Page 1 of 1 | Morningstar Target-Date Fund Series Report | 06-30-2016 | For Financial Professional Use Only.

Schwab Target Target-Date Fund Series Report

Morningstar Analyst Rating

‰

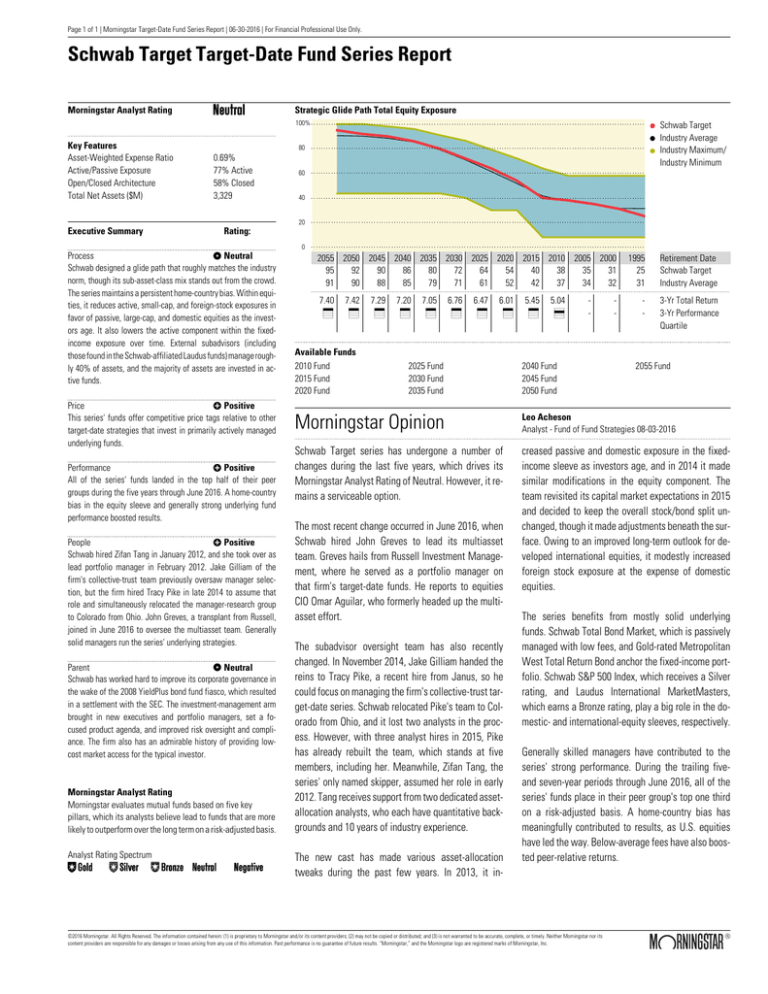

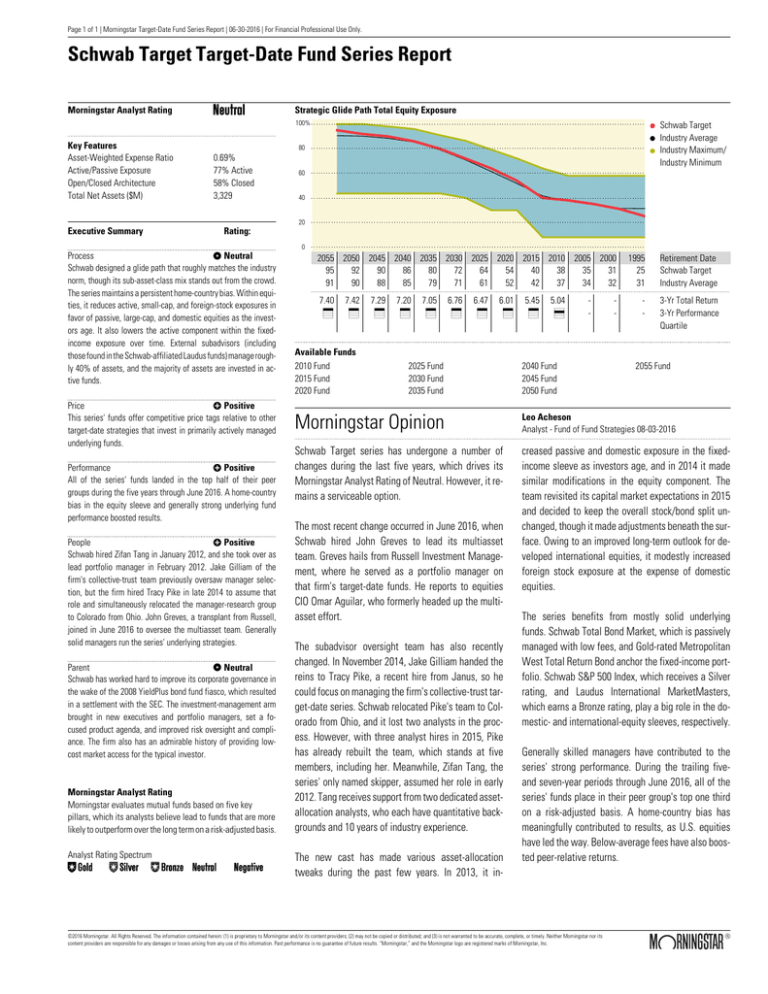

Strategic Glide Path Total Equity Exposure

100%

100

Key Features

Asset-Weighted Expense Ratio

Active/Passive Exposure

Open/Closed Architecture

Total Net Assets ($M)

0.69%

77% Active

58% Closed

3,329

Executive Summary

Rating:

¶ Neutral

Process

Schwab designed a glide path that roughly matches the industry

norm, though its sub-asset-class mix stands out from the crowd.

