quick studies

advertisement

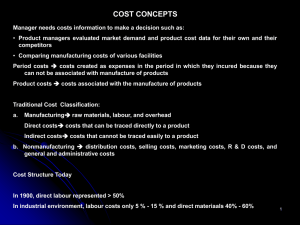

Chapter 17 Activity-Based Costing and Analysis QUESTIONS 1. Manufacturing overhead costs cannot be traced to units of product like direct materials and direct labor. Assigning overhead costs to units of product requires some sort of allocation on some “reasonable” basis. 2. Overhead is commonly assigned to products using (a) a plantwide overhead rate, (b) departmental overhead rates, or (c) activity based costing. 3. Direct labor hours and machine hours are commonly used to assign overhead costs because they are readily available. Companies keep track of direct labor hours for payroll purposes anyway and machine hours can be measured easily. The ready availability and understandability of these measures are reasons that many companies use them as the basis for assigning overhead. Many overhead costs such as indirect labor and supervision may be related to direct labor hours, and others such as machine maintenance and electricity may be closely related to machine hours. So, there is also logic for using these measures for assigning such overhead costs. 4. A single plantwide overhead rate is easy to use. All the overhead costs are put into a single pool and averaged over all the products based on a single driver. If all costs consume overhead in the same proportion this may be a reasonable method of assigning overhead to product. 5. The assumptions underlying the use of a single plantwide overhead rate are (a) the overhead costs are logically related to the base used to determine the rate (e.g. direct labor hours or machine hours) and (b) all costs are consumed by products in the same proportions. 6. Anything to which costs would be assigned is considered a “cost object.” Common cost objects are units of product, product lines, departments, activities, and projects. 7. If the assumptions mentioned in question 5 are violated, there will be distortions. That is, if all overhead costs are not related to the single base there will be distortions, or if products consume resources in different proportions some products will be assigned too much overhead cost and some will be assigned too little. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 961 8. Departmental overhead rates reflect the unique costs and drivers in various departments, whereas these potentially important differences are lost when all the costs are combined into a single plantwide overhead rate. 9. Departmental overhead rates are similar to plantwide overhead rates in the fact that they pool together costs that may be incurred differently. Distorted cost assignments can occur under both departmental and plant-wide methods. They are different because the departmental rates recognize differences among departments and assign overhead to products based on the driver that makes the most sense for each department. 10. Companies may choose to use an alternative, more expensive method of assigning costs than ones allowed for external financial reporting because they may need more accurate information for strategic decision making, cost control, and other managerial purposes. 11. The first step in ABC is to identify the activities that cause costs to be incurred. 12. An activity cost driver is the measure of the activity that causes costs to be incurred. For instance, the activity driver for the activity “printing checks” might be number of checks printed. 13. Value-added activities are those that increase the value of a product or service. 14. Unit level activities: Activities that must be performed for each unit of product. Batch level activities: Activities that are related to the number of batches, lots, or groups of units. They do not have to be performed for each unit of product. Product level activities: Activities that are associated with the number of different product lines. They are not incurred for each unit or even for each batch of product. Facility level activities: Activities that are related to maintaining productive capacity. They do not change with respect to the number of units, batches, or product lines produced. 15. Activity-based costing may be used in any type of organization. The premise of ABC is that activities cause costs. Since all organizations engage in activities, these activities may be associated with costs they incur. Service enterprises must determine appropriate fees for the services they provide, so it would be just as appropriate for such a company to determine the cost of providing those services as it is for a manufacturer to determine the cost of making a product. 16. While ABC may provide more accurate cost assignments, the additional cost to implement activity-based costing may not be justified. That is, the value of the improved accuracy may not result in higher profitability. Like any business decision, the choice of accounting method depends on weighing the costs against the benefits. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 962 Financial & Managerial Accounting, 5th Edition QUICK STUDIES Quick Study 17-1 (10 minutes) 1. D 2. A 3. C 4. B Quick Study 17-2 (5 minutes) 1. A, C, D 2. B 3. A, B Quick Study 17-3 (5 minutes) The three main advantages are: (1) They are based on readily available information, (2) they are easy to apply, and (3) they are consistent with GAAP and therefore can be used for external reporting. Quick Study 17-4 (10 minutes) 1. F 2. U 3. P 4. F 5. U 6. B 7. B Quick Study 17-5 (5 minutes) 1. Plant-wide overhead rate (based on direct labor hours) ($1,200,000 + $600,000)/(12,000 DLH + 20,000 DLH) = $56.25/DLH 2. Plant-wide overhead rate (based on machine hours) ($1,200,000 + $600,000)/(6,000 MH + 16,000 MH) = $81.82/MH (rounded) Quick Study 17-6 (10 minutes) Departmental overhead rates Assembly: $1,200,000/12,000 DLH = $100/DLH Finishing: $600,000/16,000 MH = $37.50/MH ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 963 Quick Study 17-7 (10 minutes) 1. Plantwide overhead rate: $2,480,000/125,000 DLH = $19.84/DLH 2. Assign overhead costs to Deluxe and Basic models Deluxe Overhead cost 25,000 DLH x $19.84/DLH ÷ production volume (units) Average overhead cost per unit $ 496,000 ÷ 10,000 $49.60/unit Basic Overhead cost 60,000 DLH x $19.84/DLH ÷ production volume (units) Average overhead cost per unit $ 1,190,400 ÷ 30,000 $39.68/unit Quick Study 17-8 (15 minutes) Activity Expected Cost Activity Driver Activity Rate Handling material $ 625,000 100,000 parts $6.25/part Inspecting product 900,000 1,500 batches $600/batch Processing orders 105,000 700 orders $150/order Paying suppliers 175,000 500 invoices $350/invoice Insuring factory 300,000 40,000 ft2 $7.50/ft2 Designing pkg. 375,000 10 models $37,500/model $2,480,000 ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 964 Financial & Managerial Accounting, 5th Edition Quick Study 17-9 (15 minutes) Note: Activity rates are from Quick Study 17-8. Assign overhead to Deluxe and Basic model using ABC Deluxe Handling material Inspecting product Processing orders Paying suppliers Insuring factory Designing pkg. $6.25/part $600/batch $150/order $350/invoice $7.50/sq. ft. $37,500/model 20,000 parts 250 batches 50 orders 50 invoices 10,000 sq. ft. 1 model $ 30,000 parts 100 batches 20 orders 10 invoices 7,000 sq. ft. 1 model $ ÷ production volume (units) Average overhead cost per unit Basic Handling material Inspecting product Processing orders Paying suppliers Insuring factory Designing pkg. $6.25/part $600/batch $150/order $350/invoice $7.50/sq. ft. $37,500/model ÷ production volume (units) Average overhead cost per unit (rounded) 125,000 150,000 7,500 17,500 75,000 