under armour - MEGAN CAREY

advertisement

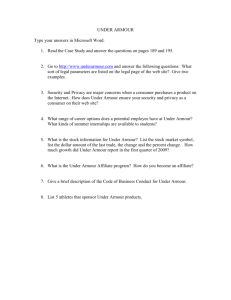

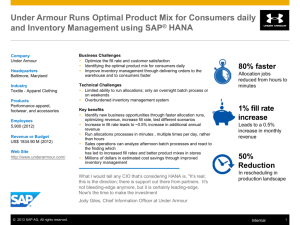

UNDER ARMOUR I. 1 TABLE OF CONTENTS Executive Summary……...……2 Company Analysis and SWOT Analysis.…….......3 Competition Analysis……....…4 Target Audience Profile...…...5 Research………………………..6-7 The Problem………….….....…..8 Gained Insights…………….……9 The Solution……………..……..10 Objectives……………….……….11 Budget………………………...….12 Media Strategy…………………13 Marcom and Ads….……..14-20 Media Plan……..…………...….21 Media Schedule..……………..22 Evaluation……………………….23 Credits………………………..….24 . I. EXECUTIVE SUMMARY Under Armour’s mission is to make all athletes better through passion, design and the relentless pursuit of innovation. Under Armour is a mature brand that manufactures highquality sports apparel and clothing. Through our research, we found that Under Armour has three problems: being known for only football, price, and mostly male consumers. Through our team’s research, we have discovered that our target audience loves the quality of the brand, but hates the price. However, members of the target audience love what the brand stands for: strength and performance. We have created advertisements which support this perception, which target women, and which emphasize the quality of the brand, all but eliminating Under Armour’s three problems. Our team placed these messages where they would be seen by the maximum amount of our target audience. 2 UNDER ARMOUR Analysis Under Armour was found to be predominantly a football company, and is attempting to be known as a basketball company as well. The large portion of Under Armour buyers are mostly football players. The Under Armour market needs to be expanded to all male and female athletes if Under Armour wants to keep up with competitors such as Nike and Adidas. In the past, Under Armour has mostly been targeting men. Under Armour is now focused on women and their activities, such as yoga, running, and spinning. Women's wear, in previous years, has been less than 20% of the overall business. Under Armour is becoming more stylish in order to attract more women to the brand. The percentage of profit generated from women grows little by little each year, but Under Armour needs to work harder if it wants to keep generating the same increases I. in sales and become a worldwide brand. The issue is still getting the gear in front of women. Under Armour CEO, Kevin Plank discussed that although Under Armour might be expensive; it is only because it is the best at answering the needs of athletes. He says the brand identifies the issues athletes may have and fixes them. With the footwear they are creating, he not only expects profits to go up, but he also hopes to expand internationally. •Established brand •Top sports brand •Variety of clothes (seasonal) •Good quality •Caters to all sports •Catchy, bright colors •Good reputation- no scandals. •Known as a strong brand Strengths Threats •Competition •Economy •Losing brand identity •Price •Gear limited to clothes and cleats Weakness Opportunities •Expand products to Under Armour equipment or soap for after workout freshness •Sponsor a large sporting event. •Advertise more- especially in commercials and fitness magazines •Partner with another widely recognized company- like Nike and Apple •Celebrity endorsements 3 COMPETITION ANALYSIS . Under Armour and Nike attempted to sell their cross trainers. This article explains that people who bought cross trainers are neither in Nike or Under Armour's target audience. However, it’s predicted that Under Armour will do particularly well during school months. This is a key piece of information about our target audience because a large piece of our target market are athletes going back to school ages 18-23. Source: Mullman, Jeremy. "Under Armour Hopes to Outrun Nike; Jumps into Declining Niche with Cross-trainer While Rival Disappoints." Lexis Nexis. Web. . Nike’s name is known internationally, mainly for their variety of shoes for every sport while Under Armour is known for their variety in athletic apparel. Regarding comparative strengths, Nike has the edge over the competition, Under Armour included, regarding sportswear and footwear, but Under Armour gained respect for their own line of merchandise. Under Armour is capitalized at $1.28 billion while Nike’s capitalization is $26.38 billion. 4 . TARGET MARKET: The target audience for Under Armour are adults, ages 18-39. The purchasers of sports clothing are men ages 18 to 35 and women ages 18 to 39. 76% of sports clothes consumers are Caucasian. Our target audience is on-the-go, commuting from work, running around the neighborhood, on the way to practice, or going to the gym. Under Armour’s target audience watches television shows such as USA Network, ESPN, FX, TBS, and the History Channel Monday through Friday, from 4:00-7:00 P.M. A few magazines the primary target audience reads are Fitness Magazine, Men’s Fitness, and ESPN Magazine. Half of the Target audience listens to the radio between 6-10 A.M. and 3-7 P.M. . 