Release Date: 12-31-2015

American

Funds 2060 Trgt Date Retire R4 RDKTX

..........................................................................................................................................................................................................................................................................................................................................

Benchmark

Morningstar Lifetime Mod 2055 TR USD

Investment Objective & Strategy

The investment seeks growth, income and conservation of

capital.

The fund normally invests a greater portion of its assets in

bond, equity income and balanced funds as it approaches and

passes its target date. The advisor attempts to achieve its

investment objectives by investing in a mix of American Funds

in different combinations and weightings. The underlying

American Funds represent a variety of fund categories such as

growth funds, growth-and-income funds, equity-income funds

and a balanced fund and bond funds. The fund categories

represent differing investment objectives.

Fees and Expenses as of 01-01-16

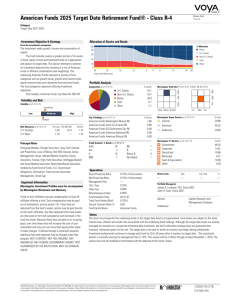

Morningstar Risk

.

.

100

80

% Allocation

Bonds

U.S. Stocks

Non-U.S. Stocks

Cash

Other

60

40

20

0

45

35

25

15

5

0

-5

-15

-25 -30

Years Until Retirement

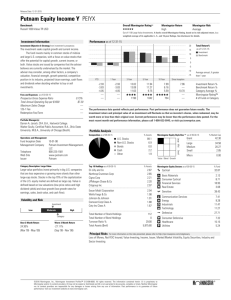

Performance

Trailing Returns

YTD

1 Year

3 Year

5 Year

10 Year

Since Inception

Investment Return %

Benchmark Return %

Category Average %

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

-1.82

-5.24

-4.12

Morningstar Rating™

# of Funds in Category

.

.

.

.

.

.

.

.

.

.

.

.

Quarter End Returns as of 12-31-15

YTD

1 Year

3 Year

5 Year

10 Year

Since Inception

Fund Return %

Standardized Return %

.

.

.

.

.

.

.

.

.

.

-1.82

-1.82

........................................................................................................................................................................................................................

Prospectus Net Expense Ratio

0.83%

Total Annual Operating Expense

Maximum Sales Charge

12b-1 Fee

Redemption Fee/Term

1.07%

.

0.25%

.

Waiver Data

Type

Exp. Date

OtherFee

Contractual

01-01-17

%

0.24

Operations and Management

Portfolio Analysis as of 09-30-15

Composition as of 09-30-15

% Assets

The index measures the performance of a portfolio of global

equities, bonds and traditional inflation hedges such as

commodities and TIPS. This portfolio is held in proportions

appropriate for a US investor who is about 45 years away from

retirement. The Moderate risk profile is for investors who are

comfortable with average exposure to equity market volatility.

Category Description: Target Date 2051+

Target-date portfolios provide a diversified exposure to stocks,

bonds, and cash for those investors who have a specific date

in mind (in this case, the years 2051 and beyond) for retirement.

These portfolios aim to provide investors with an optimal level

of return and risk, based solely on the target date. Management

adjusts the allocation among asset classes to moreconservative mixes as the target date approaches, following a

preset glide path. A target-date portfolio is part of a series of

funds offering multiple retirement dates to investors.

Value Blend Growth

Low

Benchmark Description: Morningstar Lifetime Mod 2055 TR USD

Morningstar Style Box™ as of 09-30-15(EQ) ; 09-30-15(F-I)

Med

56.7

27.5

7.6

5.3

2.9

High

U.S. Stocks

Non-U.S. Stocks

Bonds

Cash

Other

Small

03-27-15

Wesley K.-S. Phoa

James B. Lovelace, CFA

American Funds

800-421-4225

www.americanfunds.com

Performance Disclosure: The performance data quoted represents past performance and does not guarantee future

results. The investment return and principal value of an investment will fluctuate; thus an investor’s shares, when

redeemed, may be worth more or less than their original cost.

Large Mid

Name of Issuer

Telephone

Web Site

Morningstar Return

.

Allocation of Assets

From investment’s prospectus

Fund Inception Date

Portfolio Manager(s)

Overall Morningstar Rating™

Ltd

Mod

Ext

Morningstar Sectors as of 09-30-15

% Fund

S&P 500 %

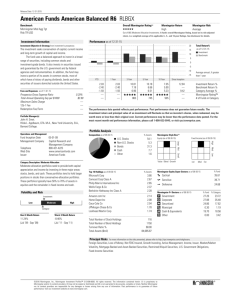

American Funds Invmt Co of Amer R6

American Funds Washington Mutual R6

American Funds American Mutual R6

American Funds Fundamental Invs R6

American Funds AMCAP R6

9.00

9.00

8.00

8.00

7.00

h Cyclical

30.75

31.26

r

t

y

u

4.34

12.32

13.15

0.94

2.64

11.25

15.16

2.21

American Funds Capital World Gr&Inc R6

American Funds Growth Fund of Amer R6

American Funds New Perspective R6

American Funds SMALLCAP World R6

American Funds American Balanced R6

7.00

7.00

7.00

7.00

5.00

j Sensitive

40.72

40.11

i

o

p

a

6.36

6.93

12.26

15.17

4.20

6.50

10.83

18.58

k Defensive

28.52

28.64

s Consumer Defensive

d Healthcare

f Utilities

8.40

17.79

2.33

9.99

15.66

2.99

Top 10 Holdings as of 09-30-15

% Assets

.......................................................................................................

.......................................................................................................

Total Number of Holdings

Annual Turnover Ratio %

Total Fund Assets ($mil)

16

20.00

54.23

...............................................................................................

Basic Materials

Consumer Cyclical

Financial Services

Real Estate

...............................................................................................

Communication Services

Energy

Industrials

Technology

...............................................................................................

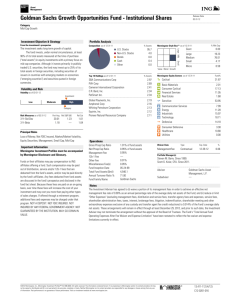

Principal Risks as of 09-30-15

Emerging Markets, Foreign Securities, Long-Term Outlook and Projections, Loss of Money, Not FDIC Insured, Active Management,

Issuer, Market/Market Volatility, Equity Securities, Futures, High-Yield Securities, Mortgage-Backed and Asset-Backed Securities,

Restricted/Illiquid Securities, Underlying Fund/Fund of Funds, U.S. Government Obligations, Derivatives, Fixed-Income Securities,

Management, Small Cap

©2016 Morningstar, Inc., Morningstar Investment Profiles™ 312-696-6000. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may

not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of

information. Past performance is no guarantee of future performance. Visit our investment website at www.morningstar.com

ß

®