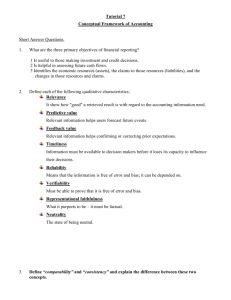

2002

advertisement

Engineering & Energy 2002 MICHAEL BAKER CORPORATION Investor Relations Presentation Ninth Annual Emerald Groundhog Day Investment Forum February 5, 2002 1 2002 Safe Harbor Engineering & Energy This presentation will contain information related to events which may occur in the future. These forward-looking statements may include future business trends, revenue and earnings forecasts, and acquisition and corporate finance activity. These statements are subject to market, regulatory, operating and other risks and uncertainties and, as a result, actual results may vary. Such forwardlooking statements are made pursuant to the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. 2 2002 Summary / Highlights Focused on Two Segments Engineering & Energy Engineering and Energy Leader in Professional Services Oil & Gas Production O&M Transportation and Civil Infrastructure Engineering Positioned to Accelerate Margin Growth, Led by Energy Segment Currently Valued at 5x EBITDA 3 2002 Decade of Performance $400 Engineering & Energy Dollars in Millions $390 $349 $150 Continuing Business Revenue $121 $283 $300 $248 $199 $200 $157 $127 $100 $41 $86 $136 $189 $179 $72 $45 $42 $43 $115 $210 $69 $228 $55 $43 $240 $203 $39 $150 $127 $205 $80 $179 $162 $165 1996 1997 $134 $93 $0 1990 1991 1992 1993 1994 1995 Engineering 1998 1999 2000 2001(E) Energy 4 2002 Core Energy Service Offerings Oil & Gas Engineering & Energy Operations & Maintenance Operations Engineering Competency-Based Training Supply Chain Management Power Operations & Maintenance New Equipment Installation Outage Planning/Overhauls Engineering / Start-up Assistance 5 2002 Differentiation of Services Engineering & Energy Energy OPCOSM Integrated Services and Solutions for Global O&G Upstream Production Operations Competency-Based Training and Nationalization Programs 6 2002 OPCO SM Engineering & Energy OPCO Integrated Decision-making in Production Operations Idea Explore Construct Management Develop Produce Monetize Operations Network Growth Maintenance OPCO Supply Chain Management HS&E Production Operations Functions and Critical Decisions Training & Development Human Resources 7 2002 Energy Growth Drivers Engineering & Energy Fixed Fee Income Annual Performance Bonus Sharing Cost Savings Baker VALUE CREATION SHARED SAVINGS LEVERAGED ECONOMIES of SCALE OPCO SM Client Reduced Operating Costs Increased Revenues Increased Efficiency 8 $0 Jan-02 Nov-01 Price Driver Sep-01 Jul-01 May-01 Mar-01 Jan-01 Nov-00 Sep-00 Jul-00 May-00 Mar-00 Jan-00 Nov-99 Sep-99 Jul-99 May-99 Mar-99 Jan-99 Nov-98 Sep-98 Jul-98 May-98 Mar-98 Jan-98 $/bbl 2002 Engineering & Energy Historical Oil Prices (WTI) $40 $35 $30 $25 $20 $15 $10 $5 Data Source: www.eia.doe.gov 9 2002 OPCO Diffusion Curve Early Adopters Early Majority Late Majority Engineering & Energy Laggards 10 2002 Our OPCO Potential Market Engineering & Energy 11 2002 Our OPCO-Served Market Engineering & Energy 12 2002 Deepwater Opportunities Engineering & Energy Largest Supplier