Page 1 of 5 | Morningstar Target-Date Fund Series Report | 06-30-2010 | For Financial Professional Use Only.

American Funds Target Date Rtmt Target-Date Fund Series Report

Target-Date Series Rating

Top

Above Average

Average

Below Average

Bottom

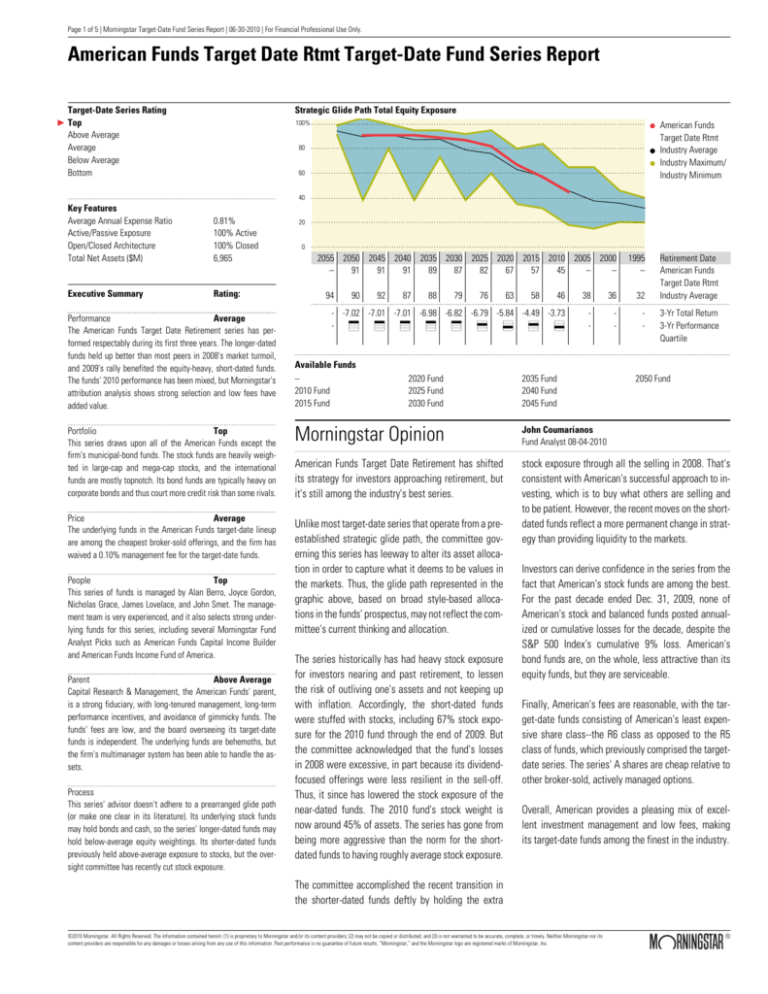

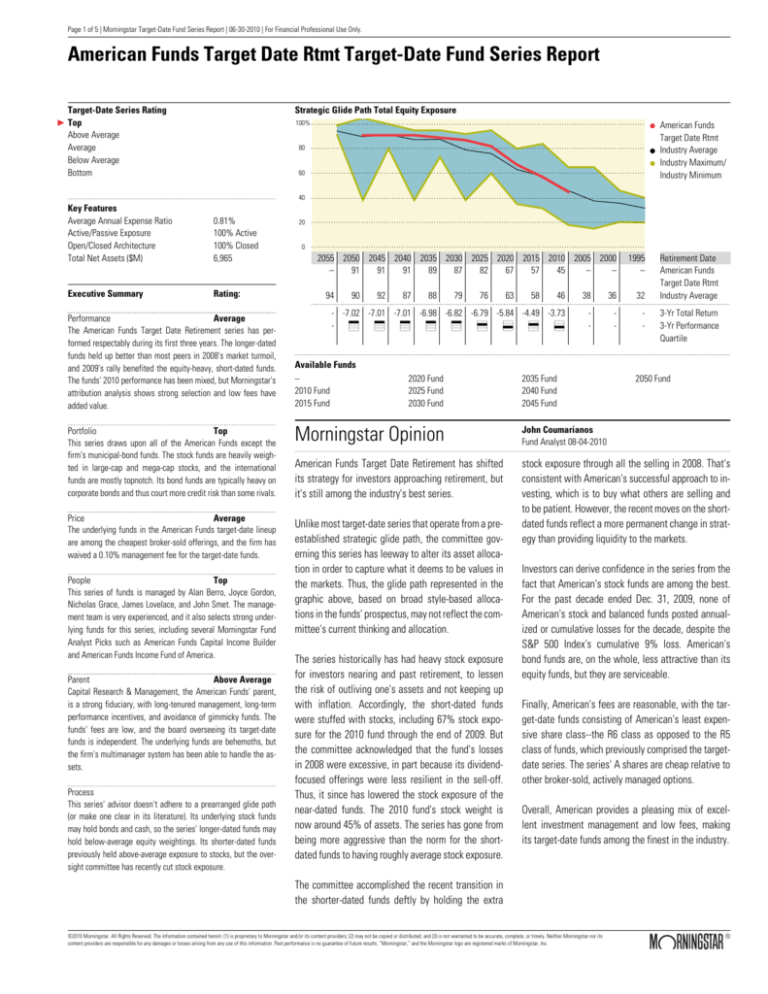

Strategic Glide Path Total Equity Exposure

100%

100

American Funds

Target Date Rtmt

Industry Average

Industry Maximum/

Industry Minimum

80

80

60

60

40

40

Key Features

Average Annual Expense Ratio

Active/Passive Exposure

Open/Closed Architecture

Total Net Assets ($M)

0.81%

100% Active

100% Closed

6,965

Executive Summary

Rating:

Performance

Average

The American Funds Target Date Retirement series has performed respectably during its first three years. The longer-dated

funds held up better than most peers in 2008's market turmoil,

and 2009's rally benefited the equity-heavy, short-dated funds.

The funds' 2010 performance has been mixed, but Morningstar's

attribution analysis shows strong selection and low fees have

added value.

Portfolio

Top

This series draws upon all of the American Funds except the

firm's municipal-bond funds. The stock funds are heavily weighted in large-cap and mega-cap stocks, and the international

funds are mostly topnotch. Its bond funds are typically heavy on

corporate bonds and thus court more credit risk than some rivals.

Price

Average

The underlying funds in the American Funds target-date lineup

are among the cheapest broker-sold offerings, and the firm has

waived a 0.10% management fee for the target-date funds.

People

Top

This series of funds is managed by Alan Berro, Joyce Gordon,

Nicholas Grace, James Lovelace, and John Smet. The management team is very experienced, and it also selects strong underlying funds for this series, including several Morningstar Fund

