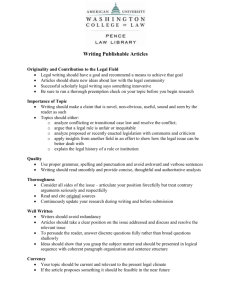

Form - Anchin, Block & Anchin

advertisement

The K-­‐1 Boot Camp • Dissec&ng the (Form 1065) Schedule K-­‐1 • 9:00 – 10:15 • January 31, 2014 1 Presenters Contact InformaCon E. George Teixeira, CPA Partner Anchin, Block & Anchin LLP 1375 Broadway New York, New York 10018 (212) 863-­‐1298 Email: george.teixeira@anchin.com Jay D. Freedman Principal KPMG US 345 Park Avenue New York, NY 10154 (212) 954-­‐3693 Email: jayfreedman@kpmg.com 2 Agenda I. Line-­‐by-­‐line review of the Schedule K-­‐1… pages 4-­‐5 Trader v. Investor (brief discussion)… pages 6-­‐10 II. III. Investment Interest Expense – a li\le history… page 11 IV. Schedule K-­‐1 Line Placement Differences… pages 12-­‐14 V. Common Schedule K-­‐1 Footnotes… pages 15-­‐29 VI. New Schedule K-­‐1 Footnotes (NII)… pages 30-­‐33 3 2013 Schedule K-­‐1 -­‐ Final 4 2013 Schedule K-­‐1 -­‐ Final 5 Trader vs. Investor “Why We Care” • Investment related expenses (including management fees) – Trader -­‐ deducbble in arriving at adjusted gross income (as business expenses under IRC § 162). – Investor -­‐ deducbble only as itemized deducbons (under IRC § 212) -­‐ subject to the 2% floor • Both investors and traders hold securiCes as capital assets – Capital gains/losses (whether or not the securibes are held in connecbon with his/ her trade or business) – Not to be confused with dealers who have ordinary trading income – Traders may make IRC § 475(f) elecbon to mark to market– taxed as ordinary but avoid wash sales, straddles, etc. • May be advantageous to funds with mostly ordinary income from FX or fixed income • May otherwise have complex straddle analyses on parbal hedges • May have eligibility challenged and be subjected to straddle/wash sale/ capital gain/loss matching 6 Trader vs. Investor DefiniCon è Trader -­‐ buys and sells securibes with reasonable frequency in an effort to capture swings in daily market movements and thus profit on a short-­‐term basis – Tax Court two-­‐part test: • (1) the taxpayer's trading is substanbal (i.e., sporadic trading won't be a trade or business), and • (2) the taxpayer seeks to catch the swings in the daily market movements, and to profit from these short-­‐term changes, rather than to profit from long-­‐term holding of investments è Investor -­‐ purchases securibes to be held for capital appreciabon and income (dividends and interest), usually without regard to short-­‐term developments that would influence the price of the securibes on the daily market 7 Trader vs. Investor “Empirical Tests” • Turnover Rabo – Consider shorts? • Long Term vs. Short Term Mix – Doesn’t properly consider tax lot idenbficabon effect – Consider longs and shorts? (shorts are always short term) • Number of trades per year – Lumpiness? – Size of Trades? – Buys vs. Sells? • Number of days in the market – Differenbate between buying days and selling days? – What if only a buyer? What if only a seller? 