Semi Annual Report

advertisement

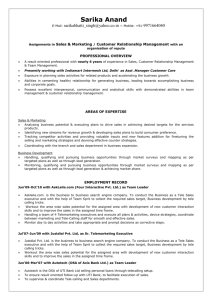

Schroder Asian Income Semi-Annual Report & Financial Statements June 2015 SCHRODER ASIAN INCOME (a sub-fund of Schroder International Opportunities Portfolio) Constituted under a Trust Deed in the Republic of Singapore on 3 January 2006 Manager Schroder Investment Management (Singapore) Ltd 138 Market Street #23-01 CapitaGreen Singapore 048946 Reg. No. 199201080H Trustee HSBC Institutional Trust Services (Singapore) Limited 21 Collyer Quay #10-02 HSBC Building Singapore 049320 Auditors PricewaterhouseCoopers LLP 8 Cross Street #17-00 PWC Building Singapore 048424 Solicitors to the Manager Allen & Gledhill LLP One Marina Boulevard #28-00 Singapore 018989 Solicitors to the Trustee Shook Lin & Bok LLP 1 Robinson Road #18-00 AIA Tower Singapore 048542 Further Information Schroders is a Foreign Account Tax Compliance Act (“FATCA”) compliant organisation. Please find the FATCA classification of this entity and its Global Intermediary Identification Number (“GIIN”) below. FATCA entity classification: Foreign Financial Institution (“FFI”) Sponsoring entity: Schroder Investment Management (Singapore) Ltd Sponsoring entity GIIN: WM9S4Z.00000.SP.702 1 SCHRODER ASIAN INCOME (a sub-fund of Schroder International Opportunities Portfolio) Constituted under a Trust Deed in the Republic of Singapore on 3 January 2006 COMMENTARY Asian equity had a strong start for the year 2015 finishing the first quarter in the positive territory, as further easing measures in China and a delay in market expectations of an interest rate rise by the US Federal Reserve (Fed) drove gains. The People’s Bank of China (PBoC) cut the required reserve ratio (RRR) by 50 basis points in early February as it stepped up efforts to counter the impact of capital outflows and to alleviate tight liquidity conditions before the Chinese New Year. The central bank then cut interest rates in early March to help boost flagging growth. These boosted returns in Hong Kong and Chinese equities. However, returns were weaker in ASEAN markets given disappointing economic data and profit taking pressure following strong performance in 2014. In fixed income, global bond yields fell across the board with most Asian bond markets delivering positive returns. The massive quantitative easing (QE) response by the European Central Bank (ECB) boosted sentiment globally. The JPMorgan Asia Credit index was up +2.3% in Q1 2015. The second quarter of 2015 was a volatile period for Asian equities. Chinese and Hong Kong equities soared in April and May amid further easing through reducing interest rates and RRR, although the market reversed sharply after hitting seven-year high in midJune. However, despite the crash, Chinese equities’ performance remained positive over the quarter. In ASEAN, all markets fell given decelerating economic growth and disappointing earnings. Rising bond yields globally also resulted in negative returns in fixed income, although performance of Asian bonds were better relative to other markets. Indonesia was the worst performer amidst weaker economic data and as Indonesian President Jokowi’s proreform initiative faced further setbacks, whereas Chinese credit outperformed on the back of falling onshore rates. Most Asian currencies depreciated against the US Dollar on the prospect of an imminent US rate hike, with Thai Baht and Indonesian Rupiah among the losers. In the first half of 2015, the Fund maintained a preference for equities over fixed income and cash. While the broader Asian equity market outperformed fixed income, the high dividend stocks in our portfolio underperformed. Therefore, the overweight equity decision detracted value. Having more high yield than investment grade bonds helped. The allocation to global assets was a detractor as longer duration assets in Europe underperformed given the upward re-pricing of real yields. We continue to believe the global allocation not only allows us to access income opportunities outside of Asia, but also provides diversification especially in a volatile market. 2 SCHRODER ASIAN INCOME (a sub-fund of Schroder International Opportunities Portfolio) Constituted under a Trust Deed in the Republic of Singapore on 3 January 2006 Looking forward by comparing to the beginning of 2015, we believe that the world is now facing higher risks given the uncertainty from Greece in Europe and the heightened volatility from Chinese equities. Our view is that the situation in Greece is mainly driven by sentiment, as the size of its economy is irrelevant and most of the debts are held in public hands. Obviously the clear win of the “No” campaign in the referendum increases the risk of a “Grexit” scenario, but the European Central Bank (ECB) stands ready to intervene to combat any excessive spill-over effects from Greece to other peripheral European countries, not to mention that the direct exposure to Greece/Europe is limited for Asia. However, we remain worried about the risks posed by the tumble in A-Shares on the rest of the region. With a significant portion of the A-Shares market still under voluntary or involuntary suspension, it remains to be seen whether the authorities’ attempt to prop up the market is successful. The recent market episode highlights the danger of chasing high momentum stocks without solid fundamental support. Looking ahead, the equity markets are likely to remain volatile over the short term given the ebb and flow of investor sentiment, especially in China A-Shares. With heightened short-term risk, we are likely to see some investors shifting their focus back to corporate fundamentals, which could benefit high-dividend yield stocks with strong business profiles and stable cash-flows. We will continue to focus on sectors such as telecoms, banks, REITs and selected utilities which could deliver stable income. Meanwhile, we are also adding some cyclical exposure via Taiwan technology names in order to capture the potential growth of Asian equities. In fixed income, the solid macroeconomic and labour market data should support the US Federal Reserve to raise interest rates in the second half of 2015. Therefore, we remain cautious on duration risk and hence maintaining the duration hedges through sale of US Treasury futures. Also, we continue to hold a net long US Dollar exposure to benefit from any further appreciation of the greenback. Despite the outperformance of Asian bonds relative to other fixed income markets, the spread pick-up remains wide, while fundamentals remain stable for most issuers with low expected default rates. The overall investment themes of lower commodity prices, divergence of monetary policy between US and Asian local rates and the easing bias of China should continue to drive the markets for the rest of the year. In particular, we believe the recent volatile Chinese equity market is unlikely to post any significant risks to the fixed income market. On the contrary, we are likely to see further easing through cutting interest rates and RRRs for banks to support the economy, as well as increased infrastructure spending through the “One Belt, One Road” policy. 