Company Report NIIT Technologies Ltd.

advertisement

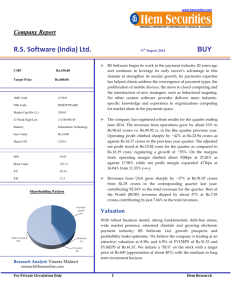

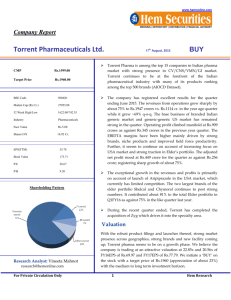

www.hemonline.com BROKING | DEPOSITORY | DISTRIBUTION | FINANCIAL ADVISORY Company Report NIIT Technologies Ltd. CMP Rs.500.95 Target Price Rs.645.00 BSE Code 532541 Market Cap (Rs Cr.) 3065.81 52 Week High/Low 632.00/335.00 Industry Information Technology Face Value Rs.10.00 Shares O/S 6.12 Cr. EPS(TTM) 43.11 Book Value 258.40 P/E 11.62 P/B 1.94 Shareholding Pattern 15th February, 2016 BUY NIIT Technologies is a leading global IT solutions organization, servicing customers in Americas, Europe, Middle East, Asia and Australia. It offers services in Application Development and Maintenance, Infrastructure Management, IP Asset or Platform Solutions, Business Process Management, and Digital Services to organisations in the Financial Services, Travel & Transportation, Manufacturing/Distribution, and Government sectors. The company has registered decent results for the quarter ending December 2015. The consolidated revenues grew by 14% to Rs.678.70 crores vs. Rs.595.30 cr. in the year ago quarter. Operating profit grew by 43.27% at Rs.123.50 crores as against Rs.86.20 crores in the corresponding quarter last year. The adjusted net profit surged sharply at Rs.75.40 crore as against Rs.48.20 crore; registering growth of 56% on a y-o-y basis. Margins continued to expand during the quarter and this was mainly on account of reduced SG&A. Amongst industry segments, BFSI grew 2.1% contributing to 38% of total revenues. Travel and Transportation revenues declined 3.7% resulting to a share of 36% and Manufacturing/Distribution contributed 9%. Revenues from Government contributed 3% of the revenue mix. Head count stood at 9,517 at the end of the quarter with utilization of direct resources at 78.7%.Business in the US contributes to 46% of overall revenues during the quarter. EMEA to 34% while the revenue share from APAC contributed 10% to total revenues and revenues from India contributed to 10% of the mix. Capex spend during the quarter stood at Rs.29.5 crores. Valuation Research Analyst: Vineeta Mahnot research@hemonline.com For Private Circulation Only With the strong order intake, good pipeline, strong traction in the Digital services business and ramp ups in Q4 may lead to FY17 to be stronger than FY16. We believe the company is trading at an attractive valuation at 10.85x and 9.63x of FY16EPS of Rs.46.17 and FY17EPS of Rs.52.04. We initiate a ‘BUY’ on the stock with a target price of Rs.645 (appreciation of about 29%) with the medium to long term investment horizon. 1 Hem Research www.hemonline.com Business overview NIIT Technologies is a leading global IT solutions organization, servicing customers in Americas, Europe, Middle East, Asia and Australia. It offers services in Application Development and Maintenance, Infrastructure Management, IP Asset or Platform Solutions, Business Process Management, and Digital Services to organisations in the Financial Services, Travel & Transportation, Manufacturing/Distribution, and Government sectors. Service Offerings- Application Development and Management: NIIT Technologies provides Application Development Services including custom software development, business intelligence and migration and modernisation to globally dispersed customers. The company helps clients manage their mission and time-critical applications by providing cost-effective application management services over a wide range of technologies. Infrastructure Management Services: NIIT Technologies’ Infrastructure Management Services simplify IT operational and investment challenges by delivering IT infrastructure and applications as completely administered services. The company provides a comprehensive portfolio of end to end Infrastructure Management Services ordained around the philosophy/vision of continuous delivery that map all aspects of IT infrastructure advisory, design, implementation and E2E business driven IT SLA agreements catering to the needs of both industrial and digital world. Business Process Management (BPM): NIIT Technologies’ BPM business offers outsourcing solutions that combine domain expertise, process excellence and cutting-edge technologies. It enables clients to effectively and efficiently manage back office, middle office and front office operations. Systems Integration and Package Implementation: These solutions mainly revolve around SAP and other ERP platforms. NIIT Technologies’ subsidiary, NIIT GIS Ltd. also provides endto-end GIS-based solutions to customers. NIIT GIS provides software products, training, technical support, data conversion and application development to varied industry sectors. They also include complete geo-spatial image processing and consulting solutions. Digital Services: The Company has clearly articulated its offerings