Company Report Torrent Pharmaceuticals Ltd.

advertisement

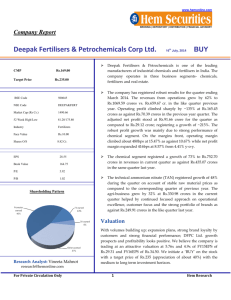

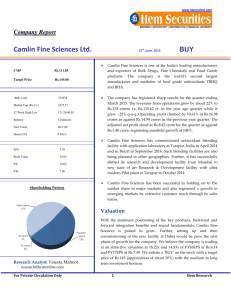

www.hemonline.com BROKING | DEPOSITORY | DISTRIBUTION | FINANCIAL ADVISORY Company Report Torrent Pharmaceuticals Ltd. CMP Rs.1599.00 Target Price Rs.1960.00 BSE Code 500420 Market Cap (Rs Cr.) 27055.08 52 Week High/Low 1622.00/742.55 Industry Pharmaceuticals Face Value Rs.5.00 Shares O/S 16.92 Cr. EPS(TTM) 55.78 Book Value 173.71 P/E 28.67 P/B 9.20 17th August, 2015 BUY Torrent Pharma is among the top 15 companies in Indian pharma market with strong presence in CV/CNS/VMN/GI market. Torrent continues to be at the forefront of the Indian pharmaceutical industry with many of its products ranking among the top 500 brands (AIOCD Dataset). The company has registered excellent results for the quarter ending June 2015. The revenues from operations grew sharply by about 75% to Rs.1947 crores vs. Rs.1114 cr. in the year ago quarter while it grew ~69% q-o-q. The base business of branded Indian generic market and generic-generic US market has remained strong in the quarter. Operating profit climbed manifold at Rs.909 crores as against Rs.345 crores in the previous year quarter. The EBIDTA margins have been higher mainly driven by strong brands, niche products and improved field force productivity. Further, it seems to continue on account of increasing focus on USA market and strong traction in Elder’s portfolio. The adjusted net profit stood at Rs.449 crore for the quarter as against Rs.256 crore; registering sharp growth of about 75%. The exceptional growth in the revenues and profits is primarily on account of launch of Aripiprazole in the USA market, which currently has limited competition. The two largest brands of the elder portfolio Shelcal and Chymoral continues to post strong numbers. It contributed about 81% to the total Elder portfolio in Q1FY16 as against 75% in the like quarter last year. During the recent quarter ended, Torrent has completed the acquisition of Zyg which drives it into the specialty area. Shareholding Pattern Valuation Research Analyst: Vineeta Mahnot research@hemonline.com For Private Circulation Only With the robust product filings and launches thereof, strong market presence across geographies, strong brands and new facility coming up; Torrent pharma seems to be on a growth phase. We believe the company is trading at an attractive valuation at 22.85x and 20.56x of FY16EPS of Rs.69.97 and FY17EPS of Rs.77.79. We initiate a ‘BUY’ on the stock with a target price of Rs.1960 (appreciation of about 23%) with the medium to long term investment horizon. 1 Hem Research www.hemonline.com Business Details Torrent Pharma, the flagship company of Torrent Group, is ranked amongst the top pharma companies of India. It is a dominant player in the therapeutic areas of cardiovascular (CV) and central nervous system (CNS) and has achieved significant presence in gastro-intestinal, diabetology, anti-infective and pain management segments. It has also forayed into the therapeutic segments of nephrology and oncology while also strengthening its focus on gynecology and pediatric segments. Torrent Pharma is the sole manufacturer of Insulin Formulations for Novo Nordisk in India since the early ‘90s and has also set up a dedicated formulation and packaging facility for Insulin. It is also amongst the few Indian pharma majors to recognize the importance of research and development in the post 2005 GATT era. Its modern and well-equipped R&D Centre is ranked amongst the best in the country and has a team of highly qualified scientists working on various Drug Discovery and Development projects. The R&D Centre has been approved by USFDA and various other regulatory authorities. The Company's manufacturing plants located at Indrad, Baddi & Sikkim have facilities to produce Formulations and Bulk drugs. The plants are approved by authorities from various regulated and semi regulated markets like US, UK, Brazil, Germany, Australia and South Africa. Recently, Torrent Pharma acquired the branded domestic formulations business of Elder Pharmaceuticals in India and Nepal. The acquisition comprises a portfolio of 30 brands including market-leading brands in