2014 Annual Information Form

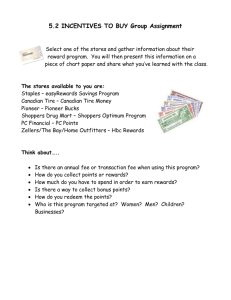

advertisement