in this area which has four elements: Digital Experience, Cloud, Analytics and Digital integration. For Private Circulation Only 2 Hem Research www.hemonline.com Strong order inflow There has been good order intake by the company over the recent quarters as a result of realignment of the company’s sales and marketing effort. NIIT Tech has added 4 significant new customers during the December quarter, including new large engagement with Ofcom. The value of the contract is GBP 23 million over a six year period which includes an initial term of 4 years and extensions. This Ofcom deal contributes to margin improvement for the business. In all the company added four new logos this quarter- two in EMEA and two in APAC. Three new clients are from the Travel and Transportation space and one from the others. There has been order intake to the tune of $123 million during the quarter taking the order book to $301 million executable over the next twelve months. The order intake has been geographically spread with $50 million from USA, $55 million from EMEA and the remaining $18 million from rest of the markets. In this quarter the company completed some key flagship digital experience projects in multiple clients in the travel vertical. The Company secured 5 new Digital engagements in areas like Predictive Demand modelling, Omni-channel commerce, Next Best Action and Migration to Amazon Web Services. The Company is investing in developing strong capabilities across Digital Experience, Analytics and Digital Integration. For Private Circulation Only 3 Hem Research www.hemonline.com Good growth potential next year Company expects revenue growth to recover from the first quarter of financial year 2017 in line with industry average after witnessing Q3 as a soft quarter. Even Q4 may remain soft on account of some programs in the Travel space which has gone live. However for FY16, the management expects to grow at the lower end of the industry average. On the margin front, the company expects to improve from the fourth quarter of FY16 driven by better business mix and strong order intake. The Digital business and GIS business proportion is expected to improve. The good traction in the Digital services will help the company in its growth trajectory for FY17. The company plans to focus on main verticals like BFSI, Travel and Media which constitutes the bulk of the order pipeline and will drive the mainstream of growth going forward. The company is seeing good traction especially in the Insurance vertical and in the US in Banking. The company sees good order pipeline going ahead. Though there may be some softness in the order book on account of changing nature of business as contribution of digital business is increasing to 15% which generally has short executable period of 2-3 months. Further, under digital business, the company expanded the capability of its advanced analytics platform, Digital Foresight to deliver business outcomes aimed at increasing sales, reducing customer churn and combating fraud. For Private Circulation Only 4 Hem Research www.hemonline.com Consolidated Profit & Loss Account Rs. Crore Particulars Net sales FY13 FY14 FY15 FY16E FY17E 2021.36 2304.99 2372.50 2704.65 3050.84 14.03% 2.93% 14.00% 12.80% Growth Expenditure 1692.06 1953.85 2039.62 2231.33 2507.79 EBITDA 329.30 351.14 332.88 473.31 543.05 6.63% -5.20% 42.19% 14.73% Growth EBITDA margin 16.29% 15.23% 14.03% 17.50% 17.80% Other income Depreciation & Amortisation 22.75 30.25 17.31 21.64 24.41 56.69 61.90 91.64 102.98 115.28 EBIT 295.37 319.48 258.55 391.97 452.18 EBIT margin 14.61% 13.86% 10.90% 14.49% 14.82% 1.91 1.10 2.68 3.61 4.07 PBT 293.45 318.38 255.87 388.36 448.11 Tax 75.04 80.23 53.99 89.32 112.03 PAT 218.41 238.15 201.88 299.04 336.08 Share of Associates 0.00 0.00 0.00 0.00 0.00 Minority Interest 5.19 7.62 7.86 17.20 18.40 213.22 230.53 194.02 281.84 317.68 8.12 (15.84) 45.26 12.72 Interest Adjusted PAT Growth Net Profit margins 10.55 10.00 8.18 10.42 10.41 Exceptional item 0.00 0.00 79.96 0.00 0.00 Reported PAT 213.22 230.53 114.07 281.84 317.68 Equity Capital 1033.88 1263.17 1296.30 1,517.14 1,770.77 Res. & Surplus 1013.08 1015.08 1308.63 1,392.62 1,492.13 Equity Shares 6.02 6.07 6.10 6.10 6.10 Adjusted EPS 35.39 37.98 31.79 46.17 52.04 For Private Circulation Only 5 Hem Research www.hemonline.com Balance Sheet Rs. Crore Particulars FY13 FY14 FY15 FY16E FY17E Equity Share Capital 60.24 60.70 61.04 61.04 61.04 Reserves & Surplus 1033.88 1263.17 1296.30 1,517.14 1,770.77 Shareholders’ funds 1094.12 1323.87 1357.35 1578.18 1831.81 Borrowings 9.29 5.26 4.85 9.02 10.17 Minority Interest 17.30 18.90 18.87 19.43 20.41 Sources of funds 1120.71 1348.04 1381.07 1606.63 1862.39 Gross block 701.99 750.84 933.62 1040.25 1164.44 Accumulated Depreciation 263.68 297.49 375.73 478.71 593.99 Net block 438.31 453.36 557.89 561.54 570.45 Capital