Sample EQA Snapshot - Gradient Analytics

advertisement

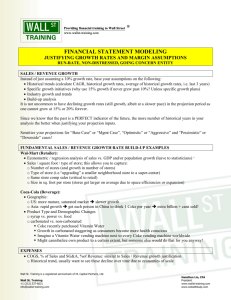

Snapshot

LULU

NEGATIVE

1 9 J A N U A R Y 20 1 2

Lululemon Athletica Inc.

www.lululemon.com

Industry

Textile – Apparel

Clothing

Price

$60.51 (01/18/12)

Market Cap

8.68 billion

Enterprise Value

8.41 billion

Price-Earnings Ratio

53.41

EV/Revenue

9.61

Debt/EBITDA

0.00

Short Interest

19.1%

Days to Cover

3.2

Company Description

Cash-Flow Deterioration

Continues

1

2

Considerations: A substantial decline in cash flows has led to a build of

positive accruals and plummeting FCF margins.

Potentially elevated

inventory levels from rising input costs may pressure future

earnings/margins.

Declining new-store productivity may signal the early

stages of a slowdown in growth for the retail chain.

Expenses are likely

to be outsized in the near future, given the unusual uptrend in CapEx to

depreciation.

Lululemon Athletica Inc. (LULU), together with its subsidiaries, engages in

the design, manufacture, and distribution of athletic apparel and accessories

for slim-figured women, men, and female youth primarily in Canada, the

United States, and Australia. Its apparel assortments include fitness pants,

shorts, tops, and jackets for healthy lifestyle activities, such as yoga, running,

and general fitness. The company’s fitness-related accessories comprise bags,

socks, underwear, yoga mats, instructional yoga DVDs, and water bottles.

LULU sells its products through its retail stores and a network of wholesale

accounts (such as yoga studios, health clubs, and fitness centers), as well as

directly to consumers through e-commerce. As of 10/30/11 the company had

165 corporate-owned stores under the Lululemon Athletica and Ivivva

Athletica brand names. Lululemon Athletica Inc. was founded in 1998 and is

based in Vancouver, Canada.

For the 12 months ended 10/30/11, LULU’s net income came in at $165.3

million, representing a 73.0% YOY increase. Over the same period, FCF

(CFOA) diverged from net income, falling 70.9% (5.5%) to $36.5 million

($145.6 million).

The combination of the increase in reported earnings and significant cashflow deterioration resulted in a 3,120 bps YOY increase in total accruals1 to

24.1% of average total assets. This figure is also 2,255 bps higher than the

company’s trailing three-year average of 1.5%.

Similar to total accruals, operating accruals2 increased 2,907 bps to 27.8% of

average current assets. Growth in inventory was the primary driver behind the

recent growth in total and operating accruals, consuming $54.9 million in

CFOA in the most recent TTM period.

Defined as net income + stock based compensation – free cash flow.

Defined as EBITDAS – CFOA (pre-tax and pre-interest).

14614 N. Kierland Blvd., Suite S-260

Scottsdale, Arizona USA 85254

Tel 480.998.8585 Fax 480.998.4747

products@gradientanalytics.com

www.earningsquality.com

© Copyright 2012 Gradient Analytics Inc.

LULU

Snapshot

LULU’s accruals also remained outsized when compared to its peer group,3

which on average reported total and operating accruals of 8.1% and 10.1%,

respectively, for the period ended 10/30/11.

Table 1. Analysis of Cash Flows and Accruals

($ units in millions)

12M Ended:

10/30/11

EBITDAS

$280.7

YOY % change

54.5%

07/31/11

$261.6

64.4%

05/01/11

$234.9

70.9%

01/31/11

$214.1

88.8%

10/31/10

$181.7

99.5%

$165.3

73.0%

$145.6

-5.5%

$36.5

-70.9%

$152.2

81.4%

$165.0

33.3%

$58.9

-42.3%

$135.6

90.1%

$173.1

35.5%

$73.8

-32.0%

$121.8

109.1%

$180.0

52.6%

$149.6

46.1%

$95.5

134.3%

$154.1

123.3%

$125.6

154.2%

FCF margin

YOY bps change

Accruals/ATA

YOY bps change

Peer accruals/ATA

YOY bps change

4.2%

-1,586

24.1%

3,120

8.1%

568

7.2%

-1,090

19.5%

2,328

4.7%

462

9.7%

-1,159

14.7%

2,618

5.0%

585

21.0%

-158

-7.4%

705

1.0%

171

20.0%

757

-7.1%

-475

2.4%

472

Operating accruals/ACA

YOY bps change

Peer operating accruals/ACA

YOY bps change

27.8%

2,907

10.1%

801

19.2%

1,648

6.8%

809

9.8%

2,065

7.1%

1,067

0.9%

2,242

2.9%

844

-1.2%

167

2.1%

424

Net income

YOY % change

CFOA

YOY % change

FCF

YOY % change

Inventory Metrics Spike

Upwards

3

For the 12 months (three months) ended 10/30/11, LULU posted YOY sales

growth of 39.5% (31.0%) to $874.7 million ($230.2 million). By contrast, the

company’s inventory balance increased by 76.9%YOY to $129.2 million.

Inventory relative to 12-month revenue increased 312 bps YOY to 14.8%,

representing a three-year high for the company. Looking at shorter-term

trends, inventory to three-month revenue increased to 56.1%, up 1,457 bps

YOY and also a three-year high.

Mitigating some of our concerns, $33 million of the total increase in inventory

was from in-transit inventory (versus $11 million last year); with management

explaining that the increased inventory amount was due to keeping up with

excess demand (Q3 2011 analyst call). However, should demand trends

change, we remain concerned about deteriorating margins from higher

markdowns, rising input costs, and increased competition in the upcoming

quarters.

Peer group includes Under Armor (UA), Nike (NKE), Finish Line (FINL), Bebe Stores (BEBE), Wet Seal (WTSLA), and Urban Outfitters (URBN).

Page 2 of 5

LULU

Snapshot

Table 2. Inventory Analysis

($ units in millions)

Period Ended:

Inventory

Inventory to 3M Revenue

Inventory to 3M Forward

Revenue

Inventory to 12M Revenue

3M DSI

12M DSI

YOY change

Inventory (%)

Inventory to 3M Revenue (bps)

Inventory to 3M Forward

Revenue (bps)

Inventory to 12M Revenue (bps)

3M DSI (%)

12M DSI (%)

New Store Productivity

Declines

4

10/30/11

$129.2

56.1%

07/31/11

$88.9

41.9%

05/01/11

$64.4

34.5%

01/31/11

$57.5

23.4%

10/31/10

$73.0

41.5%

38.8%

38.6%

30.3%

30.8%

29.8%

14.8%

98

10.8%

78

8.5%

72

8.1%

58

11.6%

81

81

73

69

67

72

76.9%

1,457

33.6%

-184

26.9%

-221

30.4%

-402

40.2%

-462

906

77

-300

-110

-268

312

21.3%

12.2%

-96

4.2%

3.1%

-149

6.6%

-1.8%

-166

-1.4%

-11.6%

-150

1.3%

-15.6%

For Q3 2011, LULU had sales growth of 31.0% YOY, including the results

from 31 new stores added in the last year. Excluding these new-store

openings, comparable-store sales increased 18.0% YOY.

Based on these trends, we estimate that new-store productivity4 declined to

56.0% in the most recent quarter from 188.2% in Q3 2010, compared to an

average of 168.0% in 2010.

When asked about the decline in the Q3 2011 analyst call, CFO John Currie

said, “New store productivity is not down from what it’s been at all. New

stores are still opening, better projected annual rate in excess of 11,000 square

foot, and that’s been the case throughout the year and it’s not declining.”

However, as shown in Chart 1 (next page), according to our estimate, newstore productivity has declined significantly over the last four quarters.

We calculate new store productivity as (Sales growth – SSS) / Total Sq. Footage Growth.

Page 3 of 5

LULU

Snapshot

Chart 1. Sales Growth Trends

250.0%

200.0%

Total Sales

Growth

150.0%

100.0%

Same Store

Sales

New Store

Productivity

50.0%

0.0%

Q2 2009 Q3 2009 Q4 2009 Q1 2010 Q2 2010 Q3 2010 Q4 2010 Q1 2011 Q2 2011 Q3 2011

-50.0%

Capital Expenditures Rise

Relative to Depreciation

Expense

During the TTM ended 03/31/11, capital expenditures (CapEx) increased

79.3% to $51.1 million,5 while depreciation increased by a comparatively

slower 13.3% to $26.0 million.

