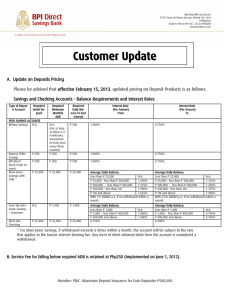

A. Update on Deposits Pricing Please be advised that

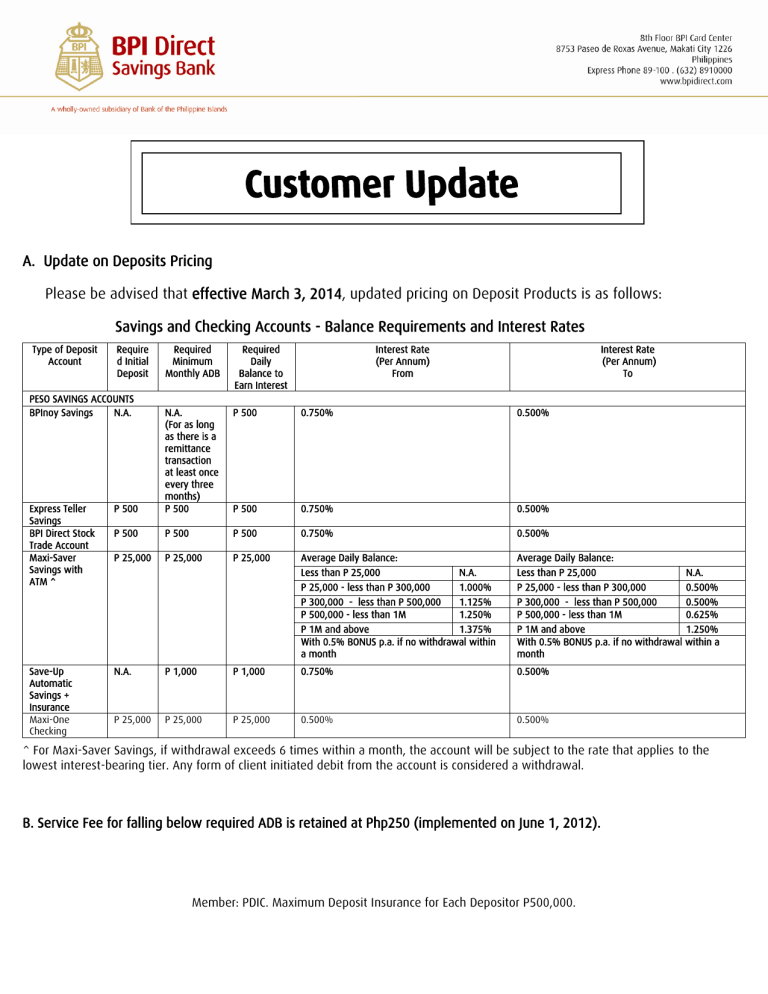

A. Update on Deposits Pricing

Please be advised that effective March 3, 2014, updated pricing on Deposit Products is as follows:

Type of Deposit

Account

Savings and Checking Accounts - Balance Requirements and Interest Rates

Require d Initial

Deposit

Required

Minimum

Monthly ADB

Required

Daily

Balance to

Earn Interest

Interest Rate

(Per Annum)

From

Interest Rate

(Per Annum)

To

PESO SAVINGS ACCOUNTS

BPInoy Savings N.A. P 500 0.750% 0.500%

P 500

N.A.

(For as long as there is a remittance transaction at least once every three months)

P 500 P 500 0.750% 0.500% Express Teller

Savings

BPI Direct Stock

Trade Account

Maxi-Saver

Savings with

ATM ^

P 500 P 500

P 25,000 P 25,000

P 500

P 25,000

0.750%

Average Daily Balance:

Less than P 25,000

P 25,000 - less than P 300,000

N.A.

1.000%

0.500%

Average Daily Balance:

Less than P 25,000

P 25,000 - less than P 300,000

P 300,000 - less than P 500,000 1.125%

P 500,000 - less than 1M 1.250%

P 1M and above 1.375%

With 0.5% BONUS p.a. if no withdrawal within a month

N.A.

0.500%

P 300,000 - less than P 500,000

P 500,000 - less than 1M

0.500%

0.625%

P 1M and above 1.250%

With 0.5% BONUS p.a. if no withdrawal within a month

Save-Up

Automatic

Savings +

Insurance

Maxi-One

Checking

N.A. P 1,000

P 25,000 P 25,000

P 1,000

P 25,000

0.750%

0.500%

0.500%

0.500%

^ For Maxi-Saver Savings, if withdrawal exceeds 6 times within a month, the account will be subject to the rate that applies to the lowest interest-bearing tier. Any form of client initiated debit from the account is considered a withdrawal.

B. Service Fee for falling below required ADB is retained at Php250 (implemented on June 1, 2012).

Member: PDIC. Maximum Deposit Insurance for Each Depositor P500,000.