An entrepreneurial mechanical engineer started a tire

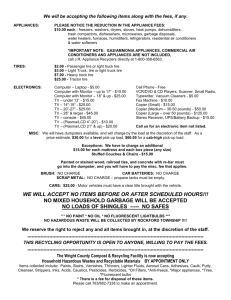

advertisement

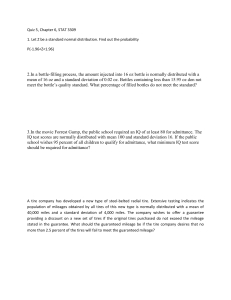

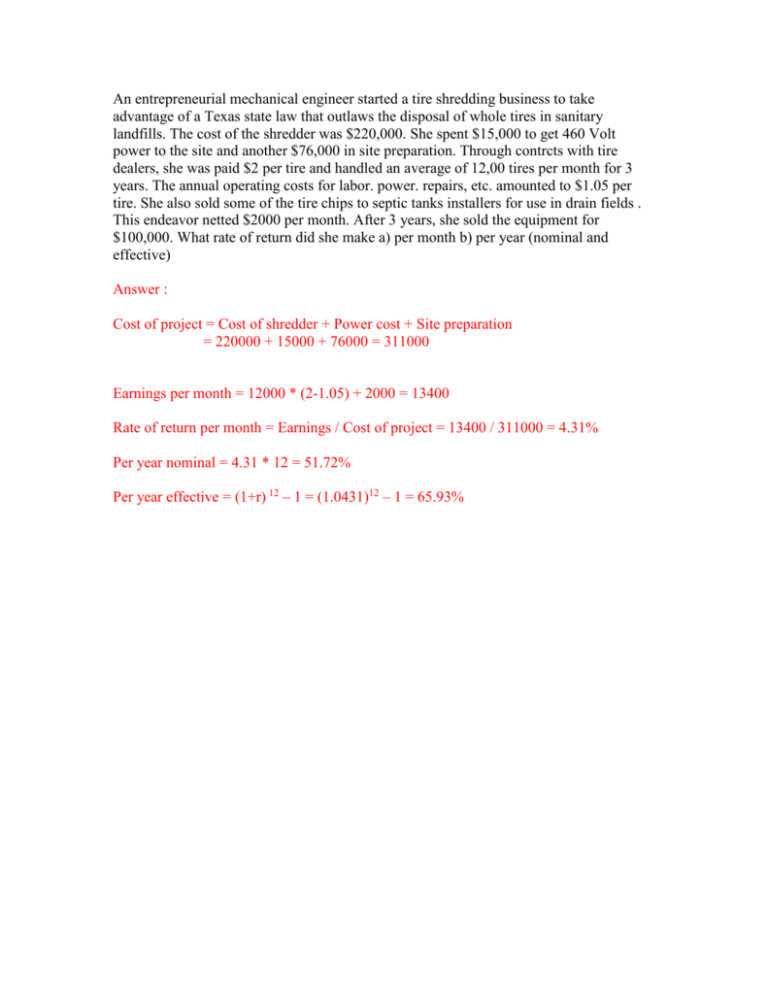

An entrepreneurial mechanical engineer started a tire shredding business to take advantage of a Texas state law that outlaws the disposal of whole tires in sanitary landfills. The cost of the shredder was $220,000. She spent $15,000 to get 460 Volt power to the site and another $76,000 in site preparation. Through contrcts with tire dealers, she was paid $2 per tire and handled an average of 12,00 tires per month for 3 years. The annual operating costs for labor. power. repairs, etc. amounted to $1.05 per tire. She also sold some of the tire chips to septic tanks installers for use in drain fields . This endeavor netted $2000 per month. After 3 years, she sold the equipment for $100,000. What rate of return did she make a) per month b) per year (nominal and effective) Answer : Cost of project = Cost of shredder + Power cost + Site preparation = 220000 + 15000 + 76000 = 311000 Earnings per month = 12000 * (2-1.05) + 2000 = 13400 Rate of return per month = Earnings / Cost of project = 13400 / 311000 = 4.31% Per year nominal = 4.31 * 12 = 51.72% Per year effective = (1+r) 12 – 1 = (1.0431)12 – 1 = 65.93%