8 Trader vs. Investor “QualitaCve Tests” è Amount of bme devoted to trading (full bme/part bme) – “conbnuous and regular” • Is trading acbvity exclusive means of earning income (vs. side business) è Sophisbcabon of investment strategy è Type of Research Due Diligence, earnings, financial statements, future outlook, management visits Technical Data – moving average, short interest, oscillators, hedges è Use of shorts and derivabves è Staff and office space è Holding self out as a business – hedge fund vs. personal trading è Third party management è Earning management fees è Investor Disclosure – holding out as long term “investment” strategy 9 Trader vs. Investor “Final Thoughts” Ø Year-­‐to-­‐year determinabon (status can change year to year) Ø Most case law is about day traders – none to date on Investment Partnerships – most cases go against the taxpayer – INVESTOR (most recent case law will be discussed in a later session) Ø www.irs.gov/taxtopics/tc429 -­‐-­‐ Topic 429 -­‐ Traders in Securibes (Informabon for Form 1040 Filers) Ø Last reviewed/updated: December 12, 2013 Ø Massachuse\s Drau Direcbve (issued in May 2011) Ø IRS (Market Segment Specializabon Program) MSSP Audit Technique Guide (December 2003) Ø Focused on issues that fall within secbons 701 – 761 of the Code (Subchapter K) Ø Subchapter K deals primarily with the formabon, operabon and terminabon of partnerships Ø Chapter 12, pages 12-­‐2 through 12-­‐4; Issue: Securibes Traders – Engaged in a Trade or Business? Now (Reserved) per IRS website… 10 Investment Interest Expense • Investment Interest LimitaCon (Code Sec. IRC §163(d) – Trader – rules don’t apply in the case of interest on debt incurred by a trader where the proceeds are used to buy or carry investments used in the trade or business and the partner materially parbcipates (GP); for limited partners IRC §163(d) is applicable – Investor – interest expense may be limited • Revenue Ruling 2008-­‐12 (March 2008) – TRADER -­‐-­‐ for tax reporbng purposes, should the partnership separately show the amount of interest expense that it incurred or could the interest expense be ne\ed against the partnership’s income? • Announcement 2008-­‐65 (July 2008) – where should an individual limited partner (that is, a partner who does NOT materially parbcipate in the acbvibes of the partnership), report the interest expense deducbon on his/her tax return? • Revenue Ruling 2008-­‐38 (July 2008) – (1) Investment interest expense deducbble to the limited partner only to the extent of their investment income; (2) interest expense will be deducbble to the limited partner in the same manner as incurred by the partnership – Trader = Schedule E (“above the line”). Investor = Schedule A (“itemized deducbon”). – What about General Partners (partners who materially par;cipate in the ac;vi;es of the partnership? If Trader Fund? If Investor Fund? 11 Line Placement Differences Ø Line 1 vs. Line 11F/13W for Income/Loss from Trading Acbvibes Ordinary Income/Loss from Trading Acbvibes is somebmes reported as Ø Line 1, Ordinary Business Income (loss) or Ø Line 11F Other Income (loss) Ø Related expenses are either on Line 11F or Line 13W Other Deducbons – Passive Income (Loss) is usually included in Line 1, therefore it is important to footnote breakdown between passive/nonpassive amounts. – Income from Trading Acbvibes is considered Investment Income for purposes of the Investment Interest Expense limitabon. Instrucbons for Form 1065 indicate that Line 20a Investment Income includes investment income included on lines 5, 6a, 7 and 11 of Schedule K. 12 Line Placement Differences (cont’d) Ø Line 1 or 11F vs. Lines 5, 6a, 6b, 8, and 9a. Ø Interest income, dividend income and long and short-­‐term capital