Chapter 5

advertisement

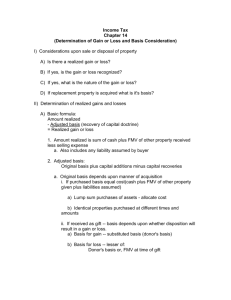

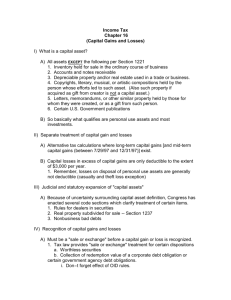

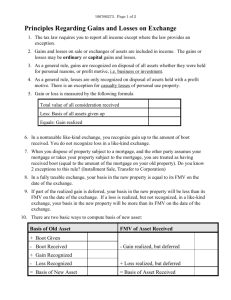

Income Tax Chapter 5 Property Transactions: Capital Gains and Losses I) Considerations upon sale or disposal of property A) Is there a realized gain or loss? B) If yes, is the gain or loss recognized? C) If yes, what is the nature of the gain or loss? D) If replacement property is acquired what is it's basis? II) Determination of realized gains and losses A) Basic formula: Amount realized - Adjusted basis (recovery of capital doctrine) = Realized gain or loss 1. Amount realized is sum of cash plus FMV of other property received less selling expense a. Also includes any liability assumed by buyer 2. Adjusted basis: Original basis plus capital additions minus capital recoveries a. Original basis depends upon manner of acquisition i. If purchased basis equal cost(cash plus FMV of other property given plus liabilities assumed) a) Lump sum purchases of assets - allocate cost b) Identical properties purchased at different times and amounts ii. If received as gift -- basis depends upon whether disposition will result in a gain or loss. a) Basis for gain -- substituted basis (donor's basis) b) Basis for loss -- lesser of: Donor's basis or, FMV at time of gift c) Adjustment for gift tax paid 1) Gifts before 1977 add 100% of gift tax paid (cannot exceed FMV of gifted property) 2) Gifts after 1976 add portion of gift tax which relates to appreciation. Formula for determination: Appreciation --------------------------Taxable gift X Gift tax paid d) Holding period 1) If substituted basis then substituted holding period 2) If loss basis applies then hold period starts on date of gift iii Inherited property a) Basis generally is FMV on date of death 1) Alternate valuation date b) Sale always results in long-term gain or <loss> b. Capital Additions -- Capital improvements c. Capital recoveries -- depreciation, insurance proceeds, casualty/theft loss deductions. d. Other basis considerations i. Disallowed losses under Section 267 ii. Conversion of property to business use from personal use iii. Wash sale rules iv. Allocation of stock basis upon receipt of nontaxable stock dividends or nontaxable stock rights v. Amortization of discounts and premiums. vi. Special rules for tax straddles -- Section 1092 III) Will gain or loss be recognized? A) General rule -- All realized gains and losses will be recognized B) Many exceptions!!! 1. Losses on personal assets never recognized! 2. Certain nontaxable exchanges 3. Involuntary conversion gains 4. Certain other property transactions 5. Note -- many of the exceptions are elective IV) What is a capital asset? A) All assets EXCEPT the following per Section 1221 1. Inventory held for sale in the ordinary course of business 2. Accounts and notes receivable 3. Depreciable property and/or real estate used in a trade or business. 4. Copyrights, literary, musical, or artistic compositions held by the person whose efforts led to such asset. (Also such property if acquired as gift from creator is not a capital asset.) 5. Letters, memorandums, or other similar property held by those for whom they were created, or as a gift from such person. 6. Certain U.S. Government publications B) So basically what qualifies are personal use assets and most investments. V) Separate treatment of capital gain and losses (separate reporting or sold) A) Alternative tax calculations where long-term capital gains [and mid-term capital gains (between 7/29/97 and 12/31/97)] exist. B) Capital losses in excess of capital gains are only deductible to the extent of $3,000 per year. 1. Remember, losses on disposal of personal use assets are generally not deductible (casualty and theft loss exception) VI) Judicial and statutory expansion of "capital assets" A) Because of uncertainty surrounding capital asset definition, Congress has enacted several code sections which clarify treatment of certain items. 