Bridgeton Industries

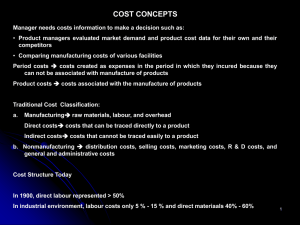

advertisement

Questions We Will Answer Today • How are traditional cost systems designed? • What are the limitations of traditional cost systems when used for internal decisionmaking purposes? • What is a death spiral? Bridgeton Industries Background • The ACF plant competes with other Bridgeton plants and local suppliers for a shrinking pool of production contracts. • The ACF experienced a plant closing in the past with the shut-down of its diesel engine plant. Tell me what the consultants did. Strategic Analysis • Bridgeton hired a consulting firm to classify all plants’ products as: – Class I products should remain at present locations. – Class II were to be watched closely – Class III products were outsourced or dropped. • Four criteria were supposedly used: – Quality, customer service, technical capability, and cost. Where did the consultants get their cost data? Where did the consultants get their cost data? Please tell me you’re kidding! Describe Bridgeton’s existing cost system. The Cost System • One budgeted plantwide overhead cost pool • One allocation base – Direct labor dollars • Utilization-based denominator volume What are the problems with this type of traditional cost system? The Problems • One heterogeneous plantwide overhead cost pool • One volume-related allocation – Direct labor dollars • Reliance on a utilization-based denominator volume • Disregard of selling & administrative expenses Should Bridgeton be concerned about these limitations? Should Bridgeton Be Concerned About These Limitations? • Yes! Because: – They have product diversity. – The non-volume-related overhead dollars are material. – They probably have unused capacity. Compute Bridgeton’s Plantwide overhead rate for 1988. 1988 Overhead Rate $109,890 ÷ $25,294 = $4.3445 per DL$ What overhead rate did the consultants use as quoted in the case? What overhead rate did the consultants use as quoted in the case? 435%, or essentially the same overhead rate used in Bridgeton’s traditional plantwide cost system. Why is this plantwide rate useless? Why is this plantwide rate useless? • To assume that all overhead is driven by direct labor is flawed. – Miller and Vollmann graph • To assume that $109 million of overhead is driven by any single volume-related allocation base is very flawed. – Miller and Vollmann transactions framework (quality, change, balancing, and logistical transactions) • Assigning used and unused capacity costs distorts product cost consumption What Distortions Will It Create? What Distortions Will It Create? • It will overcost labor-intensive, high volume products and undercost non-laborintensive, low volume products. • It will overcost all products to the extent products are assigned unused capacity costs. Why do you think Mufflers/Exhausts and Oil Pans were the first products labeled Class III? Why Mufflers and Oil Pans? Fuel tanks: $4,238 ÷ $75,196 = 5.6% Manifolds: $6,027 ÷ $84,776 = 7.1% Doors: $2,731 ÷ $45,174 = 6.1% Muffler/Exhausts: $5,766 ÷ $66,266 = 8.7% Oil Pans: $6,532 ÷ $79,658 = 8.2% The Outsourcing Decision • Muffler/Exhausts and Oil Pans get outsourced • The ACF responds by making as many improvements as possible. Compute Bridgeton’s budgeted plantwide overhead rate for 1989. 1989 Overhead Rate $78,157 ÷ $13,537 = $5.77 per DL$ Why did the rate go up? Compute the percent decrease in direct labor dollars from 1988 to 1989. Percent Decrease in DL$ ($25,294 − $13,537) ÷ $25,294 = 46.5% Compute the percent decrease in each overhead account from 1988 to 1989. Percent Decrease in MOH Accounts • • • • • • 1000 1500 2000 3000 4000 5000 (28.6%) (13.8%) (46.5%) (46.5%) (17.2%) (17.9%) • • • • • 8000 (37.0%) 9000 (12.2%) 11000 (37.1%) 12000 (46.5%) 14000 (17.9%) The Death Spiral • Fixed overhead costs are being spread over a shrinking denominator volume. • To make matters worse, those overhead costs that were consumed by products are probably being misallocated for reasons previously mentioned. • Well done consultants! Why is Bridgeton’s approach okay for external reporting? Why is Bridgeton’s approach okay for external reporting? • The “wash effect” • The segments vs. entity perspective Handout Utilization-Based Overhead Rates Plant A June: ($120,000 + $500,000) ÷ 60,000 DLH = $10.33/ DLH July: ($100,000 + $500,000) ÷ 50,000 DLH = $12/DLH Plant B June: ($160,000 + $600,000) ÷ 80,000 DLH = $9.50/DLH July: ($180,000 + $600,000) ÷ 90,000 DLH = $8.67/DLH Product Costs Plant A: DM DL MOH Total June $15 $10 $5.17 $30.17 July $15 $10 $6 $31 Plant B: DM DL MOH Total June $15 $10 $4.75 $29.75 July $15 $10 $4.34 $29.34 Capacity-Based Overhead Rates Plant A June: ($200,000 + $500,000) ÷ 100,000 DLH = $7.00/DLH July: ($200,000 + $500,000) ÷ 100,000 DLH = $7.00/DLH Plant B June: ($200,000 + $600,000) ÷ 100,000 DLH = $8.00/DLH July: ($200,000 + $600,000) ÷ 100,000 DLH = $8.00/DLH Product Costs Plant A: DM DL MOH Total June $15 $10 $3.50 $28.50 July $15 $10 $3.50 $28.50 Plant B: DM DL MOH Total June $15 $10 $4.00 $29.00 July $15 $10 $4.00 $29.00 What is the unused capacity cost for each plant for each month? Unused Capacity Costs June Plant A: Fixed portion of rate Unused capacity in DLH Unused capacity cost Plant B: Fixed portion of rate Unused capacity in DLH Unused capacity cost July $5.00 × 40,000 $200,000 $5.00 × 50,000 $250,000 $6.00 × 20,000 $120,000 $6.00 × 10,000 $60,000 Questions We Answered Today • How are traditional cost systems designed? • What are the limitations of traditional cost systems when used for internal decisionmaking purposes? • What is a death spiral?