1Q

American Funds 2040 Trgt Date

Fund

2015

STYLE & RISK

FUND OBJECTIVE/STRATEGY

The investment seeks growth, income and conservation of capital.

The fund normally invests a greater portion of its assets in bond, equity income and balanced funds as it

approaches and passes its target date. It attempts to achieve its investment objectives by investing in a mix

of American Funds in different combinations and weightings. The underlying American Funds represent a

variety of fund categories such as growth funds, growth-and-income funds, equity-income funds and a

balanced fund and bond funds. The fund categories represent differing investment objectives.

Portfolio Manager Name(s) ................................. Berro, Lovelace, Smet, Phoa, Suzman

Lead Portfolio Manager Tenure (since) .......................................................Feb. 2007

Management Company........................................................................American Funds

FUND FACTS

As of 03/31/15 unless otherwise noted

RDGTX

02630T530

Target Date 2036-2040

02/01/07

$414.8

0.78%

$7.80

1.00%

Morningstar Star Rating

Ticker

CUSIP

Investment Class

Inception Date

Total Net Assets (millions)

Net Expense Ratio

1 Yr. annual operating expense for $1000†

Portfolio Turn-over Rate (as of 10/31/14)

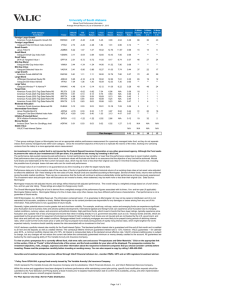

ANNUALIZED PERFORMANCE

YTD

1 yr.

3 year numbers

Beta

R-Squared

Alpha

Sharpe

0.95

97.30

2.32

1.48

Conservative

FUND MANAGER

3 mo.

(Class R4 Shares)

Moderate

Aggressive

LARGEST HOLDINGS

As of 12/31/14

American Funds Invmt Co of Amer R6

American Funds Washington Mutual R6

American Funds AMCAP R6

American Funds American Mutual R6

American Funds Fundamental Invs R6

American Funds Growth Fund of Amer R6

American Funds New Perspective R6

American Funds SMALLCAP World R6

American Funds Capital World Gr&Inc R6

American Funds American Balanced R6

8.00%

8.00%

7.00%

7.00%

7.00%

7.00%

7.00%

7.00%

6.00%

5.00%

TOP INDUSTRY ALLOCATIONS

As of 12/31/14

As of 03/31/15

3 yr.

5 yr.

10 yr.

Life

14%

Healthcare

16.31%

Technology

12%

10%

8%

15.10%

Industrials

12.85%

Financial Services

12.66%

Consumer Cyclical

6%

12.38%

Consumer Defensive

4%

8.80%

Energy

6.91%

2%

Communication Servic es

6.10%

0%

Basic Materials

-2%

The Fund

Benchmark

Peer Group

3 mo. YTD

1 yr. 3 yr.

5 yr. 10 yr. Life

The Fund

2.25% 2.25% 7.38% 13.07% 11.20% 6.11%

Benchmark*

3.08% 3.08% 7.41% 11.47% 10.60% Morningstar Cat.** 2.65% 2.65% 6.65% 10.26% 9.56% Category Rank***

84%

84%

33%

3%

9%

* DJ Target 2040 TR USD

The Dow Jones Real Return Target Date Indexes are constructed to consider the relationship between risk and

return over time. Each index initially includes a mix of asset classes that intends to measure a phase of capital

accumulation, or one with an aggressive risk-reward strategy that might be considered consistent with earlystage growth.

** MorningStar Target Date 2036-2040

*** Category Rank represents the fund’s percentile ranking within the MorningStar Target Date

2036-2040

For funds with less than a full year of performance the returns are cumulative.

Utilities

ASSET ALLOCATION

Domestic Equities

Foreign Equities

Cash Equivalents

Domestic Fixed Income

Other Securities

Foreign Fixed Income

Preferred Securities

Convertible Securities

4.33%

3.32%

As of 12/31/14

55.5%

27.4%

7.5%

7.0%

1.7%

0.8%

0.2%

0.0%

Investment Products: Not FDIC Insured · May Lose Value · No Bank Guarantee To view or print a prospectus for a currently offered fund, visit

www.valic.com and click on Access ePrint at the right-hand side of the screen. Enter your Group ID in the Login field and click Continue. Click on "Funds" at the left-hand side of the

screen, and the funds available for your plan will be displayed. The prospectus contains the investment objectives, risks, charges, expenses and other information about the

respective investment companies that you should consider carefully before investing. Please read the prospectus carefully before investing or sending money. You can also request a

copy by calling 1-800-428-2542.

The performance data quoted represents past performance. Current performance may be higher or lower than the performance stated due to recent market volatility. Past performance does not

guarantee future result. Investment values will fluctuate and there is no assurance that the objective of any funds will be achieved. Mutual fund shares are redeemable at the then current net asset

value, which may be more or less than their original cost. Please call 1-800-448-2542 for the most recent month-end performance results.

5821 RSVP/Profile-EQ Page 1 of 2

1Q

2015

DISCLOSURES

An investment in a money market fund is not insured or guaranteed by

the Federal Deposit Insurance Corporation (FDIC) or any other

government agency. While the fund seeks to preserve the value of your

investment at $1 per share, it is possible to lose money while investing

in the fund.

Generally, higher potential returns involve greater risk and short-term volatility.

For example, small-cap, mid-cap, and emerging funds can experience

significant price fluctuation due to business risks and adverse political

developments. International (global) and foreign funds can experience price

fluctuation due to changing market conditions, currency values, and economic

and political climates. High-yield bond funds, which invest in bonds that have

lower ratings, typically experience price fluctuation and a greater risk of loss of

principal and income than when investing directly in U.S. government securities

such as U.S. Treasury bonds and bills, which are guaranteed by the government

for repayment of principal and interest if held to maturity.

