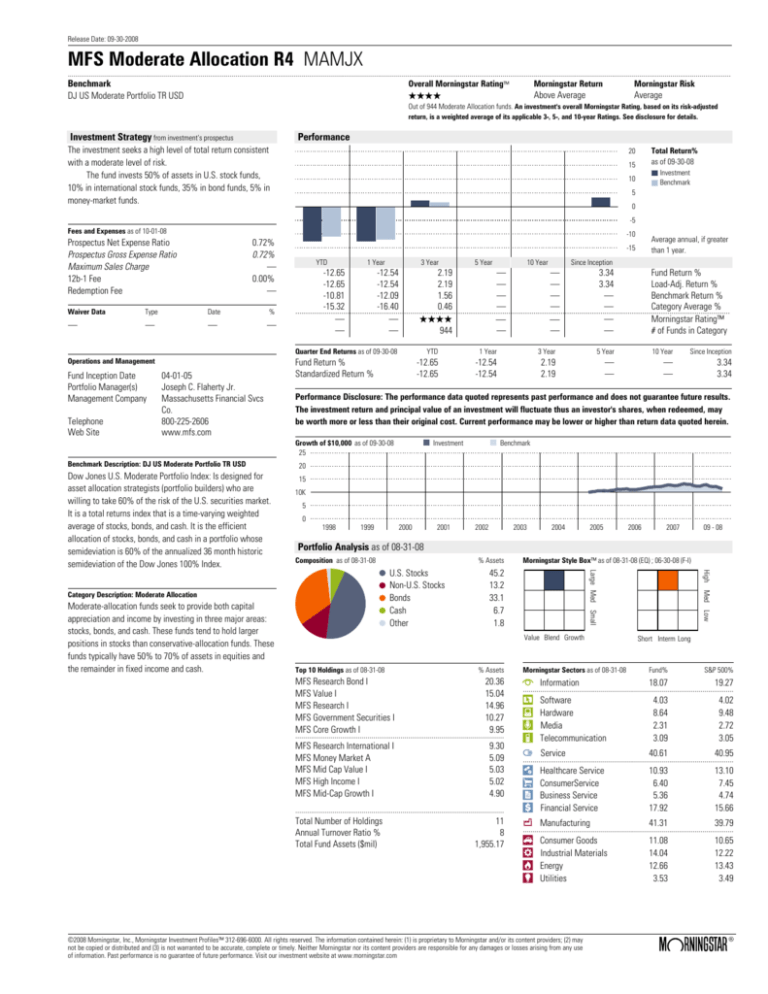

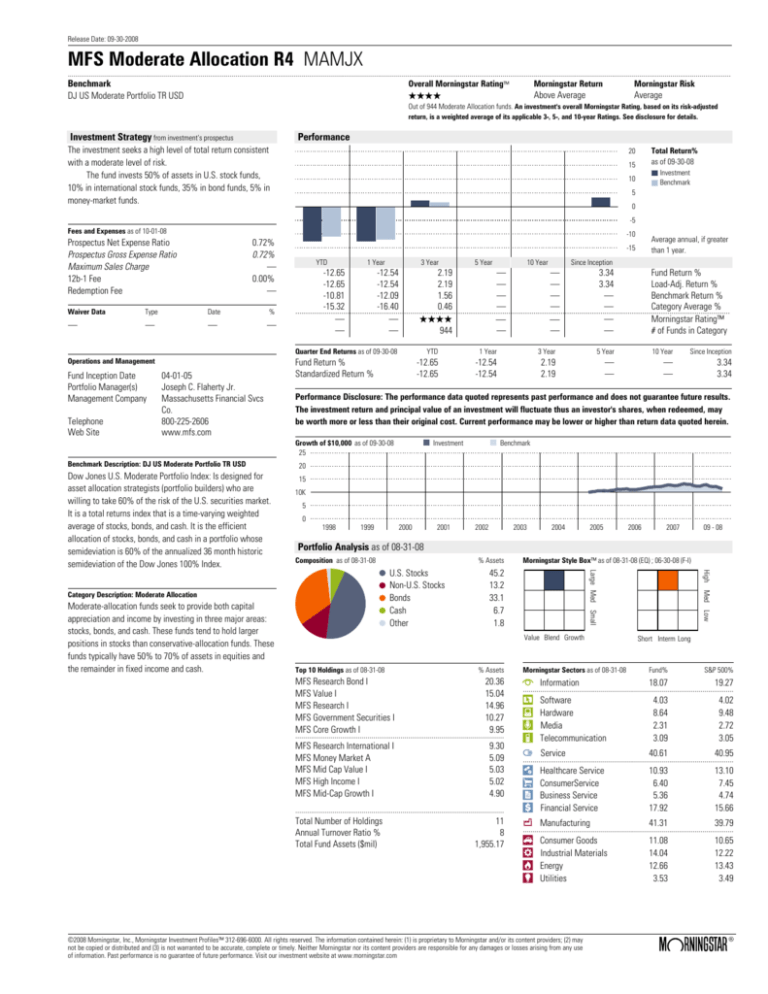

Release Date: 09-30-2008

MFS Moderate Allocation R4 MAMJX

....................................................................................................................................................................................................................................................................................................................................................

Overall Morningstar Rating™

Morningstar Return

Morningstar Risk

Benchmark

DJ US Moderate Portfolio TR USD

Above Average

QQQQ

Average

Out of 944 Moderate Allocation funds. An investment's overall Morningstar Rating, based on its risk-adjusted

return, is a weighted average of its applicable 3-, 5-, and 10-year Ratings. See disclosure for details.

Investment Strategy from investment's prospectus

Performance

The investment seeks a high level of total return consistent

with a moderate level of risk.

The fund invests 50% of assets in U.S. stock funds,

10% in international stock funds, 35% in bond funds, 5% in

money-market funds.

Total Return%

as of 09-30-08

20

15

Investment

Benchmark

10

5

0

-5

Fees and Expenses as of 10-01-08

Prospectus Net Expense Ratio

Prospectus Gross Expense Ratio

Maximum Sales Charge

12b-1 Fee

Redemption Fee

0.72%

0.72%

.

0.00%

.

Waiver Data

Type

Date

%

.

.

.

.

-10

YTD

1 Year

3 Year

Fund Inception Date

Portfolio Manager(s)

Management Company

Telephone

Web Site

04-01-05

Joseph C. Flaherty Jr.

Massachusetts Financial Svcs

Co.

800-225-2606

www.mfs.com

Fund Return %

Standardized Return %

Dow Jones U.S. Moderate Portfolio Index: Is designed for

asset allocation strategists (portfolio builders) who are

willing to take 60% of the risk of the U.S. securities market.

It is a total returns index that is a time-varying weighted

average of stocks, bonds, and cash. It is the efficient

allocation of stocks, bonds, and cash in a portfolio whose