1. Rules for dealers in securities 2. Real property subdivided for sale -- Section 1237 3. Nonbusiness bad debts VII) Recognition of capital gains and losses A) Must be a "sale or exchange" before a capital gain or loss is recognized. 1. Tax law provides "sale or exchange" treatment for certain dispositions a. Worthless securities b. Collection of redemption value of a corporate debt obligation or certain government agency debt obligations. i. Don’t forget effect of OID rules. B) Treatment of sale of options 1. Character of underlying property determines nature of gain. C) Treatment of Patents -- Automatic long term capital gain treatment assuming the “holder” is an individual. D) Sales of franchise generally results in ordinary income because significant powers, rights, or continuing interests are retained. VIII) Classification of capital gains and losses A) Holding periods 1. Pre July 29, 1997--short-term vs long-term 2. After July 28, 1997 and before January 1, 1998--short-term, mid-term, long-term 3. After December 31, 1997--short-term vs. long-term B) Special rules for determining holding period. 1. Inherited property -- Always long-term 2. Gift property -- if substituted basis (gain rule) is used, then a substituted holding period. C) Capital gain rates--post December 31, 1997 1. Short-term gains--taxed at regular tax rates 2. Long-term gains--taxed at a rate of 10% or 20% or 25% or 28% depending upon type of property. 3. Special rates of 8% and 18% for certain gains after 2000. D) Lowest rates (10/20%) only apply to “adjusted net capital gain” 1. This is the net capital gain determined without considering --gain from the sale of a collectible(28% rate) --unrecaptured section 1250 gain (25% rate) --gain excluded from income from sale of “small business stock” (28% rate) E) Special rates for tax years beginning after December 31, 2000 1. The “adjusted net capital gain” on assets held more than 5 years, an 8% tax rate applies in lieu of the 10% rate (i.e. taxpayer in 15% bracket) 2. The “adjusted net capital gain” on assets held more than 5 years, considering only property for which the holding period begins after December 31, 2000 qualifies for an 18% rate rather than a 20% rate. a) A taxpayer (except a corporation) may elect to treat any readily tradable stock, and/or any other capital asset or property used in a trade or business, as having been sold on January 1, 2001 and reacquired on that date for an amount equal to its FMV. I) Gains will generally be recognized. ii) Losses will not be allowed. F) Netting of Capital gains and losses 1. LTCG's----------LTCL's ----------- Net LTCG or LTCL--\ STCG's---------/ STCL's ---------- Net STCG or STCL-- Net if opposite (i.e. one gain and other loss) 2. Results of netting Gain -LTCG STCG LT and ST Losses -- LTCL STCL LT and ST 3. If netting results in a LTCG, the portion attributable to each alternative rate must be determined. (How much of the gain is subject to a 28% rate, how much to a 25% rate, and how muchqualifies for 10/20% rate) 4. During the netting process (within LT category) losses always reduce gains taxed at the highest rate first. (See Examples 57 and 58 in text) a) Also, any net STCL will offset highest rate LTCG’s first. G) Limitation and carryover of capital losses. 1. Limitation on capital loss deduction is $3,000 per year. 2. Short-term losses are used first. 3. Excess capital losses may be carried over indefinitely. They retain their character (ST vs. LT) . 4. Watch for special carryover computations where you have negative taxable incomes. a) Capital losses are only deemed used if they serve to reduce taxable income. b) Carryover is measured by the capital loss minus the lesser of: --capital loss deduction claimed on the return (generally $3,000), --or taxable income increased by the capital loss deducted plus the personal and dependency exemptions. c) Calculate taxable income before capital loss deduction and personal and dependency exemptions. This is the measure for determining whether any benefit from the capital loss deduction was received.