Sample EQA Alert - Gradient Analytics

advertisement

Research Alert

GNTX

A N A L Y ST : B R E N T M I L L E R

Gentex Corp.

600 North Centennial St.

Zeeland, MI 49464

(616) 772-1800

www.gentex.com

INDUSTRY

Auto Parts

PRICE

$29.64 (01/05/12)

MARKET CAP

4.25 billion

ENT. VALUE

3.80 billion

P-E RATIO

26.46

EV/REVENUE

3.85

DEBT/EBITDA

0.00

SHORT INTEREST

3.6%

DAYS TO COVER

5.1

Earnings Quality Thesis

We are initiating coverage of Gentex Corp. (GNTX) with a grade of D. A

growing gap between FCF and net income has led to total accruals

reaching a five-year high while FCF margin hit a five-year trough.

Inventory growth appears outsized relative to both trailing and forward

sales, as DSI and inventory-to-forward sales metrics both reached five-year

highs. Flat ASPs and higher input costs related to supply-chain

disruptions could threaten gross-margin targets, particularly if sales of

RCD-equipped mirrors fall below expectations. A significant spread

between CapEx and depreciation expense could raise the risk of EPS

misses in 2012. The company appears to trade at a significant absolute and

relative valuation premium, which may prove to be unsustainable given

our earnings quality and fundamental concerns.

EARNINGS QUALITY GRADE

Scale A - F

Increasing accruals may threaten

persistence of earnings

pg 6

Outsized inventory growth could

further pressure margins

pg 7

An increasing gap between net income

and FCF has led to total accruals

reaching a five-year high of 9.0% of

average total assets. FCF margin and

FCF-to-net income also have declined

to five-year lows. The deterioration in

FCF was primarily driven by growth in

inventory and a surge in capital

spending. As accruals inevitably begin

to decline, GNTX may be at risk of

posting lower-than-expected bottomline results.

GNTX’s three-month and 12-month

DSI metrics both reached five-year

highs as the firm’s inventory balance

increased by 64.1% YOY. Inventory

also appears outsized relative to

expected demand. Pricing pressure

and rising raw-materials costs

resulting from supply-chain

disruptions may result in gross

margin contracting by more than the

modest decline forecasted by

management.

14614 N. Kierland Blvd., Suite S-260

Scottsdale, Arizona 85254

Tel 480.998.8585 Fax 480.998.4747

05 J A N U A R Y 2 0 1 2

D

Surge in CapEx and unusually low

depreciation expense may threaten

earnings targets

pg 11

Prior-period cuts in capital spending

have led to unusually low levels of

depreciation and amortization.

However, a recent upswing in capital

outlays has resulted in the CapEx-todepreciation ratio reaching a five year

high of 2.48. As this ratio begins to

normalize, the firm may face a

heightened risk of EPS shortfalls, as

current sell-side estimates may

underestimate the level of depreciation

expense the company will incur in 2012.

products@gradientanalytics.com

www.earningsquality.com

2012 Copyright Gradient Analytics Inc.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

Research Alert

GNTX

01.05.12 GENTEX CORP.

Company Background, Overview of

Recent Results, and Introduction to

Gradient’s Thesis

COMPANY BACKGROUND

Gentex Corp. (GNTX) designs, develops, manufactures, and markets electrooptical products to automotive, commercial building, and aircraft industries in

the United States and internationally. Over 98% of revenue for the nine months

ended 09/30/11 was due to sales of automatic-dimming rearview mirrors, which

utilize proprietary electrochromic technology to dim in proportion to the

amount of headlight glare from trailing vehicle headlamps. The firm also offers

camera-based driver-assist systems, which are increasingly becoming integrated

components of the company’s auto-dimming mirror products. GNTX also

provides commercial smoke alarms and signaling devices to the North American

fire protection market, as well as dimmable aircraft windows for the commercial,

business, and general aviation markets. The firm sells its automotive mirror

products directly and offers its fire protection products directly and through

manufacturer representative organizations to fire protection and security

product distributors, electrical wholesale houses, and original equipment

manufacturers of fire protection systems. The company was founded in 1974 and

is based in Zeeland, Mich.

INTRODUCTION TO GRADIENT’S THESIS

Our thesis centers on a number of earnings quality and fundamental signals that

could indicate a higher probability of near to mid-term share-price

underperformance. These issues include:

Rapidly expanding accruals and deteriorating FCF margin could indicate

that recent results may prove to be less persistent than expected, raising the

risk of negative surprises in coming quarters.

Unusual growth in inventory has led to GNTX’s three-month and 12-month

DSI metrics reaching five-year highs. Current inventory levels also appear

outsized relative to expected sales.

Flooding in Thailand has resulted in supply-chain disruptions, forcing

GNTX to order electronic components from non-Thai suppliers. Lower

supply and higher demand for raw materials have led to higher input costs,

which, when coupled with lower ASPs, could lead to greater-than-expected

gross-margin contraction.

The 12-month CapEx-to-depreciation ratio reached a five-year high in the

most recent period, indicating that depreciation and amortization expense

may be unsustainably low. Current 2012 sell-side EPS estimates may

understate the level of depreciation expense the firm will incur, possibly

raising the risk of the company falling short of consensus estimates in the

coming year.