5 Sources: MRI Plus and Experian Simmons PRIMARY RESEARCH: Focus Group What are the following brands most known for? Nike: All sports Champion: Boxing Adidas: Soccer Under Armour: Football Under Armour vs. Competition: Under Armour has brighter colors. Under Armour makes better sneakers than Nike. Nike clothes wear out faster than Under Armour. Under Armour is more comfortable. Products have a better material; they absorb sweat and don’t smell as much. Target audience buys the following brands for these reasons: •Nike: buy for running sneakers, cleats, baseball gloves, running shorts, and socks. •Champion: Sweatshirts and sweatpants. •Adidas: Sneakers for show (to look nice in) and tracksuits •Under Armour: Compression shorts, shorts, and thermals. •Knockoff Brands: shirts that look like Under Armour. When members of the focus group walk into a store, they immediately go to: The participants go to the section of the store which is selling what they are looking for, and buy the cheapest, most dependable product. They will buy Under Armour if it is on sale. There is no strong sense of brand loyalty. Focus group members purchase clothing depending on the amount of time they need for it to last. Focus group members all agree that if they need something to last long, they will sacrifice price for clothing durability. 6 . . PRIMARY RESEARCH: Survey Our team randomly selected 14 people in our target audience to complete this survey. What This Means: This means that while many people own Under Armour clothes, there is not a large preference or brand loyalty toward Under Armour. However, if Under Armour quality and appearance were stressed in the advertising, people will be more likely to buy it. What would you change about Under Armour? Price 75% of active people said they wore Under Armour often. 50% 71% of active people think Under Armour is the leader in sports clothing and apparel. 29% of our target audience think Nike is the leader in sports clothing and apparel. 59% of out target audience own 10 or more Under Armour items. 12% 42% 8% 25% Nothing Quality of Under Armour 3% Excellent 43% Good 50% Normal 8% Which Brand Do You Prefer? 13% 50% 21% No preference Under Armour Nike Champion Puma 71% Love it Like it Indifferent 7 KEY FINDINGS: The Three Problems Reputation as Football Brand One of the important findings our research has provided is that Under Armour is mostly known for football. In the focus group, we found that many people did not associate Under Armour with running or other sports, except for football, and they didn’t even think to buy Under Armour for regular workout clothes. Price vs. Quality Another important, unearthed discovery is that while Under Armour is expensive, people will still buy it if they know that the clothes will last for a long time. While sales have been strong, it was determined in the focus group that quality was passed by word-of- mouth, not by advertising. Untapped Market 8 . . One last thing we have discovered through our research was that the women’s market in Under Armour is underdeveloped. Sales for the female department have inconsistently increased through the years. The one aspect about Under Armour for women that was frequently discussed in our focus group was the bright colors and the amazing comfort. This section of our target audience has potential to increase sales exponentially. Gained Insights . Primary and secondary research shows that the women’s market, until recently, has been untapped. Women really love the comfort of the material that allows them to work hard, as well as the bright colors that make them stand out at the gym, practice, or training. 9 . Primary Research shows that most adults like the strength that Under Armour exudes. The brand is perceived as motivational, tough, and strong, and research says to sell merchandise, it should be kept that way. THE BIG IDEAS Overachieve. Overreach. Overcome. This campaign was created to deal with the first problem Under Armour has: its football reputation. The “Overachieve. Overreach. Overcome.” campaign was developed to emphasize that Under Armour is not only used in football, but in the weight room or at practice for any and every sport. . Stand Out. Work Hard. The “Stand out. Work Hard.” campaign is for women and emphasizes the bright colors Under Armour has and shows that you can work hard in Under Armour clothes because they are durable and comfortable. 10 OBJECTIVES . Increase sales by 2% evaluated after four financial quarters. Increase woman’s market 2% evaluated by amount of women’s apparel sold at the end of four financial quarters. Increase brand awareness as apparel for all forms of sports and exercise, not just football and basketball . . 11 UNDER ARMOUR’S ADVERTISING BUDGET $91 Million Out Of Home Radio $100,405 $4.9 Million UNDER ARMOUR’S BUDGET Cable Print $160,080 $25 Million $25 Million Advertising $100 Million Public Relations Sales Promotions 12 MEDIA STRATEGY Under Armour’s strategy is to convince adults ages 18 to 39 to buy Under Armour, not Nike, Champion, Adidas, or Reebok because Under Armour has leading insulation technology and special sweat-absorbing materials in workout clothes. According to our secondary research, Under Armour users are not generally on the internet and are usually on-the-go. It is for this reason that Under Armour is advertising on billboards, subway trains, and bus station instead of mostly internet and print media. However, our research shows that in their free time, over 60% of our target audience watches ESPN and USA Network, reads Fitness Magazine, and listens to Z100. Under Armour will be advertising seasonally. In the first quarter , Under Armour will be advertising its ColdGear. In the second and beginning of the third quarter, Under Armour will execute campaigns with the same frequency using the same channels, only Under Armour will be advertising its running gear and will completely focus on women with the women’s campaign during the spring and summer months. The fourth quarter will feature ColdGear for the changing weather and back-to-school sports. . 