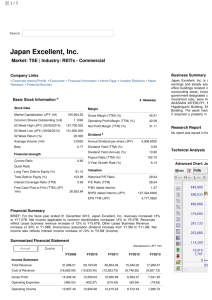

Nippon Prologis REIT Inc

advertisement

頁1/2

Search :

Nippon Prologis REIT Inc

Consensus

Target Price

Last Traded

Price (23 May 14)

JPY

JPY

Potential

Upside

▲ 5.3%

235,000.00‡ 223,100.000

Market: TSE | Industry: REITs - Commercial

Company Links

Business Summary

• Corporate History/Profile • Financial Information • Home Page • Investor Relations • News Releases •

Products/Services

Nippon Prologis REIT Inc. is a Japan-based real estate investment trust (REIT). It aims to achieve

sustainable growth in asset and stable earnings from mid- to long-term perspectives. The REIT

mainly invests in logistic facilities, focusing on A class logistic facilities. Its portfolio included

Prologis Park Ichikawa 1, Prologis Park Zama 1 , Prologis Park Kawajima , Prologis Park Osaka

2, Prologis Park Maishima 3 , Prologis Park Kasugai, Prologis Park Maishima 4, Prologis Park

Kitanagoya, Prologis Park Tagajo and Prologis Park Takatsuki, among others. The asset manager

of the REIT is Prologis REIT Management K.K. On June 13, 2013, it acquired seven properties.

On December 3, 2013, it acquired four properties.

Basic Stock Information Ø

Stock Data

Margin

Market Capitalization (JPY 'mil)

348,872.60

Common Shares Outstanding ('mil)

1.3948

52 Week High (JPY) (22/05/2014)

223,900.000

52 Week Low (JPY) (07/06/2013)

152,662.482

Gross Margin (TTM) (%)

55.82

Operating Profit Margin (TTM) (%)

55.45

Research Report

Net Profit Margin (TTM) (%)

43.69

No report was issued in the last one year.

§

52 Week Return (%)

27.680

Dividend

Average Volume ('mil)

0.0047

Annual Dividend per share (JPY)

Beta

-

Dividend Yield (TTM) (%)

Dividend Yield (Annual) (%)

Financial strength

Current Ratio

2.31

Quick Ratio

5,504.8000

Technical Analysis

2.47

2.15

Payout Ratio (TTM) (%)

114.44

3-Year Growth Rate (%)

-

Advanced Chart: NIPPON PROLOGIS REIT INC

-

Long Term Debt to Equity (%)

78.69

Valuation

Total Debt to Equity (%)

80.66

Historical P/E Ratio

34.47

P/E Ratio (TTM)

36.04

Interest Coverage Ratio (TTM)

Free Cash Flow to Firm (TTM) (JPY

'mln)

7.14

299,557.10

P/BV (latest interim)

BVPS (latest interim) (JPY)

EPS TTM (JPY)

1.80

123,738.3000

6,189.4930

Financial Summary

BRIEF: For the fiscal year ended 30 November 2013, Nippon Prologis REIT Inc revenues totaled

Y13.68B. Net income applicable to common stockholders totaled to Y5.98B.

Summarized Financial Statement

Standarized in JPY ‘mln

Annual

Quarter

FY2013

Income Statement

Total Revenue

13,678.75

Cost of Revenue

(6,043.60)

Gross Profit

Operating Expenses

Operating Income

Others, Net

Income before Taxes

Tax

Extraordinary Items and

Adjustments

Net Income

7,635.16

(50.72)

7,584.43

(1,606.64)

5,977.79

(1.96)

5,975.83

Balance Sheet

Cash and Short Term

Investments

Total Receivables, Net

2,745.62

17,249.35

Total Assets

1,270.71

323,487.99

1,247.84

Other Current Liabilities

6,215.08

Total Long Term Debt

7,462.91

135,800.00

Other Liabilities

7,641.13

Total Liabilities

150,904.04

Common Equity

167,941.29

Retained Earnings

(Accumlated Deficit)

Other Equities

Total Equity

4,642.66

0.00

172,583.95

Cash Flow Statement

Cash Flow From Operations

Activities

P/E

P/BV

EPS

Div Yield(%)

DPS

2.87

5.38

34.47

1.80 6,189.4930 5,504.8000

2.47

Nippon Building Fund Inc.

Japan Real Estate Investment

Corporation

Japan Retail Fund Investment

Corporation

UNITED URBAN

INVESTMENT CORP.

2.60

5.11

29.98

1.5619,078.350017,072.0000

2.98

2.22

4.48

36.69

1.6415,316.180015,253.0000

2.74

2.47

5.26

26.93

1.34 8,094.8730 7,797.0000

3.86

2.32

5.16

32.32

1.62 4,983.4300 5,500.0000

3.41

Recommendation

Current

1 week

ago

1 month

ago

2 months

ago

3 months

ago

Buy

Outperform

Hold

UnderPerform

Sell

No Recommendation

1

6

3

0

0

0

1

5

3

0

0

0

2

5

2

0

0

0

2

5

2

0

0

0

1

5

2

0

0

0

Total Recommendation

10

9

9

9

8

Consensus Target Price

Consensus

Recommendation

235,000.00

Outperform

Outperform

304,967.94

Payables and Accrued

Expenses

Total Current Liabilities

ROA(%) ROE(%)

3,161.09

Total Current Assets

Other Long Term Assets

Industry Peer

Nippon Prologis REIT Inc

11,342.64

Other Current Assets

Property/Plant/Equipment, Net

Peer Comparison Ø

8,002.10

Outperform Outperform Outperform

Management Team

Name

Position

Masahiro Sakashita

Executive Officer

頁2/2

Company Related News

Cash Flow From Investing

Activities

Cash Flow From Financing

Activities

(299,726.27)

No News available!

305,536.99

Currency Translation

Adjustments

-

Net Change in Cash

13,812.82

Ratios & Other data

ROA (%)

1.85

ROE (%)

3.46

DPS (JPY)

5,504.8000

EPS (JPY)

6,472.0150

Selected data supplied by

All information contained on Phillip Stock Analytics is provided on an “as is” and “as available” basis. Please see disclaimer for full details.