Chapter 07 Discounted Cash Flow Techniques

Chapter 07 - Discounted Cash Flow Techniques

Chapter 07

Discounted Cash Flow Techniques

1. Which of the following is not an important step in the financial evaluation of an investment opportunity?

A. Calculate a figure of merit for the investment.

B. Estimate the accounting rate of return for the investment.

C. Estimate the relevant cash flows.

D. Compare the figure of merit to an acceptance criterion.

E. All of the above are important steps.

2. Which of the following figures of merit might not use all possible cash flows in its calculations?

I. Payback period

II. Internal rate of return

III. Net present value (NPV)

IV. Accounting rate of return

A. III only

B. I & III only

C. II & III only

D. I & IV only

E. III & IV only

F. I, II, III, and IV

3. Which of the following figures of merit does not directly take into consideration the time value of money?

I. Payback period

II. Internal rate of return

III. Net present value (NPV)

IV. Accounting rate of return

A. IV only

B. I & III only

C. II & III only

D. I & II only

E. I & IV only

F. I, II, III, and IV

7-1

© 2012 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Chapter 07 - Discounted Cash Flow Techniques

4. Ian is going to receive $20,000 six years from now. Sunny is going to receive $20,000 nine years from now. Which one of the following statements is correct if both Ian and Sunny apply a

7 percent discount rate to these amounts?

A. The present values of Ian and Sunny's monies are equal.

B. In future dollars, Sunny's money is worth more than Ian's money.

C. In today's dollars, Ian's money is worth more than Sunny's.

D. Twenty years from now, the value of Ian's money will be equal to the value of Sunny's money.

E. Sunny's money is worth more than Ian's money given the 7 percent discount rate.

F. None of the above.

5. You plan to buy a new Mercedes four years from now. Today, a comparable car costs

$82,500. You expect the price of the car to increase by an average of 4.8 percent per year over the next four years. How much will your dream car cost by the time you are ready to buy it?

A. $98,340.00

B. $98,666.67

C. $99,517.41

D. $99,818.02

E. $100,023.16

F. None of the above.

6. Your grandmother invested a lump sum 26 years ago at 4.25 percent interest. Today, she gave you the proceeds of that investment which totaled $51,480.79. How much did she originally invest?

A. $15,929.47

B. $16,500.00

C. $17,444.86

D. $17,500.00

E. $17,999.45

F. None of the above.

7. Naomi plans on saving $3,000 a year and expects to earn an annual rate of 10.25 percent.

How much will she have in her account at the end of 7 years?

A. $21,000

B. $12,354

C. $19,765

D. $14,485

E. None of the above.

7-2

© 2012 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Chapter 07 - Discounted Cash Flow Techniques

8. In question 7, if the interest rate changed to 5.9%, what is the future value of the cash flow stream?

A. $21,000

B. $28,235

C. $37,432

D. $19,765

E. $25,104

9. No question

10. No question

11. A project will produce after-tax operating cash inflows of $3,200 a year for 5 years. The after-tax salvage value of the project is expected to be $2,500 in year 5. The project's initial cost is $9,500. What is the net present value of this project if the required rate of return is 16 percent?

A. -$311.02

B. $2,168.02

C. $4,650.11

D. $9,188.98

E. $21,168.02

F. None of the above.

12. Which of the following should be included in the analysis of a new product?

I. Money already spent for research and development of the new product

II. Reduction in sales for a current product once the new product is introduced

III. Increase in working capital needed to finance sales of the new product

IV. Interest expense on the loan used to finance the new product launch

A. II and III only

B. II and IV only

C. I, II, and III only

D. II, III, and IV only

E. I, II, III, and IV

F. None of the above.

13. No question

7-3

© 2012 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Chapter 07 - Discounted Cash Flow Techniques

14. Which of the following statements related to the internal rate of return (IRR) are correct?

I. The IRR is the discount rate at which an investment's NPV equals zero.

II. An investment should be undertaken if the discount rate exceeds the IRR.

III. The IRR tends to be used more than net present value simply because its results are easier to comprehend.

IV. The IRR is the best tool available for deciding between mutually exclusive investments.

A. I and II only

B. I and III only

C. II and III only

D. I, II, and IV only

E. I, II, III, and IV

F. None of the above.

15. You plan to pay $50 for a share of preferred stock that pays a $2.40 dividend per year the next 6 years, when you expect to sell it for $75 . What is the IRR that you realize?

A. 19.45 percent

B. 11.19 percent

C. 14.80 percent

D. 10.57 percent

E. 20.83 percent

F. None of the above.

16. NO Question

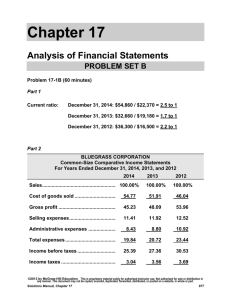

17. What is the benefit-cost ratio for an investment with the following cash flows at a 14.5 percent required return?

A. 0.94

B. 0.98

C. 1.02

D. 1.06

E. 1.11

F. None of the above.

7-4

© 2012 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.

Chapter 07 - Discounted Cash Flow Techniques

18. When making a capital budgeting decision, which of the following is/are NOT relevant?

I. The size of a cash flow.

II. The risk of a cash flow.

III. The accounting earnings from a cash flow.

IV. The timing of a cash flow.

A. I only

B. II only

C. III only

D. II and III only

E. III and IV only

F. They are all relevant.

7-5

© 2012 by McGraw-Hill Education. This is proprietary material solely for authorized instructor use. Not authorized for sale or distribution in any manner. This document may not be copied, scanned, duplicated, forwarded, distributed, or posted on a website, in whole or part.