The company appears to trade at a significant premium relative to its

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

2

Research Alert

GNTX

01.05.12 GENTEX CORP.

industry peers and its own historical valuation multiples. Given our earnings

quality and fundamental concerns, this premium valuation may be

unwarranted, particularly if near-term demand for RCD-equipped mirrors

falls below expectations.

OVERVIEW OF RECENT RESULTS

In 2010, GNTX’s revenue grew by 49.9% to $816.3 million (see Table 1, Page

5), snapping a two-year streak of declining sales growth. In 2008, the

company’s top line came in at $623.8 million, representing a 4.6% YOY

decline. In the company’s 2008 10K, management attributed the decline to a

5% decline in auto-dimming mirror shipments, primarily driven by decreased

demand from “the traditional Big Three automakers.” The firm’s 2009 results

exhibited a more pronounced downward trend, with auto-dimming mirror

shipments falling by 19% YOY, which resulted in a 12.7% sales decline versus

2008 when netted against a higher ASP. Accordingly, a portion of the 2010

sales growth appears to have driven by this weak 2009 comp. In the

company’s 2010 10K, management attributed the revenue increase to a 46%

increase in auto-dimming mirror shipments resulting from “increased light

vehicle production globally and increased penetration of auto-dimming

mirrors with electronic content.”

The company’s low annual gross-margin watermark for the most recent fiveyear period occurred in 2008, with gross margin plummeting by 226 bps to

32.6%. Following flattish performance in 2009, the company’s 2010 gross

margin improved by 362 bps YOY to 36.2%, an expansion that management

attributed to “higher sales leveraged over fixed manufacturing overhead

costs.” The result also represented the firm’s highest gross margin over the

most recent five-year period.

GNTX’s operating margins followed a similar trajectory, as annual operating

margins fell by 499 bps to 17.4% in 2008 before retreating an additional 3 bps

in 2009. In the company’s 2008 10K, management cited a 13.5% increase in

R&D expenses (excluding one-time litigation charges) and a 20.2% jump in

SG&A expenses as being the primary drivers of the contraction.1 In 2010, the

firm’s operating margin displayed a 602 bps YOY improvement, an expansion

that was largely driven by the sharp increase in the company’s revenue, which

more than offset the 26.3% increase in operating expenses.

The material YOY operating margin expansion helped drive GNTX’s 2010 diluted

EPS up by 106.8% (123.6%) to $0.97 versus 2009 (2008). In 2008, the company

saw its diluted EPS fall by 49.5% YOY to $0.43, a decline that management

attributed to reduced operating margin and a $57.5 million decline in other

income from $40.9 million in other income in 2007 to $16.6 million in other

1

The increase in R&D expense was attributed to “additional staffing for new electronic product development, including SmartBeam, Rear

Camera Display and telematics, and new vehicle programs,” (2008 10K). Expansion of the company’s overseas sales offices and a higher

allowance for doubtful accounts were cited as the primary drivers of the increased SG&A expense (2008 10K).

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

3

Research Alert

GNTX

01.05.12 GENTEX CORP.

expense in 2008.2 While other income increased by $18.4 million YOY to $1.7

million in 2009, the firm’s earnings only exhibited an 8.1% YOY increase to $0.47

per share as a result of the company’s depressed margins.

For Q3 2011 (nine months ended 09/30/11) GNTX reported net sales of $269.5

million ($763.4 million), representing a 30.3% (28.5%) YOY increase (see Table 2,

Page 5). The firm’s Q3 sales also exceeded the consensus sell-side estimate of

$259.6 million by $9.9 million. In the company’s Q3 2011 10Q, management

attributed the quarterly revenue growth to a 31% YOY increase in auto-dimming

mirror unit shipments, primarily driven by increased sales to European and Asian

automakers. GNTX went on to cite a 29% increase in auto-dimming mirrors as

the primary catalyst behind the top-line expansion for the nine months ended

09/30/11, a trend that management attributed to “increased light vehicle

production in North America and Europe as well as increased penetration of

auto-dimming mirrors on 2011 model year vehicles.”

Q3 2011 gross margin came in at 35.4%, representing a 30 bps decline and a

modest 12 bps sequential improvement. In the Q3 2011 10Q, management cited

“annual automotive customer price reductions” as the primary catalyst behind

the YOY gross margin contraction, a trend that was partially offset by “the

company’s ability to leverage fixed overhead costs and certain purchasing cost

reductions.” For the nine months ended 09/30/11, GNTX’s gross margin fell by 86

bps YOY to 35.5%, a decline management attributed to “annual automotive price

reductions” in the company’s Q3 2011 10Q (see Page 9 for a detailed discussion of

this subject).

Despite the YOY decline in gross margin, Q3 2011 operating margin increased by

39 bps YOY to 23.1% as operating expenses increased by just 23.3% YOY against

a 30.3% rise in sales. As a result, diluted EPS was in line with the sell-side

consensus estimate at $0.30. On a nine-month basis, the YOY gross-margin

decline and a 26.1% increase in operating expenses sent the firm’s operating

margin down by 62 bps YOY to 23.0% for the period ended 09/30/11.

Management’s Q4 2011 revenue guidance calls for sales to increase by 20% (to

25%) in Q4 2011 versus Q4 2010.3 The higher revenue-growth target relative to

the unit shipment forecast implies greater penetration in 2012 model years and/or

market-share gains, an outlook that is somewhat consistent with recent

management commentary and trends in GNTX shipments relative to IHS’

2

According to GNTX’s 2008 10K, the YOY decline in other income was the result of lower investment income stemming from “lower interest

rates and decreased year-end mutual fund distribution income,” as well as a noncash impairment charge for available-for-sale securities and

realized losses on the sale of equity investments.