gains are somebmes included in Line 1 or 11F and detailed in footnotes to Schedule K-­‐1. Ø Alternabvely, these amounts are somebmes reported on the following respecbve lines on the Schedule K-­‐1. Ø Line 5 – Interest Income Ø Line 6a – Dividends Ø Line 6b – Qualified Dividends Ø Line 8 – Net Short-­‐term Capital Gain (loss) Ø Line 9a – Net Long-­‐term Capital Gain (loss) 13 Conforming the Different PresentaCons Fund of Funds Ø Pass through to investors exactly the same manner as reported on underlying K-­‐1’s? or Ø Reclassify items to report underlying K-­‐1 informabon in a consistent manner? Ø Form 8082 (Nobce of Inconsistent Treatment or Administrabve Adjustment Request) -­‐-­‐ does this raise this issue or form requirement? 14 Common Schedule K-­‐1 Footnotes (What Do You Mean it’s Nonpassive?) RegulaCon 1.469-­‐1T(E)(6)(i) “In general. An acbvity of trading personal property for the account of owners of interests in the acbvity is not a passive acbvity (without regard to whether such acbvity is a trade or business acbvity.)” Some Footnote Examples: 1) Unless otherwise noted, income from the Partnership is not passive income for purposes of the Passive Acbvity Loss rules (Temp. Reg. Secbon 1.469-­‐1T(e) (6)). 2) PLEASE NOTE THAT EXCEPT FOR LINE 1 AND 3, NONE OF THE DISTRIBUTIVE SHARE ITEMS REPORTED ON SCHEDULE K-­‐1 ARE CONSIDERED AS DERIVED FROM A PASSIVE ACTIVITY UNDER TREASURY REGULATION SECTION 1.469-­‐1T(E)(6). 3) THE PARTNERSHIP HAS TAKEN THE POSITION THAT IT IS A TRADER IN SECURITIES. THE AMOUNTS REPORTED ON YOUR SCHEDULE K-­‐1 ARE NEITHER PORTFOLIO NOR PASSIVE UNDER REG. SEC. 1.469-­‐IT(E) (6), UNLESS OTHERWISE INDICATED. 15 Common Schedule K-­‐1 Footnotes (Box 13, Code H -­‐ Investment Interest Expense) Some Footnote Examples: 1. THE K-­‐1 HAS BEEN PREPARED ON THE BASIS OF A PARTNER WHO DOES NOT MATERIALLY PARTICIPATE IN THE OPERATIONS OF THE PARTNERSHIP. THEREFORE, INTEREST EXPENSE HAS BEEN INCLUDED IN BOX 13, CODE H AS INVESTMENT INTEREST EXPENSE AND IS NOT INCLUDED IN BOX 11, CODE F. 1040 FILERS SHOULD ENTER THIS AMOUNT ON FORM 4952, LINE 1. ANY DEDUCTIBLE INTEREST EXPENSE SHOULD THEN BE ENTERED ON SCHEDULE E, PART II, COLUMN (H) (or Schedule A). INVESTMENT INCOME/EXPENSE ITEMS IN BOX 11, CODE C AND BOX 11, CODE F HAVE NOT BEEN INCLUDED IN BOX 20, CODE A AND BOX 20, CODE B. THESE AMOUNTS SHOULD BE CONSIDERED WHEN PREPARING FORM 4952. PLEASE CONSULT YOUR TAX ADVISOR. =================================================================================== 2. Individual partners that do not materially parbcipate in the operabons of the Partnership must report interest expense as investment interest expense on Form 4952, line 1. Auer applicabon of the limitabons of Form 4952, any resulbng deducbon pertaining to this amount should be entered on Schedule E, Part II, column (h) (or Schedule A). Individual partners that materially parbcipate in the operabons of the Partnership enter the amount in Box 13 Code H directly on Schedule E, Part II, column (h). The amount reported in Box 20 Code A includes Interest and Dividends (including Qualified Dividends). The amount reported in Box 20 Code B includes the expenses in Box 13 Codes K and/or W. Amounts reported in Boxes 1, 8, 9a, and 11 should be considered in compubng your Net Investment Income. Please consult your tax advisor. 