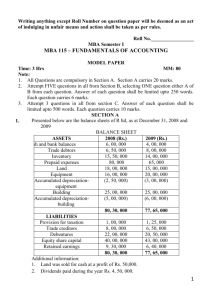

Accounts - Text Books

advertisement