Analyst Picks such as American Funds Capital Income Builder

and American Funds Income Fund of America.

Parent

Above Average

Capital Research & Management, the American Funds' parent,

is a strong fiduciary, with long-tenured management, long-term

performance incentives, and avoidance of gimmicky funds. The

funds' fees are low, and the board overseeing its target-date

funds is independent. The underlying funds are behemoths, but

the firm's multimanager system has been able to handle the assets.

Process

This series' advisor doesn't adhere to a prearranged glide path

(or make one clear in its literature). Its underlying stock funds

may hold bonds and cash, so the series' longer-dated funds may

hold below-average equity weightings. Its shorter-dated funds

previously held above-average exposure to stocks, but the oversight committee has recently cut stock exposure.

20

20

00

2055 2050 2045 2040 2035 2030 2025 2020 2015 2010 2005 2000

–

91

91

91

89

87

82

67

57

45

–

–

94

90

46

38

36

32

- -7.02 -7.01 -7.01 -6.98 -6.82 -6.79 -5.84 -4.49 -3.73

&

&

&

&

&

*

(

*

(

-

-

-

Available Funds

–

2010 Fund

2015 Fund

92

87

88

79

76

2020 Fund

2025 Fund

2030 Fund

63

58

1995

–

2035 Fund

2040 Fund

2045 Fund

Retirement Date

American Funds

Target Date Rtmt

Industry Average

3-Yr Total Return

3-Yr Performance

Quartile

2050 Fund

Morningstar Opinion

John Coumarianos

Fund Analyst 08-04-2010

American Funds Target Date Retirement has shifted

its strategy for investors approaching retirement, but

it's still among the industry's best series.

stock exposure through all the selling in 2008. That's

consistent with American's successful approach to investing, which is to buy what others are selling and

to be patient. However, the recent moves on the shortdated funds reflect a more permanent change in strategy than providing liquidity to the markets.

