Equinox (Eclipse 2006-1) plc Quarterly Surveillance Report for the

advertisement

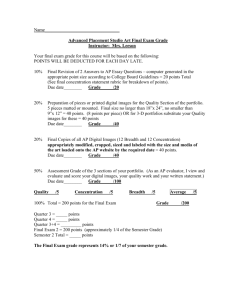

Contents Content Equinox (Eclipse 2006-1) plc Quarterly Surveillance Report for the Collection Period January – April 2012 Issue Date: 14th June 2012 Contents INDEX Deal Overview 3 Activity since Last Reporting 4 Special Servicing 8 Contact Details 10 Link to Deal Summary Report 10 Deal Overview Deal Overview The transaction consists of 13 loans, originated by Barclays Bank PLC, and all domiciled in the UK, in the sum of £401.36 million. The Weighted Average Cut-Off Date LTV is 63% with ICR 1.76x and DSCR 1.62x. The loans vary in size from £3.89 million to £83.18 million with a weighted average of £52.72 million and they similarly vary from single asset single tenant to multi asset/multi tenant. In total there are 136 properties securing the 13 loans. Three of the loans have since been prepaid or liquidated. The loans are diversified in terms of property type and geographical location. Geographically, the largest concentration is Greater London (38%) and the South East (19%). The remainders are spread throughout 10 areas of the UK, with the North East accounting for 11% and no other area accounting for more than 10%. With regards to property type, office account for 55%, healthcare (nursing home) 20%, retail 15%, residential 10% and industrial 0.1%. Five of the loans have B note structures being Royal Mint Court, Redleaf Portfolio, Macallan Portfolio, Herbrand Street and Holland Park Towers totalling £219.64 million. Redleaf Portfolio and Herbrand Street have since been liquidated and prepaid respectively. In addition the Ashbourne Portfolio A loan, totalling £79.94 million, is a super senior portion of the senior tranche of the Ashbourne Portfolio Whole Loan that also has two further senior tranches, a mezzanine tranche and a junior tranche. Capita acts as both Primary and Special Servicer to the issuer. 3 Activity since Last Reporting Activity since Last Reporting Royal Mint Court This loan is secured against four office properties located in London. The loan makes up 29.27% of the securitisation and matures on 16th October 2013. The loan has an A/B note structure, with the securitised portion representing 83.80% of the outstanding loan amount. All debt service payments have been made by the Borrower this quarter and the Quarterly Property reporting has been received in full. The office buildings in this portfolio are fully let with a weighted average lease length of 1.91 years. The weighted average lease term of the top 5 tenants is also 1.91 years. The vacant area at the gym continues to be marketed and is discounted from occupancy calculations. The total NOI for this portfolio received this quarter is £2.03 million. The ICR and DSCR remained stable this quarter, with both projected and annual ICR calculations remaining above the Cash Trap trigger of 1.25x at 1.48x and 1.47x respectively. A new valuation report has been commissioned and the updated Market Value of the property is £32,500,000, taking the LTV of the whole loan to 266%. There are no LTV covenants but the Servicer is currently in discussions with the Borrower on the future strategy of the loan. CSU Portfolio This loan is secured against two student residences in Southern England. The loan makes up 7.96% of the securitisation and matures on 16th January 2013. All debt service payments have been made by the Borrower this quarter and the Quarterly Property reporting has been received in full. The portfolio is fully occupied with a weighted average lease length of 17.09 years. Annual projected NOI is £2,464,000. The projected ICR improved this quarter from 2.21x to 2.39x as a result of a reduced Net Interest sum reflecting in the calculation due to the conclusion of the Swap at loan maturity. LTV remained stable quarter to quarter. This loan is on the Watchlist due to the loan’s pending maturity. Discussions are ongoing with the Borrower to determine the exit strategy for this loan. No material changes to be reported this quarter. 4 Activity since Last Reporting Holland Park Towers This loan is secured against a single-tenant office building located in West London. The loan makes up 8.30% of the securitisation and matures on 15th January 2016. The loan has an A/B note structure, with the securitised portion representing 84.73% of the outstanding loan amount. All debt service payment has been made by the Borrower this quarter and the Quarterly Property reporting has been received in full. The property is fully let on a fixed FRI lease with 5.14 years to first lease break. The total NOI for this portfolio received this quarter is £466,000. The ICR, DSCR and LTV have remained stable from quarter to quarter. No material changes to be reported this quarter Avocado Court Portfolio This loan is secured against a portfolio of five office properties in Northern England and Scotland. The loan makes up 6.93% of the securitisation and matures on 15th July 2012. All debt service payments have been made by the Borrower this quarter and the Quarterly Property reporting has been received in full. The loan amortised £118,000 as scheduled this quarter. The portfolio is currently 78.62% occupied with the portfolio weighted average lease term of 4.59 years. The weighted average lease term of the top 5 tenants is 4.83 years. The total NOI for this portfolio received this quarter is £418,000. The Projected ICR has increased from 1.27x to 1.35x due to lower expenses and rent adjustments. Actual ICR has increased from 1.48x to 1.73x. The Projected ICR test remains below the cash trap trigger of 1.50x but above the default level of 1.10x. This loan is on the Watchlist due to the loan’s pending maturity. Discussions are ongoing with the Borrower to determine the exit strategy for this loan. No material changes to be reported this quarter. Portland Place This loan is secured against a single-tenant office building located in Central