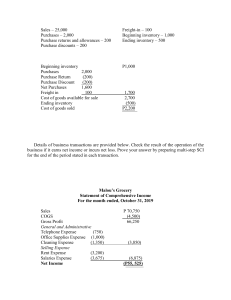

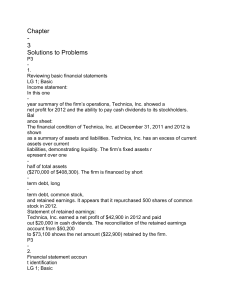

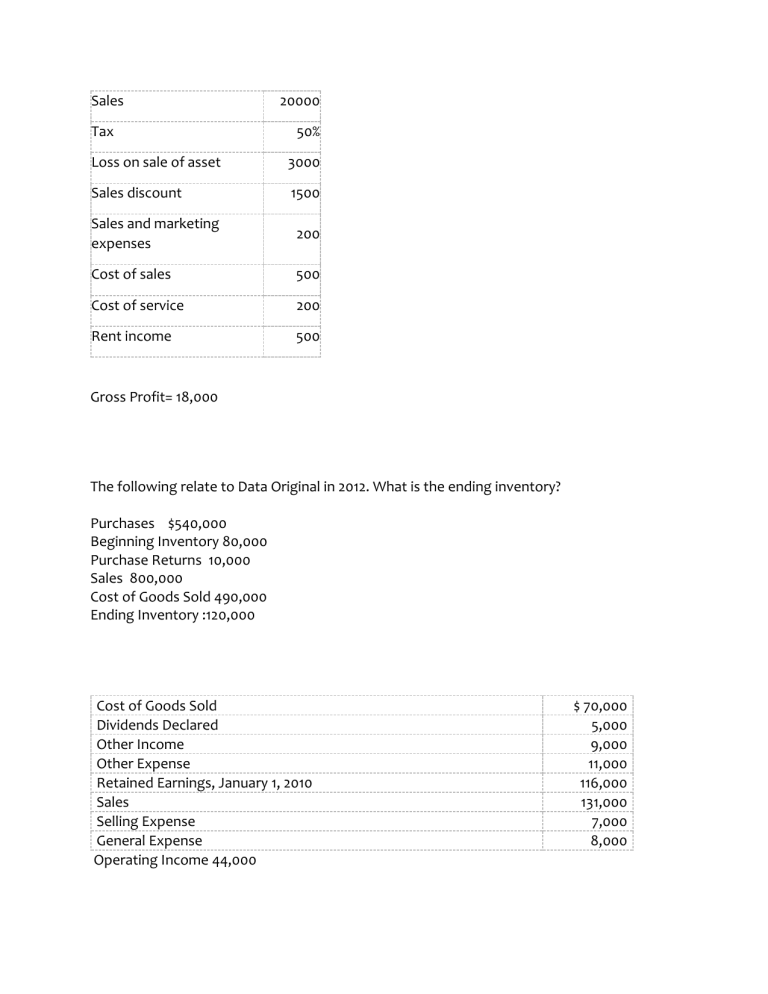

Sales Tax 20000 50% Loss on sale of asset 3000 Sales discount 1500 Sales and marketing expenses 200 Cost of sales 500 Cost of service 200 Rent income 500 Gross Profit= 18,000 The following relate to Data Original in 2012. What is the ending inventory? Purchases $540,000 Beginning Inventory 80,000 Purchase Returns 10,000 Sales 800,000 Cost of Goods Sold 490,000 Ending Inventory :120,000 Cost of Goods Sold Dividends Declared Other Income Other Expense Retained Earnings, January 1, 2010 Sales Selling Expense General Expense Operating Income 44,000 $ 70,000 5,000 9,000 11,000 116,000 131,000 7,000 8,000