Unlike most target-date series that operate from a preestablished strategic glide path, the committee governing this series has leeway to alter its asset allocation in order to capture what it deems to be values in

the markets. Thus, the glide path represented in the

graphic above, based on broad style-based allocations in the funds' prospectus, may not reflect the committee's current thinking and allocation.

The series historically has had heavy stock exposure

for investors nearing and past retirement, to lessen

the risk of outliving one's assets and not keeping up

with inflation. Accordingly, the short-dated funds

were stuffed with stocks, including 67% stock exposure for the 2010 fund through the end of 2009. But

the committee acknowledged that the fund's losses

in 2008 were excessive, in part because its dividendfocused offerings were less resilient in the sell-off.

Thus, it since has lowered the stock exposure of the

near-dated funds. The 2010 fund's stock weight is

now around 45% of assets. The series has gone from

being more aggressive than the norm for the shortdated funds to having roughly average stock exposure.

Investors can derive confidence in the series from the

fact that American's stock funds are among the best.

For the past decade ended Dec. 31, 2009, none of

American's stock and balanced funds posted annualized or cumulative losses for the decade, despite the

S&P 500 Index's cumulative 9% loss. American's

bond funds are, on the whole, less attractive than its

equity funds, but they are serviceable.

Finally, American's fees are reasonable, with the target-date funds consisting of American's least expensive share class--the R6 class as opposed to the R5

class of funds, which previously comprised the targetdate series. The series' A shares are cheap relative to

other broker-sold, actively managed options.

Overall, American provides a pleasing mix of excellent investment management and low fees, making

its target-date funds among the finest in the industry.

The committee accomplished the recent transition in

the shorter-dated funds deftly by holding the extra

©2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. “Morningstar,” and the Morningstar logo are registered marks of Morningstar, Inc.

Page 2 of 5 | Morningstar Target-Date Fund Series Report | 06-30-2010 | For Financial Professional Use Only.

American Funds Target Date Rtmt Target-Date Fund Series Report

Performance

Rating:

Average

The American Funds target-date funds boast some of

the best underlying stock funds in the business, but

the longer dated funds have generally outperformed

their peer groups while the shorter dated funds

haven't. This series used to get more equity-heavy relative to the peer-group norm as investors near and

pass retirement. American Funds Target Date 2010,

which had roughly 67% of its assets in equities versus a 50% norm, gained more than 23% in 2009.

However, the short dated funds struggled mightily in

2008, and the funds' oversight committee has now reduced the amount of stock exposure in the shorter dated funds. So, the 2010 fund, for example, now has

45% equity exposure. This is likely a permanent risk

reduction. Although the committee thinks maintaining significant stock exposure for early retirees is important, it also recognizes that early retirees can handle only so much volatility. Over the life of Target

Date 2010, however, from Feb. 2, 2007, through June

30, 2010, the fund has underperformed its peer group

because of its rocky 2008 performance.

tion, Target Date 2045 also eked out a victory over its

category's 31% return during 2009's rally with a

31.6% return. Cash in the longer-dated funds also

has helped in downdrafts, and it hasn't hurt in recent

rallies.

The series' bond funds, such as American Funds Bond

Fund of America, suffered mightily in 2008, when only U.S. Treasuries rallied. Those funds typically have

avoided Treasuries (though they may lean on them

more in the future) and sought to add value with corporate bonds that its credit analysts believe are mispriced. This strategy fared much better in 2009, as investors' appetite for risk has increased.