3 SCHRODER ASIAN INCOME (a sub-fund of Schroder International Opportunities Portfolio) Constituted under a Trust Deed in the Republic of Singapore on 3 January 2006 Overall, we expect the Asian equity market to stay volatile over the shorter-term and, therefore, will continue to actively manage the portfolio’s equity hedges to reduce downside risks. With higher uncertainty, risk management will become increasingly important for investors in the course of investing for income. The Fund’s diversified and defensive allocation as well as our active hedging strategies should help our investors ride out this challenging environment more smoothly. June 2015 4 STATEMENT OF TOTAL RETURN For the financial period ended 30 June 2015 (Unaudited) 30 Jun 2015 30 Jun 2014 $ $ Income Dividends: Singapore Foreign Interest on deposits with banks Sundry income Less : Expenses Management fees Trustee fees Valuation fees Custodian fees Registration fees Audit fees Transaction costs Others Net income Net gains or losses on value of investments and financial derivatives Net (losses)/gains on investments Net gains/(losses) on spot foreign exchange contracts Net (losses)/gains on forward foreign exchange contracts Net gains/(losses) on futures contracts Net gains on options contracts Net losses on swap contracts Net foreign exchange losses Total (deficit)/return for the period before income tax Less : Income tax Total (deficit)/return for the period 5 5,120,186 16,586,672 4,477 5,971 21,717,306 4,828,122 10,737,599 20,346 7,032 15,593,099 9,291,005 230,421 185,820 113,334 735,848 8,008 513,518 271,956 11,349,910 10,367,396 7,132,414 178,615 142,648 144,705 564,887 7,707 373,479 77,645 8,622,100 6,970,999 (10,687,872) 69,561,515 91,046 (6,613,756) (30,672) 4,670,760 441,747 (1,008,799) 778,471 (425,085) (658,081) (802,152) (98,363) (17,217,601) 72,436,360 (6,850,205) (2,306,032) 79,407,359 (1,593,926) (9,156,237) 77,813,433 STATEMENT OF FINANCIAL POSITION As at 30 June 2015 (Unaudited) 30 Jun 2015 $ 31 Dec 2014 $ ASSETS 1,712,027,040 1,150,396,307 Portfolio of investments 88,762,786 5,437,524 24,383,290 6,917,619 4,945,874 Bank balances Sales awaiting settlement Receivables Financial derivatives Margin account Total assets 56,352,495 18,991,119 5,795,916 1,536,798 1,842,474,133 1,233,072,635 LIABILITIES Purchases awaiting settlement Payables Financial derivatives 22,674,569 12,592,364 12,725,114 9,364,253 16,799,692 Total liabilities 47,992,047 26,163,945 EQUITY Net assets attributable to unitholders 1,794,482,086 1,206,908,690 6 STATEMENT OF MOVEMENTS OF UNITHOLDERS’ FUNDS For the financial period ended 30 June 2015 (Unaudited) 30 Jun 2015 $ Net assets attributable to unitholders at the beginning of the financial period/year 31 Dec 2014 $ 1,206,908,690 1,284,672,844 Operations Change in net assets attributable to unitholders resulting from operations Unitholders’ contributions/ (withdrawals) Creation of units Cancellation of units Change in net assets attributable to unitholders resulting from net creation and cancellation of units (9,156,237) 132,464,876 847,548,833 404,923,352 (209,273,723) (551,246,160) 638,275,110 (146,322,808) Distributions (41,545,477) (63,906,222) Total increase/(decrease) in net assets attributable to unitholders 587,573,396 (77,764,154) Net assets attributable to unitholders at the end of the financial period/year 1,794,482,086 1,206,908,690 7 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Collective investment scheme LUXEMBOURG (country of domicile) Schroder International Selection Fund – Global Multi-Asset Income I Accumulation Share Class Total Collective investment scheme 849,171 137,712,199 7.67 137,712,199 7.67 19,831,570 12,156,418 20,910,340 1.10 0.68 1.17 10,043,681 0.56 6,323,838 14,618,347 4,216,957 0.35 0.81 0.23 28,659,831 1.60 17,026,670 26,902,624 29,552,364 18,344,823 4,953,175 213,540,638 0.95 1.50 1.65 1.02 0.28 11.90 Equities AUSTRALIA AGL Energy Ltd 1,232,310 ASX Ltd 294,392 AusNet Services 14,483,721 Australia & New Zealand Banking Group Ltd 301,391 Commonwealth Bank of Australia 71,778 DUET Group 6,114,762 Myer Hldg Ltd 3,326,261 National Australia Bank Ltd 831,366 Spark Infrastructure Group 8,415,428 Stockland 6,340,216 Telstra Corp Ltd 4,650,687 Westpac Banking Corp 551,348 Woolworths Ltd 177,524 8 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Equities CHINA China Construction Bank Corp H Shares China Mobile Ltd Industrial & Commercial Bank of China Ltd H Shares HONG KONG BOC Hong Kong (Hldg) Ltd CLP Hldg Ltd Fortune REIT Hang Seng Bank Ltd HK Electric Investments and HK Electric Investments Ltd Stapled Shares HKT Trust and HKT Ltd Stapled Shares Hutchison Telecommunications Hong Kong Hldg Ltd Link REIT MGM China Hldg Ltd Power Assets Hldg Ltd Sands China Ltd VTech Hldg Ltd 20,465,000 319,500 25,165,570 5,507,609 1.40 0.31 20,908,000 22,369,432 53,042,611 1.25 2.96 2,771,000 183,000 18,848,000 271,300 15,545,361 2,094,586 25,566,900 7,138,783 0.87 0.12 1.42 0.40 34,089,823 31,380,682 1.75 16,204,020 25,667,252 1.43 11,062,000 3,989,000 679,600 633,000 93,200 339,200 6,186,589 31,454,418 1,496,699 7,772,932 422,492 6,062,238 160,788,932 0.35 1.75 0.08 0.43 0.02 0.34 8.96 9 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Equities INDONESIA Telekomunikasi Indonesia Persero Tbk PT JAPAN Activia Properties Inc Advance Residence Investment Corp Daiwa House REIT Investment Corp Daiwahouse Residential