"Know Your Client Rule has No Age," National Post

advertisement

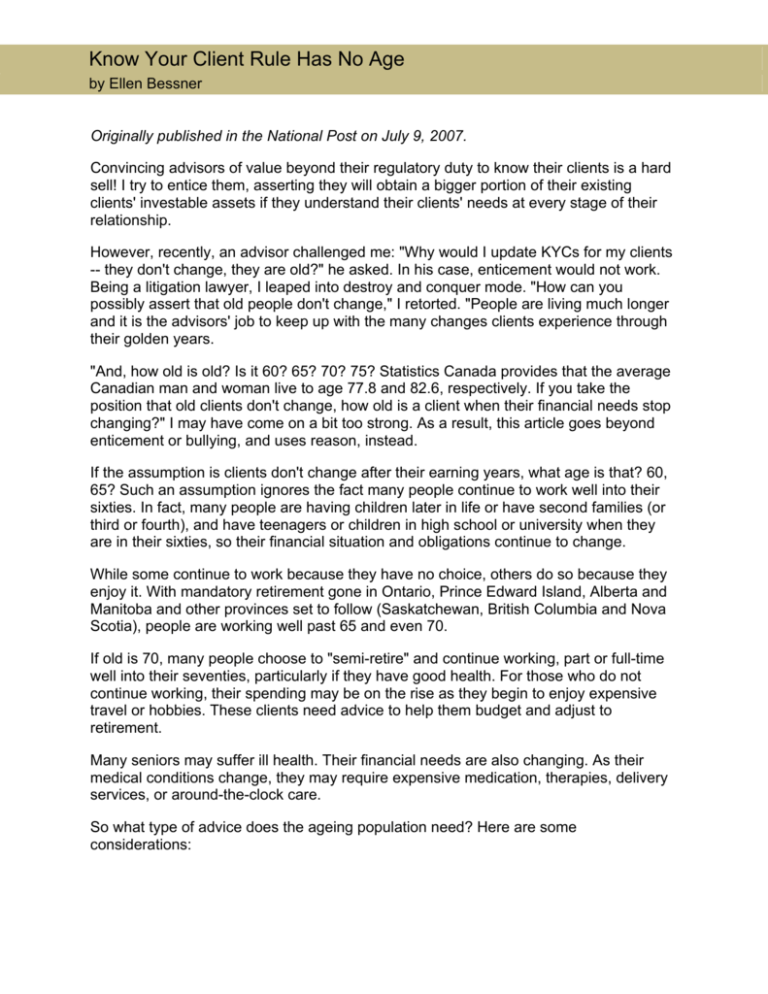

Know Your Client Rule Has No Age by Ellen Bessner Originally published in the National Post on July 9, 2007. Convincing advisors of value beyond their regulatory duty to know their clients is a hard sell! I try to entice them, asserting they will obtain a bigger portion of their existing clients' investable assets if they understand their clients' needs at every stage of their relationship. However, recently, an advisor challenged me: "Why would I update KYCs for my clients -- they don't change, they are old?" he asked. In his case, enticement would not work. Being a litigation lawyer, I leaped into destroy and conquer mode. "How can you possibly assert that old people don't change," I retorted. "People are living much longer and it is the advisors' job to keep up with the many changes clients experience through their golden years. "And, how old is old? Is it 60? 65? 70? 75? Statistics Canada provides that the average Canadian man and woman live to age 77.8 and 82.6, respectively. If you take the position that old clients don't change, how old is a client when their financial needs stop changing?" I may have come on a bit too strong. As a result, this article goes beyond enticement or bullying, and uses reason, instead. If the assumption is clients don't change after their earning years, what age is that? 60, 65? Such an assumption ignores the fact many people continue to work well into their sixties. In fact, many people are having children later in life or have second families (or third or fourth), and have teenagers or children in high school or university when they are in their sixties, so their financial situation and obligations continue to change. While some continue to work because they have no choice, others do so because they enjoy it. With mandatory retirement gone in Ontario, Prince Edward Island, Alberta and Manitoba and other provinces set to follow (Saskatchewan, British Columbia and Nova Scotia), people are working well past 65 and even 70. If old is 70, many people choose to "semi-retire" and continue working, part or full-time well into their seventies, particularly if they have good health. For those who do not continue working, their spending may be on the rise as they begin to enjoy expensive travel or hobbies. These clients need advice to help them budget and adjust to retirement. Many seniors may suffer ill health. Their financial needs are also changing. As their medical conditions change, they may require expensive medication, therapies, delivery services, or around-the-clock care. So what type of advice does the ageing population need? Here are some considerations: -2Encourage saving for a rainy day. Clients of all ages need to ensure they have funds put aside for medical or other emergencies. While advisors, particularly fee-based advisors, may be accused of keeping too much of their clients' money in cash it is important to discuss and document how much liquidity is required in each client's portfolio. Identify how much they can afford to spend when that day comes. Some seniors are scared to spend their money whether it's a rainy day or not. They are paranoid about running out of money so they stay home and spend nothing. Ultimately, they are wasting their lives. These clients would benefit from a thorough analysis of how much money they can spend. Furthermore, if their health is taking a turn for the worse, they may be worried about spending money on support and assistance which can be costly. The advisor may need to help clients identify when the rainy day has arrived. Ensure a power of attorney has been signed. While the topic of growing old is sensitive, it is crucial for the advisor to have a copy (or better, an original) of each client's power of attorney or, at least, written permission from the client to speak to the lawyer who has the original power of attorney. This is not just relevant for seniors but for all clients. Accidents and debilitating diseases can strike anytime. These simple measures would avoid big problems for the dealer and the advisor down the road. Ensure all references to beneficiaries are up-to-date. The beneficiary generally is designated when the account is opened but clients and their relationships change over time, even for seniors; they get married, divorced, their children get married and divorced and this may affect the beneficiary designation. Ensure medical, disability or life insurance has been purchased. If the advisor is licensed to sell insurance products, discussions to ensure these products have been offered should be documented so there is a paper trail proving the client was offered the appropriate insurance and declined. To know your clients is not an obligation that ends at retirement. It is important for advisors to understand the changes elderly clients will experience, and help them plan accordingly. This approach enables advisors to do what they are mandated to do: Know their clients and help them with their changing financial needs. It is the best way to build a successful business and manage regulatory and legal risk.