Insurance

advertisement

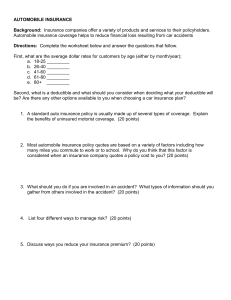

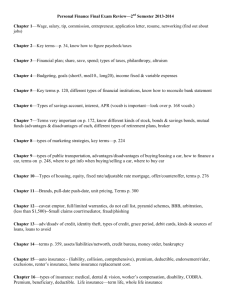

Insurance Ways to deal with personal and financial risk… But first… A quick quiz to see how much you already know! True or False? Automobile accidents are the most common cause of death among teenagers TRUE! Because they are more likely than other groups to be in automobile accidents, teenagers pay a higher rate for automobile insurance. True or False? Smokers pay the same amount for life insurance as non-smokers FALSE! Smokers typically pay more over the course of their lifetimes for life insurance because their chance of dying before nonsmokers is statistically greater. True or False? On average, women live longer than men TRUE! Women live about seven years longer than men. That’s why life insurance rates for women are often lower than for men. True or False? Students who have health care coverage through their parents risk losing it when they leave high school or college FALSE! As part of the new Healthcare Reform bill, you can remain on your parents’ health insurance until age 26 (whether or not you are still attending school). True or False? On average each American family spends $5000 a year on health care FALSE! In 2009, the average yearly cost of health care for a family was $15,000 (including insurance premiums, co-pays, etc.) True or False? Only people born with disabilities need disability insurance FALSE! The main purpose of disability insurance is to replace lost income. It can help any person who is unexpectedly injured or sick and unable to go to work. Did You Know? The average renter has more than $20,000 worth of stuff. (State Farm) The average cost per emergency room visit is $560. (National Safety Council) The average cost of a disabling auto injury is $49,700. (Agency for Healthcare Research and Quality) So…. How can you deal with all this potential personal and financial loss? The answer is… RISK MANAGEMENT! RISK MANAGEMENT You have FOUR options when dealing with potential personal or financial loss… #1. Avoid the Risk If you’re worried about being injured in a plane crash, you could take the train instead. #2. Reduce the Risk To reduce the risk of being hurt in a car accident, you could wear a seatbelt, avoid doing distracting things while driving, choose a car with airbags, etc. #3. Accept the Risk Instead of buying an extended warranty for your cell phone, you could take the chance of having to replace it yourself if something happens.. #4 - RISK POOLING! Your chance of risk is “pooled” (grouped together) with other people with the same type of risk. This is what insurance is all about! In exchange for monthly payments, an insurance company promises to “cover” (pay for) a large portion of the expense should a personal or financial disaster occur. TEACHERS…show that video clip now! Common Insurance Terms Liability: Bodily injury or property damage you have caused another Claim: Demand by an individual to recover losses covered by insurance Premium: Payment to the insurance company for coverage Deductible: Amount the insured must pay before the insurance company pays Higher Deductible = Lower Premium Example: You have a $1000 car insurance DEDUCTIBLE and unfortunately just got into a car accident…(oops!) You will have to pay $1000 BEFORE the insurance company covers the rest. If the damage is less than $1000, the insurance company will not cover any of the damage. The benefit of this is that your MONTHLY PREMUIM will be LOWER (since the insurance company will ultimately spend less money on your claims) Lower Deductible = Higher Premium Example: You have a LOWER DEDUCTIBLE ($100) and get into that same car accident… You will only have to pay $100 before the insurance company covers the rest of the damage. This also means that they will cover much smaller amounts of damage (scratches, small dents) assuming the damage costs over $100 to repair. However, if you have a lower deductible, then the insurance company will increase your MONTHLY PREMIUM to compensate for the increased cost/frequency of your claims. Life Insurance “It is not for the person who dies, it is for the ones who are left” Life Insurance protects a family’s way of life - Spouses Dependents Cost of the funeral How much should you get? - Enough to replace income Pay for time off of work for loved ones Other - College for the kids? Pay off the house? Medical/Health Insurance Helps cover the costs associated with medical care (doctor visits, prescriptions, etc) - May be partially covered by employer - Individual policies are available (but are more expensive) - Students can be covered by parents’ policy up to age 26. - Amounts and types of coverage vary by plan, read the fine print before choosing! Disability Insurance Insures your earning power (loss of income because of illness or accident) - Usually ½ to 2/3 of your salary - Often covered by employer - - if accident happens at work site Can be purchased individually - for accidents that happen on personal time Homeowners/Renters Insurance Homeowners: - Covers the buildings, garage, property, contents - May require additional “riders” for damages caused by floods, earthquakes, etc. or for “one of a kind” items like jewelry or art collections. How to reduce risks: - Develop good security habits (ex: lock doors) - Reduce water damage (ex: check pipes) - Reduce Fire Risks (ex: maintain fire alarms) Renter’s Insurance - Renters do not own the building, so insurance covers your belongings and liability - - Take inventory of your belongings! (photograph or videotape) Keep receipts for major items Keep documentation in a place other than your home Does not cover - Structural damage caused by carelessness (such as damage by animal) Usually less than $15/month!!! Auto Insurance Why do I need it? It’s the law! What happens if… You’re involved in a crash that causes property damage? You hurt yourself or someone else? Your car is damaged when you’re not driving it? (by weather, vandalism or a hit & run) Your car is stolen? Your car breaks down and needs to be towed? Types of Auto Insurance Coverage - - - - - Collision: - Covers damage to car resulting from collision to another car, object or rollover Comprehensive: - This covers loss or damage that doesn't involve a collision. (including theft, vandalism, natural disasters)) Property Damage Liability: - Damage to another person’s property caused when you’re driving Bodily Injury Liability: - This will cover the injuries that you cause in an accident Uninsured Motorist Coverage: - Just like it sounds. Covers you (and your car) if the person who hit you doesn't have insurance. Personal Injury Protection: - This will pay to treat the injuries and provide for the lost wages of you and your passengers if in an accident. What affects the cost of car insurance premiums? # of Accidents/Tickets Kinds of Accidents/Tickets Type of Car Color of Car Age of Driver Sex of Driver Credit History Anti-Theft Systems Safety Features (airbags) Grades (Good Student Discount) Married vs. Single Drivers Ed - - Now… - - Turn to the student next to you Tell them 3 facts about insurance that you didn’t know before today! How can you use this information in the future?