16 Common Schedule K-­‐1 Footnotes (Box 13, Code W -­‐ Other DeducCons) • Some Footnote Examples: 1. Part III, Box 13 Other Deducbons, Code W -­‐-­‐ Other Deducbons: professional fees, management fees, and other deducbons which are related to the Partnership's acbvity as a trader in securibes should be entered by an "individual" taxpayer on Schedule E, Part II as nonpassive. ================================================================= 2. EXPENSES REPORTED ON LINE 13 CODED W -­‐ OTHER DEDUCTIONS ARE RELATED TO A TRADE OR BUSINESS AND SHOULD BE REPORTED ON SCHEDULE E, FORM 1040. THESE DEDUCTIONS ARE NOT SUBJECT TO THE 2% OF AGI LIMITATION FOR ITEMIZED DEDUCTIONS. 17 Common Schedule K-­‐1 Footnotes (Box 20, Code V -­‐ UBTI) • Some Footnote Examples: 1. BOX 20, CODE V: INFORMATION REGARDING UNRELATED BUSINESS TAXABLE INCOME: YOUR SHARE OF ALL SCHEDULE K-­‐1 ITEMS OF INCOME/(LOSS) AND DEDUCTIONS OTHER THAN CAPITAL GAINS/LOSSES AND SECTION 1256 GAINS/(LOSSES) THAT IS CONSIDERED UNRELATED BUSINESS TAXABLE INCOME IS: XXXX YOUR SHARE OF CAPITAL GAINS/(LOSSES) ON YOUR SCHEDULE K-­‐1 THAT IS CONSIDERED UNRELATED BUSINESS TAXABLE INCOME IS: XXXX ============================================================================== 2. Part III, Box 20 Other InformaCon, Code V -­‐ Unrelated Business Taxable Income: UBTI -­‐ Ordinary income (expense)* XXXX UBTI -­‐ Short term capital gain (loss) XXXX UBTI -­‐ Long term capital gain (lOSS) XXXX Your share of Qualified Dividends included in Ordinary income (loss) subject to UBTI: XXXX =============================================================================== Add to either of the above: (The above amounts should be modified if indebtedness was incurred to acquire your interest in this fund. Please consult your tax advisor). 18 Common Schedule K-­‐1 Footnotes (Line 19 DistribuCons) • K-­‐1 marked “final” in year liquidated (irrespecbve of when final cash payout is made/received)? • K-­‐1 marked “final” in year final cash payment is made/received? Some Footnote Examples (need to read the footnotes): 1. Part III, Box 19 DistribuCons -­‐-­‐ Gain or Loss on DistribuCon from the Partnership: If you made a withdrawal from the Partnership, you may have a gain or loss to recognize outside the Partnership in the year you received the cash distribubon from the Partnership. Please note that the withdrawal shown in Box 19 Code A of the K-­‐1 may reflect distribubons that may be received/paid in the following tax year. Please consult your tax advisor. ====================================================================== 2. DISTRIBUTIONS THE AMOUNT REPORTED ON 19A, IF ANY, OF YOUR SCHEDULE K-­‐1 REFLECTS THE ACTUAL CASH DISTRIUBUTED TO YOU DURING THIS TAXABLE YEAR. THIS AMOUNT WILL REDUCE YOUR TAX BASIS IN YOUR PARTNERSHIP INTEREST FOR THE CURRENT YEAR. THE TAX RULES RELATED TO PARTNERSHIP DISTRIBUTIONS ARE COMPLEX. PLEASE CONSULT YOUR TAX ADVISOR. 