Accounting Theory(1602722)

advertisement

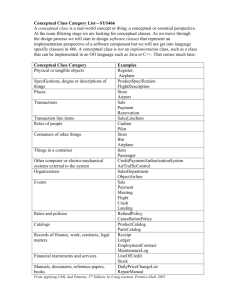

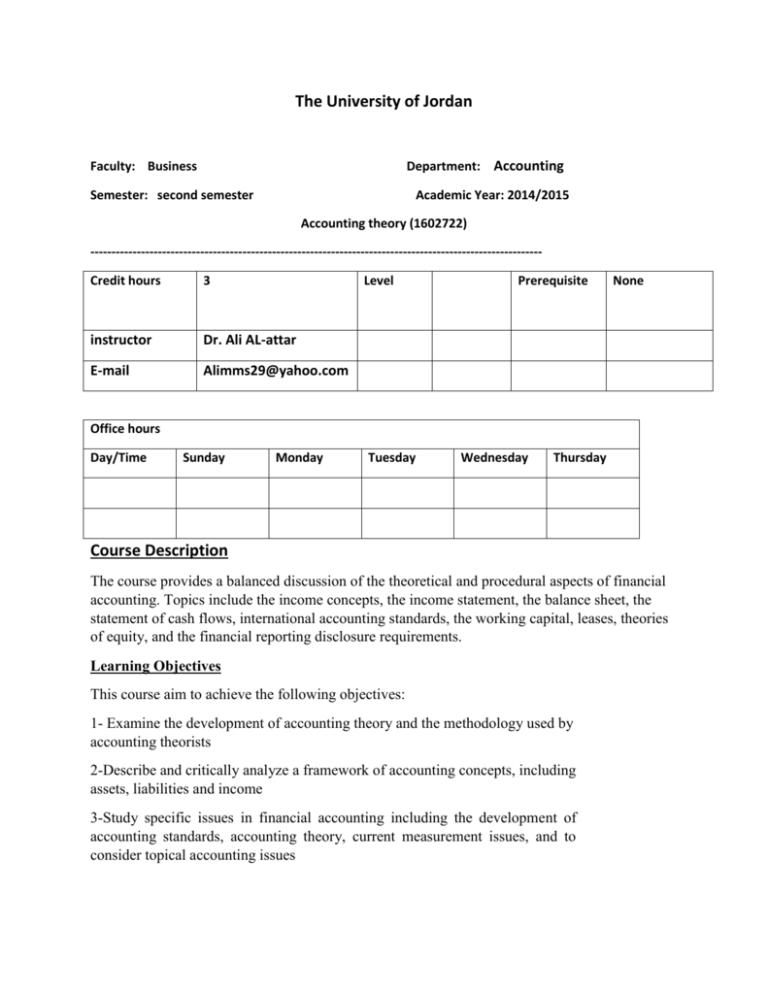

The University of Jordan Department: Accounting Faculty: Business Semester: second semester Academic Year: 2014/2015 Accounting theory (1602722) ----------------------------------------------------------------------------------------------------------Credit hours 3 Level instructor Dr. Ali AL-attar E-mail Alimms29@yahoo.com Prerequisite None Office hours Day/Time Sunday Monday Tuesday Wednesday Thursday Course Description The course provides a balanced discussion of the theoretical and procedural aspects of financial accounting. Topics include the income concepts, the income statement, the balance sheet, the statement of cash flows, international accounting standards, the working capital, leases, theories of equity, and the financial reporting disclosure requirements. Learning Objectives This course aim to achieve the following objectives: 1- Examine the development of accounting theory and the methodology used by accounting theorists 2-Describe and critically analyze a framework of accounting concepts, including assets, liabilities and income 3-Study specific issues in financial accounting including the development of accounting standards, accounting theory, current measurement issues, and to consider topical accounting issues Upon the completion of this course the students expected to 1-Understand the evolution of accounting thought and the conceptual framework of accounting and accounting organization attempts on the scientific nature of accounting and research methods 2- understand the development of conceptual framework project and accounting standard setting 3- To evaluate accounting policy alternatives with respect to the Conceptual Framework of the FASB, other accounting paradigms, and the point of view of the various accounting constituencies. Intended Learning Outcomes (ILOs): Successful completion of the course should lead to the following outcomes: A. Knowledge and Understanding: Student is expected to A1- Understand the evolution of accounting thought and the conceptual framework of accounting and accounting organization attempts on the scientific nature of accounting and research methods A2- understand the development of conceptual framework project and accounting standard setting A3- expose students to specific accounting practices in financial accounting and reporting B. Intellectual Analytical and Cognitive Skills: Student is expected to B1- To evaluate accounting policy alternatives with respect to the Conceptual Framework of the FASB, other accounting paradigms, and the point of view of the various accounting constituencies. B2-Be able to think critically about underlying theories, concepts, assumptions and arguments in accounting B3- Critically evaluate and discuss the role of positive accounting theory in explaining and predicting accounting policy choice, the behaviour of the capital markets and the behaviour of relevant individuals, including ethical