The longer-dated funds have done better relative to

their peers. Target Date 2045, for example, has dropped 14% over its existence through June 30, 2010,

while the Target Date 2041-2045 category average is

a 21% loss. Thanks in part to American's stock selec-

Target-Date Fund Performance as of 06-30-2010

American Funds Trgt Date Ret 2010 A

American Funds Trgt Date Ret 2015 A

American Funds Trgt Date Ret 2020 A

American Funds Trgt Date Ret 2025 A

American Funds Trgt Date Ret 2030 A

YTD

Return %

-1.7

-3.2

-4.3

-5.7

-6.4

2009

Return %

23.3

24.6

26.8

29.4

31.1

2008

Return %

-27.5

-29.1

-32.5

-34.8

-35.2

3-Yr

Return %

-3.7

-4.5

-5.8

-6.8

-6.8

3-Yr % Rank

in Cat

70

48

60

38

24

3-Yr

Std Dev

14.4

15.5

17.0

18.4

18.9

5-Yr

Return %

–

–

–

–

–

5-Yr % Rank

in Cat

–

–

–

–

–

American Funds Trgt Date Ret 2035 A

American Funds Trgt Date Ret 2040 A

American Funds Trgt Date Ret 2045 A

American Funds Trgt Date Ret 2050 A

American Funds Trgt Date Ret 2055 A

-6.6

-6.8

-6.8

-6.8

–

31.3

31.6

31.5

31.6

–

-35.5

-35.6

-35.6

-35.6

–

-7.0

-7.0

-7.0

-7.0

–

18

8

15

3

–

19.2

19.3

19.3

19.3

–

–

–

–

–

–

–

–

–

–

–

Star

Rating

QQ

QQ

QQ

QQ

QQQ

QQQ

QQQ

QQQ

QQQQ

–

For peer comparisons, 1 = highest return or lowest risk, 100 = lowest return or highest risk.

Target Date Funds Risk-Adjusted Returns +/- Category Average

Data as of 06-30-2010

Attribution Analysis

Trailing 3-Year Returns as of 06-30-2010

7.8%

0.81

Total

0.70

Selection

Cost

Glide Path

5.2

2.38

2.03

-0.32

2.6

0

0.08

-1.21

-3.5

-7.0

-10.

5

-3.22

2055

2050

2045

2040

2035

2030

2025

2020

2015

2010

2005

2000

Risk-adjusted return exceeding category average

Risk-adjusted return trailing category average

Category Average

Data is based on longest available performance history: three or five years. For series with more than 18 months of history, but less than three years of

history, the risk-adjusted return of the appropriate Morningstar Lifetime Moderate Index is used to create a 3-year history.

-0.56

1995

Glide Path

Cost

Selection

Total

©2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. “Morningstar,” and the Morningstar logo are registered marks of Morningstar, Inc.

-5.12

-8.69

American Funds Target Date Rtmt

-1.21

0.08

0.81

-0.32

Page 3 of 5 | Morningstar Target-Date Fund Series Report | 06-30-2010 | For Financial Professional Use Only.

American Funds Target Date Rtmt Target-Date Fund Series Report

Portfolio

Rating:

Top

Series Holding-based Style Map - Equity

Data as of 06-30-2010

Giant

big that it's difficult for them to gain significant exposure to mid-caps and small caps.

Large

Lately, the firm has revamped its core bond offering

Bond Fund of America. Although the firm brings formidable expertise to credit analysis, its managers and

analysts arguably held on to lower-grade bonds too

long in 2008 when spreads (the difference in yield between high-grade and low-grade bonds) narrowed considerably. Bond Fund of America now has a tamer

look, owing to a permanent stake in U.S. Treasuries.