Investment Corp Frontier Real Estate Investment Corp Fukuoka REIT Corp GLP J-REIT Japan Excellent Inc Japan Prime Realty Investment Corp Japan Rental Housing Investments Inc Japan Retail Fund Investment Corp Kenedix Office Investment Corp Nippon Accommodations Fund Inc 72,465,100 21,443,281 1.19 180 2,054,000 0.11 764 2,521,268 0.14 258 1,464,936 0.08 1,188 3,630,291 0.20 346 801 2,611 1,531 2,086,439 1,881,826 3,358,694 2,382,175 0.12 0.11 0.19 0.13 297 1,243,541 0.07 2,720 2,574,047 0.14 1,334 3,594,957 0.20 491 3,317,409 0.19 378 1,967,443 0.11 10 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Equities JAPAN (continued) Nomura Real Estate Master Fund Inc Orix JREIT Inc Sekisui House SI Residential Investment Corp United Urban Investment Corp 1,601 1,282 2,741,259 2,488,489 0.15 0.14 1,367 1,922,421 0.11 1,260 2,400,030 41,629,225 0.13 2.32 MALAYSIA DiGi.Com Bhd 4,151,400 7,941,067 0.44 NEW ZEALAND Spark New Zealand Ltd 9,450,979 24,054,946 1.34 12,480,200 30,701,292 1.71 12,562,400 9,693,400 7,251,300 19,597,344 20,840,810 11,819,619 1.09 1.16 0.66 8,780,200 632,300 18,087,212 2,048,652 1.01 0.11 16,279,700 23,849,760 1.33 21,538,300 21,969,066 1.22 SINGAPORE Ascendas Real Estate Investment Trust CapitaLand Commercial Trust CapitaLand Mall Trust CDL Hospitality Trusts Frasers Centrepoint Trust M1 Ltd Mapletree Commercial Trust Mapletree Greater China Commercial Trust 11 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Equities SINGAPORE (continued) Mapletree Industrial Trust 13,469,300 Singapore Telecommunications Ltd 7,233,600 Soilbuild Business Space REIT 10,167,000 StarHub Ltd 5,014,700 Suntec Real Estate Investment Trust 10,876,600 United Overseas Bank Ltd 424,800 SOUTH KOREA SK Telecom Co Ltd TAIWAN Advanced Semiconductor Engineering Inc Chunghwa Telecom Co Ltd Novatek Microelectronics Corp Siliconware Precision Ind Co Taiwan Mobile Co Ltd Taiwan Semiconductor Manufacturing Co Ltd 21,012,108 1.17 30,453,456 1.70 8,641,950 19,808,065 0.48 1.10 18,762,135 1.05 9,800,136 257,391,605 0.55 14.34 85,305 25,743,684 1.43 3,528,000 6,435,654 0.36 2,420,000 10,391,979 0.58 1,271,000 8,264,558 0.46 6,965,000 3,620,000 14,361,862 16,271,726 0.80 0.91 392,000 2,403,534 58,129,313 0.13 3.24 12 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Equities THAILAND Advanced Info Service PCL (F) 1,544,700 Bangkok Bank PCL (F) 2,250,900 BTS Rail Mass Transit Growth Infrastructure Fund (F) 31,404,000 Electricity Generating PCL NVDR 2,530,200 Intouch Hldg PCL NVDR 4,740,800 Ratchaburi Electricity Generating Hldg PCL NVDR 1,655,900 Ratchaburi Electricity Generating Hldg PCL (F) 3,219,700 UNITED KINGDOM HSBC Hldg PLC 1,453,200 Total Equities 13 14,163,693 16,017,655 0.79 0.89 12,644,768 0.71 15,483,451 14,741,808 0.86 0.82 3,779,324 0.21 7,348,445 84,179,144 0.41 4.69 17,705,770 0.99 965,590,216 53.80 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income BARBADOS Rated BBColumbus Intl Inc 7.375% 30 Mar 2021 BRAZIL Rated BBB Votorantim Cimentos SA 7.25% 5 Apr 2041 Rated BBBBraskem America Finance Co 7.125% 22 Jul 2041 Braskem Finance Ltd 6.45% 3 Feb 2024 Samarco Mineracao SA 4.125% 1 Nov 2022 Rated BBCimpor Financial Operations BV 5.75% 17 Jul 2024 Minerva Luxembourg SA 7.75% 31 Jan 2023 Minerva Luxembourg SA Var Perp Tupy Overseas SA 6.625% 17 Jul 2024 1,000,000 1,466,002 0.08 900,000 1,193,672 0.07 400,000 475,315 0.03 1,000,000 1,282,541 0.07 1,500,000 1,878,368 0.10 1,075,000 1,230,364 0.07 300,000 407,989 0.02 2,000,000 2,726,663 0.15 222,000 295,560 0.02 14 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income BRAZIL (continued) Rated B+ Marfrig Hldg Europe BV 6.875% 24 Jun 2019 Marfrig Hldg Europe BV 8.375% 9 May 2018 2,000,000 2,598,745 0.14 500,000 682,507 0.04 Rated B2 Odebrecht Drilling Norbe VIII/IX Ltd 6.35% 30 Jun 2021 1,500,000 1,275,270 14,046,994 0.07 0.78 CHILE Rated BBBEmpresa Electrica Guacolda SA 4.56% 30 Apr 2025 200,000 261,221 0.01 Rated Baa3 Cencosud SA 4.875% 20 Jan 2023 500,000 677,331 938,552 0.04 0.05 15 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA Rated AAChina Development Bank Corp 4.2% 19 Jan 2027 Export-Import Bank of China 3.625% 31 Jul 2024 Sinopec Group Overseas Development 2013 Ltd 5.375% 17 Oct 2043 State Grid Overseas Investment 2014 Ltd 4.125% 7 May 2024 Rated A+ Alibaba Group Hldg Ltd 3.6% 28 Nov 2024 CDBL Funding 1 3.25% 2 Dec 2019 CDBL Funding 1 4.25% 2 Dec 2024 China Shenhua Overseas Capital Co Ltd 3.125% 20 Jan 2020 China Shenhua Overseas Capital Co Ltd 3.875% 20 Jan 2025 1,000,000 219,213 0.01 3,700,000 5,085,111 0.28 1,600,000 2,406,267 0.13 1,000,000 1,411,294 0.08 4,900,000 6,351,552 0.35 1,600,000 2,156,662 0.12 4,400,000 5,823,171 0.32 1,000,000 1,346,938 0.07 1,500,000 1,996,361 0.11 16 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA (continued) Rated A China Life Insurance Co Ltd Var 3 Jul 2075 Eastern Creation II Investment Hldg Ltd EMTN 2.625% 20 Nov 2017 Eastern Creation II Investment Hldg Ltd EMTN 3.25% 20 Jan 2020 Rated ABeijing State-Owned Assets Management (Hong Kong) Co Ltd 4.125% 26 May 2025 CGNPC Intl Ltd 4% 19 May 2025 CRCC Yuxiang Ltd 3.5% 16 May 2023 Industrial & Commercial Bank of China Macau Ltd Var 10 Sep 2024 Rated A3 CCCI Treasure Ltd Var Perp CRCC Yupeng Ltd Var Perp Dianjian Haixing Ltd Var Perp 1,800,000 2,423,700 0.13 4,000,000 5,435,390 0.30 2,700,000 3,644,984 0.20 1,100,000 1,451,394 0.08 2,000,000 2,684,423 0.15 2,300,000 3,002,927 0.17 1,500,000 2,054,651 0.11 4,400,000 5,879,692 0.33 700,000 958,703 0.05 3,600,000 4,935,283 0.27 17 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA (continued) Rated BBB+ Bank of China Ltd 5% 13 Nov 2024 China Cinda Finance 2014 Ltd 4% 14 May 2019 China Construction Bank Corp Var 12 Nov 2024 China Construction Bank Corp Var 13 May 2025 China Overseas Finance Cayman III Ltd 5.375% 29 Oct 2023 China Overseas Finance Cayman VI Ltd 5.95% 8 May 2024 China Resources Land Ltd EMTN 4.375% 27 Feb 2019 CITIC Ltd 6.8% 17 Jan 2023 CITIC Ltd EMTN 6.625% 15 Apr 2021 Talent Yield Investments Ltd 4.5% 25 Apr 2022 2,000,000 2,765,307 0.15 1,000,000 1,380,459 0.08 1,000,000 218,772 0.01 2,800,000 3,746,938 0.21 700,000 997,077 0.06 2,000,000 2,953,790 0.16 800,000 1,113,696 0.06 2,000,000 3,146,286 0.18 1,700,000 2,640,831 0.15 650,000 909,770 0.05 18 