3

This forecast is based on IHS’ September 2011 forecast calling for a 5.4% YOY increase in light vehicle production levels in the North American,

European, and Japanese/Korean geographic markets. IHS’ European light vehicle production forecast, which calls for a modest 2.0% YOY unit

decline, appears optimistic when compared to cautious comments from European auto part supplier SKF Group. In its 10/19/11 nine-month

update, SKF stated that Q4 demand in Europe and the Automotive Division were both expected to be lower relative to last year. In addition,

SKF CEO Tom Johnstone stated that the company expects to see weaker demand in the car market in Q4 2011.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

4

Research Alert

GNTX

01.05.12 GENTEX CORP.

automobile production forecasts.4 Management’s target revenue-growth range

also implies that Q4 sales are expected to come in between $266.5 million and

$277.6 million, compared to the current sell-side consensus estimate of $273.4

million.

While GNTX does not provide quarterly EPS guidance, SVP Enoch Jen stated in

the Q3 earnings release that supply-chain disruptions were expected to have a 25

bps to 50 bps negative impact on Q4 gross margin, resulting in a slight sequential

decline versus Q3 (see Page 9 for a detailed discussion of this subject). The

current consensus sell-side estimate calls for the company to achieve Q4 2011

diluted EPS of $0.30. Given the earnings quality and fundamental concerns

enumerated in this report, however, we believe that GNTX may be at risk of

falling short of expectations in Q4 2011 and beyond.

Table 1. Summary of Recent Annual Operating Results

($ in millions except per-share data)

2010

$816.3

49.9%

36.2%

362

23.4%

602

16.9%

500

$0.97

106.8%

Revenue

YOY % change

Gross margin

YOY bps change

Operating margin

YOY bps change

Net margin

YOY bps change

Diluted EPS

YOY % change

2009

$544.5

-12.7%

32.6%

4

17.4%

-3

11.9%

192

$0.47

8.1%

2008

$623.8

-4.6%

32.6%

-226

17.4%

-499

10.0%

-872

$0.43

-49.5%

2007

$653.9

14.3%

34.8%

3

22.4%

13

18.7%

-33

$0.86

17.6%

2006

$572.3

6.7%

34.8%

-223

22.3%

-313

19.0%

-141

$0.73

3.0%

03/31/11

$250.9

35.1%

36.0%

-92

23.9%

-7

16.9%

-61

$0.29

26.1%

12/31/10

$222.1

25.1%

35.8%

-87

22.8%

-156

16.6%

-29

$0.26

18.8%

09/30/10

$206.8

32.8%

35.7%

76

22.7%

145

16.6%

121

$0.24

41.2%

Table 2. Summary of Recent Quarterly Operating Results

($ in millions except per-share data)

3M Ended:

Revenue

YOY % change

Gross margin

YOY bps change

Operating margin

YOY bps change

Net margin

YOY bps change

Diluted EPS

YOY % change

4

09/30/11

$269.5

30.3%

35.4%

-30

23.1%

39

16.1%

-47

$0.30

25.0%

06/30/11

$243.0

20.6%

35.2%

-142

21.9%

-229

15.8%

-106

$0.27

12.5%

For example, for the 12 months ended 09/30/11, GNTX’s unit shipments comprised 48.0% of IHS’ expected unit production versus 37.8% in the

year-ago period. The midpoint of GNTX’s Q4 revenue guidance implies that Q4 unit shipments will comprise approximately 48.3% of expected

production levels, assuming flat ASPs.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

5

Research Alert

GNTX

01.05.12 GENTEX CORP.

FCF Lags Earnings by Wide Margin

TOTAL ACCRUALS JUMP TO FIVE-YEAR HIGH 9.0% OF AVERAGE TOTAL ASSETS

For the 12 months ended 09/30/11, GNTX’s cash flow from operating activities

(CFOA) increased by 35.5% YOY to $162.1 million (see Table 3, next page). The

207.9% YOY increase in net capital expenditures,5 however, resulted in FCF

falling by 31.4% YOY to $58.9 million. The YOY decline in free cash flow (FCF)

also represented a stark contrast to the increase in TTM sales, which rose by

27.7% YOY to $985.5 million. As a result of these diverging trends, FCF margin

declined by 515 bps YOY to 6.0%, reaching a five-year low in the process. The

FCF-to-adjusted net income6 metric also reached a five-year trough, coming in at

0.382, compared to the year-ago value of 0.658 and the trailing five-year average

of 0.952.

The primary working-capital drivers of the decline in FCF were inventory and

receivables growth, which consumed $59.0 million and $23.4 million,

respectively, in operating cash flow over the most recent 12-month period. The

inventory growth is particularly concerning, as it appears outsized relative to

both trailing and expected sales (see Page 7 for a detailed discussion of this

subject). In addition, a significant ramp in capital spending acted as a $102.6

million drag on FCF for the 12 months ended 09/30/11. By contrast, the company’s

average 12-month net capital expenditures over the most recent five-year period

was $46.5 million. As we discuss later in this report, the accelerating level of

capital spending could have negative consequences for the company’s margins as

additional depreciable assets come on line in future periods (see Page 11 for a

detailed discussion of this subject).