of Manpower to Deepwater GOM Ops Engineering Support to New Facilities 13 2002 eOPS Engineering & Energy Fully-Integrated, Operations and Maintenance System for Upstream Energy Industry Alliance: Baker - Content SAIC - Technology, Telecom and Knowledge Management Deloitte - Planning, Strategy and Analysis Global Market - $160 Billion Benefits Shortened Cycle Time Improved Operating Performance Lower Cost of Operation Greater Asset Return 14 2002 Core Engineering Service Offerings Transportation Engineering Services Engineering & Energy Highways Bridges (Structures) Program Management Asset Management Civil Infrastructure Services Cold Region Pipelines DoD / Federal Markets Water/Waste Water Asset Management 15 2002 Growth Drivers Engineering & Energy Transportation: TEA-21 3rd 9th 8th 1st 4th 11th 7th 12th 35th 10th 29th 23rd 6th 2nd 5th 22nd Ranking TEA-21 Funded States Baker Office 16 Source: Projected TEA-21 Apportionments 1998-2003, ENR (08/00) Growth Drivers Engineering & Energy TEA-21/AIR-21 $ in billions 2002 $45 $40 $35 $30 $25 $20 $15 $10 $5 $0 Total Federal Authorizations $36.7 $23.9 2000 $37.8 $38.7 $26.5 $24.7 2001 TEA-21 2002 (E) $39.8 $28.4 2003 (E) AIR-21 Source: Federal Highway Administrations and FAA, U.S. Department of Transportation 17 2002 Engineering Highlights - 2001 $290mm in New Work Added Won $130mm in Open-End Contracts with Department of Defense Selected as General Engineering Consultant for Hampton Roads Third Crossing Engineering & Energy $4.5 Billion Total Project Cost Successful Entry into Texas Market 18 2002 Competitive Barriers to Entry Engineering & Energy Energy Customer Relationships Content and Information Delivery Systems Implementation/Delivery Capability OPCO Network Engineering Alignment of Services to Meet Customer Needs Long-Term Relationships 19 2002 Key Customer Relationships Energy Engineering & Energy Engineering 20 2002 Acquisition Growth Opportunities Engineering & Energy Geographic and Capacity Expansion Energy Opportunities Engineering Opportunities Additional Capabilities Energy Training Program Development Maintenance Management Systems Engineering Water/Wastewater Asset Management 21 2002 Total Revenues Engineering & Energy $600 $521.3 Dollars in Millions $500 $506.0 $390.7 $348.7 $400 $300 $390.0 $281.9 $247.0 $200 $100 $0 1998 1999 Total Reported Revenues 2000 Engineering 2001 (E) Energy 22 2002 Revenues $150 Engineering & Energy Q3/Q3 Total Reported/Engineering/Energy Revenues Dollars in Millions $129.8 $125 $75 $98.4 $98.4 $92.4 $100 $89.7 $37.8 $69.0 $31.8 $17.5 $50 $57.9 $51.5 $25 $60.6 $0 1999 Total Reported Revenues 2000 Engineering 2001 Energy 23 2002 Operating Performance Engineering & Energy (in Thousands of $) TOTAL CONTRACT REVENUES Total Reported Less Non-Core ENERGY ENGINEERING Total Core ‘98 ‘99 ‘00 $521,271 274,249 $506,012 224,132 $390,710 42,018 68,607 178,414 80,158 201,722 120,708 227,984 247,021 281,880 348,692 TOTAL OPERATING INCOME (Pre-Corp. O/H and I/C Ins. Premiums) 7,075 (511) 17,543 Total Reported 1.4% -.1% 4.5% % ENERGY % ENGINEERING % Total Core % 5,297 7.7% 13,796 7.7% 6.8% 13,356 6.6% 9,314 7.7% 16,783 7.4% $19,093 7.7% $18,827 6.7% $26,097 7.5% Adjusted for $1 Million Non-Recurring Charge 5,471 24 2002 Operating Performance (Q3/Q3) Engineering & Energy (in Thousands of $) TOTAL CONTRACT REVENUES Total Reported Less Non-Core ENERGY ENGINEERING Total Core ‘99 ‘00 ‘01 $129,790 60,810 $92,351 2,634 $98,387 - 17,466 51,514 31,809 57,908 37,766 60,621 68,980 89,717 98,387 TOTAL OPERATING INCOME (Pre-Corp. O/H and I/C Ins. Premiums) (2,938) 5,503 8,801 Total Reported (2.3%) 6.0% 8.9% % ENERGY % ENGINEERING % Total Core % 1,220 563 7.0% 2,481 4.8% 2,313 7.3% 3,865 6.7% 4,121 10.9% 5,132 8.5% $3,701 5.4% $6,178 6.9% $9,253 9.4% 25 2002 Cash Flow Engineering & Energy (in millions of $) Net Income Depreciation & Amortization Other Cash from Operations Capital Expenditures Acquisition/Investments Share Repurchase Proceeds from Sale of Assets/Stock Options NET Borrowings (Repayments) NET Increase (Decrease) in Cash ‘98 ‘99 ‘00 $(2.4) 5.0 (4.0) (1.4) $(8.2) 7.4 1.9 1.1 $5.4 7.1 (0.1) 12.4 (10.6) (.8) (.8) 2.7 $(10.9) (5.3) (4.9) 7.8 $(1.3) (2.9) (9.0) 15.0 (10.1) $5.4 26 2002 Balance Sheet Engineering & Energy (in millions of $) ‘98 ‘99 ‘00 $5.0 82.7 22.4 $3.7 77.4 20.8 $9.1 9.0 68.0 16.1 17.5 7.5 16.8 151.9 17.1 14.6 15.6 149.2 10.1 10.8 10.2 133.3 LIABILITIES Current Prt LTD Trade A/P Accrued Other .8 43.4 51.7 3.5 28.9 57.1 2.2 25.7 55.0 Long Term Debt 3.1 14.9 0.1 52.9 $151.9 44.8 $149.2 50.3 $133.3 ASSETS Cash Short-Term Investment A/R Cost in Excess of Billing PPE Intangibles Other Owners’ Equity 27 2002 EPS Growth Reported EPS Pro Forma EPS Core Operating Income Less Corporate Overhead Operating Income Engineering & Energy ‘98 ‘99 ‘00 $(.30) $(1.00) $.65 $19,093 (8,744) 10,349 $17,827 (7,664) 10,163 $26,097 (7,715) 18,382 (4,864) 5,485 (4,777) 5,386 (9,375) 9,007 $.67 $.66 $1.09 Provision for Income Taxes (47% Rate for 1998 & 1999 and 51% Rate for 2000) Pro Forma EPS 2001 Estimate: $1.25 - $1.30 28 Stock Performance (12 mos.) 2002 $16.00 $15.20 $14.00 $14.00 $15.00 $13.38 $13.85 Closing Share Price Engineering & Energy $12.00 $13.60 $12.70 $12.26 $11.55 $10.00 $10.00 $8.93 $8.00 $8.25 $8.30 01/01 02/01 $6.00 $4.00 $2.00 $0.00 03/01 04/01 05/01 06/01 07/01 08/01 09/01 10/01 11/01 12/01 01/02 29 2002 Ownership Engineering & Energy Holders Shares Baker ESOP 3,420,821 Lord, Abbett & Co. 689,303 Goldman Sachs Asset Management 566,700 Dimensional Fund Advisors Inc. 477,714 Corbyn Investment Management 227,137 Tontine Management, L.L.C. 210,600 Munder Capital Management 171,900 Paradigm Capital Management 154,400 Emerald Advisers 87,100 30 2002 Conclusion Engineering & Energy Leader in: Oil & Gas Production O&M Transportation and Civil Infrastructure Engineering Energy Market Conditions Catalyst for Significant Growth Investment in Transportation Infrastructure Providing Substantial Opportunity Debt-free, Leverageable Balance Sheet Currently Valued at 5x EBITDA 31 Engineering & Energy 2001 MICHAEL BAKER CORPORATION Investor Relations Presentation 32