19 Common Schedule K-­‐1 Footnotes (Line 19 DistribuCons – ConCnued) Some Footnote Examples (need to read the footnotes): 3. LIQUIDATION OF PARTNERSHIP INTEREST: IF THIS K-­‐1 IS MARKED FINAL, THE WITHDRAWAL AMOUNT IN BOX L, REPRESENTS YOUR FINAL CASH DISTRIBUTION IN EXCHANGE FOR THE LIQUIDATION OF YOUR PARTNERSHIP INTEREST. TO DETERMINE YOUR GAIN OR LOSS FROM LIQUIDATION OF YOUR PARTNERSHIP INTEREST, YOUR TAX BASIS SHOULD BE DETERMINED IN ACCORDANCE WITH IRC SEC. 705 AND THE RELATED STATE PROVISIONS. PLEASE CONSULT YOUR TAX ADVISOR. – REDEMPTION PAYABLE OF PARTNERSHIP INTEREST: IF THE ENDING CAPITAL ACCOUNT ON THIS K-­‐1 BOX L IS MARKED "NONE" AND THE BOX FOR FINAL K-­‐1 IS NOT CHECKED, THEN THIS K-­‐1 SHOULD NOT BE CONSIDERED FINAL. YOU WILL RECEIVE A FINAL K-­‐1 IN THE FOLLOWING TAX YEAR REPORTING THE FINAL CASH DISTRIBUTION RECEIVED IN SUBSEQUENT TAX YEAR. PLEASE CONSULT YOUR TAX ADVISOR. 20 Common Schedule K-­‐1 Footnotes (Foreign Qualified Dividends) Footnote Example: • FOREIGN GROSS INCOME SOURCED AT PARTNERSHIP LEVEL, BOX 16, CODE D, E: FOREIGN QUALIFIED DIVIDENDS ARE INCLUDED IN BOX 16, CODE D, E (AS WELL AS IN BOXES 6A AND 6B AND IN BOX 11, CODE F, IF APPLICABLE). PLEASE CONSULT YOUR TAX ADVISOR REGARDING WHETHER ADJUSTMENTS SHOULD BE MADE TO THIS AMOUNT OR ANY OTHER AMOUNTS APPEARING IN BOX 16 FOR PURPOSES OF CALCULATING YOUR FOREIGN TAX CREDITS ON FORM 1116. YOUR ALLOCABLE SHARE OF FOREIGN QUALIFIED DIVIDENDS IS: XXXX 21 Common Schedule K-­‐1 Footnotes (State Tax InformaCon) Footnote Examples: (most K-­‐1s today are issued along with the various State K-­‐1s…sourcing – resident partners -­‐ etc) 1) FOR INDIVIDUAL PARTNERS: THE PARTNERSHIP FILED A NYS PARTNERSHIP RETURN WHICH REPORTED NO INCOME FROM NEW YORK SOURCES. THE PARTNERSHIP'S ACTIVITIES ARE LIMITED TO THE HOLDING, BUYING AND SELLING OF SECURITIES FOR ITS OWN ACCOUNT. FOR CORPORATE PARTNERS: THE PARTNERSHIP IS A PORTFOLIO INVESTMENT PARTNERSHIP AS DEFINED IN NYS REGULATION SECTION 1-­‐3.2(A)(6)(III)(D). IN GENERAL, A CORPORATE LIMITED PARTNER SHOULD NOT BE SUBJECT TO TAX IN NEW YORK BASED ON AN INVESTMENT IN A PORTFOLIO INVESTMENT PARTNERSHIP. FOR A CORPORATE PARTNER THAT IS REQUIRED TO FILE A NEW YORK RETURN, PLEASE NOTE THE PARTNERSHIP WILL REPORT BUSINESS AND INVESTMENT INCOME/(LOSS). PLEASE CONTACT THE PARTNERSHIP IF ADDITIONAL INFORMATION IS REQUIRED. 2) State TaxaCon Unless otherwise noted, the Fund's acbvibes consist of invesbng /trading of securibes for it's own account. In general, the income generated from these acbvibes, as well as any related por}olio income, is not subject to income tax by most states with respect to amounts allocated to nonresident investors. Please consult your tax advisor regarding the applicabon of this general principle to your situabon. 22 Common Schedule K-­‐1 Footnotes (Transfer of Property to Foreign CorporaCons) Ø Form 926 Ø Transfers of tangible or intangible property to a foreign corporabon if a) immediately auer the transfer the person holds directly or indirectly at least 10% of the total vobng power or the total value of the foreign corporabon OR b) the amount of cash transferred by the person to the foreign corporabon during the 12-­‐month period ending on the date of the transfer exceeds $100,000. Ø Form 926 is not required to be filed by the partnership, but by U.S. cibzen or resident (individual), domesbc corporabon, or a domesbc estate or trust. Ø Each domesbc partner of a domesbc partnership is treated as making the proporbonate share of the property contributed to the Foreign Corporabon. Ø Property DistribuCons Ø Tax basis of distribubon 23 Common Schedule K-­‐1 Footnotes (Form 926 – ConCnued) • Footnote Example: IRC SECTION 6038B FILING INFORMATION PURSUANT TO IRC SECTION 6038B (FOR TAXABLE YEARS BEGINNING