While GNTX’s FCF declined markedly, the company’s adjusted net income

(EBITDAS) came in at $154.3 million ($281.7 million) for the 12 months ended

09/30/11, representing an 18.2% (24.0%) YOY increase. Consequently, total

accruals jumped to 9.0% of average total assets for the 12 months ended 09/30/11,

representing five-year high for the firm and lying appreciably above the year-ago

(quarter-ago) value of 5.1% (5.5%). Additionally, while operating accruals

declined by 644 bps YOY to 8.2% of average current assets, the metric increased

by 338 bps on a sequential basis and remained well above the company’s trailing

five-year average of -0.1%. The unusual levels of both total and operating accruals

leave us concerned that GNTX’s recent accruals-based performance may prove

unsustainable.

(See table, Twelve-Month Trends in Accruals and Cash Flows, next page)

5

6

Net CapEx = capital expenditures – sale of PP&E.

Adjusted net income for the 12 months ended 09/30/11 excludes $8.8 million in stock-based compensation expense, $5.8 million tax benefit from

stock-based compensation, and $9.9 million in other income primarily stemming from investment related gains.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

6

Research Alert

GNTX

01.05.12 GENTEX CORP.

Table 3. Twelve-Month Trends in Accruals and Cash Flows

($ in millions)

12M Ended:

EBITDAS

YOY % change

Adjusted net income

YOY % change

CFOA

YOY % change

Net CapEx

YOY % change

FCF

YOY % change

FCF margin

YOY bps change

FCF/Adjusted net income

YOY % change

Accruals to average total assets

YOY bps change

09/30/11

$281.7

24.0%

$154.3

18.2%

$161.5

35.5%

($102.6)

207.9%

$58.9

-31.4%

6.0%

-515

0.382

-41.9%

9.0%

391

06/30/11

$260.7

22.4%

$144.6

20.0%

$165.6

29.2%

($76.5)

168.5%

$89.2

-10.6%

9.7%

-418

0.617

-25.5%

5.5%

300

03/31/11

$252.0

40.0%

$142.7

45.4%

$144.2

-7.5%

($55.1)

113.4%

$89.1

-31.5%

10.1%

-1,033

0.624

-52.9%

5.5%

949

12/31/10

$234.9

70.9%

$133.5

92.3%

$128.1

15.8%

($46.4)

119.8%

$81.7

-8.7%

10.0%

-643

0.612

-52.5%

5.7%

825

09/30/10

$227.2

119.9%

$130.5

177.8%

$119.1

5.2%

($33.3)

40.2%

$85.8

-4.1%

11.1%

-717

0.658

-65.5%

5.1%

1,059

Operating accruals to average current

assets

8.2%

4.8%

7.1%

7.4%

14.6%

-644

-619

775

756

2,598

YOY bps change

Inventory Level Continues to Climb

THREE-MONTH AND 12-MONTH DSI METRICS REACH FIVE-YEAR HIGHS;

INVENTORY GROWTH ALSO APPEARS OUTSIZED RELATIVE TO EXPECTED SALES

For the 12 months ended 09/30/11, GNTX reported revenue of $985.5 million,

representing a 27.7% YOY increase (see Table 4, next page). By contrast, the

company’s inventory balance increased by 64.1% to $151.1 million. As a result,

the firm’s inventory balance comprised 15.3% of TTM sales, representing a

340 bps YOY increase and a five-year high for the firm. The 12-month DSI

metric exhibits a similar trend, increasing by 15 days YOY to 65 days, which is

also a five-year record.

Short-term trends—which we tend to view as more indicative of the direction

of the trend—are even more pronounced. Specifically, the aforementioned

64.1% YOY increase in inventory (see Table 5, Page 9) was more than twice

the rate of increase in quarterly sales (30.3% YOY to $269.5 million).

Consequently, inventory was 56.1% of three-month sales, representing a 1,155

bps YOY increase and 1,842 bps above the trailing five-year average of 37.7%.

Likewise, the three-month DSI metric increased by 12 days YOY to 71 days,

representing the metric’s five-year high.

GNTX’s Q3 2011 10Q attributed the increase in inventory to “higher sales and

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

7

Research Alert

GNTX

01.05.12 GENTEX CORP.

production levels in conjunction with longer lead times for certain electronic

component raw materials inventory.” While we do not dispute that supplychain disruptions resulting from flooding in Thailand have resulted in longer

lead times for certain electronic components, the company’s current rawmaterials inventory of $97.4 million represents 64.5% of the firm’s total

inventory balance, which is in line with the trailing five-year average of 64.3%.

Accordingly, it does not appear that there has been a disproportionate rise in

raw materials.

In addition, the recent build in inventory does not appear to be entirely

congruent with expected customer demand. For example, the current inventory

level is equivalent to 12.9% of expected forward 12-month sales,7 representing a

353 bps YOY increase and a five-year high for the firm (see Chart 1, next page). In

addition, the company’s finished-goods inventory of $34.6 million constitutes

12.7% of the sell-side’s sales estimate for Q4 2011,8 representing a 354 bps YOY

increase and 411 bps above the metric’s trailing five-year average of 8.5%.

