Equity Income Fund Commentary

advertisement

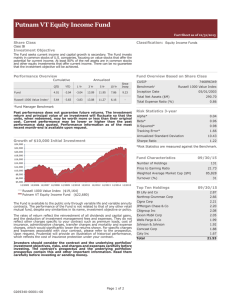

Putnam Equity Income Fund Q4 | 2015 Research is critical amid uncertainty and earnings challenges Darren A. Jaroch, CFA | Portfolio Manager Key takeaways •A lack of earnings growth, combined with relatively high valuations, are the biggest challenges for equity investors today. Walter D. Scully, CPA Assistant Portfolio Manager (industry since 1996) •For world stock markets, a dominant theme as we head into 2016 will be divergent monetary policies. •We must avoid focusing too much on what has happened historically in U.S. interest-rate hike cycles. Today, we are truly in unfounded territory. In your view, what are the biggest risks for U.S. equities as we head into 2016? Equity markets around the world are faced with an array of macroeconomic risks. Investor worries continue to escalate over slowing growth in China, which is a carefully watched market and a significant global consumer. At the same time, oil price volatility remains a critical challenge for financial markets and businesses. After plunging rapidly in 2014, oil prices remained volatile in 2015, declining to a six-year low last summer. And just after the close of the year, in early January, oil prices hit an 11-year low. As a value investor and portfolio manager, however, I am more focused on stockspecific risks such as valuation and earnings. I believe equities are generally expensive today, trading at historically high valuations. This makes it challenging to find opportunities, particularly with a value-style investing approach. Another risk facing equities relates to earnings growth. Profits for S&P 500 companies declined year-over-year in the second and third quarters of 2015. This lack of earnings growth, combined with relatively high valuations, are the biggest challenges for equity investors today, in my view. Another macroeconomic issue has been uncertainty about interest rates and monetary policies. What is your perspective on this? For world stock markets, I believe a dominant theme as we head into 2016 will be divergent monetary policies. Until recently, most regions were working to stimulate their economies and bring liquidity into their systems. Now, however, regions are beginning to move in different directions. The United States has clearly moved toward tightening; the Federal Reserve’s long-anticipated move came in December, when it raised short-term rates by 0.25%, the first such increase in almost a decade. While the U.S. Fed is tightening, governments in Europe and Japan have become more aggressive in their easing policies. This divergence could lead to some disruption, particularly in the context of currencies, across global financial markets. PUTNAM I NVESTM ENTS | putnam.com Q4 201 5 | Research is critical amid uncertainty and earnings challenges In the United States, I believe we must avoid focusing too much on what has happened historically in interestrate hike cycles. Today, we are truly in unfounded territory. The Fed has left a zero-interest-rate policy in place for a number of years, and there is really no precedent for this. I expect we will see more volatility in the equity markets as we adjust to this new paradigm of normalization from the Fed. Putnam Equity Income Fund (PEYAX) Annualized total return performance as of December 31, 2015 Class A shares (inception 6/15/77) Last quarter 1 year Stocks in the energy and basic materials sectors appear to be quite inexpensive. Are you finding opportunities here? Certainly, based on generic measures of valuation, whether earnings multiples or cash-flow multiples, the energy and basic materials sectors look extraordinarily cheap. However, we remain cautious about the fundamentals of the commodities themselves, particularly the supply-demand dynamics of oil, copper, and iron ore. We don’t anticipate improvement in demand fundamentals for several more quarters. Therefore, while the valuations are attractive, we are proceeding with caution in these areas. Value stocks, which are the focus of your fund, underperformed growth stocks in 2015. What are your thoughts on this, and might this trend continue? Yes, value stocks underperformed growth by a considerable margin in 2015. The Russell 1000 Value Index declined 3.83% for the year, while the Russell 1000 Growth Index gained 5.67%. This has been a challenge, but it is important to take a closer look at the lack of breadth in the growth equity space. Throughout 2015, and particularly over the past six months, we saw a small number of growth stocks driving the vast majority of equity performance. Because such a narrow group of stocks is involved, I don’t believe it can signal a trend for growth or value performance in the year ahead. Before sales charge 4.03% –3.18 Russell 1000 Value Index After sales charge –1.96% 5.64% –8.75 –3.83 3 years 12.74 10.54 13.08 5 years 11.66 10.34 11.27 7.72 7.08 6.16 10.08 9.91 — 10 years Life of fund Total expense ratio: 0.98% Returns for periods of less than one year are not annualized. Current performance may be lower or higher than the quoted past performance, which cannot guarantee future results. Share price, principal value, and return will vary, and you may have a gain or a loss when you sell your shares. Performance of class A shares before sales charge assumes reinvestment of distributions and does not account for taxes. After-sales-charge returns reflect a maximum 5.75% load. The fund’s expense ratio is based on the most recent prospectus and is subject to change. To obtain the most recent month-end performance, visit putnam.com. The Russell 1000 Value Index is an unmanaged index of those companies in the large-cap Russell 1000 Index chosen for their value orientation. You cannot invest directly in an index. There are no guarantees that a company will continue to pay dividends. The views and opinions expressed are those of Darren A. Jaroch, Portfolio Manager, as of December 31, 2015. They are subject to change with market conditions and are not meant as investment advice. Consider these risks before investing: Value stocks may fail to rebound, and the market may not favor value-style investing. Income provided by the fund may be reduced by changes in the dividend policies of, and the capital resources available at, the companies in which the fund invests. Stock prices may fall or fail to rise over time for several reasons, including general financial market conditions and factors related to a specific issuer or industry. You can lose money by investing in the fund. Request a prospectus or summary prospectus from your financial representative or by calling 1-800-225-1581. The prospectus includes investment objectives, risks, fees, expenses, and other information that you should read and consider carefully before investing. Putnam Retail Management | One Post Office Square | Boston, MA 02109 | putnam.com EO148 298691 1/16