Mid

Small

Micro

Nine of the underlying funds in American's targetdate series are Morningstar Fund Analyst Picks, including American Funds Balanced, American Funds Income Fund of America, Capital Income Builder, American Funds AMCAP, American Funds Fundamental Investors, American Funds Washington Mutual Investors, American Funds New Perspective, American

Funds EuroPacific Growth, and American Funds New

Economy. No other target-date lineup boasts nearly

as many Analyst Picks. All of American's stock funds

posted positive returns for the trailing decade

through the end of 2009, owing to the firm's superior

analyst staff and long-term perspective. The underlying stock funds benefit from the firm's deep stock-selection prowess, and its expertise in corporate bonds

is also formidable. All of the firm's funds are managed by multiple portfolio managers, which helps it

deal with the huge asset bases of the underlying

funds. On the downside, the firm's stock funds are so

DeepValue

CoreCore

CoreHighValue

Growth Growth

Zone represents 75% of series' largest domestic stock holdings

Fund centroid represents weighted average of series'

domestic stock holdings

The firm also lacks specialty funds in bonds, such as

a dedicated Treasury Inflation-Protected Securities

fund, and it doesn't have a real estate fund. Still, that

fact reflects its refusal to issue funds that it believes

don't stand on their own investment merits or whose

holdings don't constitute discrete asset classes.

Top Investments as of 06-30-2010

American Funds US Government Sec R6

American Funds Washington Mutual R6

American Funds Invmt Co of Amer R6

American Funds American Balanced R6

American Funds American Mutual R6

Category

Intermediate Government

Large Value

Large Blend

Moderate Allocation

Large Value

American Funds Fundamental Invs R6

American Funds Capital Inc Bldr R6

American Funds Inc Fund of Amer R6

American Funds New Perspective R6

American Funds Capital World G/I R6

Large Blend

World Allocation

Moderate Allocation

World Stock

World Stock

% of

Assets

8.61

7.43

6.95

6.90

6.33

3-Yr

Return %

–

–

–

–

–

3-Yr

% Rank

in Cat

–

–

–

–

–

3-Yr

Std Dev

–

–

–

–

–

5-Yr

Return %

–

–

–

–

–

5-Yr

% Rank

in Cat

–

–

–

–

–

Morningstar

Risk

------

Star

Rating

WWW

WWWW

WWWW

WWWW

WWWWW

5.94

5.75

5.73

5.67

5.22

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

–

------

WWWW

WWWW

WWWW

WWWW

WWWWW

Total # Holdings

% Portfolio in Top 10 Holdings

Overall Average Morningstar Rating

Price

21

64.52

3.93

Rating:

Average

Although Capital Research & Management recently

has raised fees on all of the American Funds, they remain among the cheapest broker-sold funds in the industry. The sheer amount of assets the firm runs

helps keep prices down, as larger funds can offer

economies of scale to shareholders. The firm has created separate retirement (R6) share classes of its un-

derlying funds to create the A share class of its targetdate lineup, and those A shares remain among the

least expensive in the industry. Share classes that

have American handle administrative duties for

401(k) plans, including R2 and R3, are considerably

more expensive.

Cost vs. Industry Average

American Funds Target Date Rtmt A

Industry Average

Avg Cost Per Share Class

A

R3

R2

R4

R5

©2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. “Morningstar,” and the Morningstar logo are registered marks of Morningstar, Inc.

0.81%

0.88%

Exp Ratio (%) Net Assets ($M)

0.81%

2,620

1.16%

1,589

1.54%

1,569

0.85%

756

0.55%

291

Page 4 of 5 | Morningstar Target-Date Fund Series Report | 06-30-2010 | For Financial Professional Use Only.

American Funds Target Date Rtmt Target-Date Fund Series Report

People

Rating:

Top

Management: Veteran portfolio managers Alan Berro, Joyce Gordon, Nicholas Grace, James Lovelace,

and John Smet run sleeves of the American Funds target-date funds. They have 23 years of tenure at the

firm on average. Few, if any, target-date lineups

boast such formidable and experienced management.

Smet is a fixed-income specialist, while Grace is listed as a manager on American Funds EuroPacific

Growth. Berro, Gordon, and Lovelace are listed on a

variety of the firm's domestic, foreign, and allocation

funds. American is noted for its rigorous hiring process and views its relationships with employees as marriages. It hires the best people it can find and stays

with them for the longer haul.

