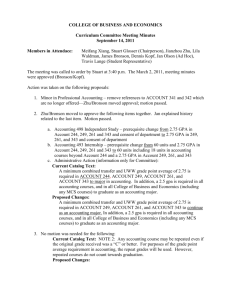

Document

advertisement

Tutorial IV • Problem 32 in Assignment I • Examples IELM310/ZHU Xiang 1 Problem 32 in Assignment I • a. Compute the total inventory • b. 20000 inventory at the end of quarter 4 • c. 3 requirements for the solution – Minimum constant workforce – Total inventory is less than that of part a – Stock-out occurs in quarter 2 IELM310/ZHU Xiang 2 Examples • Textbook – Page 204: Problem 17 – Page 211: Problem 22 – page 212: Problem 25 IELM310/ZHU Xiang 3 Problem 17 • • • • The Wod Chemical Company produces a chemical compound that is used as a lawn fertilizer. The compound can be produced at a rate of 10000 pounds per day. Annual demand for the compound is 0.6 million pounds per year. The fixed cost of setting up for a production run of the chemical is $1500, and the variable cost of production is $3.5 per pound. The company uses an interest rate of 22 percent to account for the cost of capital, and the costs of storage and handling of the chemical amount to 12 percent of the value. Assume that there are 250 working days in a year. a. What is the optimal size of the production run for this particular compound? b. What proportion of each production cycle consists of uptime and what proportion consists of downtime? c. What is the average annual cost of holding and setup attributed to this item? If the compound sells for $3.9 per pound, what is the annual profit the company is realizing from this item? IELM310/ZHU Xiang 4 Solution Sheet IELM310/ZHU Xiang 5 Solution Sheet IELM310/ZHU Xiang 6 Problem 22 • A purchasing agent for a particular type of silicon wafer used in the production of semiconductors must decide among three sources. Source A will sell the silicon wafers for $2.5 per wafer, independently of the number of wafers ordered. Source B will sell the wafers for $2.4 each but will not consider an order for few than 3000 wafers, and Source C will sell the wafers for $2.3 each but will not accept an order for fewer than 4000 wafers. Assume an order setup cost of $100 and an annual requirement of 20000 wafers. Assume a 20 percent annual interest rate for holding cost calculations. • a. Which source should be used, and what is the size of the standing order? b. What is the optimal value of the holding and setup costs for wafers when the optimal source is used? c. If the replenishment lead time for wafers is three months, determine the reorder point based on the on-hand level of inventory of wafers. • • IELM310/ZHU Xiang 7 Solution Sheet IELM310/ZHU Xiang 8 Solution Sheet IELM310/ZHU Xiang 9 Problem 25 • Parasol Systems sells motherboards for personal computers. For quantities up through 25, the firm charges $350 per board; for quantities between 26 and 50, it charges $315 for each board purchased beyond 25; and it charges $285 each for the additional quantities over 50. A large communications firm expects to require these motherboards for the next 10 years at a rate of at least 140 per year. Order setup costs are $30 and holding costs are based on an $18 percent annual interest rate. What should be the size of the standing order? IELM310/ZHU Xiang 10 Solution Sheet IELM310/ZHU Xiang 11 Solution Sheet IELM310/ZHU Xiang 12 Solution to Problem 17 • D = 0.6x106 per year, P=10000x250=2.5x106 per year, K =$1500, h =3.5x(0.22+0.12)=$1.19, h’=h(1−D/P)=0.9044 • a. Q* = (2x1500x0.6x106/0.9044)1/2 = 44612 IELM310/ZHU Xiang 13 Solution to Problem 17 (cont) • b. T=Q*/D =44612 / (600000/250)=18.59 days T1 = Q*/P =44612/(2.5x106/250)=4.46 days T2 =T−T1 =14.13 days • c. Average holding cost = h’Q*/2 =20173.55 Average setup cost =KD/Q =20173.94 Total cost =40347.49 Annual profit =(3.9−3.5)x0.6x106 − 40347.49 =240000 −40347.49 =$199652.51 IELM310/ZHU Xiang 14 Solution to Problem 22 • D=20000 per year, K=$100, h=0.2C(Q) ⎧2.5Q ⎪ C (Q) = ⎨2.4Q ⎪2.3Q ⎩ for 0 ≤ Q < 3000 for 3000 ≤ Q < 4000 for 4000 ≤ Q When c = 2.5, Q*=2829; when c = 2.4, Q*=2887; when c = 2.3, Q*=2949. IELM310/ZHU Xiang 15 Solution to Problem 22 (cont) • Comparison of Costs G(2829) =2829x2.5x0.2/2+100x20000/2829 + 2.5x20000=51414.21 G(3000) =3000x2.4x0.2/2+100x20000/3000 +2.4x20000=49386.67 G(4000) =4000x2.4x0.2/2+100x20000/4000 +2.3x20000=47420 • Q*=4000 IELM310/ZHU Xiang 16 Solution to Problem 22 (cont) • c. L=0.25 year =3 months • T*=4000/20000=0.2 year =2.4 months IELM310/ZHU Xiang 17 Leadtime and Reorder Point Q R=D(L−T) =1000 Reorder point R Place order T Time Receive order Leadtime IELM310/ZHU Xiang 18 Solution to Problem 25 • D = 140 per year, K =$30, • h =0.18 C(Q) 350Q ⎧ ⎪ C (Q) = ⎨ 350 × 25 + 315(Q − 25) ⎪25(350 + 315) + 285(Q − 50) ⎩ ⎧ 350Q ⎪ C (Q) = ⎨ 315Q + 875 ⎪285Q + 2375 ⎩ for 0 ≤ Q < 26 for 26 ≤ Q < 51 for 51 ≤ Q for 0 ≤ Q < 26 for 26 ≤ Q < 51 for 51 ≤ Q IELM310/ZHU Xiang 19 Solution to Problem 25 (cont) G (Q) = DC (Q) / Q + KD / Q + iC (Q) / 2 When 0<=Q< 26, Q*=12; when 26<=Q< 51, Q*=66; when 51<= Q, Q*=114. IELM310/ZHU Xiang 20 Comparison of Costs • G(12) =350x12+30x140/12+350x0.18x12/2 =49728 • G(114) = (285x114+2375)x140/114 +30x140/114 +0.18x(285x114+2375)/2 =45991.36 • Q*=114 IELM310/ZHU Xiang 21 Important Formulas • EPQ Q = 2 KD /(1 − D / P )h * T * = Q * / D = 2 K /(1 − D / P) Dh G (Q * ) = h(1 − D / P)Q * = 2 KD / Q * IELM310/ZHU Xiang 22 Quantity Discounts • All-units discounts Gj(Q)=cjD + KD/Q + icjQ/2 • Incremental discounts G(Q)=C(Q)D/Q + KD/Q +i C(Q)/2 IELM310/ZHU Xiang 23