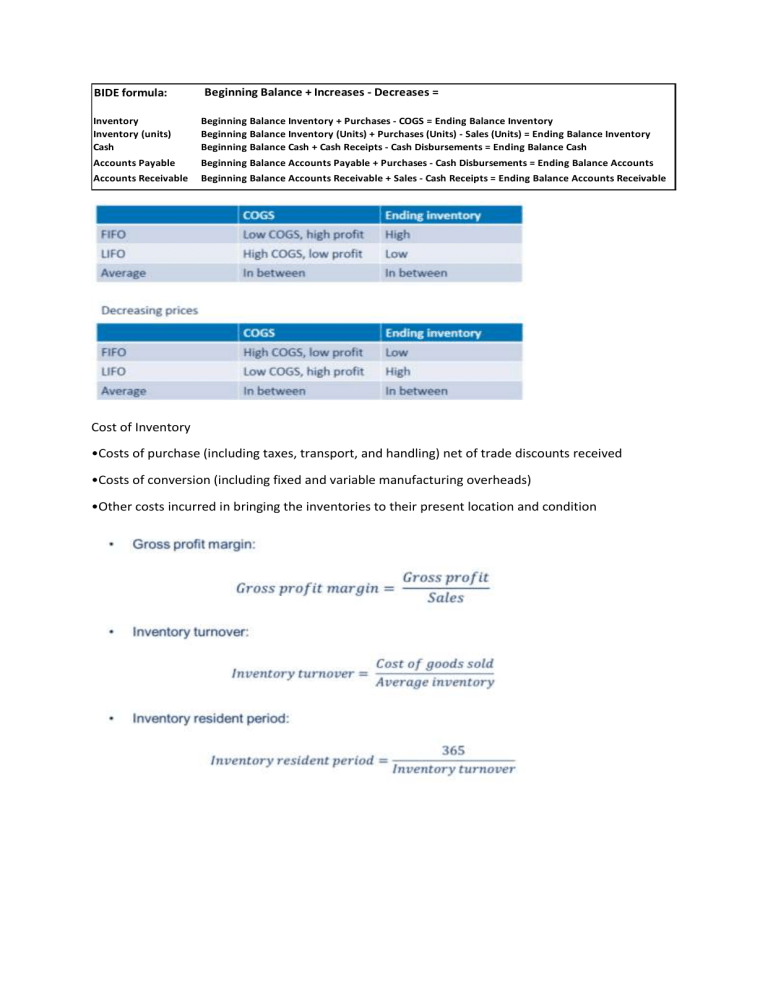

BIDE formula: Beginning Balance + Increases - Decreases = Ending Balance Inventory Inventory (units) Cash Beginning Balance Inventory + Purchases - COGS = Ending Balance Inventory Beginning Balance Inventory (Units) + Purchases (Units) - Sales (Units) = Ending Balance Inventory Beginning Balance Cash + Cash Receipts - Cash Disbursements = Ending Balance Cash Accounts Payable Beginning Balance Accounts Payable + Purchases - Cash Disbursements = Ending Balance Accounts Accounts Receivable Payable Beginning Balance Accounts Receivable + Sales - Cash Receipts = Ending Balance Accounts Receivable Cost of Inventory •Costs of purchase (including taxes, transport, and handling) net of trade discounts received •Costs of conversion (including fixed and variable manufacturing overheads) •Other costs incurred in bringing the inventories to their present location and condition Depreciation (cost residual value) * Depreciation book value * 1 Useful life 1 *2 Useful life Depreciation (cost residual value) * Number of items produced Expected total number of items produced 𝑃𝑉 = 𝐹𝑉 × (1 + 𝑖𝑑%)−𝑛𝑡 1 − (1 + 𝑖𝑑%)−𝑛𝑡 PV A = A × 𝑖𝑑%