Series Management

best practice in the mutual fund world. This keeps

them focused on their long-term results. Stock portfolios tend to average 20%-25% turnover, which

means managers tend to hold stocks for four to five

years on average. The compensation incentives allow

the managers to have the courage of their convictions and stick with stocks that they think are undervalued until the market recognizes what they've already noticed. The managers also accumulate ownership of the advisor throughout their careers. Regarding investments in the funds, Berro and Gordon have

between $100,000 and $500,000 in American's targetdate series, while Lovelace, Grace, and Smet have

less than $50,000 in the funds (though the managers

are heavily invested in the underlying funds).

Manager

James B. Lovelace

John H. Smet

Alan Berro

Joyce E. Gordon

Nicholas Grace

Start Date

02-2007

02-2007

02-2007

02-2007

02-2007

Average Tenure

Longest Tenure

Target-Date Industry

Average Tenure

3.5 years

3.5 years

4.6 years

Underlying Funds' Management

Average Tenure

12.1 years

Longest Tenure

39.4 years

Mutual Fund Industry

Average Tenure

5.1 years

Manager Incentives: American Funds portfolio managers are paid on four- and eight-year performance, a

Parent

Rating:

Above Average

Corporate Culture: Capital Research & Management, the parent of American Funds, is among the asset-management industry's finest stewards of capital. The firm seeks to hire investment professionals

for life. It succeeds so well at that goal that no other

firm boasts as many investment professionals with

multidecade careers at the same place. Capital's analysts and fund managers have unmatched experience.

The firm doesn't issue gimmicky funds based on hot,

but ephemeral, asset classes or industries. Conversely, it dedicates resources to efforts that are not remunerative for decades if they have investment merit,

such as the firm did with international investing starting in the 1950s. Its four- and eight-year compensation structure for analysts and managers allows them

to maintain the courage of their convictions and stick

with underpriced stocks until the market recognizes

their value.

Board Oversight: American Funds' target-date series is governed by an independent board of directors,

six of whom were new to the board on Jan. 1, 2010.

Twelve of the board's 14 trustees are independent,

as is the chairman. However, only six of the 12 independent directors invest more in the funds they oversee than they receive in annual compensation. The

Fund Family Data

board is charged with negotiating the funds' expense

ratios, and they've garnered a reasonable fee here.

Transparency: The American Funds' website offers

good information on its target-date lineup, especially

on the fund-level pages. Investors can gain access to

each fund's breakdown by fund category and underlying fund. There is scant detail, however, on the series' investment rationale and on how to use a targetdate fund. Although many American Funds shareholders work with advisors, who can tailor an individualized asset-allocation plan, the firm could provide

more information on the rationale for the funds and

on the theory behind the glide path. Senior portfolio

managers and executives discuss their views of the

markets in video interviews on the firm's website.

Average Star Rating

% of Assets w/Star Rating

QQQQ

57.7%

Assets

(listed in USD $Mil)

Mutual Fund Assets

ETF Assets

Other Assets

Total Assets ($M)

Number of Funds

103,212

0

19,943

123,156

65

Stewardship Grade Average

Average Manager Tenure

Longest Manager Tenure

5-year Manager

Retention Rate (%)

A

12.6 years

39.4 years

Regulatory History: These funds' advisor previously

paid for inclusion on some brokers' lists of preferred

funds, though the practice was legal at the time. Also, the SEC has not reviewed an appeal that the firm

made regarding a decision by the Financial Industry

Regulatory Authority to fine the firm $5 million for directing brokerage commissions to firms that were top

sellers of its funds.

©2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. “Morningstar,” and the Morningstar logo are registered marks of Morningstar, Inc.

98.7%

Page 5 of 5 | Morningstar Target-Date Fund Series Report | 06-30-2010 | For Financial Professional Use Only.

American Funds Target Date Rtmt Target-Date Fund Series Report

Process

Glide Path: This series' advisor doesn't adhere to a

prearranged glide path (unlike many of its peers) so

Morningstar's Glide Path graph may not match its strategic asset allocation. The American Funds targetdate fund with the largest equity allocation, American Funds Target Date Retirement 2050, had 85% of

its assets in stocks as of March 31, 2010, which is a

bit below the Morningstar category norm. American's

stock funds tend to run with some cash and bonds, so

at times, its long-dated funds' equity exposure has

been lower. The series' stock exposure begins to taper off about 15 years before retirement, with American Funds Target Date Retirement 2010 having roughly 45% equity exposure after the firm recently reduced its stock allocation.