37,500 $ 412,500 ÷ 10,000 $41.25/unit 187,500 60,000 3,000 3,500 52,500 37,500 $ 344,000 ÷ 30,000 $11.47/unit Quick Study 17-10 (5 minutes) 1. D 2. A 3. D ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 965 Quick Study 17-11 (10 minutes) $250,000 = $25 10,000 1. Cost of technical support per service call = 2. Assign technical support costs to each model Deluxe: 550 calls x $25 per call = $13,750 Basic: 250 calls x $25 per call = $ 6,250 Quick Study 17-12 (10 minutes) Activity Expected Cost Activity Driver* Activity Rate 1 $ 140,000 35,000 $ 4.00 2 90,000 30,000 3.00 3 82,000 5,125 16.00 *Computed as the sum of the budgeted cost driver activity of all three products. Quick Study 17-13 (15 minutes) Overhead cost allocation of indirect labor and supplies to Department 1 Rate: ($5,400 + $2,600) / $32,000 = $0.25 / $ of labor cost Allocation: $18,800 x $0.25 = $4,700 Overhead cost allocation of rent and utilities, general office, and depreciation to Department 1 Rate: Allocation: ($12,200 + $4,000 + $3,000) / 3,200 hrs = $6.00/machine hour 2,000 machine hrs x $6.00/machine hour = $12,000 Total overhead allocated to Department 1 $4,700 + $12,000 = $16,700 ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 966 Financial & Managerial Accounting, 5th Edition Quick Study 17-14 (15 minutes) 1. Activity Expected Cost Activity Driver Activity Rate 1 $ 93,000 7,750 $ 12.00 2 92,000 10,000 9.20 3 87,000 5,800 15.00 2. Activity 1 2,500 x $12 5,250 x $12 Standard Deluxe 30,000 63,000 Activity 2 4,500 x $9.20 5,500 x $9.20 41,400 50,600 Activity 3 3,000 x $15 2,800 x $15 $ 45,000 __________ $ 42,000 Total overhead cost $ $ 155,600 ÷ Units produced Overhead cost per unit 116,400 ÷ 36,375 units $ 3.20 ÷ 62,240 units $ 2.50 Quick Study 17-15 (10 minutes) a. P b. P c. A d. I e. I f. A g. I h. E Quick Study 17-16 (5 minutes) The two key components of lean accounting are (1) eliminating waste in the accounting process and (2) using alternative metrics, such as percentage of defective products produced, instead of focusing on cost-allocations as in activity-based costing. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 967 EXERCISES Exercise 17-1 (10 minutes) 1. D 2. B 3. B 4. C Exercise 17-2 (10 minutes) There are two basic stages to activity-based costing. The first stage cost assignment is to identify the activities involved in manufacturing products and match those activities with the costs they cause. The second stage is to compute an activity rate for each cost pool and then use this rate to allocate overhead costs to products Exercise 17-3 (10 minutes) Overhead allocation under ABC is more accurate because (1) there are more cost pools, (2) costs in each pool are more similar, and (3) allocation is based on activities that cause costs. Exercise 17-4 (10 minutes) Activity Part (1) Control Level Part (2) Activity Driver A. Registering patients U Number of patients B. Cleaning beds U Beds, patients, labor hours C. Stocking exam rooms F Number of rooms D. Washing linens B Loads E. Ordering equipment F Cost of equipment, Number of suppliers F. Heating F Degree-days, space G. Providing security F Hours worked, hours open H. Filling prescriptions U Number of prescriptions ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 968 Financial & Managerial Accounting, 5th Edition Exercise 17-5 (15 minutes) 1. 2. 3. Overhead rate: €630,000/270,400 DLH = €2.33/DLH Wine glasses: 254,000 DLH x €2.33/DLH = €591,820 €591,820/211,000 units = €2.80/unit Vases: 16,400 DLH x €2.33/DLH = €38,212 €38,212/17,000 units = €2.25/unit Overhead rate: €630,000/1,000 set-ups = €630/setup Wine glasses: €630/setup x 200 setups = €126,000 €126,000/211,000 units = €0.60/unit Vases: €630/setup x 800 setups = €504,000 €504,000/17,000 units = €29.65/unit Assigning the setup costs based on the activity that drives these costs will give a more accurate cost assignment. This is true because setup cost is a batch-level cost and not a unit-level cost (as would be implied if direct labor hours was used as the base). Exercise 17-6 (25 minutes) 1. $1,004,000 + $465,300 + $232,000 = $283.55/machine hour 6,000 machine hours Model 145 1,800 machine hours x $283.55/machine hour ÷ units produced Model 212 4,200 machine hours x $283.55/machine hour ÷ units produced $ 510,390 ÷ 1,500 units $ 340.26/unit $ 1,190,910 ÷ 3,500 units $ 340.26/unit ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 969 Exercise 17-6 (concluded) 2. Model 145 Materials and labor Overhead Total cost per unit $250.00 340.26 $590.26 Model 212 Materials and Labor Overhead Total cost per unit $180.00 340.26 $520.26 3. Price per unit Model 145 $820.00 Model 212 $480.00 Cost per unit 590.26 520.26 $229.74 $(40.26) Profit (loss) per unit Using a single plantwide overhead rate, Model 212 appears to be unprofitable. Management may be inclined to stop producing this product, increase its selling price, or look for ways to cut the cost of producing Model 212 in order to make it appear profitable. The plantwide rate may be inappropriate in this case, since machine hours are only accumulated in the components department, and over 40% of the overhead is incurred outside of that department. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 970 Financial & Managerial Accounting, 5th Edition Exercise 17-7 (25 minutes) 1. Components Finishing Support $1,004,000/6,000 MH $465,300/3,000 WH $232,000/450 PO $167.33/machine hour* $155.10/welding hour $515.56/purchase order* *rounded Model 145 Component Overhead 1,800 MH x $167.33/MH 4,200 MH x $167.33/MH Finishing 800 WH x $155.10/WH 2,200 WH x $155.10/WH Support 300 POs x $515.56/PO 150 POs x $515.56/PO Total overhead cost ÷ Units produced Overhead cost per unit $ Model 212 301,194* $ 702,786* 124,080 341,220 154,668** _________ $ 579,942 ÷ 1,500 units $ 386.63 77,334** $ 1,121,340 ÷ 3,500 units $ 320.38 * The sum of these two amounts is $1,003,980. There is a $20 difference from $1,004,000 due to rounding of the overhead rate. **The sum of these two amounts is $232,002. There is a $2 difference from $232,000 due to rounding of the overhead rate. 2. Materials & labor per unit Overhead cost per unit Total cost per unit Model 145 $250.00 386.63 $636.63 Model 212 $180.00 320.38 $500.38 Price per unit Cost per unit Profit (loss) per unit Model 145 $820.00 636.63 $183.37 Model 212 $480.00 500.38 $(20.38) 3. Model 145 appears profitable and Model 212 appears unprofitable. Management may be inclined to stop producing Model 212, or may consider increasing its selling price, if it is unable to cut production costs to make that product show a profit. Departmental rates allocate overhead differently based on departmental usage, so may be more reflective of how each product uses that department’s resources. