Competition in Mobile Financial Services In Bangladesh

advertisement

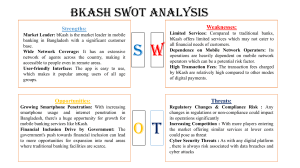

Competition in Mobile Financial Services In Bangladesh The journey of Mobile Financial Services (MFS) is on its 5th year. Many players are in the market and doing their best to take the vision forward. MFS Vision in Bangladesh • Provide mobile phone based financial service through a broad based agent network. • Ensure security and convenience in monitory transactions. • Promote access to formal financial services at affordable cost especially for the poor and unbanked population segment. MFS in Bangladesh (database) • MFS Method in Bangladesh: Bank-led model. • Regulator Form: Bangladesh Bank (Central Bank). • No of Approved Bank for MFS: 28. • No of Bank started to Provide the Service: 20. • No of Agents: .54 million (Oct, 2015). • No of Registered Clients (lac): 30 million (Oct, 2015). • No. of daily average transaction: 3.57 million (Oct, 2015). • Average daily transaction (in BDT): 4.34 billion equivalent Us $ 54 million (Oct, 2015). MFS Achievements in Bangladesh Financial Inclusion: Agent based financial service is a more feasible option than setting up bank branches in the 68,000 villages of the country to serve the country’s largely unbanked population. Bringing Rural Sales into Banking Channel: Brings idle cash in millions of shops in rural areas into the banking channel. Cost-cutting: Mobile technology lowers the high cost of bank terminals (by almost 90 percent). Time Saving: The use of automated delivery channels saves time for customers as well as bank staff. Discouraging Cash Transfer: Electronic payments lower the risks of corruption and leakages by increasing transparency. MFS Service Providers in Bangladesh Together with the regulator, most of MFS are doing their best to make a place in the market share Dutch Bangla Bank Mobile Banking IFIC Mobile Banking United Commercial Bank UCash mCash bKash Limited EXIM Bank MFS Service Providers in Bangladesh (Cont..) SureCash Hello Cash Bangla Cash Hello MFS Market Competition-At a Glance… 1. India Visa Processing fee collection through Ucash 2. Cricket Tournament Ticketing through Ucash IFIC Bank Limited had their press advertisements keeping bangla menu as their key strength point for MFS. IFIC Bank Limited has recently signed a mobile banking agreement with Independent Television Limited (ITV) at the latter's office in the city for disbursing the ITV district correspondents salary through the bank FSIBL FirstPay SureCash launched Dhaka WASA bill payment service. MD of Dhaka WASA Engineer Taqsem A Khan and MD of First Security Islami Bank launched the service. Jessore Municipality citizens can pay Water Bill & other Taxes through Mobile Banking Services of First Security Islami Bank Limited Even Some operators are trying to get all out to grab the market share Agent locations having no exclusivity.. … Why bKash is in a Lead Position in the Industry? - bKash is a specialized organization to deliver MFS. - bKash has done an extraordinary work in familiarizing mobile banking in Bangladesh. It has done so awesome that bKash has become the synonym for mobile money transaction. - The distinguishing difference between bKash and other MFS providers is in its focus. It is a company that does only MFS and is especially focused on the unbanked masses. - bKash is doing better than its competitors because it is mandated to provide only financial services through a dedicated workforce and cannot afford to move away from its MFS focus. Why bKash is in a Lead Position in the Industry?(Cont..) - A total 15,000 agents all over the country are trained as financial agents of bKash. - A shared vision for scale among a diverse investor group. - An enabling and flexible regulatory environment. - bKash has already established it’s transparency. ensured Safe and secure transaction, easily available agent network. Better the Competition Better is the Performance As we speak, some operators are spending more than bKash in media and have more variety in services, paving the way for a stronger industry. We welcome all such initiatives from all the industry players and believe together we will be able to achieve the best of financial inclusion. Thank You