Mortgage-related funds’ underlying mortgages are more likely to be prepaid

during periods of declining interest rates, which could hurt the fund’s share

price or yield, and may be prepaid more slowly during periods of rapidly rising

interest rates, which might lengthen the fund’s expected maturity. Investors

should carefully assess the risks associated with an investment in the fund.

Fund shares are not insured and are not backed by the U.S. government, and

their value and yield will vary with market conditions. Investing in a singlesector fund involves greater risk and potential reward than investing in a more

diversified fund. International and global funds can experience significant price

fluctuation and returns due to business and currency risks as well as adverse

political climates. Investments in emerging markets involve greater risk, such as

increased volatility and potentially less liquidity.

The performance data quoted represents past performance. Current

performance may be higher or lower than the performance stated due

to recent market volatility. Past performance does not guarantee future

result. Investment values will fluctuate and there is no assurance that

the objective of any funds will be achieved. Mutual fund shares are

redeemable at the then current net asset value, which may be more or

less than their original cost. Please call 1-800-448-2542 for the most

recent month-end performance results.

Fees and expenses are only one of several factors that participants and beneficiaries

should consider when making investment decisions.

The cumulative effect of fees and expenses can substantially reduce the growth of a

participant's or beneficiary's retirement account; visit the Employee Benefit Security

Administration's website http://www.dol.gov/ebsa/publications/401k_employee.html

for an example demonstrating the long-term effect of fees and expenses.

†The total annual operating expense of the investment for a one-year period expressed as

a dollar amount for a $1,000 investment assuming no returns.

To view or print a prospectus for a currently offered fund, visit

www.valic.com and click on Access ePrint at the right-hand side of

the screen. Enter your Group ID in the Login field and click Continue.

Click on "Funds" at the left-hand side of the screen, and the funds

available for your plan will be displayed. The prospectus contains

the investment objectives, risks, charges, expenses and other

information about the respective investment companies that you

should consider carefully before investing. Please read the

prospectus carefully before investing or sending money. You can

also request a copy by calling 1-800-428-2542.

For funds with less than a full year of performance the returns are cumulative.

Returns reflect the deduction of fund expenses. There may be a quarterly

administration charge for investments in mutual funds, depending on the

contract.

Performance data prior to the inception date of the new class of funds is

hypothetical and reflects historical returns of an existing share class at net asset

value adjusted to reflect the additional 12B-1 fees relating to the new class of

funds. Mutual funds are classified according to Morningstar. There can be no

assurance that the funds will continue to achieve substantially similar

performance as they previously experienced. The investment return and

principal value will fluctuate so an investor’s shares, when redeemed, may be

worth more or less than their original cost. Data Source: Morningstar

Morningstar measures risk-adjusted returns. The overall rating is a weighted average

based on a fund’s three-, five- and 10-year star rating. The information contained

herein (1) is proprietary to Morningstar and/or its content providers; (2) may not be

copied or distributed; and (3) is not warranted to be accurate, complete or timely.

Neither Morningstar nor its content providers are responsible for any damages or

losses arising from any use of this information.

Morningstar calculates a Morningstar rating (based on a Morningstar risk-adjusted

return measure that accounts for variation in a fund’s monthly performance,

including the effects of sales charges), placing more emphasis on downward

variations and rewarding consistent performance. The top 10 percent of funds in

each category receive five stars, the next 22.5 percent receive four stars, the next 35

percent receive three stars, the next 22.5 percent receive two stars, and the bottom

10 percent receive one star. The fund was rated against U.S.-domiciled funds. Other

share classes may have different performance characteristics.

Data Source: Morningstar

Schwab Personal Choice Retirement Account® (if applicable to the plan) A prospectus(es) containing more complete information, including

management fees, charges and expenses, is available from Schwab (1-800-435-4000). Please read the prospectus(es) carefully before

investing. Other fees and charges for value-added services may apply. You can ask a Schwab representative for more information. Schwab’s

standard transaction fee will be charged on each redemption of fund shares bought with no transaction fee and held for 90 days or less. Schwab reserves the right

to assess Schwab’s standard transaction fees in the future should short-term trading become excessive. Schwab receives remuneration from Mutual Fund

OneSource companies. Schwab reserves the right to change the funds made available without transaction fees. Depending on the terms of your retirement plan,

your Schwab Personal Choice Retirement Account® is a custodial account established under Section 401(a), Section 403(b)(7) or Section 457 of the Internal

Revenue Code of 1986, as amended. Your rights under the account are governed by the terms of your account or your employer’s plan.

Securities and investment advisory services are offered by VALIC Financial Advisors, Inc., member FINRA, SIPC and an SEC-registered investment advisor.

Annuities issued by The Variable Annuity Life Insurance Company. Variable annuities distributed by its affiliate, AIG Capital Services, Inc., member FINRA.

VALIC represents The Variable Annuity Life Insurance Company and its subsidiaries, VALIC Financial Advisors, Inc. and VALIC Retirement Services Company.

Copyright© The Variable Annuity Life Insurance Company. All rights reserved.

This report has been prepared by Fluent Technologies, Inc. for us and is intended for distribution to retirement plans and their participants only. Portions of the mutual fund performance

information contained in this display were supplied by Morningstar. ©2014 Morningstar, Inc. All Rights Reserved. The performance information contained herein: (1) is proprietary to

Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers

are responsible for any damages or losses arising from any use of this information.

RSVP/Profile Page 2 of 2

Rev 04/10/2015 2:11:36 - EQ