London. The loan makes up 3.69% of the securitisation and matures on 16th January 2014. All debt service payment has been made by the Borrower this quarter and the Quarterly Property reporting has been received in full. 5 Activity since Last Reporting The property is fully let with 4.54 years to lease expiry. The total NOI for this portfolio received this quarter is £260,000 with no non-recoverable costs or rent arrears. The ICR, DSCR and LTV remained stable this quarter. No material changes to be reported this quarter. Fullswing Portfolio This loan is secured against nine retail properties in Southern England and East Anglia. The loan makes up 2.90% of the securitisation and matures on 16th October 2012. All debt service payment has been made by the borrower this quarter and the Quarterly Property reporting has been received in full. The portfolio is fully let with a weighted average of 6.07 years to first lease break. The weighted average lease term to first break across the top five tenants is 6.33 years. The total NOI for this portfolio received this quarter is £154,000. The projected and annual ICR calculation and LTV remains stable from quarter to quarter. Projected DSCR has increased from 1.54x to 1.65x this quarter due to the conclusion of the amortisation schedule after the July 2012 Interest Payment Date. This loan is on the Watchlist due to its pending maturity. Discussions are ongoing with the Borrower to determine the exit strategy for this loan. No material changes to be reported this quarter. Ocean Park Portfolio This loan is secured against four out of town offices near Cardiff. The loan makes up 2.42% of the securitisation and matures on 15th October 2015. All debt service has been paid by the Borrower this quarter and the Quarterly Property reporting has been received in full. The portfolio is fully let with a weighted average of 3.31 years to lease break. The weighted average lease term of the top five tenants is 3.92 years. The total NOI received this quarter is £175,143. The projected ICR and DSCR have decreased from 1.61x to 1.42x due to a lease expiry, three lease break options and the inception of a new lease at lower rent. This loan is on the Watchlist due to a cash trap provision of the Final Projected Interest Cover calculation. No material changes to be reported this quarter. 6 Activity since Last Reporting St Mary’s Court This loan is secured against a single-tenant office building located half a mile south of Cardiff city centre in Wales. The loan makes up 1.32% of the securitisation and matures on 15th October 2012. All debt service payment has been made by the Borrower this quarter and the Quarterly Property reporting has been received in full. The property is fully let with two years and 11 months to lease break. The total NOI received this quarter is just under £81,000 with no rental arrears. The historical ICR and LTV remained stable this quarter; there has been an increase in the projected annual DSCR from 1.28x to 1.48x due to the conclusion of the amortisation schedule following the July 2012 Interest Payment Date. No material changes to be reported this quarter. 7 Special Servicing Special Servicing Ashbourne Portfolio A This loan facility, which is constructed on a floating rate basis and fully hedged by interest rate swaps, represents the 26.99% participation of the Senior tranche of a loan originated by the Royal Bank of Scotland. The loan is secured against 90 nursing homes across the UK. Currently the borrower (with the lenders consent) is working to sell one of the homes that is vacant. The loan makes up 29.32% of the securitisation and matures on 13th October 2015. The borrower has been working in collaboration with the Operators to finalise the business plan that should eventually guide restructuring of the loan, however, further home by home analysis is required in order to determine both “catch-up” and regular operational Capex requirements going into the future. In addition, active negotiations are in course with the subordinate lenders who hold positions outside of the securitisation. Because of a shortfall on Operating Capital during the transfer period the Servicer agreed to withhold interest and amortisation payments starting in September 2011. The notes will continue to receive interest from the Liquidity Facility pending such time as a loan modification has been agreed and arrears of interest and principal are then subsequently cleared. Macallan Portfolio This loan originally comprised 10 properties across the UK and as at Q1 2012 Interest Payment Date, eight of these had been sold, the then most recent being the Armstrong House property with a gross sales price of £0.2m being achieved on 24 November 2011. The loan makes up 7.90% of the securitisation and matures on 15th October 2012. The loan has an A/B note structure, with the securitised portion representing 80.65% of the outstanding loan amount. Funds held on the tranching account representing distributions from the LPA Receivership were applied towards interest at the April 2012 Interest Payment Date, with the residual balance of £119,691 being held to provide a contingency for unforeseen property holding costs. No payments were made to the Junior Lender. Two properties remain in the portfolio: one of these is a seven storey 65,500 sq ft building situated in Birmingham currently given over to predominantly office use (vacant) with retail units to the ground and nightclub use to the basement floors; the other property comprises office accommodation extending to 14,900 sq ft situated in Washington, Tyne & Wear. Whilst quarterly rent collected at c.