in standard setting • Inconsistent answers in different projects Lack of attention to the Framework also seems to have perpetuated misunderstandings about the present Framework particularly in segments of the academic community. Financial Reporting Issues Conceptual Framework 34 Misunderstandings of Both IASB and FASB Frameworks Basic conclusion as to conceptual primacy of assets and liabilities • Thought to be a balance sheet view • Implies there could be an income statement view • Implies the basic conclusion resolves measurement which must be at fair value Financial Reporting Issues Conceptual Framework Framework is essential: 1. To resolve accounting debates in a consistent manner 2. To defend accounting standard-setting process as in fact neutral 3. To achieve “principles-based standards” 4. Alternatives suggested just won’t work: • Consensus • Compromise • Consequences Financial Reporting Issues 35 Credit Crisis 36 Lessons I wish we had learned: • Accounting can’t cause losses • Accounting can’t cure the fact that losses have occurred even if ignored • Objectives of regulators are not consistent with objective of financial reporting • Information if current is pro-cyclical • Circumstances like the past few years are in part a crisis of confidence • Undermining confidence in financial reporting with bad accounting only makes things worse Financial Reporting Issues