Strategic Glide Path Total Equity Exposure

100%

100

American Funds

Target Date Rtmt

Industry Average

Industry Maximum/

Industry Minimum

80

80

60

60

40

40

20

20

00

2055 2050 2045 2040 2035 2030 2025 2020 2015 2010 2005 2000

–

91

91

91

89

87

82

67

57

45

–

–

94

90

92

87

88

79

76

63

58

1995

–

46

38

36

32

- -7.02 -7.01 -7.01 -6.98 -6.82 -6.79 -5.84 -4.49 -3.73

&

&

&

&

&

*

(

*

(

-

-

-

80

60

40

2055 2050 2045 2040 2035 2030 2025 2020 2015 2010 2005 2000

–

53

53

53

52

53

54

59

61

64

–

–

–

10

10

10

10

10

9

7

6

6

–

–

–

29

29

29

29

29

29

28

28

24

–

–

–

7

7

7

8

8

7

5

4

3

–

–

–

1

1

1

1

1

1

1

1

3

–

–

1995

–

–

–

–

–

Retirement Date

U.S. Large Cap

U.S. Mid/Small Cap

Non-U.S. Developed

Non-U.S. Emerging

Other

Fixed-Income Allocation

100%

TIPS

U.S. Government

U.S. Investment

Grade

U.S. High Yield

Foreign

Cash

Other

80

60

40

Fixed Income %

Rationale: American's portfolio-oversight committee

reserves the right to shift the funds' asset allocation

rather than sticking to a prearranged glide path. In

less able hands, that approach would cause greater

concern. Yet the firm's multiple portfolio counselor

system, where managers oversee sleeves of the underlying funds, is time-tested and has proved highly

successful. The target-date portfolio managers also

manage sleeves of the underlying funds, reinforcing

our confidence that the team has its finger on the

pulse of the target-date funds' asset-allocation policy.

U.S. Large Cap

U.S. Mid/Small Cap

Non-U.S. Developed

Non-U.S. Emerging

Other

Equity %

The funds favor large- and mega-cap stocks over

small- and mid-caps, a likely side effect of the underlying funds' massive asset bases. Despite the firm's

credit expertise, this series doesn't take inordinate

risks on the bond side. The American Funds Target

Date Retirement 2035 Fund has 79% of its fixed-income assets in securities rated AAA, for example,

and American Bond Fund of America recently added a

strategic U.S. Treasuries stake. The funds don't shy

away from international-stock exposure.

3-Yr Total Return

3-Yr Performance

Quartile

Equity Allocation

100%

The portfolio-oversight committee of American's target-date funds reduced the series' equity allocation

in 2009's fourth quarter so the series' glide path is far

more conservative in the years leading up to and just

past retirement. The committee made this move after

its dividend-focused offerings, which typically hold

up well in market downturns, failed to protect capital

as the committee expected in 2008's downturn. The

move away from equities is intended to reduce performance volatility in the years surrounding retirement.

Retirement Date

American Funds

Target Date Rtmt

Industry Average

2055 2050 2045 2040 2035 2030 2025 2020 2015 2010 2005 2000

–

2

2

2

2

2

2

2

2

2

–

–

–

25

25

25

25

27

33

32

34

32

–

–

–

24

25

25

26

27

30

30

32

31

–

–

–

–

–

–

4

5

39

1

4

5

39

1

4

5

39

1

4

6

35

1

5

6

32

2

4

4

25

1

4

15

15

2

4

14

12

2

9

14

10

3

–

–

–

–

©2010 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. “Morningstar,” and the Morningstar logo are registered marks of Morningstar, Inc.

–

–

–

–

1995

–

–

–

–

–

–

–

Retirement Date

TIPS

U.S. Government

U.S. Investment

Grade

U.S. High Yield

Foreign

Cash

Other