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA (continued) Rated Baa1 Charming Light Investments Ltd EMTN 3.75% 3 Sep 2019 Rated BBB Century Master Investment Co Ltd 4.75% 19 Sep 2018 Greenland Global Investment Ltd 5.875% 3 Jul 2024 Haitong Intl Finance 2015 Ltd 4.2% 29 Jul 2020 Rated BBBBluestar Finance Hldg Ltd EMTN 4.375% 11 Jun 2020 Franshion Development Ltd 6.75% 15 Apr 2021 Poly Real Estate Finance Ltd 5.25% 25 Apr 2019 Sino-Ocean Land Treasure Finance I Ltd EMTN 6% 30 Jul 2024 Sino-Ocean Land Treasure Finance II Ltd 4.45% 4 Feb 2020 Wanda Properties Intl Co Ltd 7.25% 29 Jan 2024 2,100,000 2,853,622 0.16 2,000,000 2,838,314 0.16 800,000 1,097,591 0.06 1,000,000 1,361,803 0.08 200,000 270,303 0.01 1,950,000 2,986,705 0.17 1,000,000 1,418,726 0.08 1,200,000 1,657,212 0.09 1,350,000 1,841,352 0.10 3,700,000 5,415,289 0.30 19 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA (continued) Rated Baa3 Yuexiu Property Co Ltd 4.5% 24 Jan 2023 Rated BB+ CAR Inc 6.125% 4 Feb 2020 China Resources Power Hldg Co Ltd Var Perp Country Garden Hldg Co Ltd 7.5% 9 Mar 2020 Country Garden Hldg Co Ltd 10.5% 11 Aug 2015 Rated BB China Hongqiao Group Ltd 6.875% 3 May 2018 China Hongqiao Group Ltd 7.625% 26 Jun 2017 Fufeng Group Ltd 7.625% 13 Apr 2016 Industrial & Commercial Bank of China Ltd Var Perp 3,000,000 3,852,431 0.21 1,400,000 1,918,089 0.11 7,200,000 9,973,526 0.56 2,200,000 3,073,386 0.17 900,000 1,223,969 0.07 400,000 541,185 0.03 1,200,000 1,640,845 0.09 400,000 370,157 0.02 600,000 837,707 0.05 20 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA (continued) Rated BB Longfor Properties Co Ltd 6.75% 28 May 2018 Longfor Properties Co Ltd 6.75% 29 Jan 2023 Longfor Properties Co Ltd EMTN 6.875% 18 Oct 2019 7,000,000 1,534,200 0.09 600,000 804,264 0.04 5,000,000 7,055,660 0.39 Rated Ba2 Yancoal Intl Trading Co Ltd Var Perp 1,000,000 1,370,737 0.08 Rated BBBank of China Ltd Var Perp 10,000,000 2,287,964 0.13 Rated Ba3 Central Plaza Development Ltd 7.6% 29 Nov 2015 7,000,000 1,547,172 0.09 1,600,000 2,348,296 0.13 3,000,000 4,184,340 0.23 Rated B+ CIFI Hldg Group Co Ltd 12.25% 15 Apr 2018 Future Land Development Hldg Ltd 10.25% 21 Jul 2019 21 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA (continued) Rated B+ Gemdale Intl Hldg Ltd 9.15% 26 Jul 2015 18,000,000 Greentown China Hldg Ltd 8% 24 Mar 2019 3,200,000 Greentown China Hldg Ltd 8.5% 4 Feb 2018 2,800,000 KWG Property Hldg Ltd 8.625% 5 Feb 2020 2,600,000 Yanlord Land HK Co Ltd 5.375% 23 May 2016 5,000,000 Rated B1 Logan Property Hldg Co Ltd 9.75% 8 Dec 2017 Logan Property Hldg Co Ltd 11.25% 4 Jun 2019 Rated B Times Property Hldg Ltd 12.625% 21 Mar 2019 Yuzhou Properties Co Ltd 8.625% 24 Jan 2019 3,931,338 0.22 4,580,254 0.26 4,007,723 0.22 3,546,412 0.20 1,071,456 0.06 600,000 818,774 0.05 600,000 842,082 0.05 1,250,000 1,795,177 0.10 1,800,000 2,441,878 0.14 22 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA (continued) Rated B Yuzhou Properties Co Ltd 8.75% 4 Oct 2018 Yuzhou Properties Co Ltd 11.75% 25 Oct 2017 1,100,000 1,503,367 0.08 500,000 720,377 0.04 Rated BChina Aoyuan Property Group Ltd 10.875% 26 May 2018 China Aoyuan Property Group Ltd 11.25% 17 Jan 2019 900,000 1,206,397 0.07 1,900,000 2,546,837 0.14 1,681,346 0.09 3,623,432 0.20 1,083,814 0.06 2,165,610 0.12 660,086 0.04 Not Rated 361 Degrees Intl Ltd 7.5% 12 Sep 2017 8,000,000 Central Plaza Development Ltd Var Perp 2,600,000 China Development Bank Corp 4.3% 2 Aug 2032 5,000,000 China Minmetals Corp 3.65% 28 Mar 2016 10,000,000 China New Town Finance I Ltd 5.5% 6 May 2018 3,000,000 23 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income CHINA (continued) Not Rated China Unicom (Hong Kong) Ltd EMTN 3.8% 24 Jul 2016 8,000,000 China Unicom (Hong Kong) Ltd EMTN 4% 16 Apr 2017 8,000,000 CITIC Ltd Var Perp 2,300,000 CITIC Ltd REGS Var Perp 1,700,000 Eastern Air Overseas Hong Kong Corp Ltd 3.875% 5 Jun 2016 3,000,000 Hero Asia Investment Ltd Var Perp 3,000,000 Jinchuan Group Co Ltd 4.75% 17 Jul 2017 10,000,000 Lenovo Group Ltd 4.95% 10 Jun 2020 5,000,000 Poly Property Group Co Ltd 4.75% 16 May 2018 1,000,000 Proven Honour Capital Ltd 4.125% 19 May 2025 4,000,000 24 1,736,099 0.10 1,739,033 3,236,313 0.10 0.18 2,632,408 0.15 650,158 0.04 4,085,954 0.23 2,115,657 0.12 1,108,714 0.06 1,353,064 0.08 5,352,445 207,681,692 0.30 11.57 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income COLOMBIA Rated BBBBanco de Bogota SA 5% 15 Jan 2017 500,000 695,625 0.04 Rated Ba1 Bancolombia SA 5.125% 11 Sep 2022 500,000 676,090 0.04 Rated Ba2 Banco Davivienda SA 5.875% 9 Jul 2022 1,700,000 2,322,874 3,694,589 0.13 0.21 COSTA RICA Rated Ba1 Instituto Costarricense de Electricidad 6.375% 15 May 2043 600,000 671,109 0.04 Rated BB Costa Rica Government Intl Bond 7% 4 Apr 2044 700,000 916,630 1,587,739 0.05 0.09 25 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income HONG KONG Rated A+ Sun Hung Kai Properties Capital Market Ltd EMTN 4.5% 14 Feb 2022 Sun Hung Kai Properties Capital Market Ltd EMTN Var 25 Feb 2024 Rated A Bank of China (Hong Kong) Ltd 5.55% 11 Feb 2020 Link Finance Cayman 2009 Ltd EMTN 3.6% 3 Sep 2024 Rated A2 Zhejiang Energy Group Hong Kong Ltd 2.3% 30 Sep 2017 Rated ADouble Rosy Ltd 3.625% 18 Nov 2019 Hutchison Whampoa Intl 14 Ltd 3.625% 31 Oct 2014 1,000,000 1,430,104 0.08 250,000 340,479 0.02 2,000,000 2,954,208 0.17 1,000,000 1,335,857 0.08 2,000,000 2,709,064 0.15 1,200,000 1,631,392 0.09 2,400,000 3,191,609 0.18 26 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income HONG KONG (continued) Rated A3 ICBCIL Finance Co Ltd 2.625% 19 Mar 2018 3,600,000 4,862,815 0.27 1,000,000 1,371,976 0.08 4,000,000 5,415,704 0.30 Rated BBB HKT Capital No. 2 Ltd 3.625% 2 Apr 2025 2,400,000 3,118,979 0.17 Rated Baa2 China Construction Bank Asia Corp Ltd EMTN Var 20 Aug 2024 1,600,000 2,191,930 0.12 Rated BBBNan Fung Treasury Ltd 4.5% 20 Sep 2022 1,500,000 2,071,940 0.12 600,000 795,159 0.04 1,500,000 1,985,414 0.11 Rated BBB+ CLP Power HK Finance Ltd Var Perp Goodman HK Finance EMTN 4.375% 19 Jun 2024 Rated Baa3 LS Finance 2025 Ltd 4.5% 26 Jun 2025 Rated BB+ China Oil & Gas Group Ltd 5% 7 May 2020 27 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income HONG KONG (continued) Rated BBShimao Property Hldg Ltd 8.125% 22 Jan 2021 500,000 Not Rated Champion MTN Ltd EMTN 3.75% 17 Jan 2023 