AFTER FEBRUARY 5, 1999), A PARTNERSHIP'S CONTRIBUTION OF PROPERTY, WHICH INCLUDES CASH, TO A FOREIGN CORPORATION IS DEEMED TO BE MADE BY THE PARTNERS OF SUCH PARTNERSHIP. YOUR SHARE OF FUNDS TRANSFERRED TO THE FOREIGN CORPORATION IS INDICATED ON THE SCHEDULE BELOW. AS A RESULT, YOU MAY HAVE A FILING REQUIREMENT UNDER TREASURY REGULATION SEC. 1.6038B-­‐1(B)(3) WITH REGARD TO SUCH CONTRIBUTIONS ON FORM 926. PLEASE CONSULT YOUR TAX ADVISOR REGARDING THIS FILING REQUIREMENT. THE FOLLOWING INFORMATION IS PROVIDED IN ORDER FOR YOU TO COMPLY WITH THE FORM 926 FILING REQUIREMENTS. THE LINE NUMBERS BELOW CORRESPOND TO THOSE ON FORM 926. 24 Common Schedule K-­‐1 Footnotes (Form 8621 – PFICs) • Footnote Examples: 1) PASSIVE FOREIGN INVESTMENT COMPANY ("PFIC') INFORMATION: ABC VALUE FUND LP INDIRECTLY INVESTS IN PASS THROUGH ENTITIES THAT HOLD INVESTMENTS THAT ARE TREATED AS PASSIVE FOREIGN INVESTMENT COMPANIES ("PFIC") FOR U.S. TAX PURPOSES. PURSUANT TO IRC SECTION 1291 THE PASS THROUGH ENTITIES RECOGNIZED GAIN ON SHARES OF PFICS SOLD AND RECEIVED DISTRIBUTIONS FROM THE PFICS LISTED BELOW. THE TAX RULES GOVERNING PFIC INVESTMENTS ARE COMPLEX. PLEASE CONSULT YOUR TAX ADVISOR REGARDING YOUR FORM 8621 FILING REQUIREMENTS. THESE AMOUNTS HAVE BEEN INCLUDED IN TAXABLE INCOME ON YOUR SCHEDULE K-­‐1. THE FOLLOWING INFORMATION SHOULD BE USED TO PREPARE FORM 8621. YOUR SHARE OF GAIN AND DISTRIBUTIONS OF IRC SECTION 1291 NON-­‐QUALIFIED FUND ACTIVITY IS BELOW. SECURITY NUMBER OF SHARES DATE ACQUIRED DATE DISPOSED AMOUNT DESCRIPTION 25 Common Schedule K-­‐1 Footnotes (Form 8621 – PFICs) -­‐ ConCnued • Footnote Examples: 2) InformaCon Regarding PFICs That Are Qualified ElecCng Funds (QEFS) The Partnership is a domesbc partnership and has directly or indirectly invested in one or more Passive Foreign Investment Companies (PFICs) for which a Qualified Elecbng Fund (QEF) elecbon under Secbon 1295 of the Internal Revenue Code has been in effect throughout the Partnership's holding period. The ordinary earnings and net capital gain, if any, from each PFIC have already been included in Box 6a and/or 9a of your Schedule K-­‐1. Either the Partnership or an underlying domesbc partnership that owns the PFIC(s) has filed Form 8621 with respect to such PFIC(s). Neither the Partnership nor the underlying domesbc partnership that owns the PFIC(s) has transferred stock in any PFIC(s) in a nonrecognibon transacbon during the taxable year. According to the IRS instrucbons for Form 8621 (rev. December 2012), based on these facts, a partner is not required to file Form 8621 with respect to QEF(s) owned indirectly via their interest in a domesbc partnership. Therefore, no further informabon is being provided about the Partnership's QEF investments. If a partner wishes to make a Secbon 1294 elecbon, the informabon required to make that elecbon will be available upon request. Informabon about PFICs that are subject to the Secbon 1291 excess distribubon rules, if any, is reported in a separate footnote to this Schedule K-­‐1. 