How will a stock split impact Under Armour's

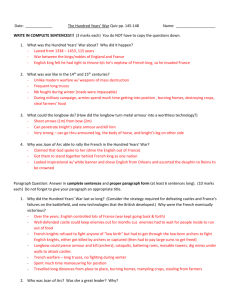

advertisement

How will a stock split impact Under Armour’s stockholders’ equity? On March 17, 2014, Under Armour, a company selling sports clothing, shoes, and accessories, announced a two-for-one stock split (see Under Armour press release dated March 17, 2014). Here is an excerpt from the Under Armour press release: “Baltimore, MD (March 17, 2014) – Under Armour, Inc. (NYSE: UA) today announced that its Board of Directors has approved a two-for-one stock split of its outstanding common stock. The stock split will be effected in the form of a stock dividend of one share of Class A Common Stock for each share of Class A Common Stock outstanding and one share of Class B Common Stock for each share of Class B Common Stock outstanding. The additional shares issued as a result of the stock split will be distributed on or about April 14, 2014 to stockholders of record on March 28, 2014.” Questions 1. What accounts will likely be debited and credited in the journal entry (if any) that Under Armour makes to record this stock split? 2. How does this stock split affect Under Armour’s stockholders’ equity? What specific accounts (if any) are affected by this stock split? 3. What is meant by “stockholders of record”? Page 1, Copyright © 2014 by Dr. Wendy Tietz, http://accountingintheheadlines.com/ This work is licensed under a Creative Commons Attribution-­‐NonCommercial 3.0 Unported License .