4,500,000 Cheung Kong Bond Securities 03 Ltd 5.375% Perp 3,000,000 Cosco Pacific Finance 2013 Co Ltd 4.375% 31 Jan 2023 3,000,000 Dorsett Hospitality Intl Ltd EMTN 6% 3 Apr 2018 16,000,000 HLP Finance Ltd EMTN 4.45% 16 Apr 2021 2,600,000 HLP Finance Ltd EMTN 4.75% 25 Jun 2022 1,900,000 Joyous Glory Group Ltd GMTN 5.7% 7 Mar 2020 3,100,000 New World China Land Ltd 5.5% 6 Feb 2018 13,000,000 New World China Land Ltd EMTN 5.375% 6 Nov 2019 1,500,000 28 708,932 0.04 5,802,308 0.32 4,059,697 0.23 3,861,398 0.22 3,456,886 0.19 3,649,058 0.20 2,649,440 0.15 4,460,998 0.25 2,912,560 0.16 2,111,649 0.12 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income HONG KONG (continued) Not Rated NWD MTN Ltd EMTN 5.25% 26 Feb 2021 3,400,000 PB Issuer No. 3 Ltd Convertible Bond 1.875% 22 Oct 2018 600,000 PB Issuer No. 4 Ltd Convertible Bond 3.25% 3 Jul 2021 500,000 PCCW Capital No. 4 Ltd 5.75% 17 Apr 2022 3,000,000 PHBS Ltd EMTN 6.625% Perp 3,000,000 SmarTone Finance Ltd 3.875% 8 Apr 2023 1,300,000 Vast Expand Ltd 5.2% 11 Sep 2017 5,000,000 INDIA Rated BBB+ Reliance Hldg USA Inc 5.4% 14 Feb 2022 Reliance Ind Ltd 4.125% 28 Jan 2025 Reliance Ind Ltd 4.875% 10 Feb 2045 Rated Baa2 Oil India Ltd 5.375% 17 Apr 2024 4,860,637 0.27 788,611 0.04 678,299 0.04 4,352,198 0.24 4,100,093 0.23 1,642,517 0.09 1,095,814 86,597,725 0.06 4.83 3,000,000 4,369,160 0.24 1,000,000 1,316,204 0.07 1,600,000 1,949,732 0.11 1,200,000 1,730,489 0.10 29 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income INDIA (continued) Rated BBBBharti Airtel Intl Netherlands BV 5.125% 11 Mar 2023 Bharti Airtel Intl Netherlands BV 5.35% 20 May 2024 Export-Import Bank of India 4% 14 Jan 2023 NTPC Ltd EMTN 5.625% 14 Jul 2021 ONGC Videsh Ltd 4.625% 15 Jul 2024 Power Grid Corp of India Ltd 3.875% 17 Jan 2023 Rated Baa3 Bharat Petroleum Corp Ltd 4.625% 25 Oct 2022 Bharat Petroleum Corp Ltd EMTN 4% 8 May 2025 India Government Bond 8.24% 22 Apr 2018 India Government Bond SPB 8.28% 21 Sep 2027 Indian Oil Corp Ltd 5.625% 2 Aug 2021 Indian Oil Corp Ltd EMTN 5.75% 1 Aug 2023 4,000,000 5,635,857 0.31 1,000,000 1,424,206 0.08 3,000,000 4,015,546 0.22 1,700,000 2,542,379 0.14 1,000,000 1,371,249 0.08 1,500,000 1,984,303 0.11 2,400,000 3,302,420 0.19 1,000,000 1,293,273 0.07 80,000,000 1,704,402 0.09 200,000,000 4,260,949 0.24 4,000,000 5,859,699 0.33 2,000,000 2,931,761 0.16 30 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income INDIA (continued) Rated BB ABJA Investment Co Pte Ltd 4.85% 31 Jan 2020 ABJA Investment Co Pte Ltd 5.95% 31 Jul 2024 Rated BBRolta Americas LLC 8.875% 24 Jul 2019 Vedanta Resources Jersey Ltd Convertible Bond 5.5% 13 Jul 2016 Vedanta Resources PLC 6% 31 Jan 2019 Vedanta Resources PLC 8.25% 7 Jun 2021 1,000,000 1,366,697 0.08 2,000,000 2,703,099 0.15 750,000 862,181 0.05 2,000,000 2,684,415 0.15 500,000 656,419 0.04 1,500,000 2,080,039 0.12 13,992,959 0.78 1,516,631 0.08 2,356,126 0.13 1,070,020 0.06 1,072,643 76,052,858 0.06 4.24 Not Rated India Government Bond 7.16% 20 May 2023 700,000,000 Power Finance Corp Ltd 9.61% 1 Jun 2017 70,000,000 Power Grid Corp of India Ltd 8.85% 19 Oct 2018 110,000,000 Rural Electrification Corp Ltd 9.38% 6 Sep 2016 50,000,000 Rural Electrification Corp Ltd 9.45% 10 Aug 2016 50,000,000 31 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income INDONESIA Rated Baa3 Astra Sedaya Finance PT EMTN 2.875% 1 Apr 2018 3,000,000 4,071,372 Indonesia Treasury Bond 8.375% 15 Mar 2034 80,000,000,000 8,008,809 Indonesia Treasury Bond 9% 15 Mar 2029 90,000,000,000 9,537,552 Rated BB+ Indonesia Government Intl Bond 3.75% 25 Apr 2022 Indonesia Government Intl Bond 4.125% 15 Jan 2025 Indonesia Government Intl Bond 5.125% 15 Jan 2045 Indonesia Government Intl Bond 6.75% 15 Jan 2044 Pelabuhan Indonesia II PT 4.25% 5 May 2025 Pertamina (Persero) PT 5.625% 20 May 2043 0.23 0.45 0.53 2,000,000 2,659,337 0.15 1,700,000 2,240,408 0.12 800,000 1,031,419 0.06 2,000,000 3,157,542 0.17 1,500,000 1,896,040 0.11 1,000,000 1,201,818 0.07 32 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income INDONESIA (continued) Rated BB+ Pertamina (Persero) PT 6% 3 May 2042 2,200,000 Pertamina (Persero) PT 6.45% 30 May 2044 2,000,000 Pertamina (Persero) PT 6.5% 27 May 2041 1,100,000 Perusahaan Gas Negara Persero Tbk PT 5.125% 16 May 2024 8,500,000 Rated BB Perusahaan Listrik Negara PT 5.25% 24 Oct 2042 Perusahaan Listrik Negara PT 5.5% 22 Nov 2021 TBG Global Pte Ltd 5.25% 10 Feb 2022 Rated BBGolden Legacy Pte Ltd 9% 24 Apr 2019 Pratama Agung Pte Ltd 6.25% 24 Feb 2020 Theta Capital Pte Ltd 6.125% 14 Nov 2020 Theta Capital Pte Ltd 7% 16 May 2019 2,757,309 0.15 2,662,704 0.15 1,473,744 0.08 11,566,856 0.64 6,900,000 8,207,221 0.46 500,000 714,419 0.04 1,500,000 1,977,335 0.11 3,000,000 4,019,302 0.22 3,700,000 4,843,150 0.27 3,308,500 4,534,420 0.25 2,300,000 3,215,774 0.18 33 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income INDONESIA (continued) Rated B+ MPM Global Pte Ltd 6.75% 19 Sep 2019 700,000 Pacific Emerald Pte Ltd 9.75% 25 Jul 2018 1,700,000 Pakuwon Prima Pte Ltd 7.125% 2 Jul 2019 1,800,000 890,710 0.05 2,443,561 0.14 2,443,090 0.14 1,550,000 2,003,592 87,557,484 0.11 4.88 JAMAICA Rated B1 Digicel Ltd 6.75% 1 Mar 2023 750,000 992,202 0.06 KAZAKHSTAN Rated BBB Kazakhstan Government Intl Bond 3.875% 14 Oct 2024 200,000 254,489 0.02 200,000 225,875 0.01 500,000 764,139 1,244,503 0.04 0.07 Rated B2 Star Energy Geothermal Wayang Windu Ltd 6.125% 27 Mar 2020 Rated BB+ KazMunayGaz National Co JSC 5.75% 30 Apr 2043 KazMunayGaz National Co JSC 9.125% 2 Jul 2018 34 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income MALAYSIA Rated APetronas Capital Ltd 4.5% 18 Mar 2045 2,700,000 3,503,761 0.20 Rated Ba1 SBB Capital Corp Var Perp 1,600,000 2,173,445 0.12 Rated BB AMBB Capital Ltd Var Perp 300,000 411,334 6,088,540 0.02 0.34 MEXICO Rated BBB+ Petroleos Mexicanos 4.5% 23 Jan 2026 300,000 396,228 0.02 Rated BBB Grupo Bimbo SAB de CV 4.875% 27 Jun 2044 1,600,000 2,018,369 0.11 Rated Baa2 BBVA Bancomer SA / Texas 6.75% 30 Sep 2022 1,850,000 2,761,903 0.15 35 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income MEXICO (continued) Rated BBBFermaca Enterprises S de RL de CV 6.375% 30 Mar 2038 1,000,000 Mexichem SAB de CV 5.875% 17 Sep 2044 500,000 Rated BB+ Metalsa SA de CV 4.9% 24 Apr 2023 Rated B+ Cemex SAB de CV 5.7% 