Personal Finance Final Exam Review

advertisement

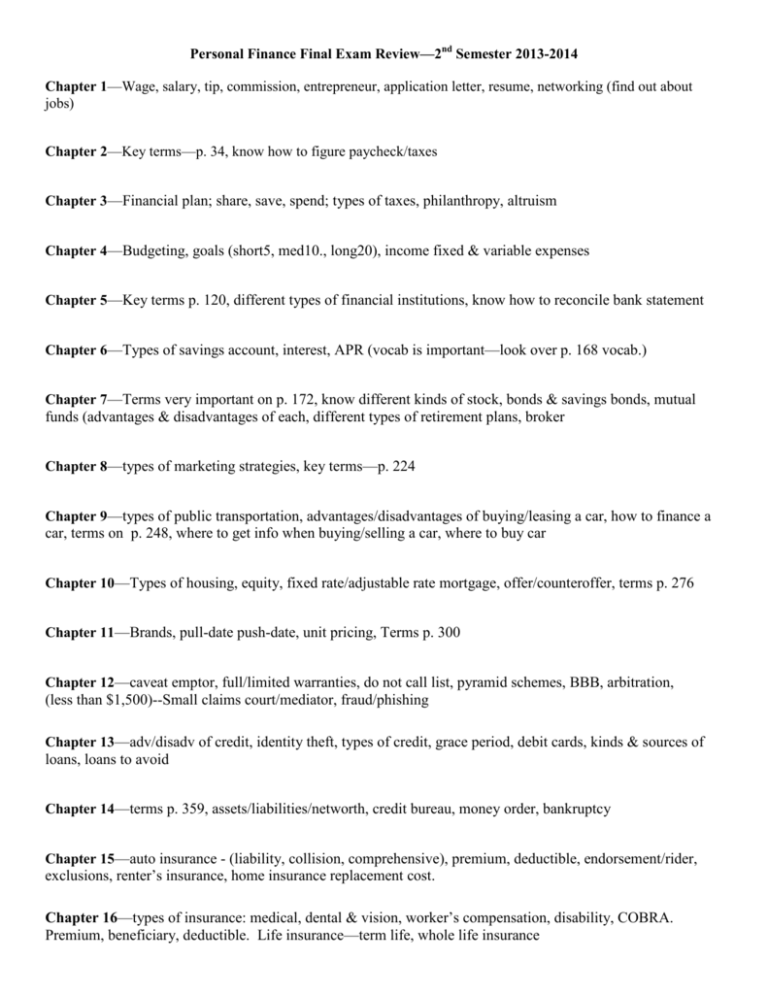

Personal Finance Final Exam Review—2nd Semester 2013-2014 Chapter 1—Wage, salary, tip, commission, entrepreneur, application letter, resume, networking (find out about jobs) Chapter 2—Key terms—p. 34, know how to figure paycheck/taxes Chapter 3—Financial plan; share, save, spend; types of taxes, philanthropy, altruism Chapter 4—Budgeting, goals (short5, med10., long20), income fixed & variable expenses Chapter 5—Key terms p. 120, different types of financial institutions, know how to reconcile bank statement Chapter 6—Types of savings account, interest, APR (vocab is important—look over p. 168 vocab.) Chapter 7—Terms very important on p. 172, know different kinds of stock, bonds & savings bonds, mutual funds (advantages & disadvantages of each, different types of retirement plans, broker Chapter 8—types of marketing strategies, key terms—p. 224 Chapter 9—types of public transportation, advantages/disadvantages of buying/leasing a car, how to finance a car, terms on p. 248, where to get info when buying/selling a car, where to buy car Chapter 10—Types of housing, equity, fixed rate/adjustable rate mortgage, offer/counteroffer, terms p. 276 Chapter 11—Brands, pull-date push-date, unit pricing, Terms p. 300 Chapter 12—caveat emptor, full/limited warranties, do not call list, pyramid schemes, BBB, arbitration, (less than $1,500)--Small claims court/mediator, fraud/phishing Chapter 13—adv/disadv of credit, identity theft, types of credit, grace period, debit cards, kinds & sources of loans, loans to avoid Chapter 14—terms p. 359, assets/liabilities/networth, credit bureau, money order, bankruptcy Chapter 15—auto insurance - (liability, collision, comprehensive), premium, deductible, endorsement/rider, exclusions, renter’s insurance, home insurance replacement cost. Chapter 16—types of insurance: medical, dental & vision, worker’s compensation, disability, COBRA. Premium, beneficiary, deductible. Life insurance—term life, whole life insurance