Accordingly, we question whether there is enough near-to-mid-term demand to

justify an inventory build of this magnitude. If not, the inventory build could

exacerbate recent weakness in gross margin.9

Table 4. Twelve-Month Inventory Analysis

12M Ended:

Revenue

YOY % change

Inventory

YOY % change

Inventory turnover

YOY % change

Inventory/sales

YOY bps change

DSI

YOY % change

09/30/11

$985.5

27.7%

$151.1

64.1%

5.59

-22.6%

15.3%

340

65

29.2%

06/30/11

$922.9

28.1%

$119.5

50.7%

5.99

-22.8%

12.9%

194

61

29.5%

03/31/11

$881.4

38.5%

$104.0

53.6%

6.35

-16.7%

11.8%

116

57

20.0%

12/31/10

$816.3

49.9%

$100.7

87.9%

6.62

-7.1%

12.3%

250

55

7.6%

7

09/30/10

$771.8

57.8%

$92.1

97.3%

7.22

9.9%

11.9%

239

51

-9.0%

For 09/30/10 and prior periods, forward sales were based on actual reported sales in the subsequent 12-month period. For periods ranging from

12/31/10 to 06/30/11, forward-sales estimates were derived by using a combination of reported sales and sell-side forecasts. For the 09/30/11

period, forward-sales estimates were based solely on the current forward sell-side forecast.

8

For 06/30/11 and prior periods, forward sales were based on actual reported sales in the subsequent quarter. For the 09/30/11 period, forward

sales estimates were based on the current sell-side forecast for Q4 2011.

9

Arguably, one potential reason for the inventory build could be that the company is expecting a surge in demand for rear camera displays

(RCDs) following the publication of the final rule related to the Kids Transportation and Safety Act (KTSA), which was expected by 12/30/11

but has been met by several delays and has not occurred as of this report’s publication date. The KTSA may require that all vehicles in the

United States be equipped with rear camera displays by September 2014. However, two issues lead us to believe that this is not a viable catalyst

for the recent inventory build. First, if the company expects a substantial increase in RCD sales in 2012, analysts covering the firm do not appear

to share this opinion, as the firm’s forward-sales estimates remain outsized relative to the inventory build. Second, even discounting the

probability of additional regulatory delays, the September 2014 deadline would not likely result in sufficient growth in 2012 model year RCD

implementation to justify a 64.1% YOY increase in inventory.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

8

Research Alert

GNTX

01.05.12 GENTEX CORP.

Table 5. Three-Month Inventory Analysis

3M Ended:

Revenue

YOY % change

Inventory

YOY % change

Inventory turnover

YOY % change

Inventory-to-sales

YOY bps change

DSI

YOY % change

09/30/11

$269.5

30.3%

$151.1

64.1%

1.29

-17.1%

56.1%

1,155

71

20.6%

06/30/11

$243.0

20.6%

$119.5

50.7%

1.41

-18.9%

49.2%

983

65

23.3%

03/31/11

$250.9

35.1%

$104.0

53.6%

1.57

-18.8%

41.5%

499

58

23.1%

12/31/10

$222.1

25.1%

$100.7

87.9%

1.48

-34.1%

45.4%

1,517

62

51.7%

09/30/10

$206.8

32.8%

$92.1

97.3%

1.55

-27.2%

44.5%

1,456

59

37.4%

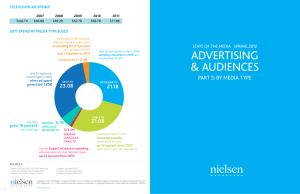

Chart 1. Five-Year Trends in Inventory-to-Forward Sales

14.0%

13.0%

12.0%

11.0%

10.0%

9.0%

8.0%

7.0%

6.0%

5.0%

4.0%

Inventory/forward 12M Sales

Gross-Margin Contraction May Prove

to be More Material than Forecasted

Finished goods inventory/forward 3M sales

RISING INPUT COSTS, CUSTOMER PRICING POWER AND “DECONTENTING” MAY

THREATEN Q4 2011 AND H1 2012 GROSS MARGINS

One factor that may explain a significant portion of the outsized inventory

growth in the most recent quarter is higher raw-materials costs resulting from

the company sourcing parts from non-Thai suppliers. The July 2011 flooding in

Thailand caused severe manufacturing disruptions among roughly half a dozen of

GNTX’s electronic component suppliers in the country.10 Though management

did not disclose the exact percentage of electronic components sourced from

Thailand, several company disclosures seem to indicate that the amount was

10

SVP Enoch Jen, Q3 2011 analyst call.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

9

Research Alert

GNTX

01.05.12 GENTEX CORP.

material. For example, in the company’s Q3 earnings announcement, SVP Enoch

Jen stated that the Thailand flooding and associated supply-chain disruptions

would negatively affect the company’s Q4 gross margin by 25 to 50 bps and

predicted a slight QOQ decline in gross margin for the quarter. Jen went on to

state that it “could take anywhere from three months to up to a year to restore

normal production for some of the facilities in Thailand.” Additionally, in

response to a follow-up question on the expected duration of gross-margin

contraction due to supply-chain disruptions, Jen stated that the “impact will go

into definitely the first quarter of next year, and then we would be hopeful that

there might be some sequential improvement after that.”