11 Jan 2025 Cemex SAB de CV 5.875% 25 Mar 2019 Cemex SAB de CV 6.125% 5 May 2025 Cemex SAB de CV FRN 15 Oct 2018 1,376,796 0.08 626,452 0.04 650,000 835,840 0.05 200,000 257,855 0.01 1,000,000 1,383,596 0.08 250,000 333,680 0.02 500,000 708,596 10,699,315 0.04 0.60 1,997,028 0.11 2,447,964 0.14 1,437,388 5,882,380 0.08 0.33 MONGOLIA Rated B+ Development Bank of Mongolia LLC EMTN 5.75% 21 Mar 2017 1,500,000 Mongolia Government Intl Bond 5.125% 5 Dec 2022 2,000,000 Trade & Development Bank of Mongolia LLC 9.375% 19 May 2020 1,000,000 36 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income PERU Rated BBB BBVA Banco Continental SA Var 22 Sep 2029 1,600,000 2,194,860 0.12 PHILIPPINES Rated BBB Philippine Government Intl Bond 3.9% 26 Nov 2022 40,000,000 1,182,629 0.07 576,744 0.03 273,682 0.02 4,166,670 0.23 1,427,036 0.08 607,594 3,873,679 0.03 0.22 1,407,712 0.08 1,779,542 0.10 2,024,729 17,320,017 0.11 0.97 Not Rated Energy Development Corp 6.5% 20 Jan 2021 385,000 ICTSI Treasury BV EMTN 4.625% 16 Jan 2023 200,000 ICTSI Treasury BV EMTN 5.875% 17 Sep 2025 2,900,000 Megaworld Corp 4.25% 17 Apr 2023 1,100,000 Petron Corp 7% 10 Nov 2017 20,000,000 Petron Corp Var Perp 2,700,000 Royal Capital BV Var Perp 1,000,000 SM Investments Corp 4.25% 17 Oct 2019 1,300,000 Travelers Intl Hotel Group Inc 6.9% 3 Nov 2017 1,400,000 37 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income QATAR Rated AOoredoo Intl Finance Ltd 5% 19 Oct 2025 1,500,000 2,176,685 0.12 2,000,000 438,122 0.02 3,000,000 4,126,408 0.23 Rated BBB United Overseas Bank Ltd EMTN Var 19 Sep 2024 6,000,000 8,338,093 0.47 Rated Baa2 Global Logistic Properties Ltd 3.875% 4 Jun 2025 5,000,000 6,611,450 0.37 Rated Baa3 China Jingye Construction Engineering (Singapore) Pte Ltd 2.95% 21 May 2017 4,500,000 4,490,325 24,004,398 0.25 1.34 SINGAPORE Rated BBB+ BOC Aviation Pte Ltd EMTN 4.2% 5 Nov 2018 Oversea-Chinese Banking Corp Ltd 4.25% 19 Jun 2024 38 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income SOUTH KOREA Rated A+ Korea Development Bank 3.75% 22 Jan 2024 2,000,000 2,820,787 0.16 3,700,000 5,166,951 0.29 1,800,000 2,490,618 0.14 Rated BBBWoori Bank Co Ltd 4.75% 30 Apr 2024 6,500,000 9,134,907 19,613,263 0.51 1.10 SUPRANATIONAL Rated Aaa Intl Finance Corp GMTN 6.45% 30 Oct 2018 80,000,000 1,682,617 0.09 TAIWAN Rated BBB+ Formosa Group Cayman Ltd 3.375% 22 Apr 2025 6,000,000 7,664,063 0.43 Rated BBB Hana Bank 4.375% 30 Sep 2024 Korea Exchange Bank 4.25% 14 Oct 2024 39 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income THAILAND Rated BBB+ PTTEP Canada Intl Finance Ltd 6.35% 12 Jun 2042 2,000,000 3,080,469 0.17 70,000,000 2,538,554 0.14 1,200,000 1,631,958 7,250,981 0.09 0.40 UNITED ARAB EMIRATES Rated A RAK Capital 3.094% 31 Mar 2025 700,000 921,825 0.05 Rated BBB MAF Global Securities Ltd 4.75% 7 May 2024 400,000 556,972 0.03 1,300,000 1,802,010 0.10 Rated Baa1 Thailand Government Inflation-Linked Bond 12 Mar 2028 Rated BBBPTT Exploration & Production PCL Var Perp Rated BBBEMG Sukuk Ltd 4.564% 18 Jun 2024 40 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) By geography Percentage of total net assets attributable to Holdings Fair value unitholders at at at 30 Jun 2015 30 Jun 2015 30 Jun 2015 $ % Quoted Fixed income UNITED ARAB EMIRATES (continued) Rated Baa3 DP World Ltd 6.85% 2 Jul 2037 2,000,000 2,966,932 0.17 Rated BB+ MAF Global Securities Ltd Var Perp 2,100,000 3,068,000 0.17 1,000,000 1,298,512 0.07 500,000 690,101 0.04 Not Rated Emirates Airline 4.5% 6 Feb 2025 Emirates NBD 2014 Tier 1 Ltd Var Perp Emirates NBD Tier 1 Ltd Var Perp 1,700,000 2,311,941 0.13 13,616,293 0.76 8,670,873 0.48 608,724,625 33.94 1,712,027,040 82,455,046 95.41 4.59 1,794,482,086 100.00 Accrued interest on fixed income securities Total Fixed income Portfolio of investments Other net assets Net assets attributable to unitholders Legend : NVDR : Non-Voting Depository Receipts (F) : Foreign 41 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Primary (continued) Percentage Percentage of total net of total net assets assets attributable attributable to to unitholders unitholders at at 30 Jun 2015 31 Dec 2014 % % By geography (summary) Quoted Australia Barbados Brazil Chile China Colombia Costa Rica Hong Kong India Indonesia Jamaica Japan Kazakhstan Luxembourg Malaysia Mexico Mongolia New Zealand Peru Philippines Qatar Singapore South Korea Supranational Taiwan Thailand United Arab Emirates United Kingdom Accrued interest on fixed income securities Portfolio of investments Other net assets Net assets attributable to unitholders 42 11.90 0.08 0.78 0.05 14.53 0.21 0.09 13.79 4.24 6.07 0.06 2.32 0.07 7.67 0.78 0.60 0.33 1.34 0.12 0.97 0.12 15.68 2.53 0.09 3.67 5.09 0.76 0.99 11.90 0.12 0.64 0.05 12.69 0.28 0.08 16.00 5.28 5.93 4.07 8.42 0.69 0.61 0.75 1.21 15.00 3.19 2.21 4.46 0.79 0.42 0.48 95.41 4.59 0.53 95.32 4.68 100.00 100.00 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Secondary By industry Percentage Percentage of total net of total net assets assets attributable attributable to to Fair value unitholders unitholders at at at 30 Jun 2015 30 Jun 2015 31 Dec 2014 $ % % Agriculture 1,298,512 Airlines Automobiles & 2,022,110 Components 253,321,882 Bank Central Bank Chemicals/ 17,848,612 Petrochemicals Collective investment scheme - Multi-Asset 137,712,199 1,108,714 Computer 3,877,399 Construction Materials 5,700,648 Consumer Durables Diversified Operations 14,847,447 6,062,238 Electronics Engineering & Construction 19,174,797 27,978,057 Finance 6,971,544 Food & Beverage 53,933,643 Government 5,376,077 Hotel 2,423,700 Insurance 6,351,552 Internet Services 17,336,392 Investment 862,181 IT Services 6,270,684 Logistics 1,466,002 Media 8,130,194 Metals 10,361,024 Mining 76,190,004 Miscellaneous 43 0.07 0.11 - 0.12 14.12 - 0.08 10.29 0.76 0.99 0.91 7.67 0.06 0.22 0.31 0.84 0.34 8.42 0.69 0.38 1.18 1.14 1.07 1.56 0.39 3.01 0.29 0.13 0.35 0.97 0.05 0.36 0.08 0.45 0.58 4.25 0.33 1.88 0.72 4.11 0.48 0.13 0.28 0.66 0.12 0.19 0.12 0.76 0.44 4.24 STATEMENT OF PORTFOLIO As at 30 June 2015 (Unaudited) Secondary (continued) By industry Percentage Percentage of total net of total net assets assets attributable attributable to to Fair value unitholders unitholders at at at 30 Jun 2015 30 Jun 2015 31 Dec 2014 $ % % 54,927,858 Oil & Gas 423,325,958 Real