Six Costly Myths About Covering College Expenses

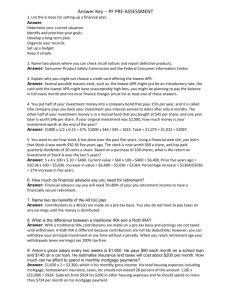

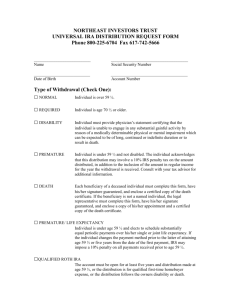

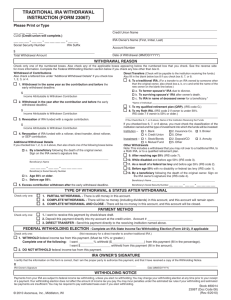

advertisement

Six Costly Myths About Covering College Expenses 1. Myth: Financial aid is free money, and it will cover my college costs. Unfortunately, this is not the reality for many students. According to the College Board, 38% of student aid is given in the form of federal loans. The rest comes from a combination of grants, scholarships, and work-study programs, but a significant portion of that is need-based aid. Research from the Department of Education shows that families in the lowest income quartile1 have only had to pay about 60% of college sticker prices—and that has been consistent going back to 2000. Families in the third income quartile2 have consistently had to pay 90% of the listed college sticker price for public institutions and 70% for private. (Note: Although private schools may offer more free money to students, the sticker price is so much higher that a private school’s 70% usually ends up being much higher than a state school’s 90%.) The average total cost for a four-year in-state public institution was $18,500 for the 2013-2014 academic year,3 and for families in the third income quartile, having to pay 90% at the drop of a hat can be difficult. Sallie Mae found that 58% of parents and 50% of students pay for a chunk of their college costs out of their current income. But there are signs of others resorting to more costly tactics. Five percent of parents have taken withdrawals from their retirement savings, 4% have used their credit cards to finance the costs, 2% have taken home equity loans, and another 2% have taken loans from their retirement accounts. Additionally, most scholarships and grants, if they are awarded, apply only toward tuition and fees, which only make up 35% to 50% of the total cost. The remainder goes to housing, meals, books and supplies, transportation, and other miscellaneous, or personal, expenses. 2. M yt h : S avi n g f o r c o l l e g e r e d u c e s m y chances of receiving financial aid. For the Federal Financial Aid calculation, the first several tens of thousands of dollars of your overall savings, depending on your age, don’t count at all toward what you’re expected to contribute for college (retirement accounts and home equity are completely excluded). And after that, only 12 cents of every dollar is considered eligible money to help pay for college. If you don’t save, where will the money come from (see myth 4)? 3. M yt h : S avi n g in a 5 2 9 p l a n l im it s m y options, such as: I can only attend a state school. Not true. While it depends on the plan, money from a 529 plan can often be used at any accredited college, university, or vocational school in the country—and even some overseas schools. Many plans also do not restrict the funds for use within the state sponsoring the 529 plan. If I don’t use it, I’ll lose it. Unused money is never lost. If the child for whom you opened the 529 account doesn’t go to college, you still have options that allow you to get a lot of bang for your buck. For instance, you can always change the beneficiary of an account. If your first child decides not to pursue college, you can change the beneficiary to your second child or another family member instead. You could also list yourself as the beneficiary in case you decide to go back to school—even just to take an art class at the local community college in retirement. If changing the beneficiary isn’t an option, it’s still not a use-it-or-lose-it scenario. The money can be withdrawn for any purpose and a 10% penalty and taxes will be applied against any earnings—although you are never forced to withdraw the money. It doesn’t matter whether I save for college in a Traditional IRA, Roth IRA, or 529 plan. It does matter. 529s give most parents more spendable money for college expenses because they lose less money in taxes compared to all the other options. Also, using money from an IRA or 401(k) can compromise your ability to achieve your more important retirement goal. UGMA and UTMA accounts, which used to be popular choices, have lost much of the tax benefits that made them advantageous in the past. Also, once the child reaches the age of majority, they get to decide what to spend the money on – so none of it might end up being spent on college! (Plus, the money in the account must be used for that child’s benefit, so there are no options to use it for anyone else.) The chart below compares the potential taxes and penalties related to withdrawals for qualified college expenses from different types of savings plans. $10, 000 w it h d r awa l F o r Q u a l iF y in g col l ege expense F roM: 529 Roth IRA Traditional IRA 401(k) 10% 90% 100% after-tax withdrawal amount 25% 75% 35% 65% taxes and premature