Page 1 1. Policy 2. Policyholder

advertisement

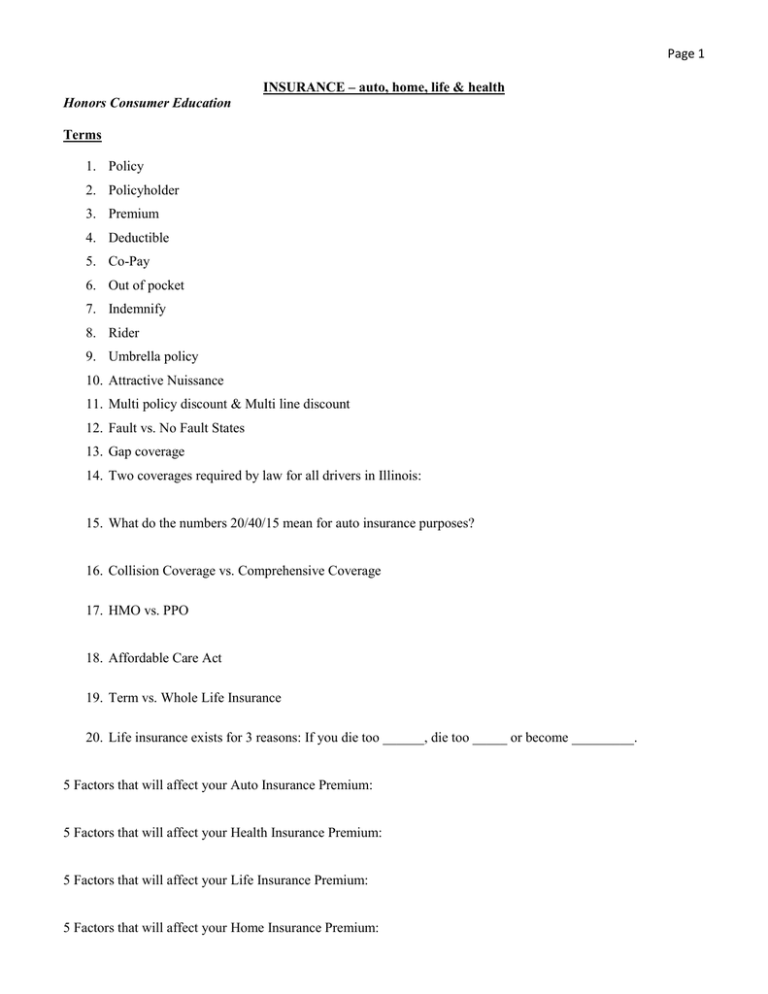

Page 1 INSURANCE – auto, home, life & health Honors Consumer Education Terms 1. Policy 2. Policyholder 3. Premium 4. Deductible 5. Co-Pay 6. Out of pocket 7. Indemnify 8. Rider 9. Umbrella policy 10. Attractive Nuissance 11. Multi policy discount & Multi line discount 12. Fault vs. No Fault States 13. Gap coverage 14. Two coverages required by law for all drivers in Illinois: 15. What do the numbers 20/40/15 mean for auto insurance purposes? 16. Collision Coverage vs. Comprehensive Coverage 17. HMO vs. PPO 18. Affordable Care Act 19. Term vs. Whole Life Insurance 20. Life insurance exists for 3 reasons: If you die too ______, die too _____ or become _________. 5 Factors that will affect your Auto Insurance Premium: 5 Factors that will affect your Health Insurance Premium: 5 Factors that will affect your Life Insurance Premium: 5 Factors that will affect your Home Insurance Premium: Page 2 INSURANCE SCENARIOS 1. Each time Gary gets a ticket or causes an accident, his state Bureau of Motor Vehicles is notified. This information becomes a part of Gary's driving record; his insurance company can then look at his driving record to determine whether to increase or decrease his premium. With each instance that is reported, what is added to his official record that could increase his car insurance premium? a. points b. risk factors c. files d. Ratings 2. Rachel is updating her homeowner’s insurance. What can Rachel purchase to provide herself with additional liability coverage that is not included in her current policy? a. deductible clause b. assigned risk coverage c. umbrella policy d. exclusion coverage 3. Greg and Jean are purchasing homeowner's insurance and want their policy to cover as many types of possible losses as it can. Which type of homeowner's insurance should they purchase? a. basic form b. special form c. renters form d. comprehensive form 4. Shakira and Teddy are leasing a home. Because they do not own the home, they did not purchase insurance. One day their neighbor's child fell down the stairs to their basement, broke his arm, and severely cut his head. They are responsible for the child's medical care, but they have no insurance to cover these expenses. What type of insurance should they have purchased for such emergencies? a. special form b. basic form c. renter's insurance d. umbrella policy 5. Property that is insured for the amount that it is currently worth is insured for its ____. a. replacement value b. original value c. market value d. liability value 6. The legal contract Abe signs that spells out the specific loss coverage and financial compensation associated with his insurance is known as his ____. a. policy b. premium c. claim d. umbrella clause 7. Andrea owns several pieces of expensive jewelry. The loss of these items is not covered under his homeowner's insurance. What special addition could he have added to his insurance to cover this specific loss? a. add-on coverage b. a special form c. a rider d. a higher deductible Page 3 8. Three years ago, Aaron purchased leather furniture for his den at a cost of $4,000. An electrical fire in his den destroyed the furniture. In order to buy furniture similar to the pieces destroyed at today's prices, what type of insurance coverage should Aaron have? a. market value b. liability value c. current value d. replacement value 9. Carmela is selecting insurance for her new home. The type of insurance that protects Carmela from the financial loss if a burglar broke into her home and stole her television set, DVD player, and stereo is ____. a. liability insurance b. property insurance c. medical insurance d. bodily injury insurance 10. Anthony was involved in an accident last week that was his fault. What part of Anthony's automobile insurance coverage pays for the damage he caused to another vehicle? a. property damage liability coverage b. medical payments coverage c. comprehensive coverage d. collision coverage 11. Medications that have the same composition as their name brand counterparts, but are less expensive, are known as ____. a. outpatient drugs b. generic drugs c. name brand drugs d. reduced drugs 12. Insurance that is designed to replace your lost income when you cannot work because of an accident or illness is ____. a. liability insurance b. long-term care insurance c. disability income insurance d. replacement insurance 13. A plan in which you pay for health services as