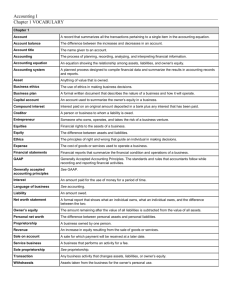

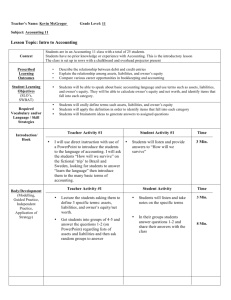

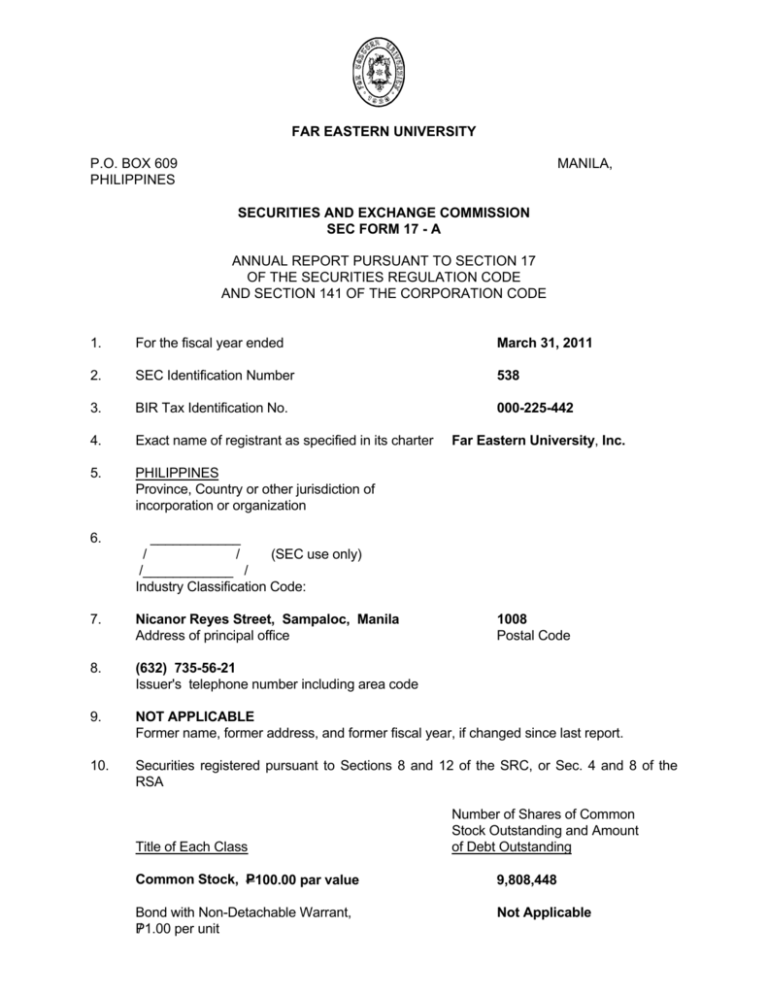

Far Eastern University – Annual Report

advertisement