semideviation is 60% of the annualized 36 month historic

semideviation of the Dow Jones 100% Index.

Since Inception

YTD

1 Year

3 Year

5 Year

10 Year

Since Inception

-12.54

-12.54

2.19

2.19

.

.

.

.

3.34

3.34

Performance Disclosure: The performance data quoted represents past performance and does not guarantee future results.

The investment return and principal value of an investment will fluctuate thus an investor's shares, when redeemed, may

be worth more or less than their original cost. Current performance may be lower or higher than return data quoted herein.

Investment

Benchmark

20

15

10K

5

0

1998

1999

2000

2001

2002

2003

2004

2005

2006

2007

09 - 08

Portfolio Analysis as of 08-31-08

Composition as of 08-31-08

% Assets

Morningstar Style Box™ as of 08-31-08 (EQ) ; 06-30-08 (F-I)

20.36

15.04

14.96

10.27

9.95

MFS Research International I

MFS Money Market A

MFS Mid Cap Value I

MFS High Income I

MFS Mid-Cap Growth I

9.30

5.09

5.03

5.02

4.90

...........................................................................................................

...........................................................................................................

Total Number of Holdings

Annual Turnover Ratio %

Total Fund Assets ($mil)

11

8

1,955.17

Low

% Assets

MFS Research Bond I

MFS Value I

MFS Research I

MFS Government Securities I

MFS Core Growth I

Med

Small

Value Blend Growth

Top 10 Holdings as of 08-31-08

High

45.2

13.2

33.1

6.7

1.8

Large Med

U.S. Stocks

Non-U.S. Stocks

Bonds

Cash

Other

Category Description: Moderate Allocation

Moderate-allocation funds seek to provide both capital

appreciation and income by investing in three major areas:

stocks, bonds, and cash. These funds tend to hold larger

positions in stocks than conservative-allocation funds. These

funds typically have 50% to 70% of assets in equities and

the remainder in fixed income and cash.