Compounding the problem of higher input costs, the company’s primary

customers are large automobile manufacturers that wield a comparatively high

degree of pricing power. Therefore, GNTX may be unable to pass on the bulk of

these cost increases. The company acknowledges this risk in its 2010 10K filing:

In addition to price reductions over the life of our long-term agreements,

we continue to experience significant pricing pressures from our

automotive customers and competitors, which have affected, and which

will continue to affect our margins to the extent that we are unable to

offset the price reductions with engineering and purchasing cost

reductions, productivity and manufacturing yield improvements, and

increases in unit sales volume, each of which pose a challenge. [emphasis

added]

Beyond pricing pressure, the company also appears to face risks related to

“decontenting” by a number of vehicle manufacturers. The 2010 10K describes

this risk as follows:

In addition, financial pressures at certain automakers are resulting in

increased cost reduction efforts by them, including requests for additional

price reductions, decontenting certain features from vehicles, customer

market testing of future business, dual sourcing initiatives and warranty

cost-sharing programs, which could adversely impact our sales growth,

margins, profitability and, as a result, our share price. [emphasis added]

An analysis of trends in the average selling price (ASP) for the company’s

automotive mirrors confirms this downward pricing pressure. For the nine

months ended 09/30/11, mirror shipments grew by 29% YOY, accounting for all of

the 29% increase in mirror-related sales. The flat ASP growth served as a sharp

contrast to the nine-month period ended 09/30/10, when ASPs grew by 8% YOY,

accounting for 12.5% of the 64% YOY increase in mirror-related sales (see Chart

2, next page). These pricing pressures, when combined with increasing input

costs, could result in a more material and sustained gross-margin contraction

than the 25 bps to 50 bps sequential decline implied by management’s recent Q4

2011 guidance.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

10

Research Alert

GNTX

01.05.12 GENTEX CORP.

Chart 2. Trends in Nine-Month Automotive Mirror ASPs

10%

8%

6%

4%

2%

0%

-2%

-4%

-6%

-8%

9M ASP YOY % Change

Unusually Low Deprecation Levels

Appear Unsustainable

SURGE IN CAPITAL SPENDING MAY FORESHADOW HIGHER-THAN-EXPECTED

DEPRECIATION AND AMORTIZATION EXPENSE

For the 12 months ended 09/30/11, GNTX’s capital spending increased by 204.0%

to $102.8 million (see Table 6, next page). In the company’s Q3 2011 analyst call,

CFO Steven Dykman explained the increase in capital outlays as follows:

The company currently estimates that 2011 capital expenditures will be

approximately $100 million to $115 million, primarily due to the increased

production equipment purchases of approximately $70 million to $80

million and new facility costs of approximately $30 million to $35 million to

increase production plant capacity. 2011 capital expenditures will be

financed from current cash and cash equivalents on hand. Depreciation

expense for the 2011 calendar year is currently estimated at approximately

$41 million to $44 million.

The recent increase in capital outlays appears to stem in part from CapEx cutbacks

in 2009 and 2010. To illustrate this, consider that from 12/31/08 to 09/30/10 GNTX’s

average 12-month capital spending was just $30.6 million—a 40.0% decline versus

the preceding two-year period (12/31/06 to 09/30/08). An analysis of CapEx to sales

tells a similar story, with the metric falling from an average of 8.0% during

12/31/06–09/30/08 to 5.2% for the 12/31/08–09/30/10 period.

Despite the 204.0% YOY increase in 12-month capital expenditures, depreciation

and amortization expense rose just 7.5% for 12 months ended 09/30/11. These

opposing trends resulted in the CapEx-to-depreciation ratio coming in at 2.48,

representing a 182.7% YOY increase, a five-year high, and the third highest level

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

11

Research Alert

GNTX

01.05.12 GENTEX CORP.

over the last 10 years (trailing only the 12 months ended 12/31/01 and 03/31/02). The

metric’s current value also lies 58.4% above its trailing 10-year average of 1.56.

Table 6. Twelve-Month CapEx-to-Depreciation and Amortization Analysis

12M Ended:

CapEx

YOY % change

Depreciation and amortization

YOY % change

CapEx/depreciation

YOY bps change

09/30/11

$102.8

204.0%

$41.5

7.5%

2.48

182.7%

06/30/11

$76.8

166.9%

$39.5

3.3%

1.95

158.4%

03/31/11

$55.5

113.5%

$38.6

1.9%

1.44

109.6%

12/31/10

$46.9

121.9%

$37.7

-0.3%

1.24

122.7%

09/30/10

$33.8

42.2%

$38.6

3.7%

0.88

37.1%

HAVE 2012 SELL-SIDE EPS TARGETS UNDERESTIMATED FUTURE

DEPRECIATION EXPENSE?

The growing disparity between capital spending and depreciation and

amortization implies that depreciation and amortization expense is likely to ramp

in the near future. To illustrate this point, we took the midpoint of management’s

CapEx guidance and the company’s previously disclosed depreciation schedules11

to arrive at an estimated level of incremental depreciation and amortization

expense for 2012. Based on these data points, we estimate incremental depreciation

and amortization expense of $12.9 million for the coming fiscal year. This figure

results in an estimated 2012 depreciation and amortization expense of $55.4

million,12 which would represent a 30.4% YOY increase versus the midpoint of

management’s 2011 guidance of $41.0 million to $44.0 million.

In a second, more-conservative base case approach, we assumed that 25% of the

capital equipment acquired in 2011 will not be put into service until 2013.

Alternatively, this method can also be viewed as providing a $3.2 million

allowance for assets that have reached the end of their useful lives and are no

longer being depreciated. Using this methodology, we estimate that depreciation

and amortization expense would still come in at $52.2 million, representing a

22.8% YOY increase versus the midpoint of management’s 2011 guidance.