the Women's Healthcare, Pain Management, Wound Care and Nutraceuticals therapeutic segments. Torrent Pharma has a strong international presence spanning over 40 countries with over 1200 product registrations. It has wholly owned subsidiaries in USA, UK, Germany, Brazil, Russia, Mexico, Philippines and other major markets. These wholly owned subsidiaries spearheads the company’s entry into several new regulated and semi regulated international markets. To sharpen its focus and enhance its customer reach in the domestic market, Torrent operates through sales and marketing divisions structured on specific Therapeutic areas. For Private Circulation Only 2 Hem Research www.hemonline.com USA market-strong foothold Torrent pharma is currently ranked eighth amongst generic Indian companies in the US and in the covered market it has a market share of about 10%. Further the company has 14 molecules and is ranked in the top three in the US. USA has registered excellent growth of 231% in the quarter ended June 2015 at Rs.888 crores from Rs.269 crores in Q1FY15. Launch of g‐Abilify (aripiprazole) and higher contribution thereof has resulted in the extremely good performance during the quarter ended June 2015. gAbilify is low competitive high volume product as there are only five players in the market and that too with about 50% price erosion. Further, the company aims a target of 15% market share in the US market for its products. The company is also significantly ramping up its pipeline with products like Ointments, Injectables, Specialty Oral solids (oncology). The Company has 49 ANDA approvals (including 5 tentative approvals) and its pipeline consists of 19 pending approvals and 44 products under development. The company plans to add 18-20 products per year from earlier 10-12 per year. It also aims to increase its presence in the new segments like Dermatology, Oncology and Ophthalmology. The US business is expected to contribute to the growth of international business in a significant way. Domestic market-India Torrent Pharma is now among the top 15 companies in the domestic market and has 9 brands in top 500 brands of the Indian Pharma market. The company ranks among the top 5 in Cardiology & CNS therapies and among the top 10 in Nutraceuticals and Gastrointestinal therapies. The company clocked a sharp growth of 39% at Rs.491 crores in quarter ended June 2015 from Rs.353 crores in the like quarter last year. The strong growth has been primarily driven by the strong performance by the Elder portfolio along with price hikes. Shelcal and Chymoralbrands of Elder portfolio continues to post strong numbers. It contributed about 81% to the total Elder portfolio in Q1FY16 as against 75% in the like quarter last year. The Company continues to focus on specialties and driving field force productivity through brand building in major therapies, expanding portfolio in newly entered segments. Further, under the branded generics it has priorities in India, Brazil and Philippines where it intend to scale up in CVD, CNS markets aiming for a stronger position and also aims to enter new therapies in these markets. It aims for strengthening access in Dermatology, Gynaecology, Oncology, Nephrology and Pain. For Private Circulation Only 3 Hem Research www.hemonline.com Outperformance in Brazil Among the Indian companies, in terms of market share, Torrent ranks No. 1 in Brazil. Brazil is the largest pharmaceutical market in Latin America and the 6th largest in the world. The Company has a development basket of 28 products with 5 products in the Cardio Vascular (CV) segment, 12 products in the Central Nervous System (CNS) segment 8 products in the Oral Anti Diabetic/obesity (OAD) segment and 3 products in other segments. There has been a fall in the revenues in the quarter ended June 2015 at Rs.138 crores from Rs. 149 crores in Q1FY15. However, the underlying business continues to perform very well, the currency movements have been responsible for the reported number essentially. Adjusted for the currency movement; Brazil operations has registered a growth of 20%. The Company has a strong pipeline (products under development + under approval) of 48 products in the above therapies to augment future growth. Despite