Estate 9,912,550 Retail 12,156,418 Securities Exchange 31,465,608 Semiconductor 3,589,962 Sovereign agency 269,123,420 Telecommunications 31,176,003 Transportation 2,024,729 Travel Services 179,028,049 Utilities Accrued interest on fixed income 8,670,873 securities Portfolio of investments 1,712,027,040 Other net assets 82,455,046 Net assets attributable to unitholders 1,794,482,086 44 3.06 23.59 0.55 0.68 1.75 0.20 15.00 1.74 0.11 9.97 2.88 25.65 0.73 0.31 1.87 13.74 1.42 0.17 9.60 0.48 0.53 95.41 4.59 95.32 4.68 100.00 100.00 UNITS IN ISSUE For the financial period ended 30 June 2015 (Unaudited) SGD Class 30 Jun 2015 31 Dec 2014 Units Units At the beginning of the financial period/year Created Cancelled 736,812,521 981,302,600 262,398,515 186,804,179 (147,140,149) (431,294,258) At the end of the financial period/year 852,070,887 736,812,521 $ Net assets attributable to unitholders $ 976,884,784 861,418,527 Net assets attributable to unitholders per unit 1.15 AUD Hedged Class 1.17 30 Jun 2015 31 Dec 2014 Units Units At the beginning of the financial period/year Created Cancelled At the end of the financial period/year 85,545,394 102,005,286 85,198,738 37,219,636 (21,408,387) (53,679,528) 149,335,745 A$ 85,545,394 A$ Net assets attributable to unitholders 155,349,490 90,542,078 Net assets attributable to unitholders per unit 1.04 1.06 45 UNITS IN ISSUE For the financial period ended 30 June 2015 (Unaudited) Class X 30 Jun 2015 31 Dec 2014 Units Units At the beginning of the financial period/year Created Cancelled At the end of the financial period/year 210,667,051 86,684,648 334,583,838 127,011,148 (6,741,560) (3,028,745) 538,509,329 210,667,051 $ Net assets attributable to unitholders $ 619,983,752 247,306,731 Net assets attributable to unitholders per unit 1.15 USD Hedged Class 1.17 13 Mar 2015 to 30 Jun 2015 Units Created Cancelled At the end of the financial period 29,363,006 (979,832) 28,383,174 US$ Net assets attributable to unitholders 27,359,280 Net assets attributable to unitholders per unit 0.96 46 UNITS IN ISSUE For the financial period ended 30 June 2015 (Unaudited) The Fund currently offers 4 Classes of units, namely SGD Class units, AUD Hedged Class units, Class X units and USD Hedged Class units. All 4 Classes of units constitute the Fund and have different features. The key differences between the Classes are the currency of denomination and distribution policy applicable to each Class. The AUD Hedged Class and USD Hedged Class, which were incepted on 31 October 2012 and 13 March 2015 respectively, are subject to foreign exchange risk against the Fund’s functional currency. Class X, which was incepted on 26 February 2013, is denominated in SGD. Net assets attributable to unitholders (“NAV”) is apportioned between SGD Class, AUD Hedged Class, Class X and USD Hedged Class units based on the proportion of NAV of each Class, which is determined by computing the equivalent number of units of SGD Class, AUD Hedged Class, Class X and USD Hedged Class units in issue. Any expense, income and/or gain which is attributable to a particular Class shall be deducted from or added to the net assets attributable to that Class. 47 FINANCIAL RATIOS For the financial period ended 30 June 2015 (Unaudited) 30 Jun 2015 30 Jun 2014 AUD USD AUD SGD Hedged Hedged SGD Hedged Class Class Class X Class Class Class Class X Expense ratio1 (excluding underlying fund’s unaudited expense ratio) 1.46% 1.46% 1.46% 1.44% 1.47% 1.47% 1.47% Expense ratio2 (including underlying fund’s unaudited expense ratio) 1.46% 1.46% 1.47% 1.45% 1.48% 1.48% 1.48% Turnover ratio3 1 30 Jun 2015 Fund 30 Jun 2014 Fund 13.59% 20.50% The expense ratio has been computed based on the guidelines laid down by the Investment Management Association of Singapore (“IMAS”). The calculation of the expense ratio was based on total operating expenses divided by the average net asset values for each Class for the year. The total operating expenses do not include brokerage and other transaction costs, performance fee, interest expense, distribution paid out to unitholders, foreign exchange gains/losses, front or back end loads arising from the purchase or sale of other funds and tax deducted at source or arising out of income received. Expenses which are common to all Classes are apportioned based on the proportion of NAV of each Class. The Fund does not pay any performance fee. The respective values used in the calculation of the expense ratio are disclosed below. The average net asset values are based on the daily balances. The Fund invests in real estate investment trusts (REITs), for which the expense ratios are not available or published. The expense ratio of the Fund does not include the expense ratios of those underlying REITs. 30 Jun 2015 30 Jun 2014 AUD USD AUD Expense ratio Hedged Hedged Hedged calculations SGD Class Class Class X Class SGD Class Class Class X $ $ $ $ $ $ $ Total operating expenses 12,882,863 1,589,825 4,334,144 231,397 15,520,236 1,699,817 1,490,904 Average net asset value 882,901,804 108,980,210 296,403,200 16,063,105 1,052,625,738 115,243,708 101,093,068 48 FINANCIAL RATIOS For the financial period ended 30 June 2015 (Unaudited) 2 The expense ratio is the sum of the Fund’s expense ratio and the underlying fund’s unaudited expense ratio. The unaudited expense ratio of the underlying fund, a Luxembourg domiciled fund, is provided by Schroder Investment Management (Luxembourg) S.A. There is no requirement for the expense ratio of this Luxembourg domiciled fund to be published or audited. 3 The portfolio turnover ratio is calculated in accordance with the formula stated in the Code on Collective Investment Schemes. The calculation of the portfolio turnover ratio was based on the lower value of purchases or sales of the underlying investments divided by the average daily net asset value. 30 Jun 2015 30 Jun 2014 Turnover ratio calculations Fund Fund $ $ Lower of purchases or sales 203,639,616 (sales) 235,797,671 (purchases) 1,498,528,964 Average net asset value 1,150,472,514 49 REPORT TO UNITHOLDERS 30 June 2015 The following is a report on the Schroder Asian Income (the “Fund”): 1. For the composition of investments of the Fund as at 30 June 2015, refer to the Statement of Portfolio on pages 8 to 44. 