26 Common Schedule K-­‐1 Footnotes ( Form 8938…) • Footnote Example: • Form 8938 (Statement of Specified Foreign Financial Assets) IRC SEC. 6038D PROVIDES THAT, FOR TAX YEARS BEGINNING AFTER MARCH 18, 2010, A "SPECIFIED PERSON" HOLDING AN INTEREST IN A "SPECIFIED FOREIGN FINANCIAL ASSET" DURING THE TAX YEAR IS REQUIRED TO COMPLETE AND ATTACH FORM 8938 TO HIS OR HER INCOME TAX RETURN FOR THE TAX YEAR IF THE AGGREGATE VALUE OF ALL SUCH ASSETS EXCEEDS THE "REPORTABLE THRESHOLD". ABC FUND LP IS A PARTNERSHIP ORGANIZED IN THE CAYMAN ISLANDS. YOUR INTEREST IN ABC FUND LP MAY FALL WITHIN THE DEFINITION OF A "SPECIFIED FOREIGN FINANCIAL ASSET" AND, THEREFORE, MAY GIVE RISE TO A FORM 8938 FILING OBLIGATION FOR TAX YEAR 2012. PLEASE REFER TO THE FORM 8938 INSTRUCTIONS FOR DETAILED INFORMATION AND CONSULT YOUR TAX ADVISOR REGARDING THIS POTENTIAL FILING REQUIREMENT. 27 Common Schedule K-­‐1 Footnotes ( Other Common Disclosures) 1. U.S. Treasury interest income • Somebmes you will see addibonal disclosures as to expenses related to U.S. Government Obligabons, Costs to Carry U.S. Treasury Obligabons, Interest Expense related to U.S. Government Obligabons, etc 2. For Corporate Partners: Dividends eligible for the Dividends Received DeducCon under IRC SecCon 243: XXXX 3. Tax-­‐exempt interest income – Box 18, Code A or Other Tax-­‐exempt income – Box 18, Code B 4. Publicly Traded Partnerships (PTP) The Fund has direct or indirect investment(s) in Publicly Traded Partnerships ("PTP"). These PTP's are not treated as corporabons pursuant to IRC Sec. 7704. As such, distribubve share items from these PTPs are included on your schedule K-­‐1. Investors may be subject to the passive acbvity loss rules with respect to their investments in PTPs under IRC Sec. 469(k). Please consult with your tax advisor. Income (loss) from PTPs is indicated in the a\ached schedules. 28 Common Schedule K-­‐1 Footnotes ( Other Common Disclosures) -­‐ ConCnued 5. Form 8886 (Reportable TransacCon Disclosure Statement) – – – – Listed Transacbon Reportable Transacbon Nobce 2006-­‐16 Protecbve Disclosures 6. Form 8865 -­‐ Report of U.S. Persons With Respect to Certain Foreign Partnerships – Report investments in foreign partnerships depending on amount of investment or ownership percentage. – Due with return including extensions, if no return is required Form 8865 must be filed separately. – Categories of Filing 1. Controlled a Foreign Partnership 2. Owned 10% or greater interest during the year 3. Contributed property to a Foreign Partnership during the year 4. Had a reportable event during the year 29 New Schedule K-­‐1 Footnotes (Box 20, Code Y -­‐ Net Investment Income) Net investment income generally includes gross income from interest, dividends, annuibes, royalbes, and rents and net gain from disposibons of property, as well as trade or business income which is income from a “passive acbvity” with respect to the taxpayer. • The Net Investment Income tax generally would apply to incenbve allocabons to investment manager general partners and to the investment returns for investors in funds. In contrast, fee income allocated to the limited partners of an investment manager could be excluded from the NII tax if the limited partners “materially parbcipate,” within the meaning of Secbon 469 of the code, in the investment manager’s advisory trade or business. • Income thresholds and special rules 1. The threshold amount above which the NII tax can apply is: $250,000, for taxpayers filing jointly (or as a surviving spouse); $125,000, for married taxpayers filing separately; and $200,000, for all other cases. These thresholds are not indexed for inflabon. 