As a result, CapEx remains outsized relative to depreciation expense. In

addition, the level of capital expenditures relative to revenue also increased,

rising by 130 bps YOY to 5.8%. Meanwhile the ratio of depreciation to

revenue declined 69 bps YOY to 3.0%.

Although we note that the company is in expansion mode, the current CapEx

to depreciation ratio of 1.97x suggests that depreciation expense could pose a

significant threat to future margins. In the long run, the ratio of CapEx to

depreciation must revert eventually to 1.0.

(See table, Analysis of CapEx and Depreciation Trends, next page)

5

This excludes $58.0 million of capital expenditure of land in Q1 2011.

Page 4 of 5

LULU

Snapshot

Table 3. Analysis of CapEx and Depreciation Trends

12M Ended:

CapEx6

Depreciation

CapEx/Depreciation

CapEx as a % of revenue

Depreciation as a % of revenue

Change, YOY

CapEx (%)

Depreciation (%)

CapEx/Depreciation (%)

CapEx as a % of revenue (bps)

Depreciation as a % of revenue (bps)

10/30/11

$51.1

$26.0

1.97x

07/31/11

$48.1

$25.1

1.91x

05/01/11

$41.3

$24.2

1.71x

01/31/11

$30.4

$23.5

1.29x

10/31/10

$28.5

$22.9

1.24x

5.8%

3.0%

5.9%

3.1%

5.4%

3.2%

4.3%

3.3%

4.5%

3.7%

79.3%

13.3%

58.2%

120.6%

13.2%

95.0%

115.1%

16.0%

85.5%

94.9%

19.2%

63.5%

45.4%

21.0%

20.1%

130

-69

200

-87

166

-91

83

-105

-40

-112

Purpose: Gradient EQA Snapshots leverage proprietary signals that our analysts use to determine Earnings Quality metrics of interest.

Following a brief review of the earnings quality signals generated by our proprietary screens leveraging a variety of proprietary and other publicly

available data, ratings of Positive, Neutral or Negative are assigned to summarize our perspective of noteworthy Earnings Quality metrics.

Disclaimer: Earnings Quality Analytics is the property of Sabrient Holdings, LLC, d/b/a Gradient Analytics (“GRADIENT”). Unauthorized

reproduction or redistribution of this document in full or in part is strictly prohibited by law and a violation of the Copyright Act. Information

contained herein may not be reproduced in whole or in part, including photocopying of printed copy or e-mail forwarding, without the express

written consent of GRADIENT. You must contact Gradient Analytics, Inc., for authorization to reprint or reproduce any part of this document.

The information, opinions and analysis contained herein are provided “AS IS” based on sources believed to be reliable, but no warranty or

representation of any kind, expressed or implied, is made as to their accuracy, completeness, correctness, or otherwise. This report is for

information purposes only and should not be used as the basis for any investment decision. GRADIENT disclaims liability for damages of any sort

(including lost profits) arising out of the use of or inability to use this report. Other than annual fees from subscribers to its Earnings Quality

Analytics/Equity Incentive Analytics services, Gradient does not receive, directly or indirectly, any consideration for publishing this report.

Gradient has not received any consideration, either directly or indirectly, from the issuer analyzed herein. GRADIENT is not an investment advisor

and this report is not investment advice. This information is neither a solicitation to buy nor an offer to sell securities. Information contained

herein reflects our judgment at the time of original publication, may include minor elements of prior screening results published to clients, and is

subject to change without notice. Gradient does not have a long or short position in securities mentioned. Safe Harbor Statement: Statements

contained in this document, including those pertaining to estimates and related plans other than statements of historical fact, are forward-looking

statements subject to a number of uncertainties that could cause actual results to differ materially from statements made. {2012.01} © Copyright

Sabrient Holdings, LLC 2012

6

All CapEx figures on this table exclude $58 million capital expenditure of land in Q1 2011.

Page 5 of 5