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 971 Exercise 17-8 (35 minutes) 1. Components Changeover Machining Setups $500,000 / 800 batches $279,000 / 6,000 machine hours $225,000 / 120 setups $625/batch $46.50/MH $1,875/setup Finishing Welding Inspecting Rework $180,300 / 3,000 welding hours $210,000 / 700 inspections $75,000 / 300 rework orders $60.10/WH $300/inspection $250/rework order $135,000 / 450 purchase orders $300/PO $97,000 / 5,000 units $ 19.40/unit Support Purchasing Providing space and utilities Model 145 Changeover 400 batches x $625/batch $ 250,000 Machining 1,800 MH x $46.50/MH 83,700 4,200 MH x $46.50/MH Setups 60 setups x $1,875/setup 112,500 Welding 800 WH x $60.10/WH 48,080 2,200 WH x $60.10/WH Inspecting 400 inspections x $300/inspection 120,000 300 inspections x $300/inspection Rework 160 rework orders x $250/rework order 40,000 140 rework orders x $250/rework order Purchasing 300 purchase orders x $300/PO 90,000 150 purchase orders x $300/PO Space & Utilities 1,500 units x $19.40/unit 29,100 3,500 units x $19.40/unit _________ Total overhead cost $ 773,380 ÷ Units produced ÷ 1,500 units Overhead cost per unit (rounded) $ 515.59 Model 212 $ 250,000 195,300 112,500 132,220 90,000 35,000 45,000 67,900 $ 927,920 ÷ 3,500 units $ 265.12 ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 972 Financial & Managerial Accounting, 5th Edition Exercise 17-8 (concluded) 2. Materials & labor cost per unit Overhead cost per unit Total cost per unit Model 145 $250.00 515.59 $765.59 Model 212 $180.00 265.12 $445.12 Price per unit Total cost per unit Profit (loss) per unit Model 145 $820.00 765.59 $ 54.41 Model 212 $480.00 445.12 $ 34.88 3. Both product lines appear profitable. Using ABC we see that Model 145 is not generating nearly as much profit as it appeared to generate using the volume-based systems in Exercise 17-6 and Exercise 17-7. Furthermore, Model 212, which appeared to be unprofitable using the volume-based cost assignment systems is clearly profitable when costs are assigned using ABC, which more accurately reflects the resources consumed to produce each product line. The company should continue to produce both product lines but may still want to look at the costs of each activity to see if both products can be even more profitable. Exercise 17-9 (10 minutes) 1. 2. ($730,000 + $590,000) / (52,000 DLH + 48,000 DLH) = $13.20/DLH Part A27C 6,200 DLH x $13.20/DLH = $81,840 Part X82B 5,650 DLH x $13.20/DLH = $74,580 ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 973 Exercise 17-10 (15 minutes) 1. Molding $730,000 ÷ 30,500 MH = $23.93/MH (rounded) Trimming $590,000 ÷ 48,000 DLH = $12.29/DLH (rounded) 2. 3. Part A27C Molding Trimming 5,100 MH x $23.93/MH 700 DLH x $12.29/DLH $122,043 8,603 $130,646 Part X82B Molding Trimming 1,020 MH x $23.93/MH 3,500 DLH x $12.29/DLH $ 24,409 43,015 $ 67,424 A27C Departmental $130,646 ÷ 9,800 units $13.33/unit* X82B Departmental $67,424 ÷ 54,500 units $ 1.24/unit* *rounded ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 974 Financial & Managerial Accounting, 5th Edition Exercise 17-11 (25 minutes) 1. ($300,000 + $200,000) / (75,000 + 125,000) DLH = $2.50/DLH 2. Direct materials $ 280,000 Direct labor Fabricating $140,000 Implementation 464,000 604,000 Overhead [(7,000 + 16,000 DLH) x $2.50/DLH] 57,500 $ 941,500 ÷ units produced Manufacturing cost per unit ÷ 35,000 $26.90/unit 3. Fabricating Implementation $300,000 / 80,000 MH = $3.75/MH $200,000 / 125,000 DLH = $1.60/DLH 4. Direct materials Direct labor Fabricating Implementation Overhead Fabricating (15,040 MH x $3.75/MH) Implementation (16,000 DLH x $1.60/DLH) ÷ units produced Manufacturing cost per unit $ 280,000 $140,000 464,000 56,400 25,600 604,000 82,000 $ 966,000 ÷ 35,000 $27.60/unit ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 975 Exercise 17-12 (35 minutes) 1. Total direct labor hours: Product A: 10,000 units x 0.20 DLH/unit = 2,000 DLH Product B: 2,000 units x 0.25 DLH/unit = 500 DLH Total direct labor hours 2,500 DLH Plant-wide overhead rate: $249,000/2,500 DLH = $99.60/DLH Product A Direct materials A: 10,000 units x $2/unit B: 2,000 units x $3/unit Direct labor A: 2,000 DLH x $24/DLH B: 500 DLH x $24/DLH Overhead A: 2,000 DLH x $99.60/DLH B: 500 DLH x $99.60/DLH Total manufacturing cost ÷ Number of units $ Product B 20,000 $ 6,000 48,000 12,000 199,200 __________ $ 267,200 $ 49,800 67,800 ÷ 10,000 units ÷ 2,000 units $ 26.72/unit $33.90/unit Price per unit Product A $20.00 Product B $60.00 Cost per unit 26.72 33.90 $ (6.72) $26.10 Manufacturing cost per unit 2. Profit (loss) per unit It appears that Product A is not profitable. The company may decide that this product line should be eliminated if it cannot reduce the cost of Product A or increase the selling price. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 976 Financial & Managerial Accounting, 5th Edition Exercise 17-12 (concluded) 3. Overhead rates Machine setup $121,000/(10 + 12) setups Material handling $48,000/16,000 parts* Quality control $80,000/(40 + 210) insp. hrs. $5,500/setup $3/part $320/insp.hr. *Product A: 1 part/unit x 10,000 units = 10,000 parts Product B: 3 parts/unit x 2,000 units = 6,000 parts 16,000 parts Product A $ 20,000 48,000 Direct Materials (from part 1) Direct labor (from part 1) Overhead Machine setup A: 10 setups x $5,500/setup 55,000 B: 12 setups x $5,500/setup Material handling A: 10,000 parts x $3/part 30,000 B: 6,000 parts x $3/part Quality control A: 40 insp. hr. x $320/insp. hr. 12,800 B: 210 insp. hr. x $320/insp. hr._________ Total manufacturing cost $ 165,800 ÷ Number of units ÷ 10,000 units Manufacturing cost per unit $ 16.58/unit 4. Price per unit Cost per unit Profit (loss) per unit Product A $20.00 16.58 $ 3.42 Product B $ 6,000 12,000 66,000 18,000 67,200 $ 169,200 ÷ 2,000 units $ 84.60/unit Product B $ 60.00 84.60 $(24.60) Using this approach (activity based costing) the company sees that Product B is not profitable, and Product A is profitable. The company should evaluate the activities used to produce Product B and determine how costs can be reduced. If they cannot be reduced, the company should consider discontinuing Product B. Volume-based costing overstates the cost of high-volume products and understates the cost of low-volume products. ABC more accurately reflects the cost of production by assigning costs to product lines based on the activities required to produce them. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 977 Exercise 17-13 (20 minutes) 1. Client consultation $270,000/1,500 contact hours $180/con.hr. Drawings $115,000/2,000 design hours $57.50/design hr. Modeling $30,000/40,000 sq. ft. $0.75/sq. ft. Supervision $120,000/600 days $200/day Billing/Collection $22,000/8 jobs $2,750/job Client consultation 450 contact hours x $180/con. hr. Drawings 340 design hrs. x $57.50/design hr. Modeling 9,200 sq. ft. x $0.75/sq. ft. Supervision 200 days x $200/day Billing/Collection 1 job x $2,750/job 2. Total cost of job $ 81,000 19,550 6,900 40,000 2,750 $150,200 ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 978 Financial & Managerial Accounting, 5th Edition Exercise 17-14 (30 minutes) Calculation of predetermined overhead rates to apply ABC Overhead Cost Total Category (Activity Total Amount of Cost Pool) Cost Cost Driver Predetermined Overhead Rate Supervision ...................... $ 5,400 $36,000 15% of direct labor cost Depreciation.....................56,600 2,000 MH $28.30 per machine hour Line preparation ..............46,000 250 setups $184.00 per setup 1. Assignment of overhead costs to the two products using ABC Rounded edge Cost Driver Supervision ............................ $12,200 Machinery depreciation ........ 500 hours Line preparation .................... 40 setups Total overhead assigned ...... Cost per Driver Unit Assigned Cost 15% $ 28.30 $184.00 $ 1,830 14,150 7,360 $23,340 Squared edge Cost Driver Supervision ............................ $23,800 Machinery depreciation ........1,500 hours Line preparation ....................210 setups Total overhead assigned ...... Cost per Driver Unit Assigned Cost 15% $ 28.30 $184.00 $ 3,570 42,450 38,640 $84,660 2. Average cost per foot of the two products Rounded edge Direct materials ........................... $19,000 Direct labor .................................. 12,200 Overhead (using ABC) ............... 23,340 Total cost ..................................... $54,540 Quantity produced ...................... 