Intermediate Accounting, 11th Edition

Kieso, Weygandt, and Warfield

Chapter 2: The Conceptual

Framework

Prepared by

Jep Robertson and Renae Clark

New Mexico Sate University

Las Cruces, New Mexico

Chapter 2: The Conceptual

Framework

After studying this chapter, you should be able

to:

1. Describe the usefulness of a conceptual

framework.

2. Describe the FASB's efforts to construct a

conceptual framework.

3. Understand the objectives of financial

reporting.

4. Identify the qualitative characteristics of

accounting information.

Chapter 2: The Conceptual

Framework

5. Define the basic elements of financial

statements.

6. Describe the basic assumptions of accounting.

7. Explain the application of the basic principles

of accounting.

8. Describe the impact that constraints have on

reporting accounting information.

Objectives of the Conceptual

Framework

• The Framework was to be the

foundation for building a set of

coherent accounting standards and

rules.

• The Framework is to be a reference of

basic accounting theory for solving

emerging practical problems of

reporting.

Statements of Financial

Accounting Concepts

• The FASB has issued seven Statements of

Financial Accounting Concepts (SFACs) to

date (Statements 1 through 7.)

• These statements set forth major

recognition and reporting issues.

• Statement 4 pertains to reporting by nonbusiness entities.

• The other six statements pertain to

reporting by business enterprises.

Statements of Financial

Accounting Concepts

Statement

• Statement 1

• Statement 2

• Statement 6

• Statement 4

• Statement 5

• Statement 7

Brief Title

• Objectives of Financial

Reporting (Business)

• Qualitative

Characteristics

• Elements of Financial

Statements (replaces 3)

• Objectives of Financial

Reporting (Non-business)

• Recognition and

Measurement Criteria

• Using Cash Flows

Overview of the Conceptual

Framework

The Framework has three different

levels,comprised of:

• The first level consists of objectives.

• The second level explains financial elements

and characteristics of information.

• The third level incorporates recognition and

measurement criteria.

Conceptual Framework for

Financial Reporting

Basic Objectives of Financial

Reporting

To provide information:

• about economic resources, the claims on

those resources and changes in them.

• that is useful to those making investment

and credit decisions.

• that is useful to present and future

investors, creditors in assessing future cash

flows.

• to individuals who reasonably understand

business and economic activities.

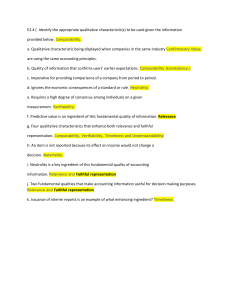

Hierarchy of Accounting Qualities

Qualitative Characteristics of

Accounting Information

• Primary qualities of accounting information

are relevance and reliability.

• Secondary qualities are comparability and

consistency of reported information.

Primary Characteristic of

Accounting Information:

Relevance

“Relevance of information means information

capable of making a difference in a decision

context.”

Ingredients of relevant information are:

• Timeliness

• Predictive value

• Feedback value

Primary Characteristic of

Accounting Information:

Relevance

Information is reliable when it can be relied on

to represent the true, underlying situation.

The ingredients of reliable information are:

• verifiability

• representational faithfulness

• neutrality (unbiased)

Secondary Characteristics of

Accounting Information

Comparability: the similar measurement and

reporting for different enterprises.

Consistency: application of the same

accounting treatment to similar events by an

enterprise period to period.

Basic Elements of Financial

Statements

•

•

•

•

Assets

Liabilities

Equity

Investment by

Owners

• Distributions

to Owners

• Comprehensive

Income

• Revenues

• Expenses

• Gains

• Losses

Recognition and Measurement

Criteria

Basic

Assumptions

1. Economic

entity

2. Going

concern

3. Monetary

unit

4. Periodicity

Principles

1. Historical

cost

2. Revenue

recognition

3. Matching

4. Full

disclosure

Constraints

1. Cost benefit

2. Materiality

3. Industry

practices

4. Conservatism

COPYRIGHT

Copyright © 2004 John Wiley & Sons, Inc. All rights reserved.

Reproduction or translation of this work beyond that permitted

in Section 117 of the 1976 United States Copyright Act without

the express written permission of the copyright owner is

unlawful. Request for further information should be addressed

to the Permissions Department, John Wiley & Sons, Inc. The

purchaser may make back-up copies for his/her own use only

and not for distribution or resale. The Publisher assumes no

responsibility for errors, omissions, or damages, caused by the

use of these programs or from the use of the information

contained herein.