SLFC North American - Sun Life Financial of Canada

advertisement

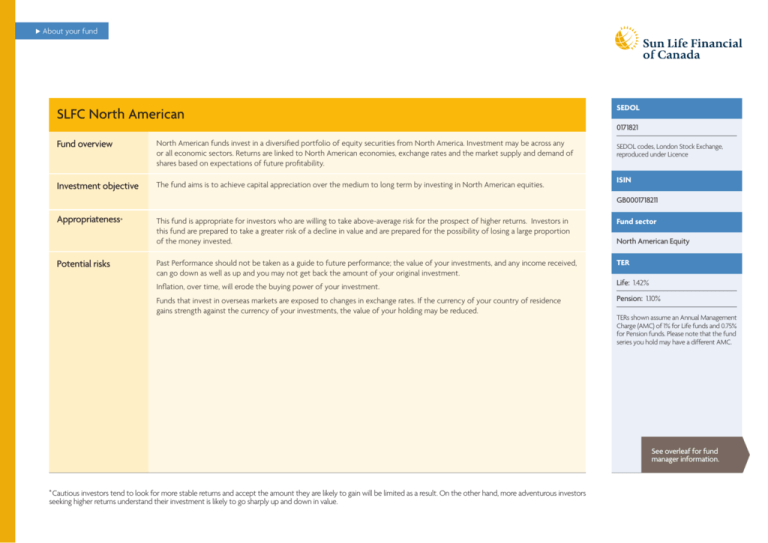

A bout your fund SLFC North American SEDOL 0171821 Fund overview North American funds invest in a diversified portfolio of equity securities from North America. Investment may be across any or all economic sectors. Returns are linked to North American economies, exchange rates and the market supply and demand of shares based on expectations of future profitability. Investment objective The fund aims is to achieve capital appreciation over the medium to long term by investing in North American equities. SEDOL codes, London Stock Exchange, reproduced under Licence ISIN GB0001718211 Appropriateness* Potential risks This fund is appropriate for investors who are willing to take above-average risk for the prospect of higher returns. Investors in this fund are prepared to take a greater risk of a decline in value and are prepared for the possibility of losing a large proportion of the money invested. Fund sector Past Performance should not be taken as a guide to future performance; the value of your investments, and any income received, can go down as well as up and you may not get back the amount of your original investment. TER Inflation, over time, will erode the buying power of your investment. Funds that invest in overseas markets are exposed to changes in exchange rates. If the currency of your country of residence gains strength against the currency of your investments, the value of your holding may be reduced. North American Equity Life: 1.42% Pension: 1.10% TERs shown assume an Annual Management Charge (AMC) of 1% for Life funds and 0.75% for Pension funds. Please note that the fund series you hold may have a different AMC. See overleaf for fund manager information. * Cautious investors tend to look for more stable returns and accept the amount they are likely to gain will be limited as a result. On the other hand, more adventurous investors seeking higher returns understand their investment is likely to go sharply up and down in value. About the fund manager Fund manager MFS Investment Management Fund manager website www.mfs.com MFS Investment Management is a global investment firm managing equity, fixed income and quantitative strategies for investors worldwide. Founded in 1924, MFS established one of the industry’s first in-house fundamental research departments in 1932. Today, MFS offers a broad range of investment styles that combine both fundamental and quantitative research and portfolio management. Its investment philosophy has remained consistent: to identify opportunities on behalf of clients through the application of global research and bottom-up security selection. As of 31 July 2015, MFS managed $446.3bn* of assets globally. MFS Investment Management, a US based asset investment adviser, is a wholly owned subsidiary of Sun Life Financial, Inc. MFS International (UK) Ltd., an indirect subsidiary of MFS, provides investment management products and services in the UK, and is authorised and regulated by the Financial Conduct Authority. *Source: MFS Investment Management July 2015. Fund manager investment process MFS believes that the consistent application of a disciplined, bottom-up research process provides opportunities to exploit market inefficiencies. We believe that fundamental research and quantitative research are complementary. We also believe that the inherent strengths of one type of research generally offset the inherent weaknesses of the other and the systematic combination of these two independent stock selection processes has the potential to generate superior, risk-adjusted returns over a full market cycle. The disciplined portfolio construction process seeks to maximize expected return relative to risk. The portfolio managers attempt to maximize exposure to stocks that are the most attractive based on MFS’ fundamental and quantitative research while attempting to minimize non-stock specific risks by maintaining relatively tight parameters at the stock, industry, and sector levels. Sun Life Assurance Company of Canada (U.K.) Limited, incorporated in England and Wales, registered number 959082, registered office at Matrix House, Basing View, Basingstoke, Hampshire, RG21 4DZ, trades under the name of Sun Life Financial of Canada and is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority. MC00000372/0916 SL3692 - 09/15