Mutual fund- Problems, prospects and challenges

advertisement

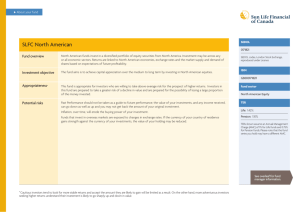

Mutual fund- Problems, prospects and challenges Financial Express, Thursday, 16 May 2013 Md Toufique Hossain Mutual fund (MF) is a very useful investment mechanism in a capital market. A developed capital market consists of varieties of investment instruments and MF is one of them. But the share of mutual funds in Bangladesh's capital market is very low. The market is fully equitybased and there is little scope to introduce any new financial instrument. That's why a rapid development has not happened in the MF sector all. But MF can be a good investment alternative in this undiversified market. What is mutual fund: A mutual fund is an investment vehicle that is made up of a pool of funds collected from many investors for the purpose of investing in securities such as stocks, bonds, money market instruments and similar assets. Mutual funds are operated by money managers, also known as portfolio managers, who invest such fund's capital and attempt to produce capital gains and income for their investors. A mutual fund's portfolio is structured and maintained to match the investment objectives stated in its prospectus. The portfolio managers apply their investment management skills and necessary research works to ensure secured return of investors' investment. Mutual funds in Bangladesh: Bangladesh has a very small market for mutual funds. As of 2012, there were 41 MFs in the country's capital market. For them, MF rules were framed by the Securities and Exchange Commission (SEC). Under the rules, a fund consists of one sponsor/entrepreneur, one trustee and obviously a fund manager. It is required for every such company to get permission of the SEC before proceeding with its fund allocation process. Performance of MFs: If we look at the performance of MFs in four consecutive years-2009, 2010, 2011 and 2012, we see that the NAVs (Net Asset Value) of MFs, as in Table 1, hit skyhigh in 2010. The unusual rise in NAVs was not natural. It happened, when the share market saw formation of a bubble that ultimately burst and investors were affected. Though the NAVs in 2009 were not that high, still it was really a potential year for the capital market compared to 2010, 2011 and even 2012. The rise in NAVs then was quite natural. So it is clear that the overall performance of MFs in the fiscal year 2009 in view of NAV was comparatively good. Here NAV is a very good indicator, because, if the dividend rate and the profit margin of an MF change, its NAV also changes. The growth scenario of MFs: Let us have a look at the overall growth of MFs during the period of 2009 to 2012. In 2009, the number of MFs was 19. In 2010 the number rose to 31. That means only 12 MFs entered the market in the year. In 2011, the number of MFs rose to 37 and in 2012, it stood at 41. The figures show a gradual fall in the number of MFs entering the market during the period of four years. However, in terms of issued capital and certificates of MFs, this particular sector was quite inactive in 2009 and 2010 as seen in Graph-1. During the period the number of MFs was low, though there should be at least 50 MFs in the market. The total number of MFs in 2009 was 19 while 385 certificates were issued and the issued capital was Tk 4,217 million only. In 2010 the number of certificates issued was 1,340 and the issued capital Tk 13,715 million. In 2011 and 2012, the MFs' performance slightly improved in terms of the number of certificates and the issued capital. But the total number of MFs did not improve that much. Source: Writer's own calculation based on weighted average During the crisis period of the capital market in 2010 both market capitalisation and turnover of MFs were lower in percentage points, compared to 2009, as is seen in the Graph-2. But it was gradually improving from 2011. In 2009 the turnover of MFs was 5.09 million, in 2010 it declined to 1.90 million and in 2011 it slightly improved to 3.49 million. On the other hand, the percentage of MFs' market capitalisation was 4.33 in 2009, 1.41 in 2010 and 1.61 in 2011. So it is clear that the percentage has seen a gradual fall and it is an ominous sign for the market. However, the market of MFs in 2012 gives some positive signals. As seen in Table-2, though the dividend declaration decreased in 2012 compared to 2011, the price-earnings (P/E) ratio increased while the EPS (earnings per share) fell. The MFs on the DGEN (DSE General Index) also saw a positive trend. The latter three indicators give positive signals about the market of MFs. In such a situation focus needs to be more and more on how to make further improvement in those areas. Actually, our MF and bond markets are not that developed despite immense potential. We need to explore this opportunity to reduce the banking sector's dominance in the capital market. Table-2: Market review of mutual funds The unusual surge in MFs' prices: As already mentioned, the MF sector in Bangladesh's capital market is mostly inactive. In this rigid capital market during the period of early 2010-late 2011 the prices of MFs were sky-high. Many corrupt companies took this advantage to invest Tk 16.835 billion (1,683.50 crore) in MFs through placement business (see Table 3). Though the related rules provide for investment of maximum 75 per cent of an MF's fund in the capital market, none of the MFs followed the rules. As a result, the NAV of MFs went down and thus the market of MFs crashed due to inefficient fund management. source: Jounal of The Institute of Share Research, Bangladesh;Page: 13; Vol 5; 25 April, 2011 The success and failure of MFs completely depend on the portfolio managers. But, the portfolio managers proved to be unreliable and the corrupt placement business destroyed the sector while the profits went into the companies' pockets. Furthermore, whether the money was invested in the market or not is totally unknown. The issue of Bangladesh Fund: Previously the government had decided to form an exclusive mutual fund to conduct key trading in the market. In this regard, an open-ended mutual fund titled 'Bangladesh Fund' was formed under the sponsorship of the Investment Corporation of Bangladesh (ICB) and seven other state-owned banks. This fund formally started its operation on May 05, 2011. Its target was to divest shares worth Tk 50 billion (5,000 crore). But there arose a question as to how transparently and efficiently the mutual fund would be managed, when the existing fund management was not that encouraging, particularly, when most of the shares were overvalued. In Graph-3 we see how irrationally the graph of the Dhaka Stock Exchange transactions moved in a month in 2011 after announcement of the Bangladesh Fund package. So, the fund could not help stabilise the market, rather it created an artificial demand in the market. Source: DSE & author's own calculation Finally, if you are a less risk-taker and long-term investor, you can consider investing in MFs. Skilled managers are supposed to be involved in mutual fund management and they are supposed to run the MFs based on extensive research work to minimise investors' risks by investing their money in different shares. To conclude, the main reason of the MF market lagging behind is that most of the funds are close-ended. That means the MF shares mature in a specific period of time. Buying and selling of open-ended MFs are different from those of close-ended MFs. The number of open-ended MFs in the market is very small. There should be more open-ended MFs alongside the close-ended ones. More MFs in the market can reduce the capital market's too much dependence on the banking sector. The writer, a stock market analyst, is now serving as a young professional at BRAC International Finance. toufique2010@gmail.com