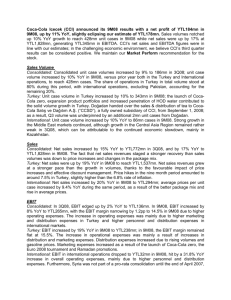

In a third approach, we examined the historical relationship between the 12-month

CapEx-to-depreciation ratio and increases in depreciation and amortization

expense in subsequent periods (see Chart 3, next page). In the two historical

examples when the 12-month CapEx-to-depreciation and amortization ratio had

reached similar peak levels (12/31/01 and 03/31/06),13 GNTX’s 12-month

depreciation and amortization expense increased by an average of 24.8% over the

subsequent five quarters. This methodology results in estimated 2012 depreciation

11

According to GNTX’s 2010 10K, the depreciable life of GNTX’s machinery and equipment is three to 10 years (average 6.5 years). The

depreciable life of GNTX’s buildings and improvements is seven to 40 years (average 23.5 years).

12

Estimate assumes that 2011 depreciation expense comes in at $42.5 million, the midpoint of management’s guidance of $41.0 million to $44.0

million.

13

The CapEx-to-depreciation ratios for the 12 months ended 12/31/01 and 03/31/06 were 3.03 and 2.27, respectively.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

12

Research Alert

GNTX

01.05.12 GENTEX CORP.

and amortization expense of $51.2 million, representing a 20.4% increase relative to

the midpoint of management’s 2011 target.14

While our analysis suggests that 2012 depreciation expense will fall between

$51.2 million and $55.4 million, the sell-side’s projection appears to reflect

expected depreciation expense of approximately $47.0 million to $49.0

million,15 the midpoint of which is 8.0% ($4.2 million) below our base case

estimate ($52.2 million, as discussed above on Page 12). Accordingly, we

believe the sell-side (and possibly the market as a whole) may have unrealistic

expectations regarding 2012 EPS for GNTX.

Chart 3. Ten-Year Trends in 12-Month CapEx-to-Depreciation Ratio and Forward Depreciation Expense

Rich Valuation Bolsters Earnings

Quality and Fundamental Concerns

RELATIVE AND ABSOLUTE VALUATION PREMIUM MAY SUGGEST THAT A

REVERSAL IS IMMINENT

Despite the deterioration in certain earnings quality and fundamental risk

metrics outlined in the preceding analysis, GNTX trades at a premium to its peer

group16 across a broad spectrum of relative valuation metrics. Trailing metrics

provide an illustration of this trend, as the company trades at a 114.0% (521.4%)

premium relative to the peer group on an EV/EBITDA (EV/TTM sales) basis (see

14

Analysis assumes that the relationship between the 12-month CapEx-to-depreciation ratio and forward 12-month depreciation expense is linear.

Morningstar and KeyBanc are forecasting depreciation and amortization expense of just $47.0 million and $48.7 million, respectively, for 2012.

Yet their 2012 EPS forecasts ($1.29 and $1.34, respectively) actually trail the consensus 2012 forecast of $1.38, leading us to conclude that the

majority of the current sell-side 2012 EPS targets may contain similarly (if not more) optimistic 2012 depreciation and amortization projections.

Accordingly, we believe GNTX may be at risk of falling short of sell-side EPS targets as a result of depreciation and amortization expense

coming in higher than what is currently embedded in consensus estimates. See 10/20/11 KeyBanc report and 10/20/11 Morningstar report.

16

GNTX’s relative valuation peer group consists of Dorman Products Inc. (DORM), Johnson Controls Inc. (JCI), Lear Corp. (LEA), Standard

Motor Products Inc. (SMP), and Visteon Corp. (VC).

15

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

13

Research Alert

GNTX

01.05.12 GENTEX CORP.

Table 7, next page). Forward-looking measures paint a similar picture, as

GNTX’s forward P/E (TEV/forward sales) metric lies 96.4% (521.4%) above the

peer-group median. The degradation in GNTX’s cash flows is particularly

evident when examining the firm on a TEV/FCF basis, which results in the firm

trading at a 320.4% premium relative to its peer group. In addition, the firm

trades at a 119.6% premium on a P/BV basis.

One potential reason for the relative valuation premium is the earnings growth

that could result from the publication of the final rule relating to the Kids

Transportation and Safety Act (KTSA), which was expected by 12/30/11 but has

been met by several delays and has not occurred as of this report’s publication

date. The KTSA may require that all vehicles in the United States be equipped

with rear camera displays by September 2014. Accordingly, the KTSA could

trigger a surge in demand for RCD-equipped rearview mirrors, a trend that

would likely lead to a surge in RCD unit shipments from 2012 to 2014. However,

the company’s expected earnings growth does not appear to fully account for the

valuation disparity, as the firm trades at an 83.0% premium relative to its peer

group on a five-year forward PEG basis.

The company also appears to trade at a premium relative to its own historical

averages for most valuation metrics. On a TEV/sales basis, for example, GNTX’s

current value of 3.85 lies 12.9% above the firm’s trailing five-year average of 3.41

(see Table 8, next page). GNTX’s P/BV tells a similar story, with the metric’s

current value of 4.32 exceeding the company’s historical average of 3.37 by 28.3%.

