factum of the applicants

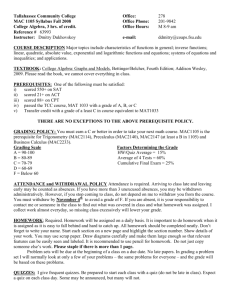

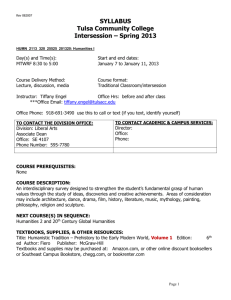

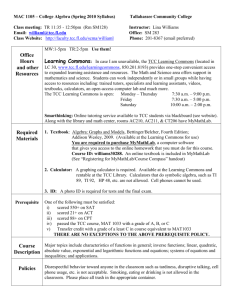

advertisement