13 . Sources: MRI Plus and Experian Simmons MARCOM: Internet . Twitter: •Tweet inspirational quotes. •Tweet daily fat-burning fitness routines •Tweet about people who lost weight while wearing Under Armour. •Retweet tweeted accomplishments. •Retweet twitpics of people using Under Armour Create a micro site. • Post workouts for specialized muscle groups. •Post a daily fat- burning routine separate for men an women •How to train yourself to run a 5K How to prepare for a marathon. •Have printer-friendly weight lifting recording templates •Online workout journal that can track progress and can be posted to Facebook, Pinterest, Twitter, Blogs Instagram: •Post pictures of weight lifters wearing Under Armour •Post pictures of famous athletes wearing Under Armour •Post fit, everyday people using Under Armour Products. 14 Bus Station#1 and #2 Advertisement . . 15 Bus Station #3 Advertisement Bill board #2 Advertisement . . 16 Radio Script for Z100 17 . . ANNOUNCER: PEOPLE EVERYWHERE WORK HARD DAILY, DEDICATING LARGE AMOUNTS OF TIME TO HEALTH AND FITNESS. UNDER ARMOUR SUPPORTS THIS FITNESS, AND WE THINK IT IS AN ACHIEVEMENT. UNDER AMROUR URGES YOU TO OVERACHIEVE AND RUN ONE MORE MILE. TO OVERREACH AND LIFT FIVE MORE POUNDS THAN THE DAY BEFORE. TO OVERCOME OBSTACLES PLACED BEFORE YOU. OVERACHIEVE. OVERREACH. OVERCOME. UNDER ARMOUR. Billboard #1 and Fitness Magazine Print Advertisement . 18 Subway Car Advertisement . . 19 Commercial Script for ESPN and USA network. . Challenge yourself to work like you never have before and stand out from your competition. Instill fear into your rivals and celebrate achievement. Turn “I can” into “I will” Under Armour challenges you to stand out and work hard. Will you? *Not what actual frames for video, just a rough idea of what it will look like. . 20 MEDIA PLAN: To effectively reach the maximum amount of people in our target audience of active 18-39 year-olds we used the following media channels: Radio: Our research shows that in New York City, the majority of our target audience listens to the z100 morning show on their way to and from work, or at the gym. Our team is running commercials during 6-10 A.M. and 3-7 P.M. Print: To reach 20% of our target market for women, we ran an ad in Fitness Magazine every month it comes out, so we can reach those active women who need a lot of workout clothes. Out Of Home: Our research shows that more than 50% of our target market is constantly on the go, traveling from one place to another. Our team put an ad on two billboards, three bus stations, and five subway cars. Our team felt that we would reach the maximum amount of people in our target market by out of home advertising. . Television: To reach the maximum amount of people in our target market, our team decided to run Under Armour commercials on two television networks, twice a night for three months. These two networks are USA and ESPN. Together, these commercials will reach a little over 63% of our target audience. Sources: MRI Plus and Experian Simmons 21 . MEDIA SCHEDULE 2014 April Mandatory dates 6 13 20 May 27 3 10 Reach June 17 24 3 10 17 24 Cost 31 Cable Citywide USA 25,000,000 ESPN 10,000,000 Citywide z100 237,000,000 Citywide Fitness 1,527,912 Citywide Billboards (2) 92,000,000 Bus Station (3) 126,000,000 Subway Ad (5) 225,000,000 $ 43,000,000.00 $ 48,000,000.00 Radio $ 100,405.00 $ 160,080.00 $ 1,400,000.00 $ 1,518,000 $ 2,025,000 $ - $ - $ - Print OOH Owned Media Impressions Twitter n/a Instagram n/a Microsite n/a 694,027,912 IMPRESSIONS: 694,027,912 *This schedule is for the second financial quarter. All quarters will have the same frequency due to Under Armour’s changing seasonal clothes 22 Copy Testing: EVALUATION “Tweets are good so people can interact with Under Armour” “Powerful: I like the challenge” “I think the radio ad was great and it had a lot of strength behind the words” “I like the bright color used. It is different and I think I would buy the product. I like the emphasis on the shorts. The shorts are my favorite clothing items from under armor and I think that they are represented well with the bright colors.” Monitoring Sales Figures: To determine how effective our advertisements are, our team will gather sales figures before the launching our campaigns. The campaigns will run for four financial quarters, and sales figures will be collected each quarter after the launch. These collected figures during the campaigns will be measured against the sales before the execution of the campaigns. . . “I like the vibrant colors and the contrast. The sneakers look great. I really like the ‘Stand Out, Work Hard slogan.” To see how members of Under Armour’s target audience would react to the images, commercials, and slogans of the campaigns, our team has created, we interviewed members of the target audience to see how the advertisements we put out would be perceived. 23 CREDITS: Special thanks to: Professor Smulowitz, Leonardo Fernandez, Mario Adajar, Corrine DiGiovine, Margaret Snare, Bret Williams, Marc Trignano, Richard Frazier, Tyler Savakinas, and Survey participants. The Team: Account Executive: Megan Carey Marketing Research Experts: John Heller and Molly Lenns Creative Directors: Fernando Borrego and Samantha Corveddu Media Placement Expert: Brian Burns Sources: MRI plus, Experian Simmons, Lexis-Nexis, EBSCO Host, SRDS, Google images, triathelon.org, and underarmour.com. . . 24