10,500 ft. Average cost per foot* (ABC) ..... $5.19 Squared edge $ 43,200 23,800 84,660 $151,660 14,100 ft. $10.76 *rounded 3. Using ABC, the average cost of rounded edge shelves declines and the average cost of squared edge shelves increases. Under the current allocation method, the rounded edge shelving was allocated 34% of all of the overhead cost ($12,200 direct labor/$36,000 total direct labor). However, it does not use 34% of all of the overhead resources. Specifically, it uses only 25% of machine hours (500 MH/2,000 MH), and 16% of the setups (40/250). Activity based costing allocated the individual overhead components in proportion to the resources used. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 979 Exercise 17-15 (40 minutes) Part 1 Determination of cost per driver unit Cost Center Cost Professional salaries ....................... $1,600,000 Driver Cost per Driver 10,000 hours $160 per hour Patient services & supplies ............ $ 27,000 600 patients $45 per patient Building cost .................................... $ 150,000 1,500 sq. ft. $100 per sq. ft. Total costs ........................................ $1,777,000 Part 2 Allocation of cost to the surgical departments using ABC GENERAL SURGERY Cost Cost per Allocated Driver Driver Unit Cost Professional salaries ............. 2,500 hours $160 per hr. $400,000 Patient services & supplies ...... 400 patients $45 per patient 18,000 Building cost .......................... 600 sq. ft. $100 per sq. ft. 60,000 Total ................................................................................................. $478,000 Average cost per patient ...................................................................$ 1,195 ORTHOPEDIC SURGERY Cost Cost per Allocated Driver Driver Unit Cost Professional salaries ............. 7,500 hours $160 per hr. $1,200,000 Patient services & supplies ...... 200 patients $45 per patient 9,000 Building cost .......................... 900 sq. ft. $100 per sq. ft 90,000 Total ................................................................................................$1,299,000 Average cost per patient ................................................................... $ 6,495 [Note that the sum of the amounts allocated to General Surgery and Orthopedic Surgery ($478,000 + $1,299,000) equals the total amount of indirect costs ($1,777,000).] ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 980 Financial & Managerial Accounting, 5th Edition PROBLEM SET A Problem 17-1A (45 minutes) 1. Plantwide rate Engineering support $ 24,500 Electricity 34,000 Setup costs 52,500 Total manufacturing overhead $111,000 ÷ 6,200* direct labor hours = $17.90/DLH *rounded * Product A Product B 10,000 units x 0.3 DLH/unit = 2,000 units x 1.6 DLH/unit = Direct materials per unit Direct labor per unit A: 0.3 DLH/unit @ $20/DLH B: 1.6 DLH/unit @ $20/DLH Manufacturing overhead per unit A: 0.3 DLH/unit @ $17.90/DLH B: 1.6 DLH/unit @ $17.90/DLH Total manufacturing cost per unit Selling price per unit ..................... Manufacturing cost per unit ......... Gross margin per unit ................... 2. Gross margin per unit x Units purchased per customer A: 10,000 units/500 customers B: 2,000 units/400 customers Gross margin per customer 3,000 DLH 3,200 DLH 6,200 DLH Product A $15.00 Product B $24.00 6.00 32.00 5.37 ______ $26.37 Product A $30.00 26.37 $ 3.63 28.64 $84.64 Product B $120.00 84.64 $ 35.36 Product A $ 3.63 Product B $35.36 x 20 units _________ $72.60 x 5 units $176.80 Total customer service cost $81,000 ÷ number of customers ÷ 900 customers Customer service cost per customer $90/customer ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 981 Problem 17-1A (continued) We see that the gross margin per customer from Product A ($72.60) is not adequate to cover the cost of providing service to customers of this product ($90). It appears that the company is incurring a loss associated with each customer of Product A. 3. Engineering Support $24,500/(12 + 58) modifications $350/modification Electricity $34,000/3,400* machine hours $10/MH Setup $52,500/(125 + 225) batches $150/batch *Product A 10,000 units x 0.1 MH/unit = 1,000 MH Product B 2,000 units x 1.2 MH/unit = 2,400 MH 3,400 MH Product A Engineering support A: 12 modifications @ $350 B: 58 modifications @ $350 $ 4,200 Electricity A: 1,000 MH @ $10/MH B: 2,400 MH@ $10/MH 10,000 Product B $20,300 24,000 Setups A: 125 batches @ $150/batch B: 225 batches @ $150/batch 18,750 ______ Total overhead cost by product line ÷ Number of units Overhead cost per unit (rounded) Direct materials cost per unit Direct labor cost per unit (part 1) Total manufacturing cost per unit $32,950 ÷10,000 units $ 3.30 15.00 6.00 $24.30 Selling price per unit Total manufacturing cost per unit Gross profit per unit $30.00 24.30 $ 5.70 33,750 $78,050 ÷2,000 units $39.03 24.00 32.00 $95.03 $120.00 95.03 $ 24.97 ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 982 Financial & Managerial Accounting, 5th Edition Problem 17-1A (concluded) 4. Product A Product B Gross profit per unit (from above) $5.70 $24.97 x units per customer (part 2) x 20 units x 5 units Gross profit per customer $114.00 $ 124.85 Gross profit per customer $114.00 $124.85 - 90.00 - 90.00 $ 24.00 $ 34.85 - Service cost per customer (part 2) Profit (loss) per customer The gross profit per customer is adequate to cover the cost of providing customer service under ABC for both Product A and Product B 5. Activity based costing gives better information than the plantwide rate based on volume-related measures because ABC associates the cost of the various activities that must be performed in order to make, sell, and provide services to customers. Resource consumption (i.e. the incurrence of costs) is driven by the activities that are performed; assigning costs based on the consumption of these activities more appropriately (accurately) reflects the cost associated with each cost object. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 983 Problem 17-2A (25 minutes) 1. When companies experience strong price pressure on their highvolume, commodity-type products, they should be concerned. Many managers will blame competitive price cutting on attempts by competitors to undercut prices to gain an edge and drive out existing companies. While this may be a strategy, it is possible that a new entrant to a market has more efficient production systems that allow more competitive pricing. Another possibility is that there is a difference in the cost assignment methods each competitor is using. 2. The company may be charging less for its low-volume, custom-order products than the competitors because the company is using a volumebased costing system, which understates the true cost of producing low-volume products. It could be that competitors know that customorder products consume relatively more resources per unit than highvolume, commodity-type products and know that a higher price should be charged on those custom-order products to cover their greater costs. 3. While prices are really set in the marketplace based on customer demand and supply of the product, companies still look at costs to determine the price they would like to get if they could affect market demand. Managers look at expected costs of production before entering a new market to determine if the market price is profitable. They may also reassess pricing strategies based on changes in the cost of production. 4. Custom-order furniture requires handling special fabrics, buying in smaller quantities (which may be more expensive than buying “in bulk”), consulting with customers about their needs and preferences, modifying pieces to suit an individual customer, and other activities that are not necessary for mass-market furniture. 