10 Year

-12.65

-12.65

Growth of $10,000 as of 09-30-08

25

Benchmark Description: DJ US Moderate Portfolio TR USD

5 Year

-12.65

-12.54

2.19

.

.

3.34

Fund Return %

-12.65

-12.54

2.19

.

.

3.34

Load-Adj. Return %

-10.81

-12.09

1.56

.

.

.

Benchmark Return %

-15.32

-16.40

0.46

.

.

.

Category Average %

................................................................................................................................................................................................................

.

.

.

Morningstar Rating™

QQQQ

.

.

.

.

944

.

.

.

# of Funds in Category

Quarter End Returns as of 09-30-08

Operations and Management

Average annual, if greater

than 1 year.

-15

Short Interm Long

Morningstar Sectors as of 08-31-08

Fund%

S&P 500%

h Information

18.07

19.27

4.03

8.64

2.31

3.09

4.02

9.48

2.72

3.05

40.61

40.95

10.93

6.40

5.36

17.92

13.10

7.45

4.74

15.66

41.31

39.79

11.08

14.04

12.66

3.53

10.65

12.22

13.43

3.49

............................................................................................................

r

t

y

u

Software

Hardware

Media

Telecommunication

j Service

............................................................................................................

i

o

p

a

Healthcare Service

ConsumerService

Business Service

Financial Service

k Manufacturing

............................................................................................................

s

d

f

g

Consumer Goods

Industrial Materials

Energy

Utilities

©2008 Morningstar, Inc., Morningstar Investment Profiles™ 312-696-6000. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may

not be copied or distributed and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use

of information. Past performance is no guarantee of future performance. Visit our investment website at www.morningstar.com

!"#### !"#### $

$

$ %

&

!"#### $ '

!"#### $ ( )

$ $ $ $ * )

+

)

%

$ ,--

$

$ %( $ +./* $ ) ( )

( ( $ $ $ !"## $ 0

1

2 $ $

/ & &

3 0 2 2

%

& 45 (

$ 6 $ 4 $ "# 5 (%

&

$, / "#7 $ 8 459 ::87 $ ; 4$ $59 <87 < 4$59 ::87 $ :

4= $59 "#7 " 4'5 3$ 2 $ $ % $% "#% 6 $

(% 4 >#%

5 & / * "#7 2 ::87 $ $ <87 $ ::87 = $ "#7 ' 2 4% $% "#%5 $

$ +

$ $ 6 $ / * "#7 ( ' 2( ::87

= $ <87 $ ::87

$ $ "#7 2( 4% $% "#%5 $

$ +

'? '

%?$

$ . %

$%% $

. 0 , "# $ $% $ @$ $ $ ( $ $ $ ( & '% % $ ?

$ @$ +

%/ $ A =

+

$ *

B $ $ ) / $ &

$ +

% %) 0

C

D = $

= $ ) 45 = 45 E0 $ $

+ == %

&( + === %

&( + E0 $ A

=== 3 =

$ ?

* $ 1 / % %

$ $

$ % ( % ( 1 $ ( $ $ ?

D $

1 $ $

$ $ 4

G:##H / /$ DI <":%J>J%J### $

, 4"5 - $

9

4:5 4<5 A $

D K $ $5 45 $

( *1 =(

, ( $ (%1

, ' 0 (

1 (

( ( 1

;#7 1 ( % <#7 % :#7 % F7 % %

0 = $ 6 $

+ ) % $ $ (

1 ( $ ) 1 $ 4$ 5 $ 6 4

5 . %

$% 6 $

$ $ $$ ( (

( (

( $ /$ ( (

$ $ $ $$ ( ( $ & $ % (

$ $ $$ ( $

$ $ ( $$ ( 0 $ ( %

% ( $

( $ $ ( $

$ $ ( 1 !"#

$$ ( $ )

!" #

$ $ %

4

&( 5 $$ ( ) $ $ $ ( $ +

$ $$ ( $ ( $

/$ & $ $

! "

# $ "" %&'((&')*&+',)#

#