£23,000 was modest and a reflection of the occupancy, additional quarterly rent includes approximately £50,000 of advertising revenue that the LPA Receiver has managed to generate through the erection of temporary signage at the Birmingham property. The LPA Receiver has confirmed that a balance of £396,000 is under his control representing retained income 8 Special Servicing which has been held as a contingency and is expected to be used in part at the Q2 2012 Interest Payment Date. The timescale to liquidation of the residual properties has been protracted given issues including a requirement to obtain a lease extension from the head lessor, change of use in relation to planning consent for one of the subjects as well as reducing the level of voids at the second subject prior to re-marketing. However, the Birmingham property is on the market with competitive interest being expressed. The Issuer was advised by the Special Servicer in April 2010 that in the event of all the properties being liquidated for a combined value of £29m, a resultant loss of £14m was anticipated allowing for the then uncertain hedge break costs. It is currently anticipated that the total net sales proceeds will fall short of this figure, and whilst the hedge termination costs are known having been closed out in April 2011 at a cost of £1.79m, it is possible that the final liquidation loss will be in excess of £14m. The Special Servicer will advise the Issuer of developments in this regard with any material updates. 9 Contact details For any questions, please contact: janis.lee@capitaassetservices.co.uk Janis Lee Asset Manager Capita Asset Services 5th Floor, 40 Dukes Place London EC3A 7NH Tel: +44 207 397 4599 Fax: +44 207 204 7501 www.capitaassetservices.ie Link to the Deal Summary Report 10 Disclaimer Unless otherwise noted, this document has been prepared by Capita Asset Services (London) Limited or one of its affiliated companies (collectively referred to as “CAS”), acting as Primary Servicer and/or Special Servicer (collectively referred to as “the Servicer”) in relation to Equinox (Eclipse 2006-1) plc. With respect to documents that have been issued as a RIS Notice, such documents have been issued by the issuer of the notes and have not necessarily been prepared by the Servicer. Deal Summary, CMSA and Asset Surveillance reports will not generally be issued as RIS Notices. This document is provided for information purposes to holders of the relevant notes from time to time and prospective investors who may lawfully receive, and have read, the prospectus for such notes. The information contained herein must be read in conjunction with, and is qualified by, such prospectus. This document is not directed to, or intended for distribution to or use by, any person or entity that is a citizen or resident or located in any locality, country, state or other jurisdiction where such distribution, publication, availability or use would be contrary to law or regulation or which would require any registration or licensing within such jurisdiction. The document does not constitute any form of commitment, advice or recommendation on the part of CAS or its officers, affiliates, advisors, agents or representatives in relation to any transaction. Nothing in any of the documents on this site constitutes any promotion in respect of any invitation, endorsement or offer to invest in any securities in any jurisdiction. The document is not intended to represent an offer of securities for sale in the United States or to U.S. persons (within the meaning of Regulation S under the U.S. Securities Act of 1933, as amended (the "U.S. Securities Act"). CAS does not offer or purports to offer investment, tax, regulatory, accounting or legal advice and these documents should not and cannot be relied upon as such. Neither CAS, nor any officer or employee thereof of The Capita Group plc or any affiliate accepts any liability whatsoever for any direct or consequential losses arising from any use of information contained herein, including, without limitation, the reliance on any information, data or model, or the use of the documents in the preparation of your financial books and records. You must rely solely on your own examinations of the prospectus for the relevant notes, and consult your own investment, tax, regulatory, accounting or legal advisors prior to making any investment decisions or taking any other action relating to the information contained on this document. Certain information contained in this document is derived from information provided to or obtained by the Servicer from third parties, including the relevant cash managers. CAS has not independently verified any of such information. Accordingly, CAS does not guarantee or provide any warranties as to their accuracy or completeness and they should not be relied upon as such. CAS does not purport that the information contained in this document is all-inclusive or contains all of the information that an investor may require to make a full analysis of the relevant notes. Each recipient of this document must make its own independent investigation and analysis of the information and the notes and its own determination of the suitability of any investment in the relevant notes, with particular reference to its own investment objectives and experience and any other factors which may be relevant to it in connection with such investment and on such other information and advice from its own legal, accounting and tax advisers as it deems relevant and without reliance on the document. Any modelling or back-testing included is not an indication as to future performance of the applicable notes. No representation is made by CAS as to the reasonableness of the assumptions made within or the accuracy or completeness of any modelling or back-testing contained herein. Capita Asset Services (Ireland) Limited is regulated by the Central Bank of Ireland under the Investment Intermediaries Act, 1995. It is registered in Ireland as a private company limited by shares and its registered number is 315348. The document or information contained herein (whether in whole or in part) may not be reproduced, distributed or transmitted to any other person or incorporated into another document or other material without the prior written permission of CAS. 11