negative GDP growth forecast, Torrent expects double digit growth in the volume trends and remains to grow faster. The company has 20 products under approval out of which 2 products are expected to be approved during the coming year in the Brazilian market. Europe Among the Generic players, Torrent holds the sixth position with a market share of 4.2% and is ranked No. 1 among Indian players in the Germany Market. Operations in Europe registered revenue de-growth of 1% for Q1 FY 2015-16. Adjusting for currency movements revenues grew by 16%. For Private Circulation Only 4 Hem Research www.hemonline.com Improvement in productivity The Company has achieved field force rationalization of around 200 more filed force in the quarter ended June 2015. So MR total strength currently is 3100 from 3300 in last quarter and by the end of the year it is expected to stabilize at 3000. Rationalization has been 50% from the Elder and 50% from across the therapies especially the acute segment. R&D expenditure is expected to scale up significantly going ahead while Tax rate would remain the same as in the financial year ended March 2015. Expansion and commissioning of manufacturing facilities Torrent pharma’s new manufacturing facility at Dahej SEZ with a capacity of 14.5 billion tablets and 81 MT of API would be one of the largest pharma manufacturing facilities in Indian at a single location. Once commissioned; it would almost double the company’s existing capacity. The facility would cater to the key regulated markets like US and Europe. The company is spending a 1000 crores capex for the same and has started the process of getting the formulation plant approved by various regulatory authorities viz. USFDA, BfArM – Germany for International markets. The facility is expected to commence commercial manufacturing in the third quarter of this fiscal year or latest by the beginning of the fourth quarter. During the financial year ended March 2015, the company has initiated an expansion of its current manufacturing facility at Sikkim. The additional capacities would be available within next two years time. Further, as part of its portfolio diversification plans, the company is planning to enter critical care therapy segment for international markets by establishing integrated manufacturing facility for drug substances and drug products (API & formulations) in oncology. The plant is expected to become operational within next two years time. For Private Circulation Only 5 Hem Research www.hemonline.com Consolidated Profit & Loss Account Rs. Crore Particulars Net sales FY13 FY14 FY15 FY16E FY17E 3211.14 4184.72 4653.45 6514.83 7114.19 30.32% 11.20% 40.00% 9.20% Growth Expenditure 2518.92 3233.24 3633.29 4860.06 5328.53 EBITDA 692.22 951.48 1020.16 1654.77 1785.66 Growth 37.45% 7.22% 62.21% 7.91% 21.56% 22.74% 21.92% 25.40% 25.10% Other income 43.36 38.13 285.55 208.37 234.77 Depreciation & Amortisation 82.69 87.00 190.74 220.10 237.14 EBIT 652.89 902.61 1114.97 1643.04 1783.29 EBIT margin 20.33% 21.57% 23.96% 25.22% 25.07% Interest 33.80 58.63 175.16 162.87 137.69 PBT 619.09 843.98 939.81 1480.17 1645.60 Tax 146.69 180.07 188.84 296.03 329.12 PAT 472.40 663.91 750.97 1184.13 1316.48 Share of Associates 0.00 0.00 0.00 0.00 0.00 Minority Interest 2.15 0.03 0.03 0.00 0.00 470.25 663.88 750.94 1184.13 1316.48 41.18 13.11 57.69 11.18 EBITDA margin Adjusted PAT Growth Net Profit margins 14.64 15.86 16.14 18.18 18.51 Exceptional item 37.49 0.00 0.00 0.00 0.00 Reported PAT 432.76 663.88 750.94 1184.13 1316.48 Equity Capital 42.31 84.62 84.62 84.62 84.62 Equity Shares 8.46 16.92 16.92 16.92 16.92 Adjusted EPS 55.57 39.23 44.37 69.97 77.79 For Private Circulation Only 6 Hem Research www.hemonline.com Balance Sheet Rs. Crore Particulars FY13 FY14 FY15 FY16E FY17E Equity Share Capital 42.31 84.62 84.62 84.62 84.62 Reserves & Surplus 1379.62 1817.81 2405.94 3,378.52 4,466.53 Shareholders’ funds 1421.93 1902.43 2490.56 3463.14 4551.15 Borrowings 692.97 1131.76 2740.35 2505.70 2294.90 Deferred tax liability 25.75 (18.16) 104.70 104.70 104.70 Minority Interest 0.37 0.40 0.43 0.43 0.43 Sources of funds 2141.02 3016.43 5336.04 6073.97 6951.18 Gross block 1,278.15 1,420.04 3,542.93 4401.91 4742.80 Accumulated Depreciation 458.33 