distribution penalties associated with withdrawal Assumptions: $10,000 is withdrawn for a qualifying college expenses. Only 2013 tax year illustrated. The depiction does not consider any state taxes owed as a result of the $10,000 distribution, nor does it consider the potential tax advantages for contributions to a Traditional IRA or 401(k). Account holder is under age 55 and in a 25% marginal tax bracket. $10,000 withdrawal amount represents $6,000 in contribution basis plus $4,000 in earnings. Contribution basis in 529 is after-tax and the withdrawal of earnings is tax-free since used for qualifying educational expense. Contribution basis in Roth IRA is after-tax, but the withdrawal of tax-deferred earnings is subject to tax since the owner is below age 59.5. In the example shown, the withdrawal amount includes all of the original contributions, which are tax-free, as well as some of the earnings, which are always withdrawn after all the contributions have been distributed. Contribution basis and earnings in Traditional IRA and 401(k) are tax-deferred and taxable upon withdrawal. Premature distribution penalty applies to 401(k) withdrawal since account holder is under age 59.5, but not to Roth or Traditional IRA given the exclusion from the penalty for qualifying higher educational expense (see IRS Form 5329). Since account holder is under age 55, there is no plan option for a waiver to the premature distribution penalty for the 401(k) account. 4. M yt h : I ’l l n e v e r b e a b le t o s av e e n o ugh, so there’ s no point in trying. Saving something—even if you think the amount is likely to be small—is always better than saving nothing. That’s because borrowing money versus saving in a tax-advantaged plan can potentially double the cost of a family’s total expenditure. As shown in the example below, every dollar saved ahead of time is like $2 this family doesn’t have to pay in debt later. C ove ri n g $ 4 0 ,0 0 0 in C o l l e g e C o s t s : Saving vs. Borrowing $40,000 in college expenses can cost much more or less depending on how it’s paid 70,000 $61,000 60,000 50,000 Total Expenditure (in today’s dollars) A family borrowing $40,000 at the start of a child’s college today would pay about $61,000 over the next 14 years, assuming an average annual 8% interest rate. Had the parents started saving in a tax-advantaged 529 account after their child was born, they would only have had to contribute a total of about $32,000 over 18 years, assuming a 6% average annual return minus 0.85% in annual fees. Additionally, the contributions to a 529 account might also have been eligible for income tax deductions based on state tax benefits, which vary state by state. 40,000 $32,000 30,000 20,000 10,000 0 Total Amount Contributed to 529 Account Total Amount Paid for College Loan Figures are pretax and and rounded to nearest $1,000. Assumptions: Figures are as of the beginning of a 4-year college period for the child. A 14-year loan with an 8% annualized rate composed of 4 years’ interest accrual during a 4-year in-college period added to the principal of the loan at the end of the period, followed by a 10-year repayment period. Eighteen years of savings to a 529 plan, contributing $110 per month, with an annualized return of 6% minus a 0.85% annualized fee. Inflation/discount rate is 3% annualized. All 529 withdrawals assumed to be for qualifying educational expenses at the beginning of college. 529 contributions, interest accrual, and loan repayments occur monthly, at the end of the month. Please note a 529 plan’s disclosure document includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. 5. M yt h : If acc e p t e d , I s h o u l d g o t o t h e better school —regardl ess of cost. Make a value judgment, considering the cost/benefit of each school—not just the benefit regardless of cost. Select a college the same way you would buy a car. If ‘Car B’ would only be slightly better than ‘Car A’ for you or your child would you be willing to pay twice as much for it? Probably not. Use the same logic when choosing a college. 6. M yt h : C e rta in s c h o o l s a r e ju s t t o o expensive. I shoul dn’ t bother applying. Don’t automatically assume a school is off limits based solely on its sticker price. If you’re interested in a school, you have to apply in order to find out the net cost, which is the cost to you once all free money (scholarships and grants) are applied. The sticker price is not your bottom line: Base your decision on the net cost. arental income of dependent student less than $36,000 in 2008. From 2007-08 National Postsecondary Student Aid Study (NPSAS:08), P U.S. Department of Education, National Center for Education Statistics. 2012 data will be released by end of year. 2 $67,000-$105,000 – again using 2008 data. 3 Source: College Board’s Trends in College Pricing 2013, pg. 10, Table 1A. 1 05820-124 140655 1/14