The firm also trades at a TEV/EBITDA premium of 5.8% compared to its own

recent historical values. The only commonly used trailing metric in which the

company trades at a discount relative to its trailing five-year average is P/E,

whose current value represents a 24.2% discount relative to the recent historical

mean. After adjusting for nonrecurring gains and losses, however, this relative

discount drops to 1.7%. Based on our earnings quality and fundamental concerns

highlighted in this report, we believe there is an increased likelihood that

GNTX’s performance will lag that of the larger market, returning its valuation

multiples to levels more in line with peers and its own historical norms.

Table 7. Relative Valuation Analysis

TTM

TEV/EBITDA

14.14

6.84

10.09

3.18

6.37

5.66

GNTX

DORM

JCI

LEA

SMP

VC

Median

GNTX vs. peer median

6.60

114.0%

12M FWD P/E

25.48

12.57

10.90

7.77

13.37

13.87

12.97

96.4%

5-Yr FWD

PEG

1.35

0.79

0.69

0.58

0.61

0.99

EV/FCF

64.68

22.99

NE

7.78

6.89

NE

P/BV

4.32

2.23

2.00

1.60

1.94

1.93

TTM

EV/Sales

3.85

1.22

0.67

0.24

0.57

0.39

12M FWD

EV/Sales

3.66

1.19

0.62

0.24

0.56

0.39

0.74

83.0%

15.39

320.4%

1.97

119.6%

0.62

521.4%

0.59

519.4%

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

14

Research Alert

GNTX

01.05.12 GENTEX CORP.

Table 8. Historical Valuation Analysis

Current value

Trailing five-year average

Current value vs. fiveyear average

Risks to Thesis

TTM

TEV/Sales

3.85

3.41

12.9%

TEV/EBITDA

14.14

13.36

5.8%

TTM P/E

26.46

34.93

-24.2%

Normalized

TTM P/E

29.56

30.07

-1.7%

P/BV

4.32

3.37

28.3%

The primary threat to our thesis is rapidly accelerating revenue growth, a risk

that is closely tied to the company’s rear camera display (RCD) products. The

publication of the final rule relating to the Kids Transportation and Safety Act

(KTSA) was expected by 12/30/11, but has not occurred as of this report’s

publication date. The KTSA may require that all vehicles in the United States be

equipped with rear camera displays by September 2014. For vehicles lacking a

built-in navigation system, the rearview mirror could represent the most optimal

display location. Accordingly, the KTSA could trigger a surge in demand for

RCD-equipped rearview mirrors, a trend that would likely lead to a surge in

RCD unit shipments from 2012 to 2014. Pushback from automakers, however,

based on implementation costs could delay the decision or result in a lessaggressive integration timeline. While these two scenarios may not have a

dramatic effect on the firm’s long-term RCD growth prospects, they would

certainly have a dampening effect on near-term (2012) RCD demand.

*Detailed Disclaimer Regarding EQA Reports and Copyright Infringements Contained on the Last Page of Report.

15

Research Alert

GNTX

01.05.12 GENTEX CORP.

Disclaimer

Analyst Certification

Earnings Quality Analytics is the property of Sabrient Holdings, LLC, d/b/a Gradient Analytics

(“GRADIENT”). Unauthorized reproduction or redistribution of this document in full or in part is

strictly prohibited by law and a violation of the Copyright Act. Information contained herein may

not be reproduced in whole or in part, including photocopying of printed copy or e-mail

forwarding, without the express written consent of GRADIENT. You must contact Gradient

Analytics, Inc., for authorization to reprint or reproduce any part of this document. The

information, opinions and analysis contained herein are provided “AS IS” based on sources believed

to be reliable, but no warranty or representation of any kind, expressed or implied, is made as to

their accuracy, completeness, correctness, or otherwise. This report is for information purposes

only and should not be used as the basis for any investment decision. GRADIENT disclaims

liability for damages of any sort (including lost profits) arising out of the use of or inability to use

this report. Other than annual fees from subscribers to its Earnings Quality Analytics/Equity

Incentive Analytics services, Gradient does not receive, directly or indirectly, any consideration for

publishing this report. Gradient has not received any consideration, either directly or indirectly,

from the issuer analyzed herein. GRADIENT is not an investment advisor and this report is not

investment advice. This information is neither a solicitation to buy nor an offer to sell securities.

Information contained herein reflects our judgment at the time of original publication, may include

minor elements of prior screening results published to clients, and is subject to change without

notice. Gradient does not have a long or short position in securities mentioned. Safe Harbor

Statement: Statements contained in this document, including those pertaining to estimates and

related plans other than statements of historical fact, are forward-looking statements subject to a

number of uncertainties that could cause actual results to differ materially from statements made.

{2012.01} © Copyright Sabrient Holdings, LLC 2012

The views expressed in this report accurately reflect the personal views and opinions based on an

examination of company filings and other relevant documents of the undersigned lead analyst(s)

about the subject issuer and the securities of the issuer. The undersigned lead analyst(s) has not and

will not receive any compensation for providing a specific recommendation or view in this report. In

addition, pursuant to Gradient Analytics' Securities Compliance Policies, analysts(s) may not trade

in securities for issuers under coverage for a minimum of one year post-publication.

Brent Miller 480.998.8585, ext. 260

14614 N. Kierland Blvd., Suite S-260

Scottsdale, Arizona 85254

Tel 480.998.8585 Fax 480.998.4747

products@gradientanalytics.com

www.earningsquality.com

2012 Copyright Gradient Analytics Inc.

16