2. Foreign tax credits are not creditable against the tax paid on NII (but may be deducbble in determining NII). 3. Self-­‐employment income is not included in NII. 4. The NII tax does not apply to a nonresident alien or to a foreign trust • 30 New Schedule K-­‐1 Footnotes (Box 20, Code Y -­‐ Net Investment Income) • Planning ConsideraCons – Management Company as limited partnership instead of LLC – acbve trade/business income (of a limited partner) not subject to SE or NII tax . What about an S Corporabon? – Incenbve as fee vs. allocabon – NYC UBT vs. NII – GP vs. management company -­‐ allocabon of expenses – Itemized deducbons not deducbble for AMT may be deducbble for NII – Allowable Tax exempt instruments – Donate appreciated stock to charity • ReporCng – Flow through enbbes – 2013 Schedule K-­‐1 new line 20Y – net investment income • Individuals, estates and trusts – Form 8960 – Net Investment Income Tax calculabon form • Drau Form 8960 instrucbons are available currently; Form 8960 was finalized recently (in early January 2014) 31 New Schedule K-­‐1 Footnotes (Box 20, Code Y -­‐ Net Investment Income) • Footnote example(s) – To Be Determined… ** New footnote: Box 20, Code Y: Net Investment Income Unless otherwise indicated, all of the distribubve share items reported on this Schedule K-­‐1 are subject to the Net Investment Income Tax pursuant to Internal Revenue Code Secbon 1411. Please consult your tax advisor. ** Modify exisCng footnote: Potenbal Gain or Loss on Distribubons from the Fund If you made a withdrawal from the Fund, you may have a gain or loss to recognize outside the fund in the year you receive the cash distribubon from the Fund. Any gain or loss on liquidaCon will also be recognized for Net Investment Income Tax pursuant to Internal Revenue Code SecCon 1411 purposes. Please note that the withdrawal shown in Box 19 Code A of the K-­‐1 only reflects distribubons that were made in 2012. Please consult your tax advisor. 32 New Schedule K-­‐1 Footnotes (Box 20, Code Y – NII -­‐ conCnued) • Footnote example(s) – To Be Determined… Investor Fund Issue… ** New footnote? PFICs with QEF elecCons and CFCs… • For 2013, the G elecbon can be made by individuals with direct PFIC/CFC investments. However, pass through enbbes can make the elecbon for 2013 only if ALL their partners/shareholders CONSENT to it. If any of these partners/shareholders is another pass thru enbty – the partners/shareholders of that pass-­‐thru enbty must consent as well… L • Absent an elecbon otherwise (G elecbon), the NII rules for CFCs and QEFs owned by non-­‐trader funds subject taxpayers to NII tax only when a distribubon is paid out of E&P (as opposed to when the income is included for regular tax purposes). • While these rules may allow some taxpayers to defer this income for NII purposes, it also adds complexity and an administrabve burden because the taxpayer has to keep two sets of records for each PFIC and QEF… • Further, partnerships would have to provide each investor all the informabon necessary for them to do the calculabons at their level Investor Funds – for 2013 – QEF elecbon for NII purposes. – Considering standardized language with respect to the “G elecbon” issue for Investor funds? Investor funds -­‐-­‐ G elecbon for 2013 – if made at enbty level, need “consent” à what consbtutes consent? 33