issues that may arise. c.Subject- Specific Skills: Students is expected to C1- Be able to apply understanding of accounting principles and knowledge of accounting techniques to solve financial reporting problems C2- Apply a conceptual approach to the definition and measurement of assets, liabilities, income, expenses, and equity. C3- Discuss theoretical concepts and principles embodied in specific accounting standards D.Transferable Key Skills: Students is expected to D1- Be able to effectively utilize oral and written communication skills to further learning and impart understanding of accounting issues to others; andD2- Work effectively as a team member in analyzing marketing issues D2- Research, analyse and discuss contemporary financial accounting issues, formulate wellreasoned and coherent arguments and reach well-considered conclusions in relation to those issues. ILOs: Learning and Evaluation Methods ILO/s Learning Methods Evaluation Methods Teaching Method ILo/s Lectures and Discussions, Homework and Assignments, Projects, Presentation. Exam, Quiz, presentation, project, assignments. Course Contents Content Week ILO/s 1+2 A1 The Pursuit of the Conceptual MR- Ch 2 Framework 3+4 A2+B1+C2 INTERNATIONAL ACCOUNTING 5 A3+C3 Research Methodology And MR-Ch 4 Theories On The Uses Of Accounting Information 6+7 A1+B2+B3 INCOME CONCEPTS MR-Ch 5 8 B2+c1 Mid-term exam 8 MR-Ch.6 9 C3+C2+B1+A3 FINANCIAL STATEMENTS II MR-Ch. 7 10 C3+C2+B1+A3 WORKING CAPITAL MR-Ch. 8 11 C3+C2+B1+A3 THE DEVELOPMENT ACCOUNTING THEORY Financial Statements I: Reference OF MR**- Ch1 MR- Ch 3 The Income Statement LONG TERM ASSETS I: PROPERTY, PLANT AND EQUIPMENT MR-Ch. 9 12 C3+C2+B1+A3 LONG-TERM ASSETS II: MR-Ch.10 13 C3+C2+B1+A3 MR-ch.11 14 C3+C2+B1+A3 15 D1+D2 INVESTMENTS AND INTANGIBLES LONG-TERM LIABILITIES Presentation the projects Final Exam 16 *some adjustments could happen according to the weeks due to the exams, quizzes and the project due date. ** Main reference Projects and Assignments . Evaluation Evaluation Point % Midterm Exam 30 Project and Presentation 30 Quiz 0 Final Exam 40 Date Main Reference/s: Financial accounting theory and analysis : text and cases, RICHARD G. SCHROEDER , et al. 11 edition. References: 1- Financial Accounting Theory, Deegan, Craig . 2014 2- Financial Accounting Theory, Scott, William R., 2014 3- Understanding IFRS Fundamentals /International Financial Reporting Standards, Mirza, Abbas A. et al.2015 Notes: Concerns or complaints should be expressed in the first instance to the module lecturer; if no resolution is forthcoming, then the issue should be brought to the attention of the module coordinator (for multiple sections) who will take the concerns to the module representative meeting. Thereafter, problems are dealt with by the Department Chair and if still unresolved the Dean and then ultimately the Vice President.For final complaints, there will be a committee to review grading the final exam. For more details on University regulations please visit: http://www.ju.edu.jo/rules/index.htm