The series maintains a persistent home-country bias. Within equities, it reduces active, small-cap, and foreign-stock exposures in

favor of passive, large-cap, and domestic equities as the investors age. It also lowers the active component within the fixedincome exposure over time. External subadvisors (including

those found in the Schwab-affiliated Laudus funds) manage roughly 40% of assets, and the majority of assets are invested in active funds.

∞ Positive

Price

This series' funds offer competitive price tags relative to other

target-date strategies that invest in primarily actively managed

underlying funds.

∞ Positive

Performance

All of the series' funds landed in the top half of their peer

groups during the five years through June 2016. A home-country

bias in the equity sleeve and generally strong underlying fund

performance boosted results.

∞ Positive

People

Schwab hired Zifan Tang in January 2012, and she took over as

lead portfolio manager in February 2012. Jake Gilliam of the

firm's collective-trust team previously oversaw manager selection, but the firm hired Tracy Pike in late 2014 to assume that

role and simultaneously relocated the manager-research group

to Colorado from Ohio. John Greves, a transplant from Russell,

joined in June 2016 to oversee the multiasset team. Generally

solid managers run the series' underlying strategies.

¶ Neutral

Parent

Schwab has worked hard to improve its corporate governance in

the wake of the 2008 YieldPlus bond fund fiasco, which resulted

in a settlement with the SEC. The investment-management arm

brought in new executives and portfolio managers, set a focused product agenda, and improved risk oversight and compliance. The firm also has an admirable history of providing lowcost market access for the typical investor.

Morningstar Analyst Rating

Morningstar evaluates mutual funds based on five key

pillars, which its analysts believe lead to funds that are more

likely to outperform over the long term on a risk-adjusted basis.

Analyst Rating Spectrum

Œ

„ ´ ‰

Á

Schwab Target

Industry Average

Industry Maximum/

Industry Minimum

80

80

60

60

40

40

20

20

00

2055 2050 2045 2040 2035 2030 2025 2020 2015 2010 2005 2000

95

92

90

86

80

72

64

54

40

38

35

31

91

90

88

85

79

71

61

52

42

37

34

32

7.40

&

7.42

&

Available Funds

2010 Fund

2015 Fund

2020 Fund

7.29

&

7.20

&

7.05

&

6.76

&

6.47

&

6.01

&

2025 Fund

2030 Fund

2035 Fund

5.45

&

5.04

*

-

2040 Fund

2045 Fund

2050 Fund

-

1995

25

31

Retirement Date

Schwab Target

Industry Average

-

3-Yr Total Return

3-Yr Performance

Quartile

2055 Fund

Morningstar Opinion

Leo Acheson

Analyst - Fund of Fund Strategies 08-03-2016

Schwab Target series has undergone a number of

changes during the last five years, which drives its

Morningstar Analyst Rating of Neutral. However, it remains a serviceable option.

creased passive and domestic exposure in the fixedincome sleeve as investors age, and in 2014 it made

similar modifications in the equity component. The

team revisited its capital market expectations in 2015

and decided to keep the overall stock/bond split unchanged, though it made adjustments beneath the surface. Owing to an improved long-term outlook for developed international equities, it modestly increased

foreign stock exposure at the expense of domestic

equities.

The most recent change occurred in June 2016, when

Schwab hired John Greves to lead its multiasset

team. Greves hails from Russell Investment Management, where he served as a portfolio manager on

that firm's target-date funds. He reports to equities

CIO Omar Aguilar, who formerly headed up the multiasset effort.

The subadvisor oversight team has also recently

changed. In November 2014, Jake Gilliam handed the

reins to Tracy Pike, a recent hire from Janus, so he

could focus on managing the firm's collective-trust target-date series. Schwab relocated Pike's team to Colorado from Ohio, and it lost two analysts in the process. However, with three analyst hires in 2015, Pike

has already rebuilt the team, which stands at five

members, including her. Meanwhile, Zifan Tang, the

series' only named skipper, assumed her role in early

2012. Tang receives support from two dedicated assetallocation analysts, who each have quantitative backgrounds and 10 years of industry experience.

The new cast has made various asset-allocation

tweaks during the past few years. In 2013, it in-

The series benefits from mostly solid underlying

funds. Schwab Total Bond Market, which is passively

managed with low fees, and Gold-rated Metropolitan

West Total Return Bond anchor the fixed-income portfolio. Schwab S&P 500 Index, which receives a Silver

rating, and Laudus International MarketMasters,

which earns a Bronze rating, play a big role in the domestic- and international-equity sleeves, respectively.

Generally skilled managers have contributed to the

series' strong performance. During the trailing fiveand seven-year periods through June 2016, all of the

series' funds place in their peer group's top one third

on a risk-adjusted basis. A home-country bias has

meaningfully contributed to results, as U.S. equities

have led the way. Below-average fees have also boosted peer-relative returns.

©2016 Morningstar. All Rights Reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete, or timely. Neither Morningstar nor its

content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results. “Morningstar,” and the Morningstar logo are registered marks of Morningstar, Inc.