5. In addition to obtaining a more accurate picture of the costs of making various products, activity based costing also gives information about the cost of the activities that are performed. Managers may be surprised to find how much these activities cost and may decide they need to take action to reduce how frequently activities are performed, which will reduce costs. They may also find that there are activities being performed that are not needed, but still cause costs, and thus target these activities for elimination. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 984 Financial & Managerial Accounting, 5th Edition Problem 17-3A (40 minutes) 1. Grinding ............................................................................... Polishing .............................................................................. Product modification .......................................................... Providing power .................................................................. System calibration .............................................................. 2. Grinding & Polishing Unit level Unit level Product level Facility level Batch level ($320,000+$135,000)/13,000 MH $35/MH Product modification $600,000/1,500 Eng. hrs. $400/Eng. hr. Providing power $255,000/17,000 DLH $15/DLH System calibration $500,000/400 batches $1,250/batch 3. Job 3175 Job 4286 Grinding & polishing 550 MH x $35 ............$19,250 5,500 MH x $35........... $192,500 Product modification 26 Eng.hrs. x $400 ... 10,400 32 Eng. hr. x $400 ....... 12,800 Providing power 500 DLH x $15 .......... 7,500 4,375 DLH x $15 .......... 65,625 System calibration 30 batches x $1,250 . 37,500 90 batches x $1,250 .... 112,500 Total cost of job 4. $74,650 $383,425 Job 3175 Job 4286 Total overhead cost of job $74,650 $383,425 ÷ Number of units in job ÷200 units ÷2,500 units Average overhead cost per unit $373.25 $153.37 ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 985 Problem 17-3A (concluded) 5. Plantwide rate: Grinding ............................................................................... $ 320,000 Polishing .............................................................................. 135,000 Product modification .......................................................... 600,000 Providing power .................................................................. 255,000 System calibration .............................................................. 500,000 Total ...................................................................................... $ 1,810,000 ÷ Direct labor hours ............................................................ ÷17,000 DLH Per DLH (rounded) .............................................................. $106.47/DLH Job 3175 Job 4286 Overhead 500 DLH x $106.47 4,375 DLH x $106.47 ÷ units in each job Average overhead cost per unit* $ 53,235 ÷200 units $ 266.18 $ 465,806 ÷2,500 units $ 186.32 Job 3175 $ 373.25 $ 266.18 Job 4286 $ 153.37 $ 186.32 *rounded 6. Average overhead cost Using ABC Using plantwide rate The plantwide rate, which is closely associated with the volume of production, overstates the cost of the high-volume product (in this case Job 4286), and understates the cost of the low-volume product (Job 3175). ABC more accurately represents the cost of producing a product because it considers how much of each resource is consumed by each product in the manufacturing process. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 986 Financial & Managerial Accounting, 5th Edition Problem 17-4A (25 minutes) 1. Liquid materials Dry materials Utilities Bottling Labeling Machine setup $2,304/(1,400 + 37,000) gallons $6,941/(620 + 12,000) pounds $1,422/(200 + 3,750) machine hrs $77,000/(12,500 + 180,000) bottles $6,525/217,500 labels** $20,000/(500 + 300) setups $0.06/gallon $0.55/pound* $0.36/MH $0.40/bottle $0.03/label $25/setup *rounded ** Hi-Voltage: EasySlim: 12,500 bottles x 3 labels/bottle = 37,500 labels 180,000 bottles x 1 label / bottle = 180,000 labels Total labels 217,500 labels Hi-Voltage Liquid material 1,400 gal x $0.06 .......... $ 84 620 pounds x $0.55 .... Dry material 341 200 MH x $0.36 ........... Utilities 72 12,500 btls x $0.40..... 5,000 Bottling 37,500 labels x $0.03 .. 1,125 Labeling Machine setup 500 setups x $25 ........ 12,500 Product Cost $19,122 2. Total cost of line ÷ Production volume Average cost per bottle* EasySlim 37,000 gal x $0.06 ..........$ 2,220 12,000 pounds x $0.55 .. 6,600 3,750 MH x $0.36 ............ 1,350 180,000 btls x $0.40 ....... 72,000 180,000 labels x $0.03 ... 5,400 300 setups x $25 ............ 7,500 $95,070 Hi-Voltage $19,122 ÷12,500 bottles $1.53/bottle EasySlim $95,070 ÷180,000 bottles $0.53/bottle *rounded 3. Price for Hi-Voltage Mfg. cost per bottle Profit per bottle $3.75 1.53 $2.22 4. The price of EasySlim must cover the costs associated with the product, so the minimum price for this product is $0.53/bottle. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 987 Problem 17-5A (45 minutes) 1. Plantwide overhead rate: Total overhead cost = $128,250 + $268,000 + $182,000 = $578,250 . Total volume 20,000 + 100,000 cases 120,000 cases = $4.82/case (rounded) Using this plantwide rate, the same overhead cost would be assigned to each case of salsa, regardless of whether it is Extra Fine or Family Style. 2. Extra Fine $ 6.00 Family Style $ 5.00 4.82 4.82 $10.82 $ 9.82 Extra Fine $18.00 Family Style $ 9.00 Manufacturing cost per case 10.82 9.82 Gross margin (loss) per case $ 7.18 $(0.82) Direct materials + Direct Labor Overhead Manufacturing cost per case 3. Selling price per case It appears that Family Style salsa is not profitable and the company may be inclined to stop producing this product if the costs cannot be reduced (or price cannot be increased) to a profitable level. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 988 Financial & Managerial Accounting, 5th Edition Problem 17-5A (concluded) 4. Mixing & Cooking ($4,500 + $11,250)/1,500 MH Product testing $112,500/600 batches Machine calibration $250,000/400 production runs Labeling & Defects ($12,000 + $6,000)/120,000 cases Recipe formulation $90,000/45 focus groups Heat, light and water $27,000/1,500 machine hours Material handling $65,000/8 container types Extra Fine Mixing & cooking Product testing Mach. calibration Labeling & defects Recipe formulation Heat, light, & water Material handling Total overhead ÷ cases Overhead/case* Material & labor Total cost/case $10.50/MH $187.50/batch $625/run $0.15/case $2,000/group $18/MH $8,125/type Family Style 500 MH x $10.50.......... $ 5,250 1,000 MH x $10.50 ..... 200 batch. X $187.50 .. 37,500 400 batch. x $187.50 . 200 runs x $625 .......... 125,000 200 runs x $625 ......... 20,000 cases x $0.15 .. 3,000 100,000 cases x $0.15 . 30 groups x $2,000 ..... 60,000 15 groups x $2,000 .... 500 MH x $18............... 9,000 1,000 MH x $18 .......... 5 types x $8,125 .......... 40,625 3 types x $8,125......... $280,375 ÷ 20,000 $ 14.02 6.00 $ 20.02 $ 10,500 75,000 125,000 15,000 30,000 18,000 24,375 $297,875 ÷100,000 $ 2.98 5.00 $ 7.98 *rounded 5. Selling price per case Manufacturing cost per case Gross margin (loss) per case Extra Fine $18.00 20.02 $(2.02) Family Style $9.00 7.98 $1.02 Using ABC, the Extra Fine salsa is not profitable, but the Family Style is profitable; this conclusion is opposite to the one that we would make if the plantwide rate was used for assigning cost. 6. Departmental overhead rates would be a modest improvement over the plantwide rate because they could show differences across departments. However, the departmental overhead rates are still based on volume-related factors and do not accurately reflect the resources consumed in manufacturing the products, so they would not be superior to activity based costing. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 989 PROBLEM SET B Problem 17-1B (45 minutes) 1. Plantwide overhead rate: Engineering support Electricity Setup costs Total overhead cost $ $ 56,250 112,500 41,250 210,000 ÷ machine hours Plantwide overhead rate/MH ÷150,000* MH $ 1.40/MH x machine hours/unit Overhead cost per unit x $ *Standard: Deluxe: 3 MH/unit 4.20/unit 40,000 units x 3 MH/unit = 120,000 MH 10,000 units x 3 MH/unit = 30,000 MH Total machine hours 150,000 MH Direct materials cost per unit Direct labor cost per unit Standard: 4 DLH x $20/DLH Deluxe: 5 DLH x $20/DLH Overhead cost per unit Manufacturing cost per unit Selling price per unit Manufacturing cost per unit Gross profit per unit Standard $ 4.00 80.00 4.20 $ 88.20 100.00 4.20 $112.20 $ 92.00 88.20 $ 3.80 $125.00 112.20 $ 12.80 2. Profit per customer Standard Gross profit per unit $3.80 x units per customer Standard (40,000 units/1,000 cust.) x 40 units/cust. Deluxe (10,000 units/1,000 cust.) ___________ Gross profit per customer $152.00 Service cost per customer ($250,000/2,000) Profit per customer Deluxe $ 8.00 125.00 $ 27.00 Deluxe $ 12.80 x 10 units/cust. $128.00 125.00 $ 3.00 This comparison shows that gross profit per customer exceeds service cost per customer for both products. Thus, both products appear to be profitable. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 990 Financial & Managerial Accounting, 5th Edition Problem 17-1B (concluded) 3. Eng. support $56,250/(50 + 25) modifications = $750/modification Electricity $112,500/150,000* machine hours = $0.75/machine hour Setup $41,250/(175 + 75) batches = $165/batch * From part 1 Standard Engineering Electricity Setups Total overhead ÷ units Overhead/unit Direct material Direct labor Mfg. cost/unit 50 mods. x $750 120,000 MH x $0.75 175 batches x $165 Selling price Mfg. cost/unit Gross profit/unit 4. Gross profit per unit x units per customer* Gross profit per customer Gross profit per customer Service cost per customer* Profit (loss) per customer Deluxe $37,500 90,000 28,875 $156,375 ÷ 40,000 $ 3.91 4.00 80.00 $ 87.91 $ $ 25 mods. x $750 30,000 MH x $0.75 75 batches x $165 92.00 87.91 4.09 $ 18,750 22,500 12,375 $53,625 ÷ 10,000 $ 5.36 8.00 100.00 $ 113.36 $ 125.00 113.36 $ 11.64 Standard $ 4.09 x 40 units $ 163.60 Deluxe $ 11.64 x 10 units $ 116.40 $ 163.60 125.00 $ 38.60 $ 116.40 125.00 $ (8.60) *From Part 2 This analysis shows that the Standard product is in fact profitable, but the high cost of production and service for the small volume of the Deluxe product is unprofitable. 5. ABC gives more appropriate information to managers because it identifies the resources consumed by each product line, and assigns the costs of these activities accordingly. Using volume-based methods such as the plantwide rate distorts product cost because the focus of these methods is on the number of units of output, which may not be the primary factor causing costs to be incurred. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 991 Problem 17-2B (25 minutes) 1. The major costs of making the boxes are designing the boxes, setting up machines to make the right cuts, cutting the cardboard, printing the boxes, obtaining the cardboard material, labor, and utilities, and shipping the boxes. Some of the costs, such as design and setup, are not related to volume, but are related to number of different products or number of batches. Some of the costs, such as materials and labor, are volume-driven. 2. Midwest has taken on more custom-made boxes for smaller-volume customers. 3. Yes. Midwest’s old customers bought the same type of boxes over and over, so the design costs were spread over many units. The new customers need different boxes for each different need, which means that design and machine configuration costs should be spread over a smaller number of units. 4. Possibly. If ABC had been used rather than a volume-based system, Midwest would have realized that small customers who want customdesigned and custom-made boxes require different activities than than those required by existing large-volume customers. With ABC the costs of activities associated with the special orders would be assigned only to those orders, rather than being shared by all orders. Midwest might have been using inaccurate cost information in setting its selling prices. 5. ABC gives managers information about the activities and the costs of these activities that will help them make strategic decisions and improve the accuracy of cost assignment. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 992 Financial & Managerial Accounting, 5th Edition Problem 17-3B (45 minutes) 1. Control levels Wrapping Unit level Assembling Unit level Product design Product level Obtaining business licenses Facility level Cooking Batch level 2. Wrapping $500,000/100,000 units $5/unit Assembling* $400,000/20,000 direct labor hours $20/DLH Product design $180,000/3,000 design hours $60/des. hr. Obtaining license* $100,000/20,000 direct labor hours $5/DLH Cooking $270,000/1,000 batches $270/batch * The costs of Assembling and Obtaining business licenses should NOT be combined because they are different with respect to their control level. From part 1, assembling is a unit level activity while obtaining business licenses is a facility level activity. (Management can control assembly costs by changing the number of direct labor hours, but the cost of obtaining business licenses cannot be controlled by changing the number of direct labor hours.) Obtaining business licenses is not really driven by the number of direct labor hours, but this basis is used in order to assign this facility level cost to units of product. 3. Holiday Basket Executive Basket Wrapping 8,000 units x $5 ............. $ 40,000 1,000 units x $5 ............. $ 5,000 Assembling 2,000 DLH x $20............. 40,000 500 DLH x $20 ............... 10,000 Product design 40 design hrs x$60 ........ 2,400 40 design hrs x$60........ 2,400 Obtaining Lic. 2,000 DLH x $5............... 10,000 500 DLH x $5 ................. 2,500 Cooking 80 batches x $270 ......... 21,600 200 batches x $270 ....... 54,000 Total ovhd. cost $114,000 $73,900 ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 993 Problem 17-3B (concluded) 4. Cost per unit Total overhead cost ÷ Units produced Overhead cost per unit Holiday Basket $114,000 ÷8,000 units $14.25 5. Plantwide overhead rate Wrapping ($300,000 + $200,000) Assembling Product Design Obtaining business license Cooking ($150,000 + $120,000) Total overhead Executive Basket $73,900 ÷1,000 units $73.90 $ 500,000 400,000 180,000 100,000 270,000 $ 1,450,000 ÷ Total direct labor hours Overhead rate per DLH ÷20,000 DLH $ 72.50 Holiday Basket Overhead assigned (2,000 DLH x $72.50/DLH) ÷ units Overhead cost per unit (rounded) $ 145,000 ÷8,000 units $ 18.13 Executive Basket Overhead assigned (500 DLH x $72.50/DLH) ÷ units Overhead cost per unit $ 36,250 ÷1,000 units $ 36.25 6. Holiday Basket Activity based cost per unit $14.25 Plantwide cost per unit $18.13 Executive Basket $73.90 $36.25 The plantwide overhead rate assigns too much cost to the Holiday Basket (which is a comparatively high-volume product) and understates the cost of the Executive Basket because it is a low-volume product. The ABC costs more accurately reflect the costs of these products because activity-based costing focuses on the consumption of resources and assigns costs accordingly, whereas volume-based costing (such as the plantwide rate) assigns costs based on measures associated with number of units of output. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 994 Financial & Managerial Accounting, 5th Edition Problem 17-4B (30 minutes) 1. Components Assembly labor Maintenance Packaging materials Shipping Machine setup *Fun with Fractions: Count Calculus: $495,000/(450,000 + 100,000) parts $244,800/(15,000 + 2,000) DLH $100,800/(5,000 + 2,000) MH $460,800/(150,000 + 10,000) boxes $27,360/1,900* cartons $187,200/(52 + 52) setups $0.90/part $14.40/DLH $14.40/MH $2.88/box $14.40/ctn. $1,800/setup 150,000 units/100 units per carton = 1,500 cartons 10,000 units/ 25 units per carton = 400 cartons Total cartons 1,900 cartons Fun with Fractions Count Calculus Components 450,000 parts x $0.90 . $ 405,000 100,000 parts x $0.90 $ 90,000 Assembly 15,000 DLH x $14.40 ... 216,000 2,000 DLH x $14.40 .... 28,800 Maintenance 5,000 MH x $14.40 ...... 72,000 2,000 MH x $14.40...... 28,800 Packaging 150,000 boxes x $2.88 432,000 10,000 boxes x $2.88 . 28,800 Shipping 1,500 cartons x $14.40 21,600 400 cartons x $14.40 . 5,760 Set-ups 52 set-ups x $1,800 .... 93,600 52 set-ups x $1,800 ... 93,600 Total cost 2. Cost per unit $1,240,200 Fun with Fractions $275,760 Count Calculus Total manufacturing cost $1,240,200 $275,760 ÷ number of units ÷150,000 units ÷10,000 units Average manufacturing cost per unit $8.27 3. Selling price of Count Calculus Cost/unit Profit/unit $27.58 $59.95 27.58 $32.37 4. Since the cost associated with Fun with Fractions is $8.27, the price should be at least $8.27 to cover these costs. A higher price would make the product profitable. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 995 Problem 17-5B (50 minutes) 1. Total overhead Total direct labor hours = $215,630 + $399,480 + $515,600 2,600 DLH + 1,600 DLH = $1,130,710 = $269.22/DLH (rounded) 4,200 DLH Pup Tent Pop-Up Tent Overhead cost by product line Pup: 2,600 DLH @ $269.22/DLH $699,972* Pop-Up: 1,600 DLH @ $269.22/DLH ÷ Number of units produced 15,200 units $430,752* 7,600 units Overhead cost per unit (rounded) $56.68 $46.05 *($699,972 + 430,752 = $1,130,724; $14 rounding error) 2. Total manufacturing cost per unit: Direct materials and direct labor Manufacturing overhead Total manufacturing cost per unit $25.00 46.05 $71.05 $32.00 56.68 $88.68 3. Gross profit per unit Selling price per unit Manufacturing cost per unit Gross profit (loss) per unit $65.00 71.05 $ (6.05) $200.00 88.68 $111.32 It appears that the Pup Tent is not profitable and management may decide to eliminate this product line if it cannot reduce cost (or raise the selling price) to generate a profit. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 996 Financial & Managerial Accounting, 5th Edition Problem 17-5B (continued) 4. Pattern alignment $64,400/560 batches $115/batch Cutting $50,430/12,300 machine hours $4.10/MH Moving product $100,800/2,400 moves $42/move Sewing $327,600/4,200 direct labor hours $78/DLH Inspecting $24,000/600 inspections $40/inspection Folding $47,880/22,800 units $2.10/unit Design $280,000/280 mod. orders $1,000/mod.order Providing space $51,600/8,600 square feet $6/sq. ft. Material handling $184,000/920,000 square yards $0.20/sq. yd. Pup Tent Pop-Up Tent Pattern alignment 140 batches x $115 .......... $ 16,100 420 batches x $115 .......... $ 48,300 Cutting 7,000 MH x $4.10 ..............28,700 5,300 MH x $4.10 ..............21,730 Moving product 800 moves x $42 ..............33,600 1,600 moves x $42 ...........67,200 Sewing 2,600 DLH x $78 ............... 202,800 1,600 DLH x $78 ............... 124,800 Inspecting 240 insp. x $40 ................. 9,600 360 insp. x $40 .................14,400 Folding 15,200 units x $2.10 .........31,920 7,600 units x $2.10 ...........15,960 Designing 70 mods. x $1,000 ............70,000 210 mods. x $1,000 .......... 210,000 Providing space 4,300 sq. ft. x $6 ...............25,800 4,300 sq. ft. x $6 ...............25,800 Material handling 450,000 sq.yd. x $0.20 ....... 90,000 470,000 sq.yd. x $0.20 ........94,000 Total overhead $508,520 $622,190 ÷ units ÷ 15,200 ÷ 7,600 Overhead per unit* $ $ 81.87 DM and DL per unit Mfg. cost per unit $ 33.46 25.00 32.00 58.46 $ 113.87 *rounded ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 997 Problem 17-5B (concluded) 5. Selling price Manufacturing cost per unit Gross profit per unit Pup Tent Pop-Up Tent $65.00 $200.00 58.46 113.87 $ 6.54 $ 86.13 Both product lines are profitable without any cost cutting. The ABC cost assignment method more accurately reflects the costs associated with each product line because it is based on the consumption of the activities that cause costs to be incurred, whereas the plantwide overhead rate bases cost assignment on volume-related factors. 6. Departmental overhead rates based on direct labor hours and machine hours are still volume-based measures and would not improve the accuracy of cost assignment relative to ABC. Departmental overhead rates may be an improvement over a plantwide rate because the departmental rates at least recognize differences in drivers between departments. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 998 Financial & Managerial Accounting, 5th Edition Serial Problem — SP 17 1. 2. Setting up machines Batch level Inspecting components Unit level Providing utilities Facility level Direct materials Direct labor 3,500 Overhead (50% of DL) 1,750 Total mfg. cost 3. $2,500 Setting up machines $7,750 $20,000/25 batches Inspecting components $7,500/5,000 parts $1.50/part Providing utilities $2.00/MH $10,000/5,000 machine hours Direct materials Direct labor Overhead Setting up: 2 batches @$800/batch Inspecting: 400 parts @$1.50/part Utilities: 600 MH @$2.00/MH Total manufacturing cost 4. $800/batch $2,500 3,500 $1,600 600 1,200 3,400 $9,400 ABC gives a better representation of the cost of producing Job 6.15 because it reflects the resources consumed in the production process and assigns costs based on this consumption. The method used in part 2 assumes that all overhead costs are directly related to the direct labor costs, which is not true in this case. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 999 Reporting in Action 1. — BTN 17-1 Examples of activities at Polaris and Arctic Cat: Ordering raw materials Receiving raw materials Assembling products Designing products Hiring employees Training employees Billing customers Providing customer service 2. Polaris and Arctic Cat are considered manufacturing enterprises since they manufacture and sell products. Both also provide some services. For example, Polaris offers financing services for customers and Arctic Cat provides repair services for its products. 3. Yes. It could be useful for determining the activities that the companies perform and identifying the costs associated with each activity. Strategically, the companies would want to focus on activities that help to generate revenues and minimize or eliminate activities that do not generate revenues, since all activities cause some costs. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 1000 Financial & Managerial Accounting, 5th Edition Comparative Analysis — BTN 17-2 1. POLARIS Dec. 31, For Year Ended ($ millions) 2011 Revenues ..................................................................... $2,656.9 Dec. 31, 2010 $1,991.1 Expenses* .................................................................... 