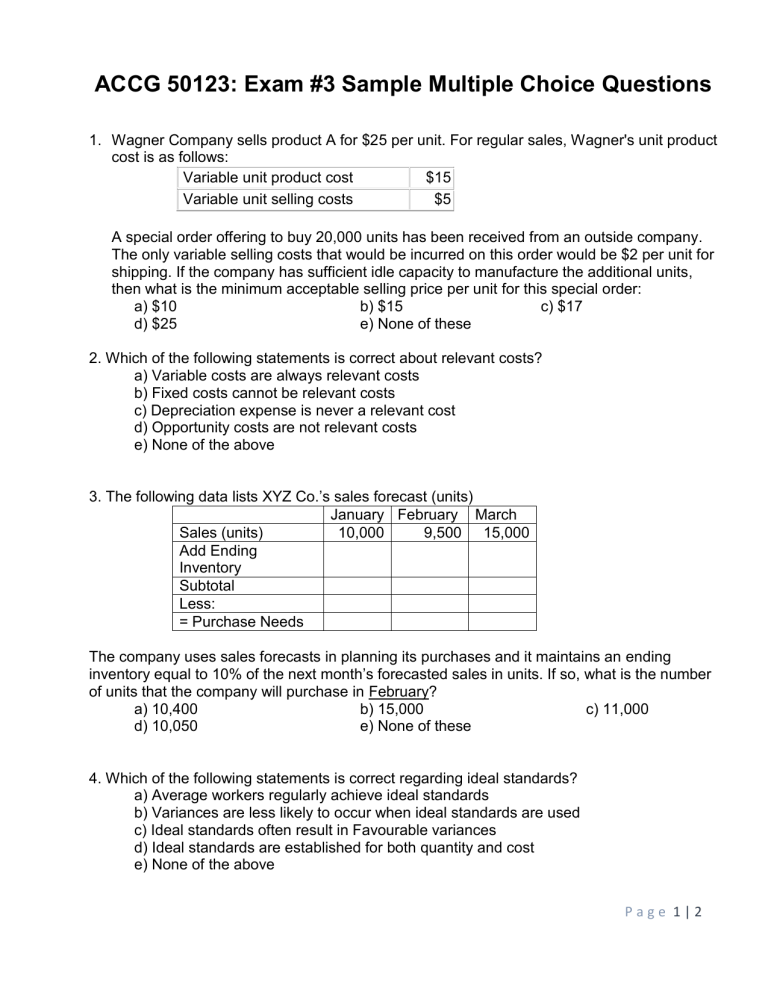

ACCG 50123: Exam #3 Sample Multiple Choice Questions 1. Wagner Company sells product A for $25 per unit. For regular sales, Wagner's unit product cost is as follows: Variable unit product cost $15 Variable unit selling costs $5 A special order offering to buy 20,000 units has been received from an outside company. The only variable selling costs that would be incurred on this order would be $2 per unit for shipping. If the company has sufficient idle capacity to manufacture the additional units, then what is the minimum acceptable selling price per unit for this special order: a) $10 b) $15 c) $17 d) $25 e) None of these 2. Which of the following statements is correct about relevant costs? a) Variable costs are always relevant costs b) Fixed costs cannot be relevant costs c) Depreciation expense is never a relevant cost d) Opportunity costs are not relevant costs e) None of the above 3. The following data lists XYZ Co.’s sales forecast (units) January February March Sales (units) 10,000 9,500 15,000 Add Ending Inventory Subtotal Less: Beg Inventory = Purchase Needs The company uses sales forecasts in planning its purchases and it maintains an ending inventory equal to 10% of the next month’s forecasted sales in units. If so, what is the number of units that the company will purchase in February? a) 10,400 b) 15,000 c) 11,000 d) 10,050 e) None of these 4. Which of the following statements is correct regarding ideal standards? a) Average workers regularly achieve ideal standards b) Variances are less likely to occur when ideal standards are used c) Ideal standards often result in Favourable variances d) Ideal standards are established for both quantity and cost e) None of the above Page 1|2 5. When a company prepares a master budget which budget should be developed first? a) Advertising budget b) Cash collections budget c) Capital budget d) Production budget e) None of the above 6. The standard cost card reflects __________ required to make one unit of output. a) All raw materials b) All resource inputs c) All labour costs d) All opportunity costs e) None of the above 7. ABC Company produces 2,000 parts per year, which are used in the assembly of one of its products. The unit product cost of these parts is: Variable manufacturing cost $32 Fixed manufacturing cost 18 Unit production cost $50 The part can currently be purchased from an outside supplier at $40 per unit. If the part is purchased from the outside supplier, 2/3 of the current fixed manufacturing costs can be eliminated. What is the relevant cost for ABC of continuing to produce the units? a) $50 b) $40 c) $44 d) $46 e) None of these 8. A(n) _______ budget is based on a range of planned activity levels and is prepared using the same budget data and standard cost card information of the _______ budget. a) Ideal, Practical b) Static; Flexible c) Sales; Cash d) Flexible; Static e) None of the above Page 2|2