you receive them is called a ____. a. prescription drug plan b. fee-for-service plan c. preferred provider plan d. prepaid plan 14. Your hospital bill is $1200. You have a $500 deductible on a 80/20 coverage plan. The amount you, as the policyholder, will be expected to pay is ____. a. $920 b. $860 c. $140 d. $640 15. Paying for health care coverage in advance instead of paying for services as you use them is a ____. a. limit amount plan b. managed care plan c. major medical plan d. pre-existing condition plan Page 4 16. A specific amount you pay for particular services regardless of the cost of those services is a ____. a. capitation b. copayment c. premium d. Benefit 17. Health insurance that supplements Medicare coverage for older Americans is called ____. a. an HMO b. a PPO c. a POS d. Medigap 18. An insurance program set up to pay expenses for work-related injuries, illnesses, and death is called ____. a. workers' compensation b. Medicare c. Medigap d. Medicaid 19. A request from your primary care physician for services from a particular specialist is a ____. a. reference b. patient's right c. referral d. Recommendation 20. The amount of time that a policyholder must wait in order to get treatment for a pre-existing condition treated is the ____. a. grace period b. waiting period c. second opinion period d. limit period 21. Mark is a young father with three children. His income is important to him for meeting his family's needs. What type of insurance could Mark purchase to replace his income if he suffers an accident or illness and cannot work? a. long-term care insurance b. catastrophic insurance c. disability income insurance d. long-term income insurance 22. One of Ryan’s employee benefits is participation in the company's health insurance plan. Once Ryan has paid the $500 annual deductible, he pays 20 percent of covered expenses while the insurance company pays the remaining 80 percent. What type of health insurance plan does Ryan’s employer provide its employees? a. managed care plan b. fee-for-service plan c. HMO d. PPO 23. What federal government program has provided Maxwell with low-cost medical insurance since she became 65 years old? a. Medicare b. Medicaid c. Medigap d. Medicneed Page 5 24. Under Matt’s managed care plan, he must obtain a request from his primary care physician before seeing a specialist. This request is known as a(n) ____. a. transfer b. in-plan transfer c. capitation d. Referral 25. Keung recognizes the value in purchasing life insurance to help his family financially in the event of his death and to save for his own retirement. He would like to purchase a policy with a fixed premium that cannot be increased over his lifetime. Keung would also like to have some choice in how his policy’s cash value is invested. Which type of insurance will meet his needs? a. convertible term life b. variable life c. whole life d. renewable term life 26. Rihanna’s medical insurance requires a $15 copayment for each office visit. It also has a $200 deductible for hospital stays and 80/20 coverage for hospital costs over that amount. Before her recent illness Rebecca had no medical expenses during this year. When she became ill she made two office visits before she was hospitalized. The total of her medical expenses for this illness was $4,000. How much will Rihanna have to pay? a. $340 b. $1,040 c. $754 d. $628 27. Jordy’s company participates in a health care plan in which the health care coverage is paid in advance instead of paying for services as they are used. The health care provider in turn controls costs by negotiating fees with health care providers who want to provide services under the plan. The employees must choose a doctor and hospital that participates in the plan. What type of insurance plan does Jordy’s company have? a. preferred provider organization plan b. fee-for-service plan c. point-of-service plan d. health maintenance organization plan 28. Erica is a single parent who wants to protect her family against the loss of her income. What type of low-cost life insurance should Erica choose? a. variable life b. term life c. universal life d. whole life 29. Under his health insurance plan, each time Elijah visits his doctor he pays $12 regardless of the cost of those services. This is called ____. a. a co-payment b. capitation c. a PPO fee d. Deductible 30. Which of the following is not normally part of a basic health insurance plan? a. vision care b. hospitalization c. inpatient surgery d. X-rays Page 6