2,331.1 1,787.3 Expenses/Revenues ...................................................0.877 0.898 *Cost of sales plus total operating expenses ARCTIC CAT Mar. 31, For Year Ended ($ millions) 2011 Revenues ..................................................................... $464.7 Mar. 31, 2010 $450.7 Expenses* ....................................................................446.5 449.4 Expenses/Revenues ...................................................0.961 0.997 *Cost of goods sold plus total operating expenses Arctic Cat has a higher ratio of expenses to revenues in both years. 2. Arctic Cat may want to analyze its costs in terms of the activities it is engaged in. It might be doing things that incur costs, without aiding productivity. 3. Some activities associated with opening a new retail location include: Finding property to buy or rent Building or remodeling Obtaining business licenses Hiring new employees Training new employees ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 1001 Ethics Challenge — BTN 17-3 1. Employees have the responsibility to be honest when asked for information by a superior. As a member of the organization it is an employee’s responsibility to help the organization achieve its goals. 2. Depending on your position, it may be appropriate to determine if the redundancy is justified. This would certainly be the responsibility of a manager who is attempting to improve efficiency, or help others accomplish this task. An operational employee may not have the responsibility to investigate. 3. Your responsibility is to report accurately and objectively. If there are personal biases in the reports filed, the decision maker may not have appropriate information upon which to base his or her decision. 4. Consider: Are you being objective? Is the activity you observed happening on a regular basis, or was it a one-time occurrence? What are the implications of reporting your findings? What are the implications if you do not report your findings? What if you do not report your findings and the organization ultimately fails, jeopardizing the livelihood of everyone in the organization? ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 1002 Financial & Managerial Accounting, 5th Edition Communicating in Practice TO: FROM: RE: — BTN 17-4 [Name], CEO [Student name], Cost Analyst Activity Based Costing Traditional methods of product costing have typically assigned manufacturing overhead costs based on direct labor hours, direct labor cost, or machine hours. These bases are all highly correlated with the volume of output. Plantwide and departmental overhead rates based on these measures are therefore appropriately referred to as “volume-based.” While the total costs being assigned to products using volume-based methods may be the same as the costs assigned in activity-base costing, ABC differs in that it focuses on the consumption of resources (i.e. inputs) required to manufacture each product line. Product lines may consume inputs in proportions different from their relative proportion of output. For example, low-volume custom orders may require much more attention to various steps in the manufacturing process and interaction with customers than the high-volume, mass-market products require. Traditional methods of cost assignment pool together all the costs other than direct materials and direct labor and spread these to products as if all those costs were consumed by products in the same proportion. When this assumption is not true, significant distortions in cost assignment may occur. An advantage of ABC is that it more accurately divides the total costs among various product lines based on the resources that go into those products. Disadvantage of ABC are that it can be difficult and costly to implement. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 1003 Taking It to the Net — BTN 17-5 Activity-based costing is tested on Part 1 “Financial Planning, Performance, and Control.” Major topics for this part of the exam include planning, budgeting, and forecasting; performance management, cost management, internal controls, and professional ethics. Students wishing to become CMAs should take courses in economics, financial accounting, management accounting, tax, auditing, quantitative methods (mathematics, statistics, and operations management), and finance. Teamwork in Action — BTN 17-6 Instructor note: Student answers to this problem will depend on the restaurant visited. 1-2. Filling an order at a typical fast-food establishment may involve several people: Someone will take the order and receive payment. Another person may obtain drinks from the fountain. There may be one person doing the frying operation for French fries, etc. A cook grill attendant may make the burger. A cook’s assistant may assemble the sandwich and wrap it. 3. Some costs in a fast-food restaurant: Ingredients Paper products Utilities Salary of manager Wages of employees who perform various tasks Taxes Cleaning supplies Training employees ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 1004 Financial & Managerial Accounting, 5th Edition Entrepreneurial Decision — BTN 17-7 1. New Belgium Brewing Company would need to: Create the product (or contract with someone to do this) Evaluate alternative ingredients Evaluate alternative methods of manufacturing Seek out the appropriate suppliers of materials and ingredients Test-market the new product line 2. Generally, we would want to assign the costs associated with productspecific activities to the products that consumed them, so we would not want the cost of new products to be assigned to existing products. If however, new products enhance the sales potential of other products, a company may consider the synergies of the combining product lines and assign costs accordingly. Hitting the Road — BTN 17-8 Refer to the TEAMWORK IN ACTION assignment. Students could make individual observations about various fast-food restaurants and pool their information. Alternatively, groups could go together to observe operations and prepare reports based on their combined efforts. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. Solutions Manual, Chapter 17 1005 Global Decision — BTN 17-9 1. KTM’s three largest geographic segments are: KTM Net sales (€ millions) 2011 Other European ........................................................... €301.5 North America .............................................................106.5 Other ............................................................................ 91.1 2. Piaggio’s three largest geographic segments are: PIAGGIO Net sales (€ millions) 2011 EMEA*/Americas ......................................................... €933.9 India..............................................................................395.0 Asia SEA** ................................................................... 188 * Europe, the Middle East, and Africa. ** Southeast Asia. 3. Customer service activities likely vary greatly across geographic markets. While all customers expect good service, differences in language, cultural customs, business customs and laws, and the availability of alternatives will vary across countries and will impact customer service activities. The ready supply of relatively inexpensive labor in India and Southeast Asia might allow Piaggio to hire more customer service personnel in those countries. Based on these data, Piaggio derives its sales from a more diverse set of countries, and thus would expect greater variation in its customer service activities as compared to KTM. ©2013 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part. 1006 Financial & Managerial Accounting, 5th Edition