544.70 710.27 930.37 1,167.51 Net block 819.82 875.34 2832.66 3471.54 3575.29 Capital WIP 285.28 534.11 678.33 581.95 758.85 Investments 60.47 185.66 297.65 303.73 393.45 Inventories 923.86 1,006.06 1,067.17 1,176.63 1,434.22 Sundry debtors 687.82 1,099.42 1,594.54 1,699.58 2,071.65 Cash and bank balance 626.97 769.42 567.36 610.11 743.67 Other current assets 209.75 319.74 473.22 501.16 610.87 Loans and advances 138.79 214.42 316.01 370.42 451.51 Total current assets Current liabilities and provisions 2587.19 3409.06 4018.30 4357.89 5311.93 1,611.74 1,987.74 2,490.90 2,641.15 3,088.33 975.45 1421.32 1527.40 1716.75 2223.60 0.00 0.00 0.00 0.00 0.00 2,141.02 3,016.43 5,336.04 6,073.97 6,951.18 Particulars FY13 FY14 FY15 FY16E FY17E Return on Networth 33.07 34.90 30.15 34.19 28.93 Return on Capital employed 30.87 29.75 21.32 27.53 26.05 Debt/Equity 0.49 0.59 1.10 0.72 0.50 Asset turnover 0.86 0.84 0.59 0.75 0.71 Current Ratio 1.61 1.72 1.61 1.65 1.72 Net current assets Misc exp Uses of funds Ratios For Private Circulation Only 7 Hem Research www.hemonline.com Consolidated Quarterly Financial Highlights Rs. Crore Particulars Q1FY16 Q1FY15 Q4FY15 YoY% QoQ% Revenues 1947 1114 1154 74.78 68.72 Expenditures 1038 769 992 34.98 4.64 Operating Profit 909 345 162 163.48 461.11 Adjusted Net Profit 449 256 130 75.39 245.38 OPM% 46.69 30.97 14.04 50.75 232.55 NPM % 23.06 22.98 11.27 0.35 104.61 Adjusted EPS* 26.41 15.06 7.65 75.39 245.23 *Adjusted for current no. of equity shares Past Price movement of the stock TORRENT PHARMA (1441.0000, 1605.9000, 1415.0000, 1568.3500, +127.9000) 1700 1700 1650 1650 1600 1550 1600 1550 1500 1500 1450 1450 1400 1350 1400 1350 1300 1300 1250 1250 1200 1150 1200 1150 1100 1100 1050 1050 1000 950 1000 950 900 900 850 850 800 750 800 750 700 700 650 650 600 550 600 550 500 500 450 450 400 350 400 350 300 300 250 250 200 150 200 150 100 100 50 50 0 -50 0 -50 -100 -100 1994 For Private Circulation Only 1996 1997 1998 1999 8 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 2015 2016 Hem Research www.hemonline.com www.hemonline.com research@hemonline.com HEM SECURITIES LIMITED MEMBER-BSE,CDSL, SEBI REGISTERED CATEGORY I MERCHANT BANKER MUMBAI OFFICE: 14/15, KHATAU BLDG., IST FLOOR, 40, BANK STREET, FORT, MUMBAI-400001 PHONE- 0091 22 2267 1000 FAX- 0091 22 2262 5991 JAIPUR OFFICE: 203-204, JAIPUR TOWERS, M I ROAD, JAIPUR-302001 PHONE- 0091 141 405 1000 FAX- 0091 141 510 1757 GROUP COMPANIES HEM FINLEASE PRIVATE LIMITED MEMBER-NSE HEM MULTI COMMODITIES PRIVATE LIMITED MEMBER-NCDEX, MCX HEM FINANCIAL SERVICES LIMITED NBFC REGISTERED WITH RBI For Private Circulation Only 9 Hem Research www.hemonline.com Disclaimer & Disclosure: This document is prepared for our clients only, on the basis of publicly available information and other sources believed to be reliable. Whilst we are not soliciting any action based on this information, all care has been taken to ensure that the facts are accurate, fair and reasonable. This information is not intended as an offer or solicitation for the purchase or sell of any financial instrument and at any point should not be considered as an investment advise. Reader is requested to rely on his own decision and may take independent professional advise before investing. Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited, Directors and any of its employees shall not be responsible for the content. The person accessing this information specifically agrees to exempt Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and further agrees to hold Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The companies and its affiliates, officers, directors, and employees, including persons involved in the preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities there of, company (ies) mentioned here in and the same have acted upon or used the information prior to, or immediately following the publication. Disclosure of Interest Statement Company Name 1. Analyst Ownership of the Stock No 2. Hem & its Group Company Ownership of the Stock Yes 3. Hem & its Group Companies’ Director Ownership of the Stock Yes 4. Broking relationship with company covered No Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. For Private Circulation Only 10 Hem Research