WIP 27.75 128.61 120.31 168.69 204.01 Investments 82.00 55.06 55.36 72.82 98.98 Deferred tax asset 12.24 22.32 38.64 38.64 38.64 Inventories 4.11 5.23 8.51 14.67 17.84 Sundry debtors 453.85 564.35 605.99 704.04 874.12 Cash and bank balance 232.93 221.23 269.25 337.35 392.46 Other current assets 178.76 154.16 105.93 117.34 124.87 Loans and advances 108.88 197.15 214.85 293.35 374.62 Total current assets Current liabilities and provisions 978.52 1142.12 1204.53 1466.75 1783.93 418.11 453.42 595.65 701.79 833.61 Net current assets 560.41 688.69 608.89 764.96 950.32 1,120.71 1,348.04 1,381.07 1,606.64 1,862.39 Particulars FY13 FY14 FY15 FY16E FY17E Return on Equity 19.49 17.41 14.29 17.86 17.34 Return on Capital employed 26.77 24.04 18.98 24.70 24.55 Debt/Equity 0.01 0.00 0.00 0.01 0.01 Asset turnover 1.31 1.28 1.20 1.17 1.13 Current Ratio 2.34 2.52 2.02 2.09 2.14 Book value per share 181.63 218.10 222.37 258.55 300.10 Interest coverage 154.36 290.30 96.41 108.58 111.10 Uses of funds Ratios For Private Circulation Only 6 Hem Research www.hemonline.com Consolidated Quarterly Financial Highlights Rs. Crore Particulars Q3FY16 Q3FY15 Q2FY16 YoY% QoQ% Revenues 678.70 595.30 677.90 14.01 0.12 Expenditures 555.20 509.10 558.50 9.06 (0.59) Operating Profit 123.50 86.20 119.40 43.27 3.43 Adjusted Net Profit 75.40 48.20 68.30 56.43 10.40 1.3 --- --- --- --- Reported PAT 74.10 48.20 68.30 53.73 8.49 OPM% 18.20 14.48 17.61 372bps 59bps NPM % 11.11 8.10 10.08 301bps 103bps Adjusted EPS* 12.36 7.9 11.20 56.46 10.36 Exceptional item *Adjusted for current number of equity shares Past Price movement of the stock NIIT TECHNOLOGIES (545.0000, 559.7000, 461.0000, 492.2500, -59.7500) 650 650 600 600 550 550 500 500 450 450 400 400 350 350 300 300 250 250 200 200 150 150 100 100 50 50 0 0 2004 2005 For Private Circulation Only 2006 2007 7 2008 2009 2010 2011 2012 2013 2014 2015 2016 2017 Hem Research www.hemonline.com www.hemonline.com research@hemonline.com HEM SECURITIES LIMITED MEMBER-BSE,CDSL, SEBI REGISTERED CATEGORY I MERCHANT BANKER Sebi Registration No For Research Analyst: INH100002250 MUMBAI OFFICE: 14/15, KHATAU BLDG., IST FLOOR, 40, BANK STREET, FORT, MUMBAI-400001 PHONE- 0091 22 2267 1000 FAX- 0091 22 2262 5991 JAIPUR OFFICE: 203-204, JAIPUR TOWERS, M I ROAD, JAIPUR-302001 PHONE- 0091 141 405 1000 FAX- 0091 141 510 1757 GROUP COMPANIES HEM FINLEASE PRIVATE LIMITED MEMBER-NSE HEM MULTI COMMODITIES PRIVATE LIMITED MEMBER-NCDEX, MCX HEM FINANCIAL SERVICES LIMITED NBFC REGISTERED WITH RBI For Private Circulation Only 8 Hem Research www.hemonline.com Disclaimer & Disclosure: This document is prepared for our clients only, on the basis of publicly available information and other sources believed to be reliable. Whilst we are not soliciting any action based on this information, all care has been taken to ensure that the facts are accurate, fair and reasonable. This information is not intended as an offer or solicitation for the purchase or sell of any financial instrument and at any point should not be considered as an investment advise. Reader is requested to rely on his own decision and may take independent professional advise before investing. Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited, Directors and any of its employees shall not be responsible for the content. The person accessing this information specifically agrees to exempt Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited or any of its affiliates or employees from, any and all responsibility/liability arising from such misuse and further agrees to hold Hem Securities Limited, Hem Finlease Private Limited, Hem Multi Commodities Pvt. Limited or any of its affiliates or employees free and harmless from all losses, costs, damages, expenses that may be suffered by the person accessing this information due to any errors and delays. The companies and its affiliates, officers, directors, and employees, including persons involved in the preparation or issuance of this material may from time to time, have long or short positions in, and buy or sell the securities there of, company (ies) mentioned here in and the same have acted upon or used the information prior to, or immediately following the publication. Disclosure of Interest Statement Company Name 1. Analyst Ownership of the Stock No 2. Hem & its Group Company Ownership of the Stock Yes 3. Hem & its Group Companies’ Director Ownership of the Stock Yes 4. Broking relationship with company covered No Analyst Certification The views expressed in this research report accurately reflect the personal views of the analyst(s) about the subject securities or issues, and no part of the compensation of the research analyst(s) was, is, or will be directly or indirectly related to the specific recommendations and views expressed by research analyst(s) in this report. For Private Circulation Only 9 Hem Research