UITF Abstract 4 Presentation of long

advertisement

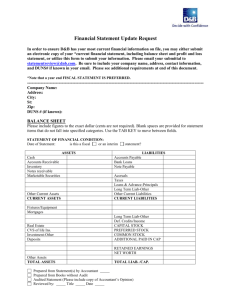

UITF Abstract 4 Presentation of long-term debtors in current assets The issue 1 Both for liabilities and for debtors the Companies Act requires a distinction to be drawn between the amounts payable or receivable within one year and those due to be settled or received after more than one year. Although the distinction is disclosed in the notes for each of the items forming part of debtors, (including prepayments and accrued income if included in debtors), unlike in the case of liabilities it is not required to be carried through to the total of current assets nor to the significant Format 1 sub-total of net current assets (liabilities). 2 In consequence, there is a certain imbalance between the items that the formats require to be classified under current assets or current liabilities. For example, a pension fund surplus (to the extent recognised in the balance sheet) could give rise to a prepayment forming part of net current assets (liabilities), whereas a deficiency would normally be shown as a provision under long-term liabilities. In some cases the period expected to be required for recovery of such an asset may be considerable, perhaps in excess of ten years. Other examples of long-term debtor items include much of the trade debtors of lessors and deferred consideration in respect of the sale of an investment or other fixed asset. Application to smaller entities 2A Reporting entities applying the Financial Reporting Standard for Smaller Entities currently applicable are exempt from this Abstract. UITF consensus 3 In most cases it will be satisfactory to disclose the size of debtors due after more than one year in the notes to the accounts. There will be some instances, however, where the amount is so material in the context of the total net current assets that in the absence of disclosure of debtors due after more than one year on the face of the balance sheet readers may misinterpret the accounts. The Task Force have agreed that, in such circumstances, the amount should be disclosed on the face of the balance sheet. Page 1 Date from which effective 4 The disclosure required by this consensus should be adopted in financial statements relating to accounting periods ending on or after 23 August 1992, but earlier adoption is encouraged. References Legislation Great Britain and Northern Ireland Companies Act 1985 and Companies (Northern Ireland) Order 1986 - Schedule 4 Balance Sheet Formats 1 and 2 including notes 5 and 6 Republic of Ireland Companies (Amendment) Act 1986, the Schedule, Balance Sheet Formats 1 and 2 including note 4 Accounting standards SSAP 21, ‘Accounting for leases and hire purchase contracts’ SSAP 24, ‘Accounting for pension costs’ International Accounting Standard 13, ‘Presentation of Current Assets and Current Liabilities’: EDITORIAL NOTE: NOT PART OF THE ABSTRACT Date of publication and subsequent amendments UITF Abstract 4 was issued on 22 July 1992. Paragraph 2A was inserted by the Financial Reporting Standard for Smaller Entities (FRSSE), issued November 1997, and amended by the FRSSE (effective march 1999) in December 1998. IAS 13, ‘Presentation of Current Assets and Current Liabilities’ was replaced by IAS 1 (Revised) ‘Presentation of Financial Statements’, issued August 1997. END OF EDITORIAL NOTE Page 2