2. The Fund has the following exposure to financial derivatives as at 30 June 2015: Fair value $ Contracts: Spot foreign exchange 7,730 Forward foreign exchange Percentage of total net assets attributable to unitholders % * (7,342,313) (0.41) Futures 766,451 0.04 Options 2,060,802 0.11 Swap (1,300,165) (0.07) * Less than 0.01 The net gain on financial derivatives realised during the period 1 January 2015 to 30 June 2015 amounted to S$1,147,881. The net loss on outstanding financial derivatives marked to market as at 30 June 2015 amounted to S$6,875,458. 3. The Fund was not invested in other unit trusts, mutual funds or collective investment schemes as at 30 June 2015 other than as stated in the Statement of Portfolio on pages 8 to 44. 4. The Fund did not have any borrowings as at 30 June 2015. 5. The amount of subscriptions and redemptions during the period 1 January 2015 to 30 June 2015 were as follows: $ Subscriptions Redemptions 847,548,833 209,273,723 50 REPORT TO UNITHOLDERS 30 June 2015 6. Top 10 holdings of the Fund as at 30 June 2015: Fair value $ SISF - Global Multi-Asset Income I Acc 137,712,199 Link REIT 31,454,418 HK Electric Investments and HK Electric Investments Ltd Stapled Shares 31,380,682 Ascendas Real Estate Investment Trust 30,701,292 Singapore Telecommunications Ltd 30,453,456 Telstra Corp Ltd 29,552,364 National Australia Bank Ltd 28,659,831 Stockland 26,902,624 SK Telecom Co Ltd 25,743,684 HKT Trust and HKT Ltd Stapled Shares 25,667,252 51 Percentage of total net assets attributable to unitholders % 7.67 1.75 1.75 1.71 1.70 1.65 1.60 1.50 1.43 1.43 REPORT TO UNITHOLDERS 30 June 2015 Top 10 holdings of the Fund as at 30 June 2014: SISF - Global Multi-Asset Income I Acc Telstra Corp Ltd SK Telecom Co Ltd Mapletree Commercial Trust Fortune REIT HKT Trust and HKT Ltd Stapled Shares National Australia Bank Ltd Suntec Real Estate Investment Trust Mapletree Industrial Trust Ascendas Real Estate Investment Trust Fair value $ Percentage of total net assets attributable to unitholders % 91,915,228 25,737,464 24,972,487 21,928,220 19,846,735 8.75 2.45 2.38 2.09 1.89 18,120,657 17,234,851 1.72 1.64 16,834,810 16,506,490 1.60 1.57 16,428,900 1.56 Legend: SISF : Schroder International Selection Fund 7. Expense Ratio (including underlying fund) SGD Class 1 July 2014 to 30 June 2015 1.46% 1 July 2013 to 30 June 2014 1.48% AUD Hedged Class 1 July 2014 to 30 June 2015 1.46% 1 July 2013 to 30 June 2014 1.48% Class X 1 July 2014 to 30 June 2015 1.47% 1 July 2013 to 30 June 2014 1.48% 52 REPORT TO UNITHOLDERS 30 June 2015 USD Hedged Class Inception of Class, 13 March 2015 to 30 June 2015 (annualised) 1.45% The total operating expenses do not include brokerage and other transaction costs, performance fee, interest expense, distribution paid out to unitholders, foreign exchange gains/ losses, front or back end loads arising from the purchase or sale of other funds and tax deducted at source or arising out of income received. Expenses which are common to all Classes are apportioned based on the proportion of NAV of each Class. The Fund does not pay any performance fee. The Fund invests in real estate investment trusts (REITs), for which the expense ratios are not available or published. The expense ratio of the Fund does not include the expense ratios of those underlying REITs. 8. Turnover of Portfolio 1 January 2015 to 30 June 2015 13.59% 1 January 2014 to 30 June 2014 9. Soft dollar commissions/arrangements: 20.50% In the management of the Fund, the Manager may accept soft dollar commissions from, or enter into soft dollar arrangements with, stockbrokers who execute trades on behalf of the Fund and the soft dollars received are restricted to the following kinds of services: (i) (ii) (iii) (iv) research, analysis or price information; performance measurement; portfolio valuations; and administration services. The Manager may not receive or enter into soft dollar commissions or arrangements unless (a) such soft dollar commissions or arrangements shall reasonably assist the Manager in their management of the Fund, (b) best execution is carried out for the transactions, and (c) that no unnecessary trades are entered into in order to qualify for such soft dollar commissions or arrangements. The Manager shall not receive goods and services such as travel, accommodation and entertainment. The description of soft dollars and the conditions set out above also apply to the investment manager of the underlying fund domiciled in Luxembourg. 53 REPORT TO UNITHOLDERS 30 June 2015 10. Related Party Transactions The Manager of the Fund is Schroder Investment Management (Singapore) Ltd. The Registrar for the Fund is Schroder Investment Management (Luxembourg) S.A, a related party of the Manager. The Trustee is HSBC Institutional Trust Services (Singapore) Limited, a subsidiary of the HSBC Group. The management fees paid to the Manager and registration fees paid to the Registrar; trustee fees, valuation fees and custodian fees charged by, and interest earned on deposits with, the HSBC Group are shown in the Statement of Total Return. As at 30 June 2015, the Fund maintained with the HSBC Group, the following bank balances: 30 Jun 2015 31 Dec 2014 $ $ 88,762,786 Current accounts 56,352,495 In addition to the above, the respective management fees are chargeable by: i) Schroder Investment Management (Luxembourg) S.A as Management Company of the following underlying fund: Underlying fund Schroder International Selection Fund - Global Multi-Asset Income I Acc 54 Per annum of NAV - REPORT TO UNITHOLDERS 30 June 2015 11. Performance of Fund for periods ended 30 June 2015 SGD Class Benchmark** 3 6 mths mths 1 yr 3 Since yrs* Inception*# -3.2% 0.7% -1.5% 3.8% 6.3% 8.8% 6.1% 8.1% 9.9% 7.9% AUD Hedged Class -2.8% 1.5% 8.8% Benchmark** -0.2% 8.8% 20.7% - 9.5% 15.2% Class X Benchmark** 6.3% 6.1% - 5.2% 8.4% - - -2.4% 2.3% -3.1% 0.7% -1.5% 3.8% USD Hedged Class -3.1% Benchmark** 0.4% - * Returns of more than 1 year are annualised # Since inception figures from 24 October 2011 (SGD Class), 31 October 2012 (AUD Hedged Class), 26 February 2013 (Class X) and 13 March 2015 (USD Hedged Class) ** Benchmark: 50% MSCI AC Asia Pacific ex Japan Net + 50% JP Morgan Asia Credit Index (SGD Hedged) Source: Morningstar, class currency, bid to bid, net dividends reinvested. 55